How to Build a Financial App and How Much It Costs

Updated 18 Sep 2023

17 Min

706 Views

Creating a finance app is an excellent opportunity for businesses and startups to engage users. Such solutions are in great demand because it is convenient; at their fingertips, people can quickly access their financial information, budget planning tools, investment opportunities, etc.

As an IT provider with 10+ years of industry expertise in financial software development, we at Cleveroad are here to share our knowledge and help you understand how to make a financial app, what features to implement, and how much it might cost.

Why Is It Profitable to Build a Financial App

A personal finance application is a handy tool that allows users to track and manage the flow of their finances, control budgets, and analyze income and expenses. Such a mobile app is in high demand among modern people because it provides real-time information, bank accounts control, handy financial services, convenient money management, high security, and quality personalization.

We wouldn't be talking about how to create a personal finance management app if such solutions were not promising, right? So, we gathered some optimistic statistics to strengthen your decision about building your FinTech app:

- A study from Maximize Market Research shows that the personal finance apps market will grow from 2021 to 2029 with an impressive 11% CAGR.

- According to Exploding Topics, between 2017 and 2024, fintech industry revenue has nearly doubled.

- Think with Google claims that 73% of smartphone users have a financial management app.

These statistics suggest that creating a finance app now is a great opportunity to promote your own solution and use the growing interest in fintech to your advantage.

Technical Side of Personal Finance App Development: Must-Have Functionality

To build a personal finance app, you need a set of certain essential functions. Let's take a closer look at them:

Secure user registration and authentication

Providing a convenient and secure registration will allow your users to create accounts. It's worth adding some registration features, like a phone number or a social media account. It's also essential to take care of mechanisms for authenticating users when they sign in to the app, such as passwords, pin codes, fingerprints, or facial scans.

Authorization screen designed by Cleveroad

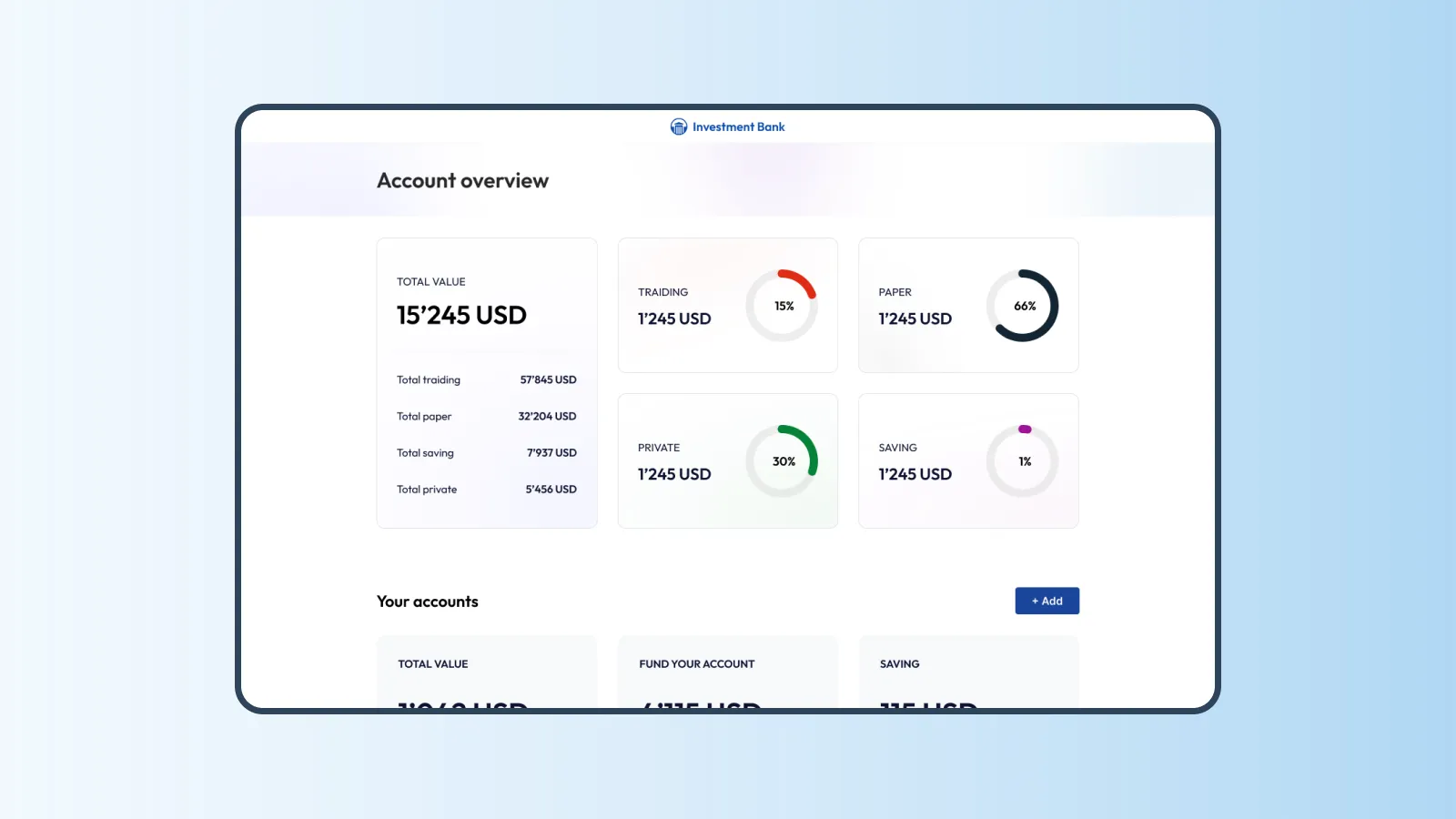

Account aggregation

Add the ability to connect and display information about a user's bank and financial accounts in one place. This allows users to see a broad financial overview and conveniently manage their accounts.

Account overview screen designed by Cleveroad

Transaction tracking and categorization

Automatically track and categorize financial transactions by categories such as purchases, bills, transfers, etc., to help users better understand where their money is going and how they can improve their financial habits.

