A Platform for Managing Investments in Property

A digital system covering all the processes and parties of real estate development investment and loan management

Industry

FinTech

Team

30 members

Started in

2020

Country

UK

About a Project

Our customer is a UK conglomerate with 22 years of experience in property investment. The company's in-house resources weren’t enough to create a software solution it needs: a platform for investors to manage funds and real estate objects. The customer required a provider with industry expertise to build a digital ecosystem covering all the processes and parties of investment flow.

Goals set to Cleveroad

Develop a solution that satisfies the customer's business model and covers the entire process of real estate investment management

Meet the industry standards, regulations, and customer requirements regarding system design to facilitate fundraising decisions

Satisfy customer’s requirements regarding product quality, development process flexibility, and solution’s cost-effectiveness

Solutions we've delivered

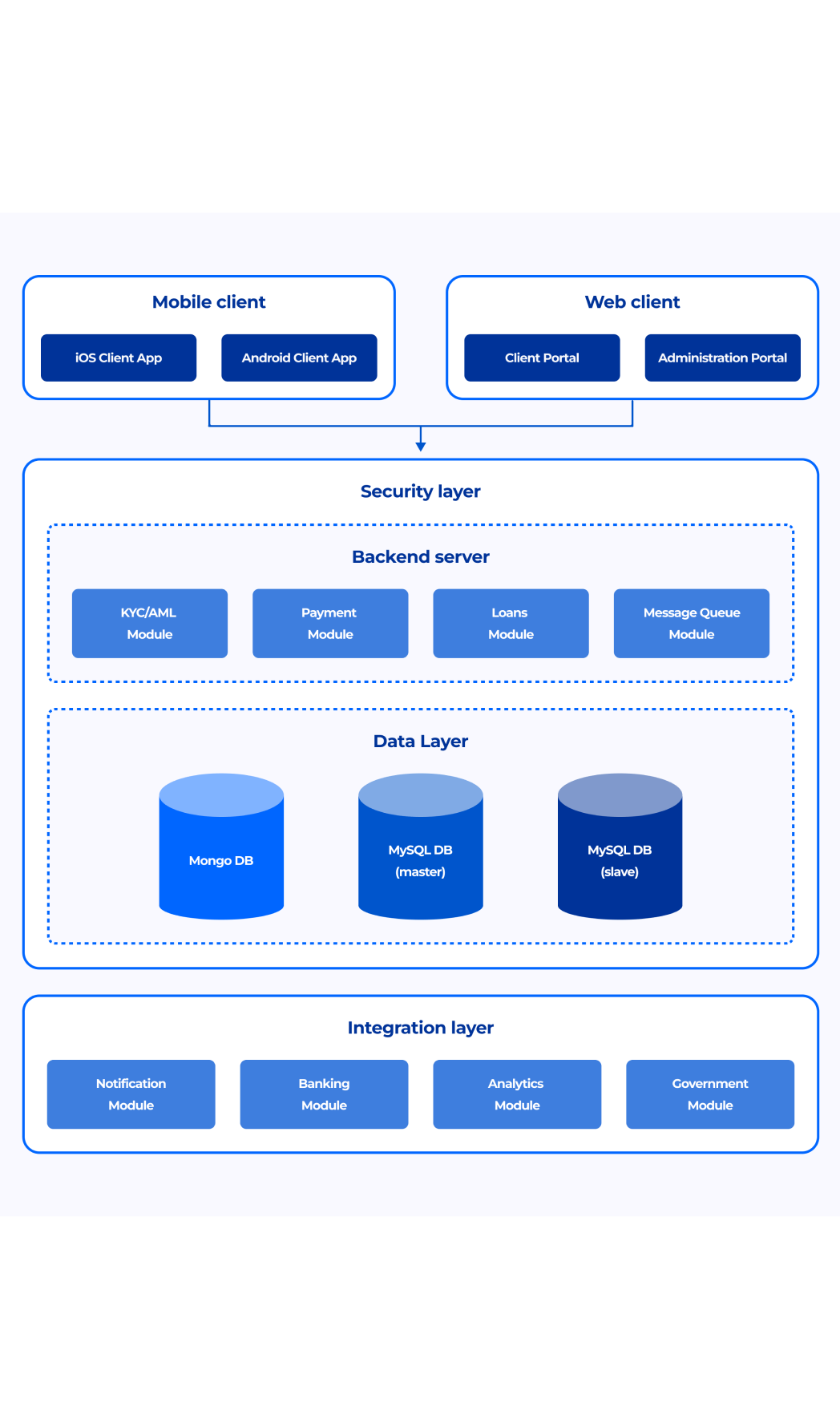

Creation of the ecosystem consisting of mobile apps (iOS and Android), a web-based Advisor portal, and a web-based backoffice for system Admins

