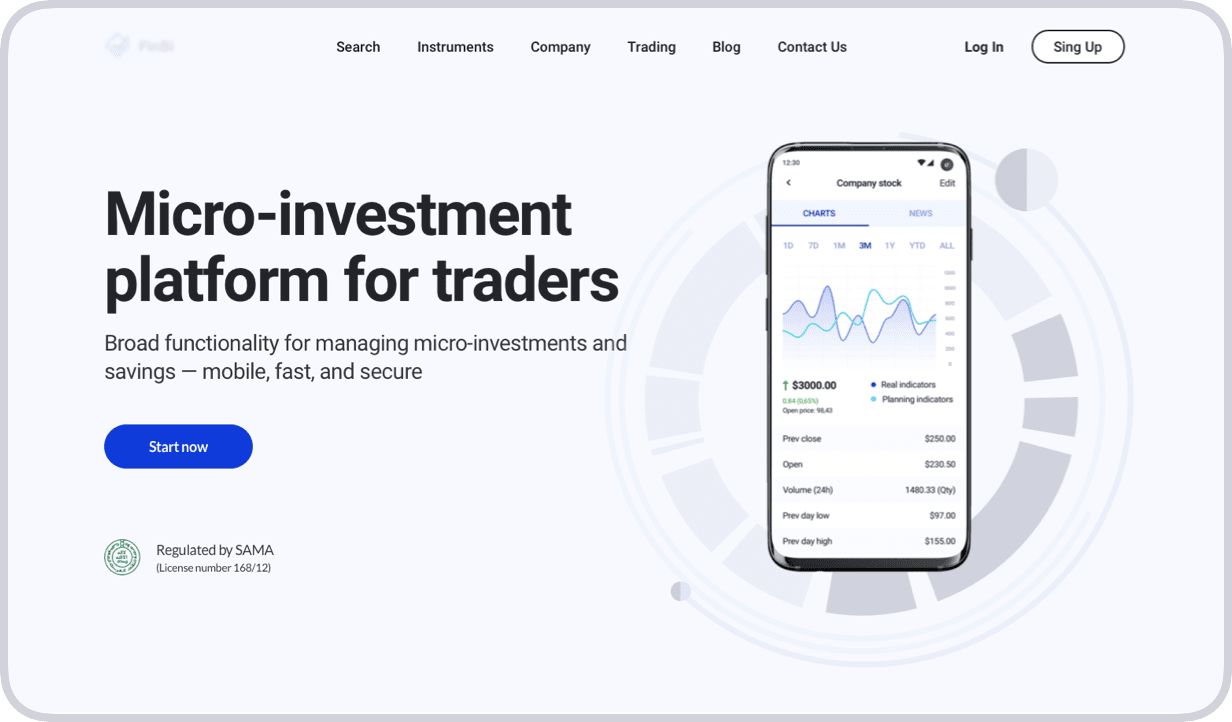

Micro-investment platform for the Middle East market

Cross-platform application with broad functionality for managing micro-investments and savings.A turnkey solution that considers all the pains, gains, and goals of the traders focused on this niche.

Industry

Fintech

Team

8 members

Started in

2023

Country

Saudi Arabia

About a Project

The solution aims to remove traditional barriers, such as minimum brokerage account sizes, and act as an intermediary between individual traders and the investment company. The app has to attract a new target audience, primarily interested in micro-investing, and provide it with a convenient automated service for managing personal savings.

Goals set to Cleveroad

Ensuring compliance with local legislation

Creation of micro-investing app from scratch

Establishing long-term partnership for app’s progress

Solutions we've delivered

Analysis of SAMA requirements. Defining rules and restrictions, features, and Software Development Life Cycle (SDLC) based on this analysis

Developing an app using UI/UX and fintech best practices. Testing micro-investments and savings functionality on the focus group

Providing the customer with IT consulting, marketing analysis, and a team of experts for further technical improvements

Results for the Customer

Successful app verification after assessment, freely and fully functioning in the legal field

Сompletely ready-to-use platform that considers pains, gains, and goals of the traders focused on micro-investing

Successful cooperation and the project’s growth due to the high-quality development and tech consulting services