Transaction tracking feature example (Source: Dribble)

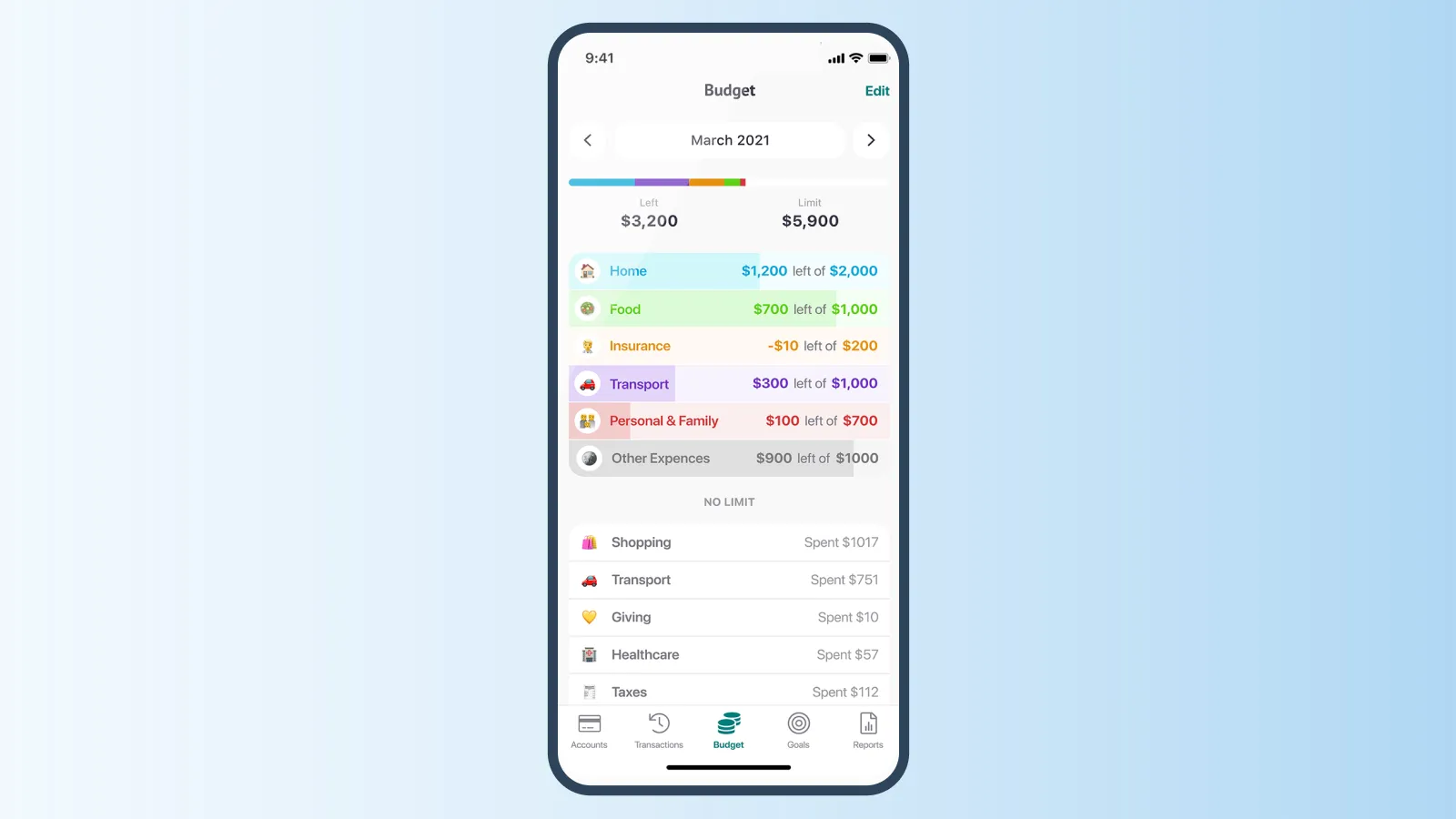

Budgeting and expense administration

Budgeting and expense management include various tools for setting budgets, tracking expenses, and managing financial goals. Users can set spending limits, get alerts when they exceed their budget, and view reports on their financial habits.

Budgeting feature example (Source: Finmatex)