Platform development according to KYC/AML requirements and a Financial Conduct Authority #722801. Creation of a design concept and custom UI/UX design

Enrichment of customer's team with Cleveroad experts within the Dedicated Team model. Application of our Quality Approach, including competitors analysis and internal focus group of Team Leads and C-level managers

Results for the Customer

A ready-to-work platform covers all stakeholders: Individual and Institutional Investors, their Advisers in investment decisions, and Property Developers making public offers to raise funds

The investment ecosystem is industry-compliant and has a modern and trendy UI allowing users to navigate and manage funds easily. It sets it apart from similar solutions and increases competitiveness

Compliance of the project with the budget frames and requirements regarding the quality of results that leads to optimization of the support costs for the customer and investor earnings growth through the use of our platform only

Business Challenges

Our customer is a British company that belongs to a multi-industry business and set out to perfect the branch of investment in real estate under development. For that, it needed a digital ecosystem that orders and brings together all parties in the process: investors, their advisors in decision-making, and developers. Despite the presence of its developers, our customer did not have sufficient resources and needed a partner software company that would to:

Provide the customer with a pool of industry experts working in cooperation with the in-house team and taking care of all stages of product delivery: from architecture and functionality creation to Quality Assurance (QA), launch, and support. To this end, we proposed a Dedicated Team, including a certified Scrum Master, that cooperates with the company's development specialists to ensure the best result.

Design a system that reflects all aspects and processes of investment flow, structure them, and simplifies user navigation and investment decision-making. Our Business Analyst (BA) and Solution Architect have conducted market research and competitor analysis to find the best solution. We’ve also provided the customer with the focus group of Cleveroad’s Team Leads and C-level executives to receive valuable feedback and implement improvements before the release.

Ensure that the delivered product complies with regulatory terms regarding investment making, financial fraud prevention, user authentication, and validation of their information in government agencies. For this, we’ve developed the solution taking into account the requirements of the Financial Conduct Authority #722801 and implemented KYC/AML check functionality.

