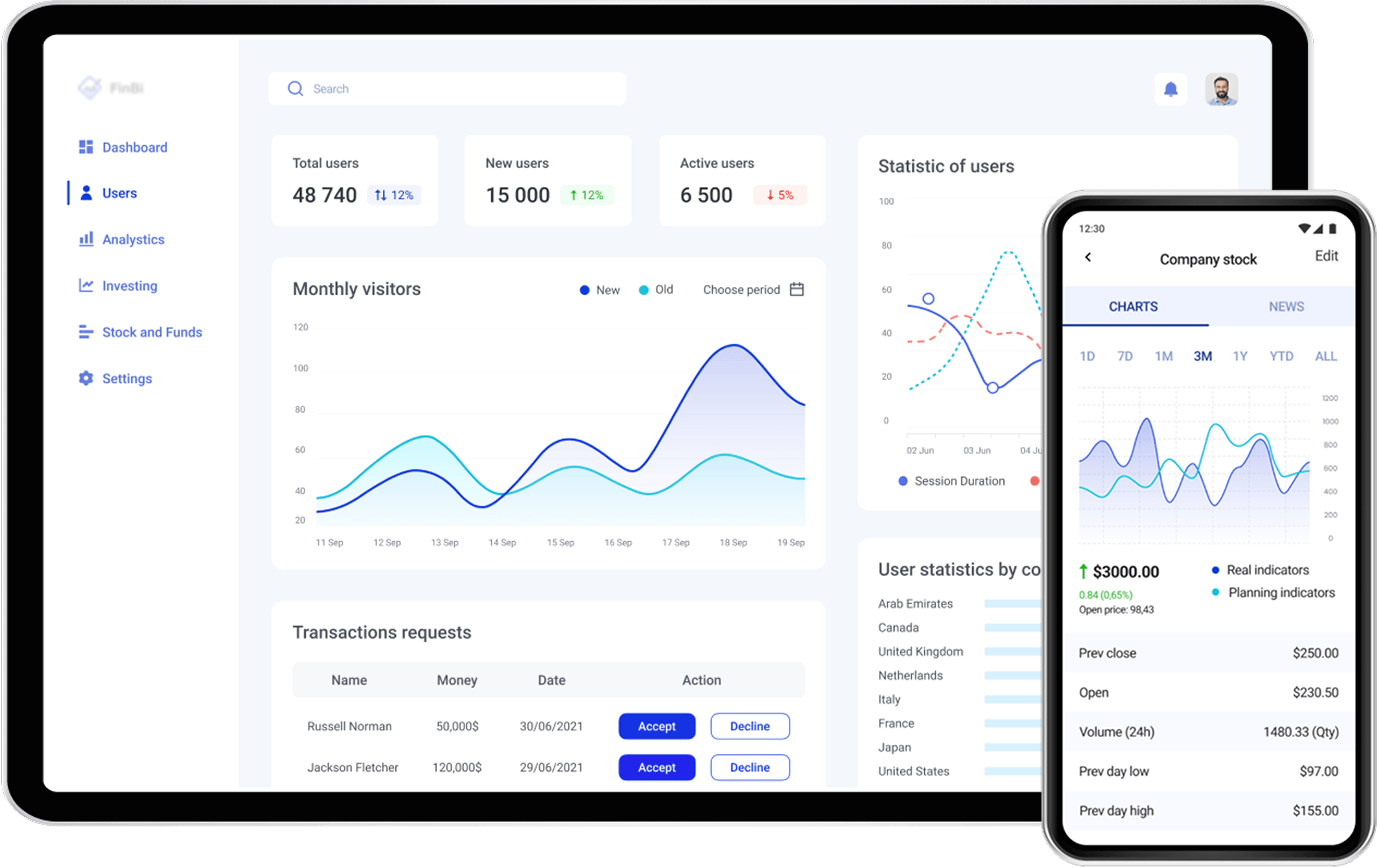

FinTech Software Development Services

- Creating custom software to improve finance and banking

- Implementing payments in your FinTech applications

- Build better analytics to make smart business decisions

Financial software development services

that help automate processes, improve transaction security, and put the latest FinTech technologies at the service of your businessFinTech Software Development

Software Modernization

Third Party Integrations

Digitalization and Optimization

FinTech software solutions

, mobile and desktop applications, intelligent analytic systems and other software that covers all the needs of financial businessesElectronic Trading Platforms

- Trading operations simplification

- Liquidity analysis

- Algorithmic trading

Blockchain and Cryptocurrency

- Cryptocurrency exchange and trading apps

- Cryptocurrency wallet

- Smart contract

- DeFi, DEXs, and auctions

Cybersecurity

- Security testing

- Malware & fraud protection

- Vulnerability assessment

- RegTech

Digital Payments

- Online payment systems

- Digital wallets

- POS software

- Recurring billing

- Payments security

- B2B payments

- Mobile payments

- P2P transfers

Analytics and AI

- Stock market quantitative analytics

- AI-based robo-advisory

- Financial data analysis and recommender systems

- Client segmentation and analytics

- Liquidity analysis

- Natural Language Processing (NLP)

- Big Data analytics & data science

Financial Planning and Management

- Finance management

- Personal finance management

- Working with financial data

- Risk management

- Gamified finance management

- Online lending & alternative financing

Our Clients Say About Us

CEO at AVFX

"Cleveroad successfully delivered our custom presentation solution from scratch, on time and with all the required functionality."