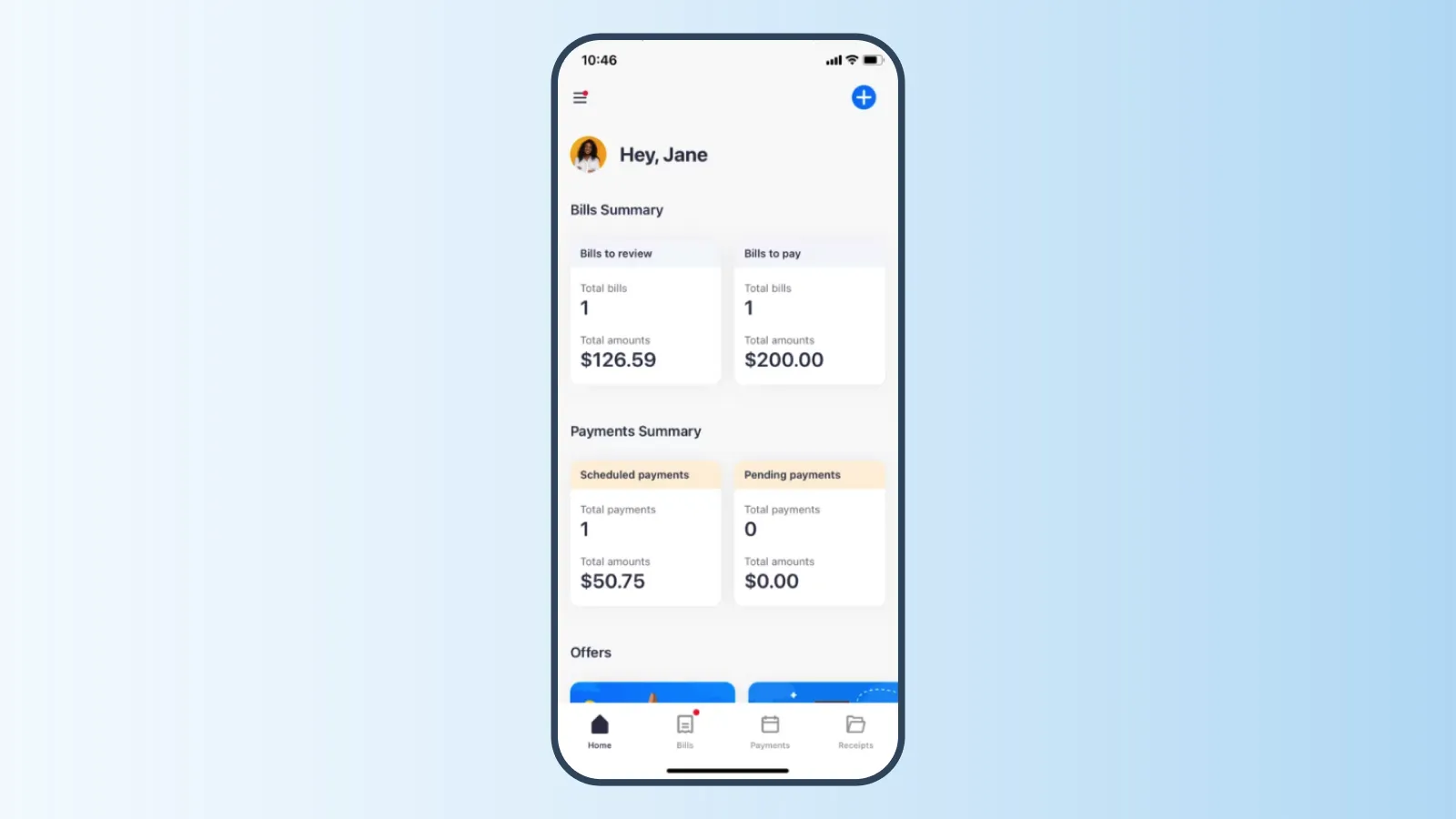

Bill payment and reminders

This feature allows users to pay bills through the app, set reminders for upcoming payments, and manage their financial obligations.

Billing feature example (Source: Sniip)

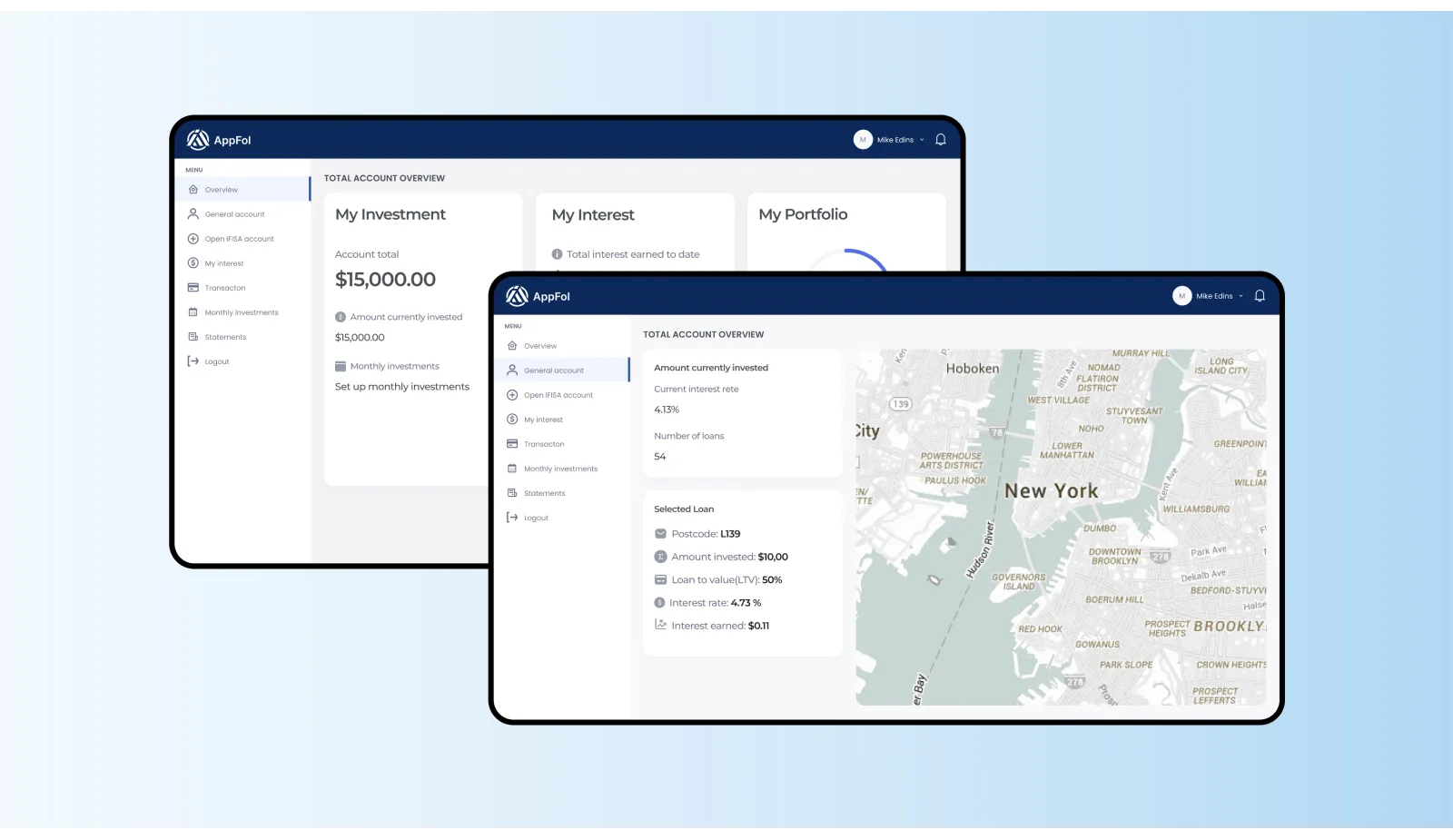

Investment and portfolio management

Also, to make the financial app appealing to users, it is worth adding the ability to track and manage investment assets and portfolios, view stock values, receive notifications of market changes and execute investment strategies.