Product in Detail

Business Architecture

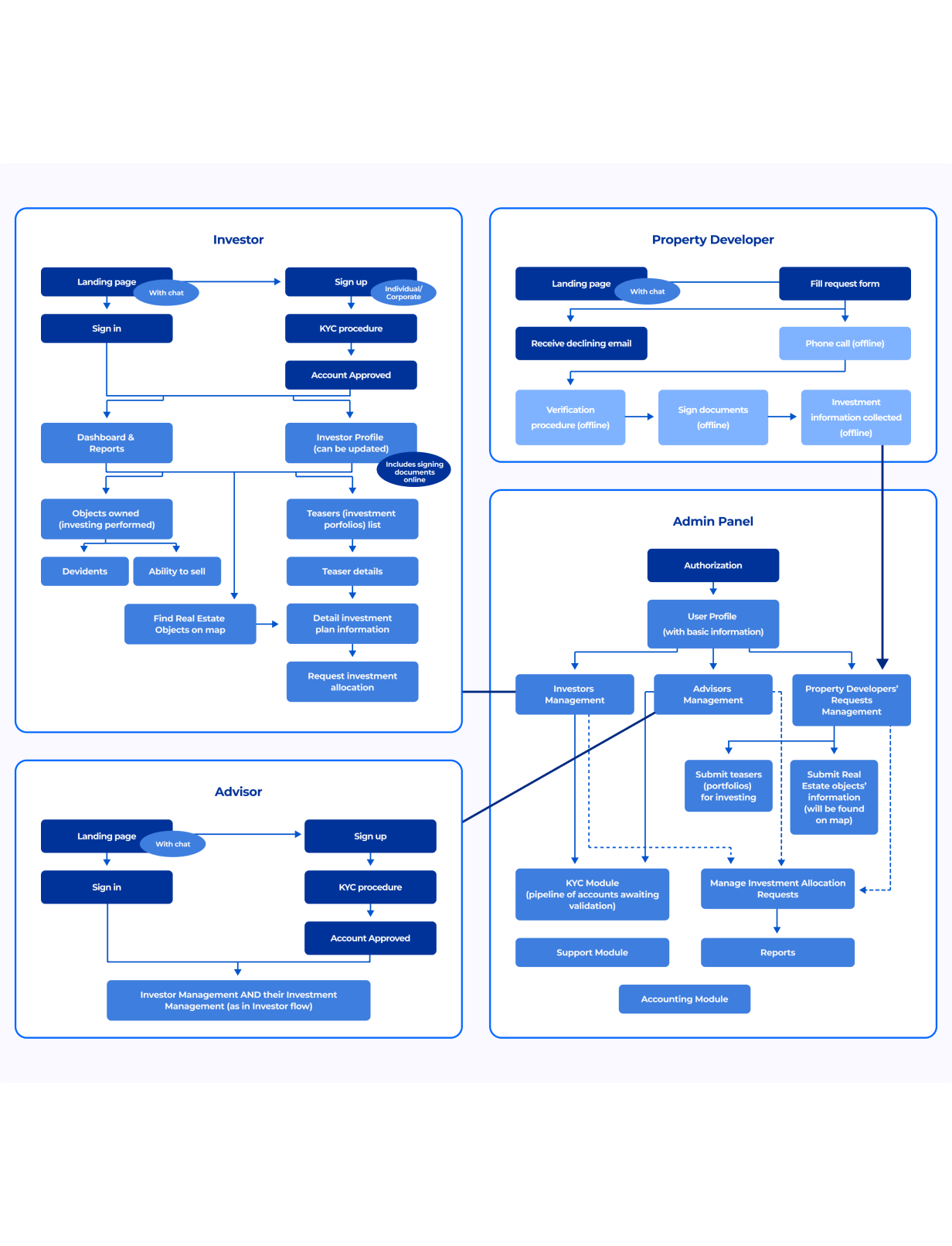

- The solution architecture was designed to reflect the investment flow and is in line with the customer’s business model. According to it, Property Developers plan to build a real estate object, make a public offer for raising investments, and Investors carry out targeted financing. Once the building is ready, investors receive back funds and the percentage — the difference between the object's value before and after commissioning.

- The software solution included a web app for all user roles and a mobile app for Individual Investors and Advisors. Investor, Investment, and Advisor Layers were intended for it. Information from the Property Developers is submitted and maintained by Admins. An extra party involved in the process is the Advisor role: advisors manage investors and their investment decisions on demand. An Admin Panel functionality allows employees to support all kinds of users and manage investments.

- We’ve also created modules covering other sides of investment flow. Support Module helps to process support requests and incoming calls and maintain KYC procedures. KYC Module is designed to process the pipeline of accounts validation and was built by our team from scratch. Accounting Module covers integration with the individual banking system, reconciliation for bank account transactions, invoices processing, and taxes.