Business Challenges

The customer is an investment company that has been on the market since 1988 and has reached US$3,319.00 AUM (assets under management) by January 2021. Our customer planned to expand to a micro-investment domain and needed:

Build mobile platform focused on micro-investments from scratch: it has to be scalable and provide opportunities for growth in the number of users and solution capabilities

Procurie compliance with the requirements of the local financial regulator and carrying out the analysis to meet fintech rules of Saudi Arabia and other Middle East countries covered by SAMA

Provide the customer with in-depth expertise and platform’s post-release maintenance and support for company’s total revenue growth on a long-term period

Project Goals

Compliance with local legislation

Provide a strict plan to ensure the platform's compliance with fintech regulations in Saudi Arabia and other Middle East countries covered by SAMA. Carry out requirements analysis to meet fintech and data protection rules and reduce legal risks.

Creating an app for micro-investments and savings

Develop an application for traders primarily focused on this domain. Provide the platform's scalability, further extension, and evolution so that the owner can conduct new rounds of fundraising and grow the business capitalization.

Getting a long-term partner ensuring constant growth

Carry out the platform’s post-release maintenance and support. Provide the customer with in-depth expertise to increase demand for the app, the remuneration for the management company, and return on equity.

Project in Details

Ensuring compliance with fintech regulations

- We have conducted an analysis of legal requirements, highlighted the core points according to SAMA restrictions and distribution area. All the detailed solutions were based on this research performed in productive communication with the customer.

- We have designed the architecture and the authentication process. We've provided the main modules: multi-factor authorization, Know-Your-Customer (KYC) verification with liveness detection, and the monitoring and reporting system.

- We have ensured the client information's protection and obligation to establish a proper SDLC. It allowed us to ensure that all sensitive data of the investment company and their customers could remain black-boxed and secret for every participant.

Application development

- We’ve provided the client with our own team. It consisted of a project manager, business analyst, UI/UX designer, tech leads, developers, QA and DevOps engineers, and solution architect. It allowed us to speed up the development process and optimize the client's costs.

- The platform was developed within 7 months with Flutter, .Net, React.js, Redux, and other appropriate technologies. We also have performed integrations with noonpayments , Absher, KYC/AML automated check, Intercom Support Real-time Chat, Microsoft Azure Cognitive Services , sarwa.co FIX API (private), and FCM.

- We have made the architecture flexible, efficient, and relevant and allowed us to ensure the needed level of security. The system logic includes special integration modules: Stock rate service for retrieving valid data in real-time, Push notifications, Payment Gateway, which should be relevant to the distribution area.

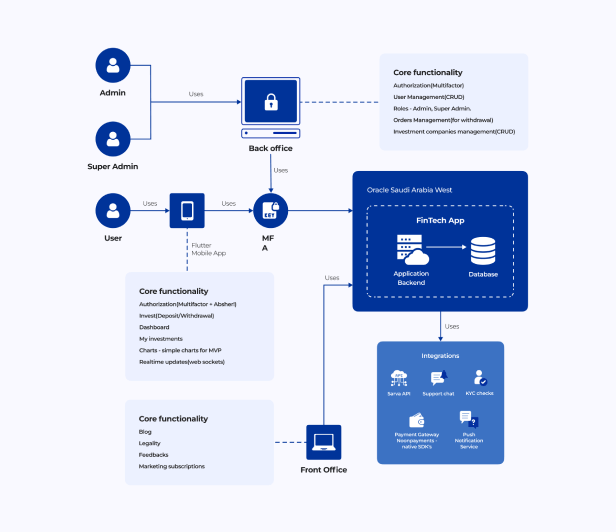

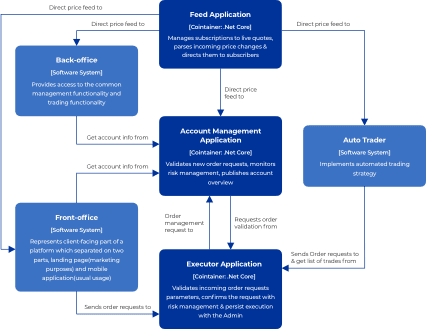

The Big Picture Architecture Diagram illustrates the technical solution and core functionality

Cross-platform mobile app

In the application, we covered all the data security requirements and the needs of micro-investment traders

Data protection

Flutter mobile app including authentication according to the SAMA requirements. Before each financial transaction, the identities of counterparties are established by KYC policies. We also provided multi-factor authentication when logging into the system.