Investment and portfolio management screen designed by Cleveroad

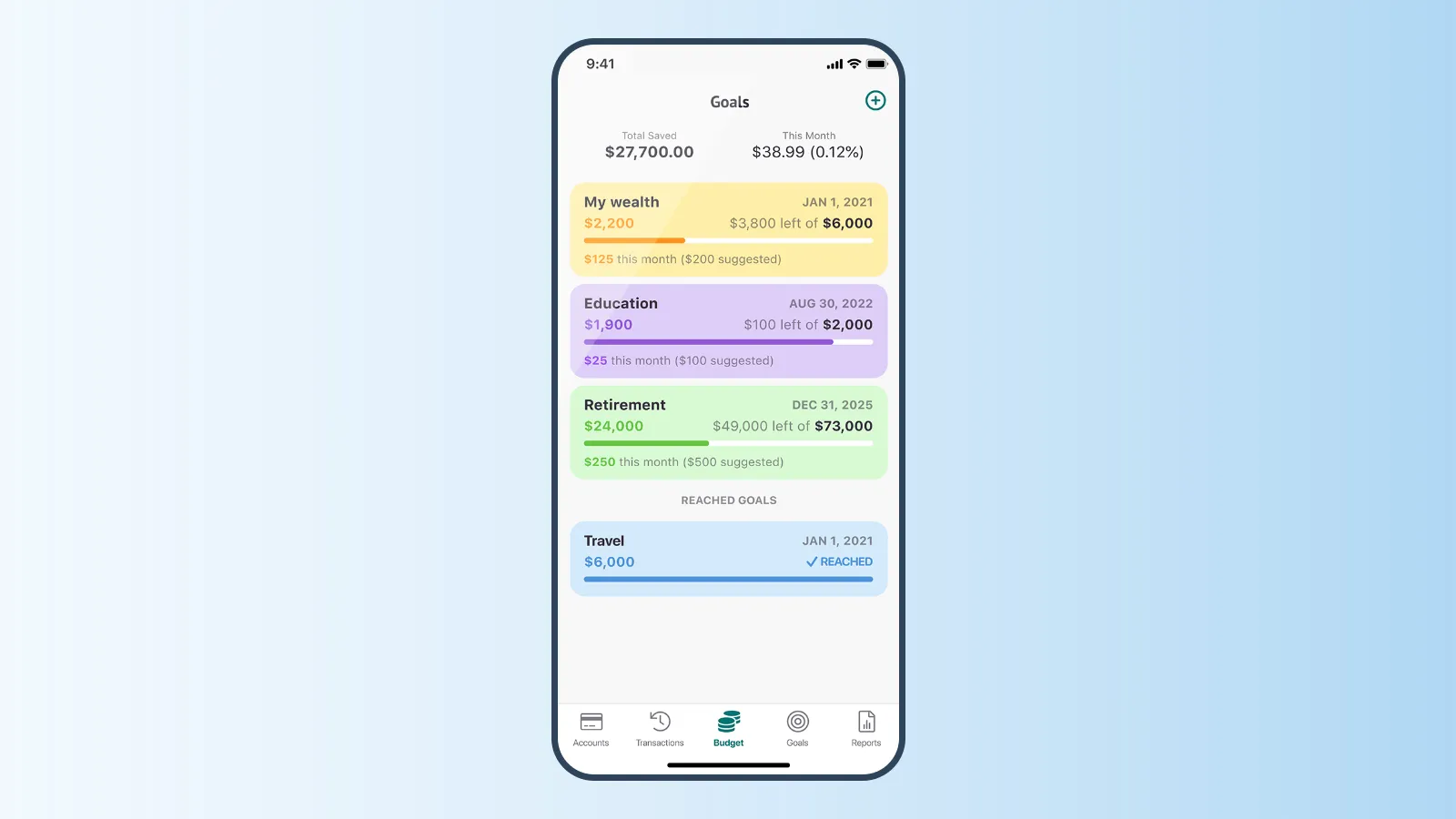

Financial goal setting

This feature will allow users to set financial goals, such as saving for vacations, buying a car, or saving for education, and track their progress toward those goals.

Financial goal setting feature example (Source: Finmatex)

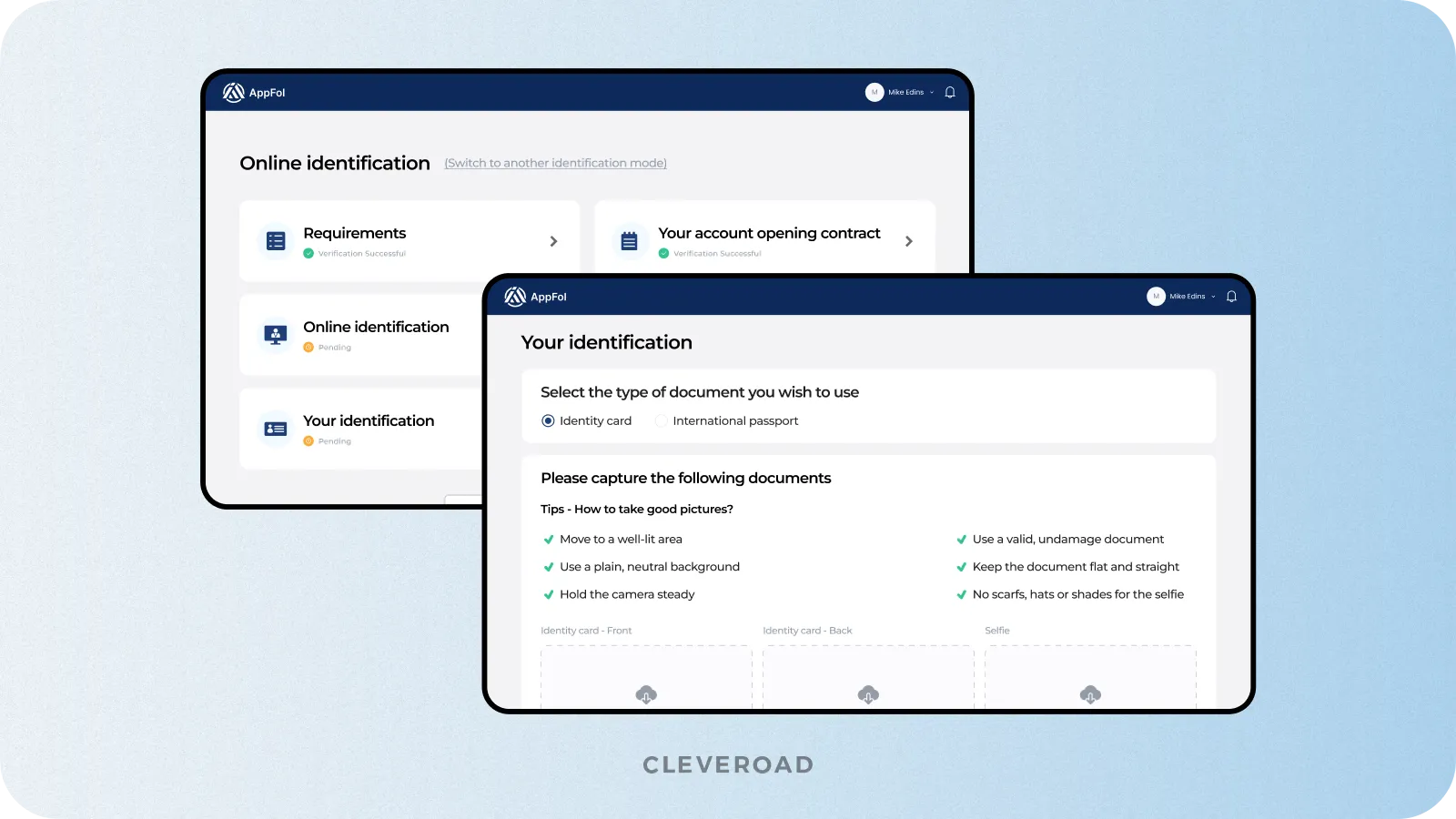

Security and privacy

Tools such as encryption, two-factor authentication, and protection against unauthorized access are needed to protect user privacy and financial data.