Product Essentials

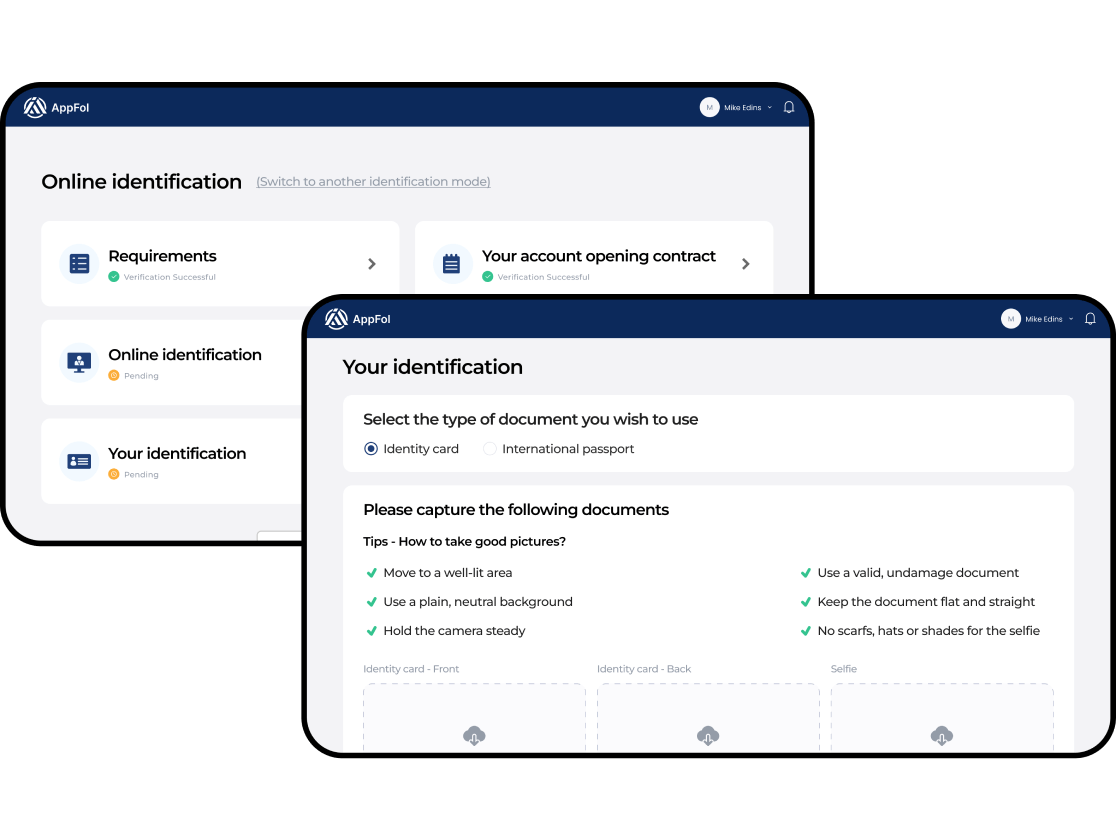

The KYC/AML check system allows platform administration to process the pipeline of accounts validation and confirm user information in multiple government databases. This module was built by our team from scratch. We have created the system for 3 KYC process options: online and online via video conference call.

The online KYC process is an option for customers who are familiar with digital operations and don't need any specific explanation to perform them. Such customers are guided with notes and tooltips on UI. The procedure includes e-signing the contract: an identification code enables it, protecting users.

A video conference call with the operator allows users to provide necessary documents and make a verification photo with real-time support and guidance. For several applicants, such identification is mandatory under financial security requirements and international KYC policies.

The identity verification is divided into 2 components: for the end-users (investors and advisors) and platform employees (admins) who perform the procedure. It is connected with client support, providing a smooth and transparent user flow. When users complete the KYC process, they can access platform functionality. Support Module allows operators to process support requests and specific incoming calls and provide maintenance with KYC procedures.

In the Investor Module, users can create accounts that activate after the KYC procedure completion. UK residents with a UK bank account can sign up via the app. In the active profile, users can:

- Set up or manage monthly investing preferences

- Manage account: change password, add a new debit card, set up bank details, etc.