FinTech Solutions We’ve Delivered

Challenges solved:

- A micro-investing application is built from scratch

- The solution is compliant with local FinTech legislation (namely SAMA)

- Any sensitive data is kept black-boxed and securely protected

- KYC verification with liveness detection is implemented

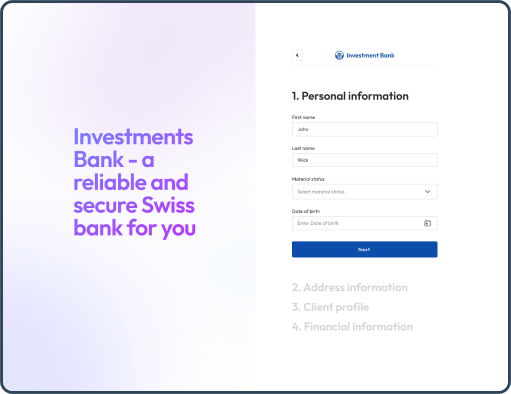

Challenges solved:

- Creation of new software to simplify investment and account opening

- Maintaining and improving of existing banking system

- Meeting the investment banking regulation (FMIA)

- Improvement of the UX for sign-up and digital account opening

FinTech software development

with the full coverage and on-demand tech services, guaranteeing quality and meeting deadlinesEngineering Services

- WEB & Mobile FinTech development services

- High-performant and fault-tolerant systems

- API design & development

Internet of Things

- IoT Cloud integration

- Data collection & analysis

DevOPS

- Delivery pipeline and continuous integration (CI/CD)

- System automation

- Infrastructure maintenance

Software Testing

- Analyze complex software for technical debt and potential risks

- Manual and automated testing

- End-to-end testing

Cloud

- Cloud adoption and migration

- Native cloud services

- Cloud agnostic design

Operations Support

- Monitoring, incident management and fixing

- Flexible support and maintenance plans

Tools and integrations for FinTech software

that we use in development enhance the solution functionality, optimizing the project’s budgetFinTech software developers

from Cleveroad design solutions in line with industry legislation, understanding the importance of regulatory compliance and data securitySecurity Standards

- PCI DSS (SDP, CISP, AIS)

- GDPR

- PA-DSS

- ePrivacy

- KYC

Industry methods and workflows

- Central Limit Order Book (CLOB)

- IOI/RFQ/Quote (Negotiation)

- EMV

Digital Signature regulations and standards

- SES

- QES

- AES

- eIDAS

Financial Legislation and regulations

- AMLD

- MiFID II

- PSD2

- MiFIR

Certifications

ISO 27001

Information Security Management System

ISO 9001

Quality Management Systems

AWS

Select Tier Partner

AWS

Solution Architect, Associate

Scrum Alliance

Advanced Certified, Scrum Product Owner

AWS

SysOps Administrator, Associate

Why Hire Cleveroad as a FinTech Development Company?

Best practices and compliance with industry security standards

We build solutions in line with the latest industry standards regarding security, financial data safety, usability, and interoperability: GDPR, GDPR, PCI DSS, SEPA, PSDA, and other FinTech regulations.

Full-cycle development

End-to-end FinTech software development, including Discovery Phase, bespoke UI/UX designs and prototypes, Delivery and post-production support.

Technology expertise

Cleveroad certified experts help choose the best tech stack for the particular financial solution and advise the architecture, allowing to achieve the project’s business goals.

Continuous innovation

Our team participates in various conferences and meetings devoted to the latest updates in FinTech. The Cleveroad experts apply new approaches and technologies in projects to make innovations serve our customers’ business goals and needs.

Industry Contribution Awards

70 Reviews on Clutch

4.9

Award

Clutch 1000 Service Providers, 2024 Global

Award

Clutch Spring Award, 2024 Global

Ranking

Top Staff Augmentation Company, 2024 Global

Ranking

Top Flutter Developers, 2024 Global

Ranking

Top Web Developers, 2024 Global

Ranking

Top Financial App Developers, 2024 Global

- Lending software (loan origination and commercial loan)

- Banking software (online banking and mobile banking)

- Insurance software (CRMs and software for agencies)

- Investment management software

- Payment processing software

- Personal finance software

- RegTech (risk management and fraud detection)

- Outsourcing grants cost-effective access to new tech domain, expertise, and talents

- Optimized IT processes

- Much lower software development cost

- In-house staff can focus on more critical tasks

- Chatbots

- Robo-advisors

- Fraud predictions

- Risk assessment and lending

- Better insurance recommendations

- Improved analysis of investments We’ve explained all ways in detail and mentioned famous AI FinTech startups in our article.

- Freshbooks

- QuickBooks

- Moneyspire

- Xero

- GoDaddy Bookkeeping

- FinTech solution grants valuable tools for automating workflows and making them more efficient

- Business can receive valuable customer insights for smarter decision-making

- Client base can be increased thanks to additional interaction way with the financial facility