Security feature on the example of KYC module designed by Cleveroad

Customer support and assistance

It's also critical to implement features to connect with the customer support team, get answers to questions, solve problems, and get advice on financial issues.

Customer support screen example (Source: Balance)

We’ve listed basic functionalities required for a successful personal finance platform. To create a more feature-rich app and attract more users, you can also add some advanced features, such as :

- Personalized insights and analytics

- Goal-based savings

- Expense analysis and trends

- Financial calculators

- Integration with financial advisors

- Integration with smart devices

- Gamification and rewards

How to Create a Financial App in 8 Steps

Now, let's learn how to make a personal finance app and discuss the mobile app development process in detail so you’ll be aware of what steps you should consider to deliver such a solution successfully.

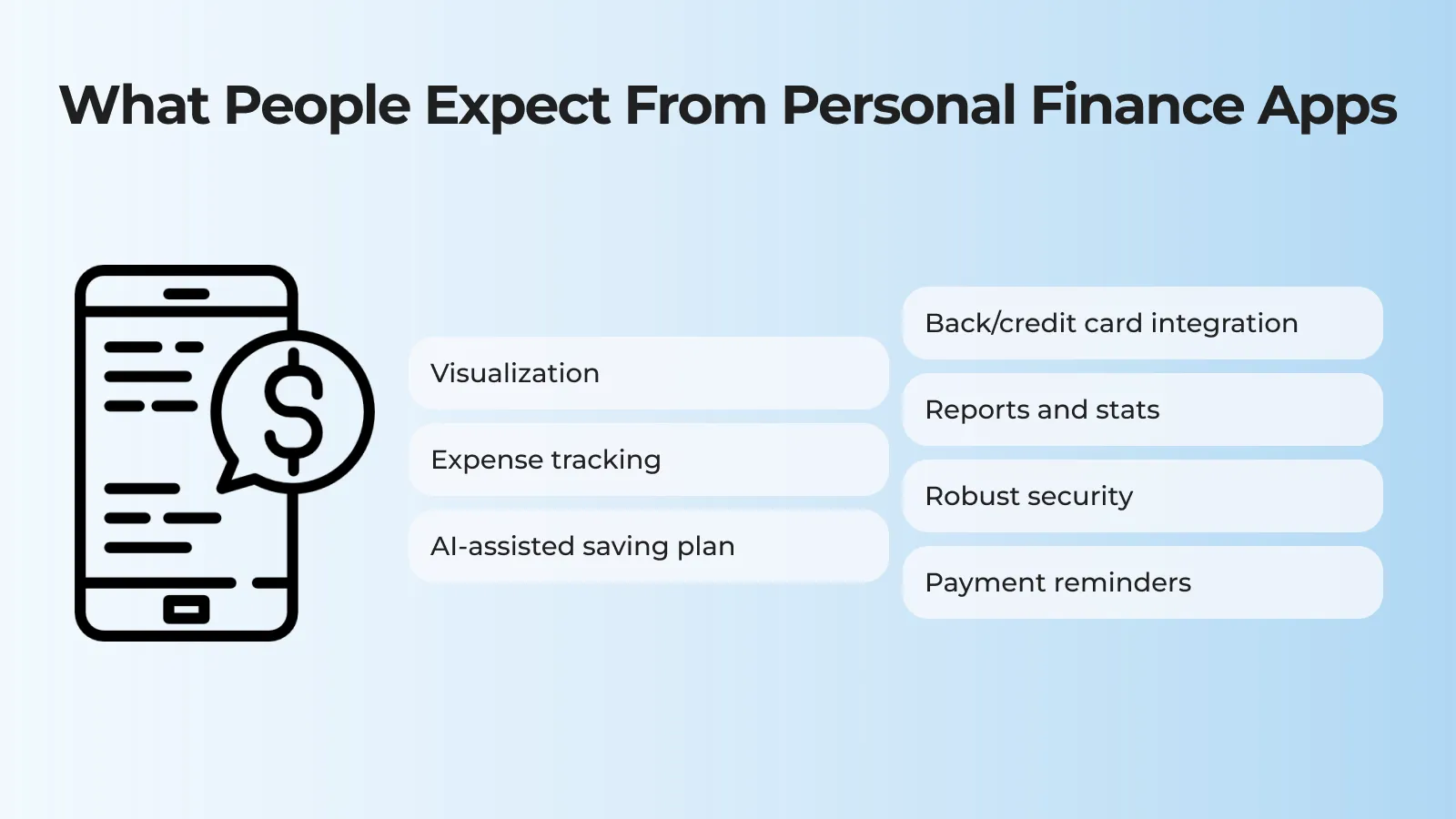

1. Define your goals and target audience

Start by defining the problem you want to solve with your app and who you’re creating it for. For example, if you plan to build a money management app to track your budget, think about what exactly it can help your potential app users with and their pains. Also, analyze what they would like to get from such software and add features to address your customers' preferences.

What users expect from financial apps

2. Conduct market analysis

Next, you must analyze the main competitors in your niche to understand what solutions they offer and why users choose them. Study real customers’ reviews to understand what users appreciate and dislike about popular personal finance apps. Market research will allow you to find inspiration for building budgeting apps and avoid your competitors' mistakes.

3. Find an experienced technical partner

To create a finance app, you will need to collaborate with an experienced IT service provider. There are several collaboration methods you can use:

Outsourcing. The most cost-effective option is to cooperate with an outsourcing mobile app development company. This method of collaboration has many advantages, such as access to unlimited talent and technology worldwide, reduced time-to-market, and so on. Also, outsource app development costs will be much lower then in-house team. Moreover, when working with an outsourcing vendor, you can choose the most convenient method of cooperation, for example, hiring a remote team or turning to outstaffing - hiring a few necessary app developers to complement your in-house team.

Discover all advantages of outsource app development in our detailed guide

Freelance. You can hire an expert at one of the freelance recruiting sites. This will save you money and allow you to find an experienced developer. However, such a large project as creating a personal finance management solution will require not only developer, but also UI/UX designer, business analyst, and DevOps specialist, and hiring and managing several freelancers is difficult and increases the cost of creating your own financial app from scratch.

In-house team. You can hire a whole team to build a personal finance mobile budget planner, including developers, QA engineers, and UI / UX designers. You can effectively manage the project in this way, but searching, hiring, and maintaining all the experts required to develop a personal finance app will be long and expensive.