- Review teasers and make investments via various options, including

- Apple Pay

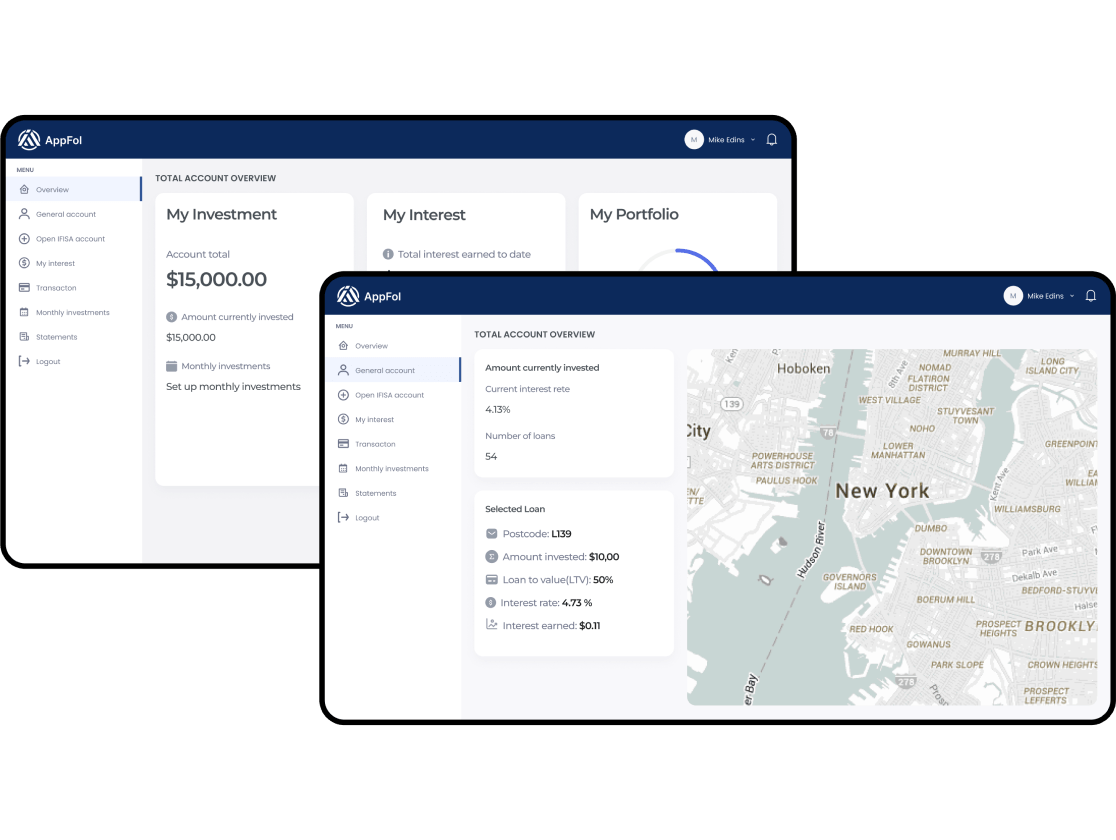

Lender dashboard with easy navigation shows the status and info of every loan users invest in. The General Account is easy to use and provides customers with the information to track investment details, including the expected return rate, the number and status of loans, real estate objects on the map, etc.

Managing the funds earned is available with auto-invest settings. Users can choose between two options: reinvesting the capital automatically (in any available loans, as soon as possible) and cash withdrawal. To select an option, the user must turn the switch in the account menu to the "on" or "off" position, respectively.