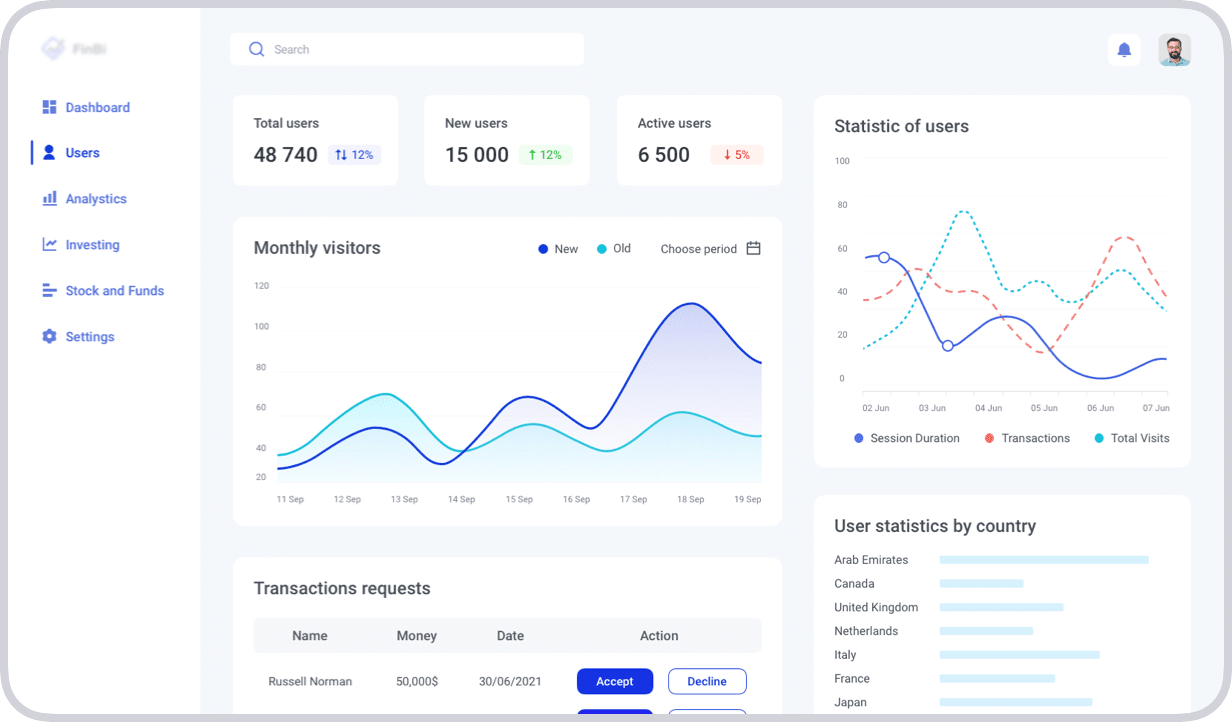

Front-office

Including a landing page, terms & conditions, privacy policy, and marketing subscription parts. We’ve designed a user-friendly environment to make the micro-investing process intuitive and simple for any trader.

Backend

Handling all main business logic and aplication’s integrations. The interaction between the backend and the frontend considers the specifics of the fintech industry and the micro-investment process.

Back office

Web app admin panel allows Super Admin and Admins to operate with users, orders, and other features. Back office includes authentication and management of traders, investment companies, and front office content.

Results Obtained

The app was developed as compatible with SAMA Cybersecurity Framework, and all legal and technical aspects were considered. After the assessment, the app was successfully verified and now can work freely without risks of regulatory sanctions

We’ve created a comprehensive turnkey solution that allows the customer to master the niche of mobile micro-investing in the shortest time. Our client received a completely ready-to-use platform that considers all the pains, gains, and goals of the traders

The quality of development and consulting allowed our customer to release the app quickly, avoid interruptions, reach a new customer audience, and get financial results from this source of profit immediately right after the start