4. Go through the Discovery Phase with your IT partner

Discovery phase is a necessary step to detail the requirements and convert them into a clear development plan. Passing this stage with your software provider allows you to reduce development time and increase efficiency. During the Discovery phase, you work with your software provider to determine how to make a financial app meeting your requirements. At this stage, your team will help determine the list of required app features and select the appropriate technology stack and architecture for your budget planner app. Also, at this stage, specialists will evaluate all the necessary criteria to create a budgeting app in full compliance with industry data protection regulations, such as GDPR or CCPA.

5. Think about the design

When creating a personal finance app, paying special attention to the design is crucial, as it should be understandable and convenient for all users. To develop a quality application design, you can use the following tips:

- Take care of intuitive navigation

- Balance and payments should be easily accessible

- Don't overload your dashboard

- Provide easy access to support

- Conveniently structure terms and conditions

- Carefully place visual accents and buttons

6. Development and QA

When starting development, it is worth starting with creating a finance app Minimum Viable Product (MVP) version. Building a Minimum Viable Product means implementing only the bare essentials required for a successful product launch. MVP development will allow you to reduce your initial investment and time-to-market, but this version will be attractive to users and investors.

Developers will build your application gradually over several two-week sprints, during which a particular part of the functionality will be created. Each stage of development is accompanied by mandatory testing to identify and fix all possible bugs. Upon completion of personal finance app development, QA engineers will conduct several additional tests.

The tech stack for creating a finance app includes several programming languages, frameworks for front-end and back-end development, libraries, and databases. HTTPS and SSL/TLS protocols are used for security and data protection. There are also a number of integrations for personal finance app development, including:

- Stripe, PayPal, Braintree, and Square payment gateways for processing payments and interacting with banking systems

- Payment APIs to perform operations such as creating payments, refunds, and checking payment status

- Banking and financial APIs

- Integration with investment platforms

7. Release and further improvements

Once your finance application is completed, your software vendor will help launch it on the app stores to make it available to users. After that, you should collect and analyze users’ feedback. Based on them, you can understand what consumers are missing and what features they appreciate. In the future, you can move on to creating a more feature-rich application to attract an even larger audience.

8. Support and maintenance

After completing all the work on personal finance app development, it is worth continuing cooperation with your IT partner. Constant updates and improvements will allow you to attract more users and increase their satisfaction with your application. Support and maintenance services include updating for new OS versions, fixing possible bugs, adding new features, etc.

Successful Examples of Finance Applications

Before you start building a finance app, it's worth looking at the current market leaders to find out how they attract users with and what unique functionality they offer. Let's take a look at the top 5 financial apps:

- YNAB (You Need A Budget). You Need A Budget is a desktop, iOS, and Android financial app that allows users to focus on effective budgeting. The peculiarity of the software is its focus not on previous results but on the present situation and future possibilities. The application allows you to identify your main financial priorities and goals and create an effective strategy to achieve them.

- Empower. Empower is a multifunctional tool that allows you to assess the complete financial picture. The application is easy enough to use; you just need to link all the information about accounts, cards, and other budget elements. Users can access features such as advisory tools, including an investment checkup, investment fee analyzer, financial planning, cash flow tracking, and much more.

- Mint. Mint is the most downloadable financial application available for all operating systems. The platform offers users many convenient features for complete budget management, such as personalized insights, customizable budgets, and subscription monitoring. A unique part of Mint is customizable budgets and alerts.

- Goodbudget. Goodbudget differs from other financial applications by using a rather original way of management - the envelope system. It involves dividing expenses into certain groups "by envelope" based on goals. Using this method allows you to save considerable sums of money. Goodbudget will enable you to use it digitally.

- Oportun. Oportun is a financial app that allows you to manage your finances and make saving money less hassle. It uses machine learning to calculate an appropriate amount to deposit in your savings account or retirement account each day, taking the task away from you. All the user has to do is set the desired amount of savings and the date by which it is needed.

What You Should Know Before Building a Finance App: Our Expert Bits of Advice

Now let's discuss some important aspects you should remember when creating a personal finance app in 2024. Based on our practical experience in FinTech soft development, we’ve collected some recommendations to contribute for the successful launching of banking apps:

Tip 1. Implement security measures

Financial applications deal with a lot of personal and sensitive information, so it is worth taking care of ensuring a high level of protection of user data. Here are the sure-fired security measures to consider:

- Using modern encryption methods to ensure robust data security

- Strong authentication will protect data from theft by third parties

- The use of monitoring systems will detect any suspicious account activity and block it in time

At Cleveroad, we treat security and legislation rules seriously, and our team can help you build a bespoke financial app compliant with industry standards, such as PCI DSS, GDPR, KYC, MiFIR, etc.

Tip 2. Compliance with financial regulations

In addition to the high requirements for data protection, you should also pay attention to building a personal finance application in accordance with all industry regulations and standards of the target region. Share the initial parameters with your software provider, and ensure they have solid FinTech app development experience so that experts can ensure full compliance with all regulations.

Explore FinTech development services provided by our company

Tip 3. Intuitive design

As we mentioned before, the design must be simple and user-friendly when building a finance app. Follow our mentioned tips and consider that the design should be as minimalistic as possible to simplify navigation and reduce the information noise, which will help users focus on the application's main functions and tasks. Moreover, the interface should be understandable so users can easily navigate the application and perform the necessary actions without complications.

Tip 4. User involvement

To attract as many users as possible, creating a personal finance app should be concerned with some important parameters. Creating a pleasant and satisfying user experience with clear instructions, contextual help, and quick feedback will help your customers when using your software. Also, it's worth considering implementing gamification elements such as achievements, badges, ratings, or prize draws to encourage user engagement and motivation in using the app.

Tip 5. Explore the needs of your target audience

For all the previous steps to be successful and help you engage more users, it's essential to research their needs and interests thoroughly. Conducting market and user research will help you better understand the requirements and preferences of your target audience. It is also worth resorting to prototyping the app and testing it with real users to get feedback and improve the user experience.

Tip 6. Think about promotion activities in advance

It is worth considering the marketing strategy before starting personal finance app development. Develop an approach based on your target audience and their interests, and use all possible channels for promotion, including social networks, community building, and user interaction. You can also use partnerships with financial institutions, banks, or other organizations to expand your user base and raise awareness of your app.

Plan Your Budget for Creating a Personal Finance App

Let's sum up and see how much it cost to build a financial app. The price depends on development time and where you hire developers.

Pay attention – this paragraph represents the time and cost to create only the MVP (Minimum Viable Product) for a financial app.