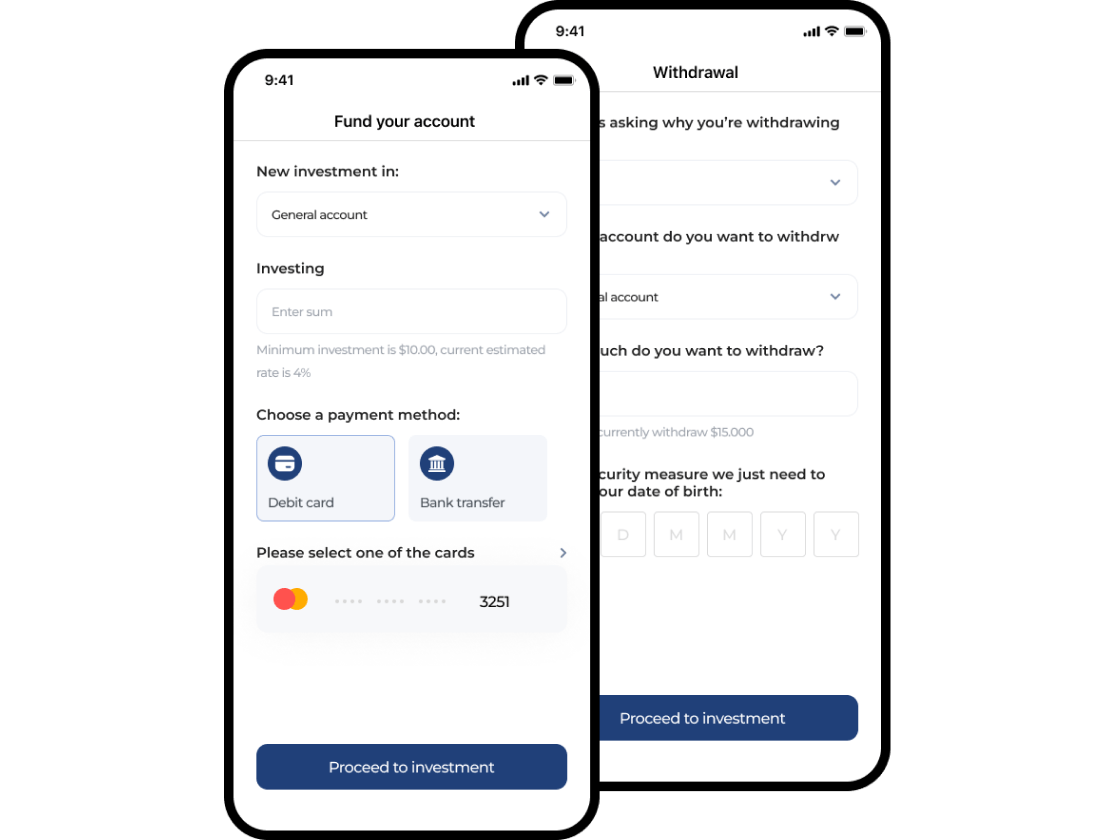

Deposits can be made by bank transfer from a UK bank or a UK debit card. Bank transfers are usually shown in the user account the same or the next working day; money from the debit card is available instantly. The loans map feature is created via an integration with a MapBox solution with an additional modification to provide better performance and end-user experience.

Money withdrawals are only available to a verified bank account and typically take 1-3 business days. The user has to enter account details to withdraw from, the sum to transfer, and the date of birth as an additional security check. Billing functionality allows clients to perform both recurring credit card payments with monthly limitations and wire transfers via their banking integration layer.

Accounting Module functionality includes:

- Integration with banking system for commission for transaction reduction

- Reconciliation for bank account transactions

- Invoices processing

- Taxes, etc.