Remember: this price is approximate. It varies according to your business needs and features

First, take a look at the approximate time to build a financial app for basic features.

| Core features | Approx time (hours) |

Registration and authentication | 176 h |

Account aggregation | 400 h |

Transaction tracking and categorization | 472 h |

Budgeting and expense administration | 500 h |

Bill payment and reminders | 276 h |

Investment and portfolio management | 720 h |

Financial goal setting | 104 h |

Security and privacy | 664 h |

Customer support and assistance | 176 h |

Total development time | 3488 h |

Keep in mind that software developers aren't the only specialists you need on a team to build such a complex product.

Here's the full team composition you'll need:

- Front-end developer

- Back-end developer

- UI/UX designer

- Business Analyst

- Project Manager

- QA engineer

- DevOps engineer

- Team lead

In total, the cost of personal finance app development can range from $40,000 to $300,000+. It depends on various factors, including the following:

- Number and complexity of features: the more features you want to include in your financial app, the more time and resources the software engineers require for its designing and development.

- Design and user interface: creating an aesthetically pleasing user interface requires time and effort from designers. The cost depends on the number of screens to be created, and the overall solution logic complexity.

- Platforms and devices: if you want your finance app to be available on different platforms, such as iOS, Android, and a web app, this can increase development costs.

- Integrations with external systems: if your app requires integration with external systems such as bank APIs, payment gateways, or asset management systems, this can impact the final development price.

The price of developing a financial app also depends on the team’s location and developer hourly rates. We've analyzed the developer’s hourly rates in the most popular outsourcing regions. The prices are taken from Clutch and GoodFirms

| Specialist | CEE region | Western Europe | South America | Asia | United States |

Business Analyst (BA) | $45 - $70 | $72 - $133 | $45 - $55 | $30 - $42 | $110 - $205 |

Solution Architect (SA) | $50 - $77 | $129 - $190 | $60 - $72 | $35 - $48 | $198 - $292 |

UI/UX designer | $36 - $56 | $51 - $106 | $40 - $50 | $25 - $36 | $ 79 - $163 |

Developer | $25 - $70 | $68 - $122 | $35 - $61 | $18 - $42 | $105 - $187 |

QA | $25 - $63 | $50 - $110 | $30 - $50 | $15 - $36 | $77 - $169 |

Project Manager (PM) | $45 - $70 | $86 - $151 | $55 - $66 | $35 - $48 | $133 - $233 |

As we mentioned earlier, outsourcing is the most cost-effective option for building a finance app. For instance, the CEE region held to be the most popular outsourcing destination. Many experienced companies and specialists are available at a relatively low price: for example, hiring a developer in the CEE region costs you $25 - $70, which is much lower compared to $105 - $187 in the US. This is due to lower taxes and high government support for the IT sector.

Personal Finance App Development Expertise from Cleveroad

Cleveroad is a financial software development company with more than 12 years of experience in the IT market. Our team has backed expertise in creating FinTech software solutions, including financial applications, software for investments, loans, banks, digital wallets, and much more. We always take care of compliance with all industry regulations and standards.

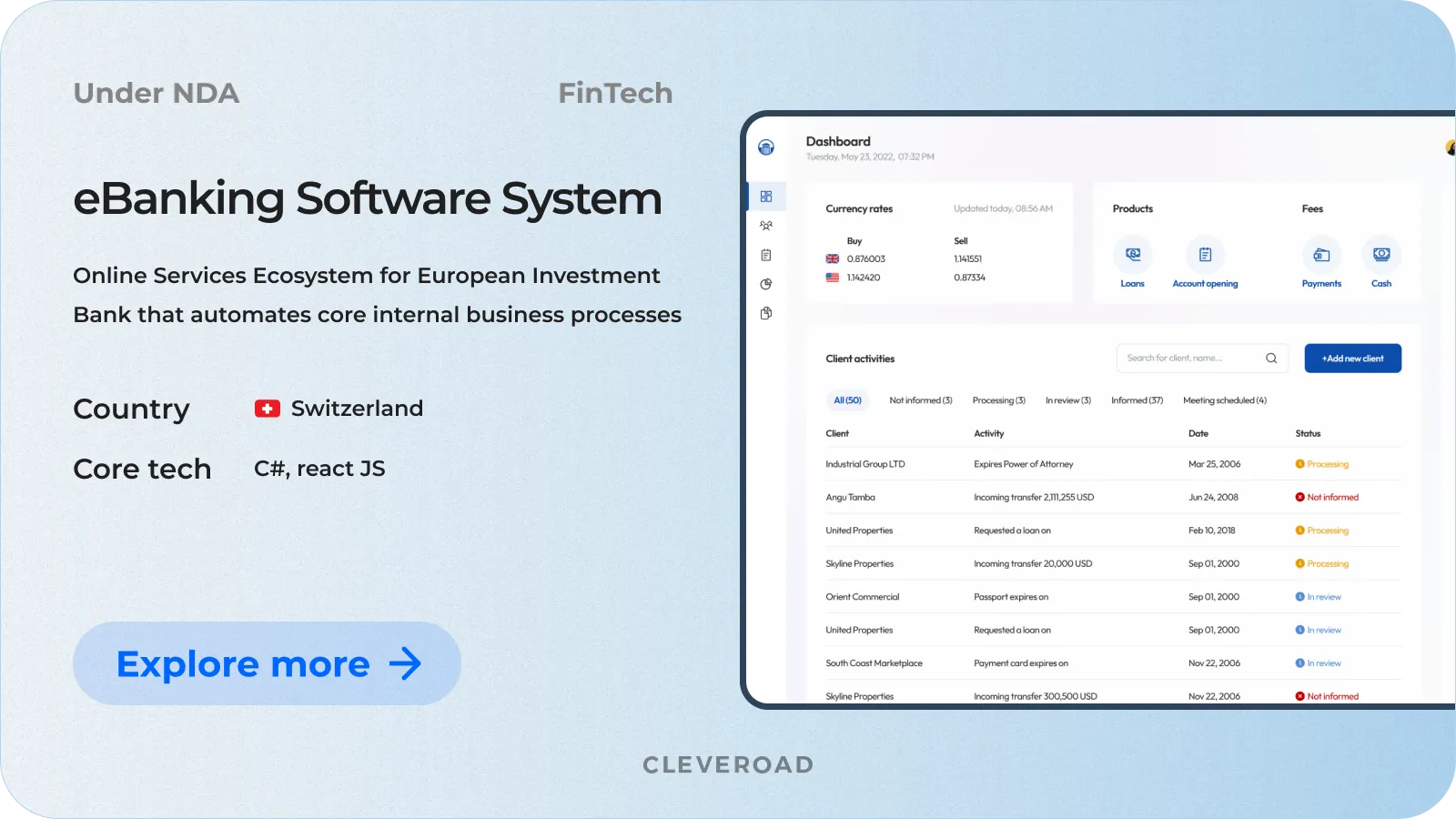

To prove our expertise in Fintech, we want to present to you our latest financial project – Online Services Ecosystem for Investment Bank.

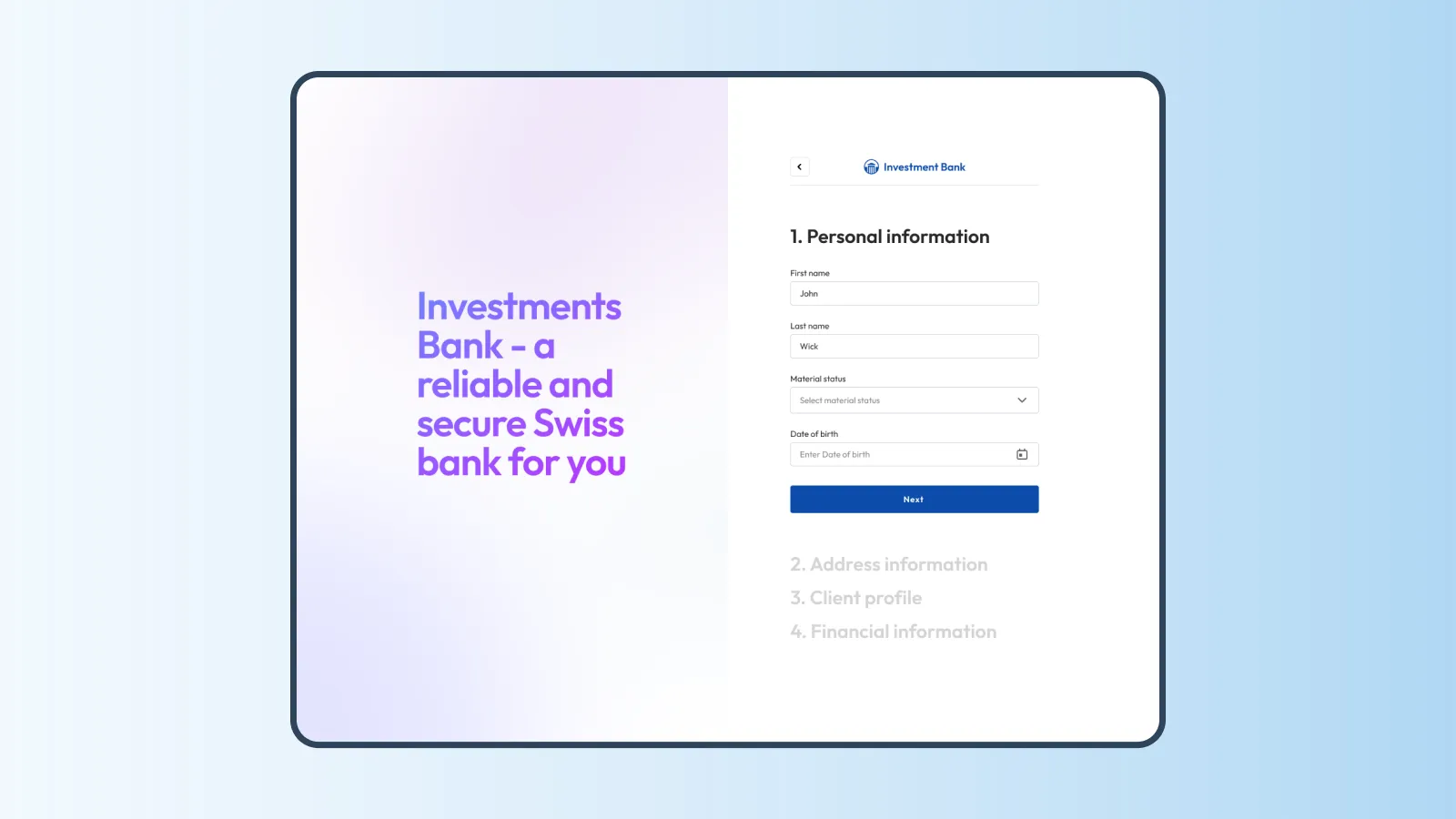

We have helped our customer, an investment bank in Switzerland, create a new flexible system to improve the quality of their investment services and meet high-security standards. To achieve the client's goals, our team has developed and implemented such solutions:

- Replace the outdated solution with a new-built holistic system that allows simple investment and opening the digital account

- Improve the user experience (UX) so that end-users can quickly complete the registration procedure and trading in the investment bank

- Build new software complying with Swiss banking regulators' requirements, namely FMIA, so the bank can freely work under its license

As a result, the client received a full-fledged ecosystem that fully meets the regulations and requirements stated in the FMIA. It allows freely operating under its license and providing clients with secure banking at the level of Swiss standards, known for their rigor. Also, thanks to the improved UX, the bank increased the user retention rate by 20%-30%.

To optimize the time and budget of our clients, we provide various collaboration models to choose from:

1. Staff augmentation. This model enables you to enhance the capabilities of your existing team by hiring additional specialists who possess expertise in the specific areas you require.

2. Dedicated team. With this model, you can hire an entire team dedicated to completing a specific scope of work. While these specialists are not part of your internal team, they will provide you or your CTO/PM with regular progress reports.

3. Fixed work scope. This model suits projects with well-defined requirements and deadlines. Once you receive the estimate and plan the development during the Discovery phase, you pay for the time spent creating your solution.

4. Time and materials. This model offers more flexibility than the previous one. Estimates are generated for each subsequent sprint based on the planned amount of work.

If you are considering creating a finance app, ask our experts for help. We will consult you on all matters, help you choose the suitable cooperation model, provide a rough app estimate, and build a personal financial app for better management of financial information and cost control.

Plan to build your own finance app?

Contact us, we provide you with Free Solution Workshop to connect your business needs with financial app functionality

A personal finance application is a handy tool that allows users to track and manage the flow of their finances, control budget, and analyze income and expenses.

To build finance app, you should go through several steps:

- Define your goals and target audience

- Conduct market analysis

- Find an experienced technical partner

- Go through the Discovery Phase

- Think about the design

- Development and QA

- Release and further improvements

- Support and maintenance

To create a successful financial app, you should include such essential features:

- Secure user registration and authentication

- Account aggregation

- Transaction tracking and categorization

- Budgeting and expense administration

- Bill payment and reminders

- Investment and portfolio management

- Financial goal setting

- Security and privacy

- Customer support and assistance

There are several ways in which businesses can benefit from personal finance app development They include:

- Increased user engagement

- Improved customer experience

- Streamlined operations

- Cost savings

- Data-driven insights

- Competitive advantage

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article