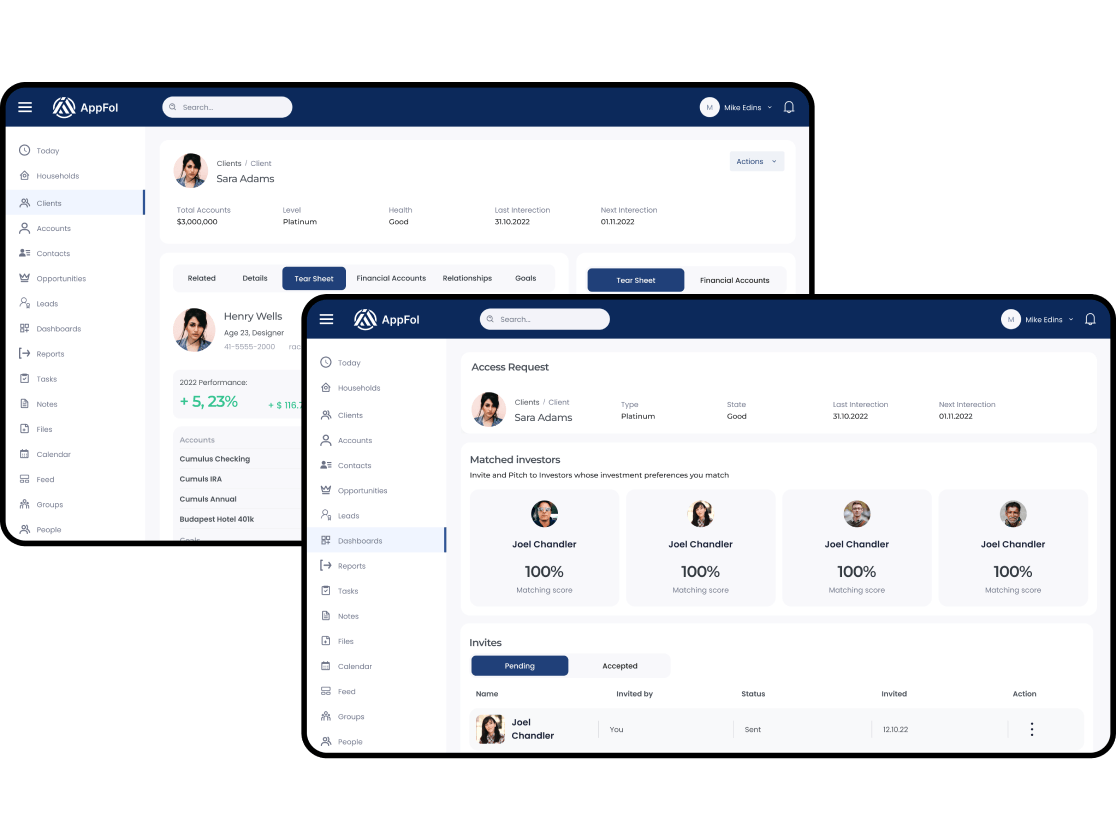

An Advisor Module includes functionality that allows Advisors to make decisions about investing for their managed investors. Advisors must create accounts set to active once KYC is completed. The basic functionality of the module includes investors and investment management: reviewing detailed portfolios for each client, along with “tear-sheets” with names, client interests, and recent lifestyle events.

Property Developer Module is represented by functionality for companies offering real estate for investment. It is the account registration/creation and the ability to provide the system Admins with “teasers” about the property. For this, the developer must fill out a request form. Admins place teasers on the platform after thorough communication with the owner company; the negotiation process is organized offline.

An Administrative Module includes core features for admin users, such as investors and advisors management. Admins can also manage property developers’ accounts: review requests, submit real estate objects information and teasers for investing, manage investment allocation requests, etc.

Development in Detail

- The Team Composition for the project covered Solution Architect (SA), Tech Lead, project manager (PM), business analyst (BA), UI/UX designer, backend and frontend developers, manual and automation QA engineers, and DevOps. The Cleveroad team performed all research and solutions-making. The stakeholders validated solutions as subject-matter experts: goals decomposition, roadmaps, prioritization, budget, etc., conducted focus groups and business tests (when needed) and controlled the infrastructure setting-up. Our BAs provided scenarios for focus groups and business tests for new features delivered and ensured the implementation of the entire project picture correctly.

- The Discovery Stage team consisted of SA, BA, PM, and a Designer. They worked with a customer-side Tech Lead and Product Owner (PO). Our Business analyst and Solution Architect conducted market research and competitor analysis to combine the results with our expertise when creating the solution. As a result, we received valuable app functionality for the release date. The Discovery phase deliverables included Mind Map, UML diagrams, Impact Map, Value Stream, Quality attributes and scenarios (workshop), Infrastructure deployment diagrams, SAD, and FBL and Scope estimation based on it.

- An iterative Development Process was conducted within the Cleveroad quality approach. The solution’s functionality was divided into 4 milestones; each was released separately, adding new functionality to the previously delivered. Our team, including a certified Scrum Master, worked with customer PO and Technical Specialist according to Scrum Framework. Tasks covered planning, sprint reviews, daily scrum meetings, user acceptance testing, and feedback. All the stages were presented to our internal Focus Group of Team Leads and C-level managers — free of charge for the customer. It helped us to get valuable feedback and implement improvements before the release.

Technology stack

Tech stack was selected considering property investment process, platform's business logic, and the UK authorities rules and regulations

Web Architecture

Backend

Node JS

GoLang

Frontend

React.js

Mobile Architecture

Android

Kotlin

iOS

Swift

Results Obtained

A versatile platform for investing in property

We have created a full-fledged and modern solution for investing in real estate objects under development. The platform covers all the processes of the large workflow and all stakeholders. They are individual and institutional investors, advisors in investment decisions, and property developers who make public offers to raise funds.

Hassle-free start to implement solution quickly

We ensured a high quality of development: about 95% of the functionality was created without bugs, and the other 5% were minor and fixed quickly. A solution is flexible: the team was able to work full-time or on demand to reduce support efforts and costs. The system is industry-compliant, so software legalization is simplified.

Growth of investor activity and customer profits

A thoughtful software product allowed investors to benefit more from fundraising via our platform. According to the official information, the peak of the investment activity was £164.4m invested by users, £7.6m was earned in the first operational year, and the sum of earnings in the second operational year was stated as £9.3m.