5 Mobile App Personalization Tools to Take User Engagement to the Next Level

Updated 28 Aug 2023

12 Min

6986 Views

When you order a cup of green tea and ask a bit of melissa in addition, that is called customization. But when you enter the teahouse and the waiter already knows what kind of tea you prefer even without asking - that's personalization.

In this sense, personalization is the following evolution step after customization. It's a powerful tool to deliver personalized user experience which helps to retain your customers and becomes more and more demanded every day.

The same is true for personalization in mobile applications. Not so long ago all mobile software was static. It gave the same experience to everyone in spite of the individual preferences. But it didn't last long. Static apps don't attract users' attention anymore. We predict that soon every app will use personalization tools similar to how almost everybody have smartphones now. So, in order to build a successful mobile app in the long-term, you should definitely personalize your software.

In this article, we'd like to disclose you the workable practices on how you can take advantages of mobile app personalization to outperform your competitors.

Why is personalization in mobile applications so important?

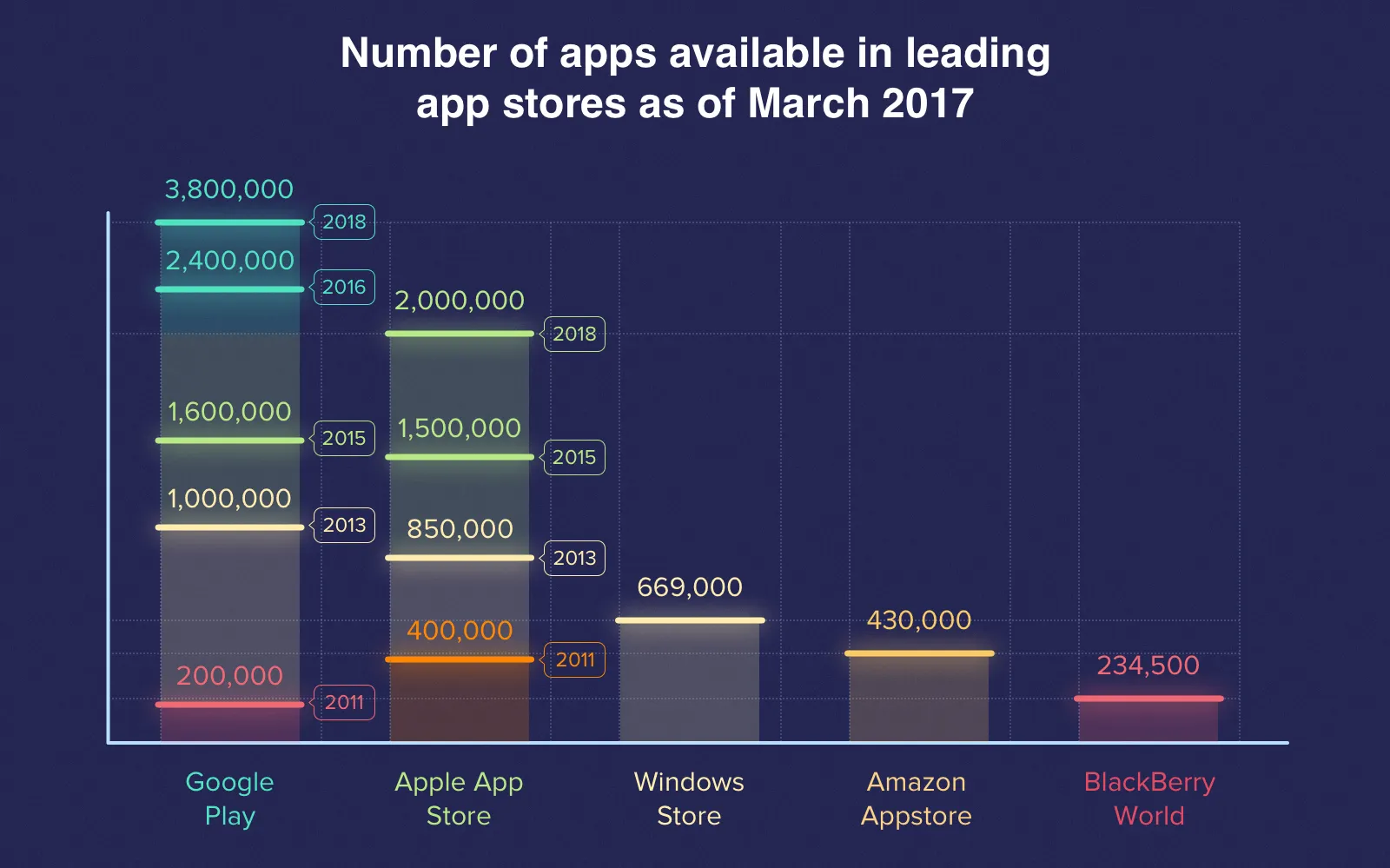

Do you know how tough is the competition in the market of mobile software currently? The number of apps has grown up to 5 million on App Store and Play Store in total.

Number of apps have significantly raised in the last years

There's no more monopoly of one application for a particular task. Mobile users today have plenty of alternatives for any app whether it's messengers, eBook readers, banking or travel apps. The possibility of choosing makes the users delete the apps that don't satisfy their expectations even a little bit. Thus, it has led to an immense drop in average retention rates for mobile applications.

Do you want to avoid the unwanted rejections when submitting your app to the App Stores? Here's how to do it for the iOS apps and the complete guide for Android apps.

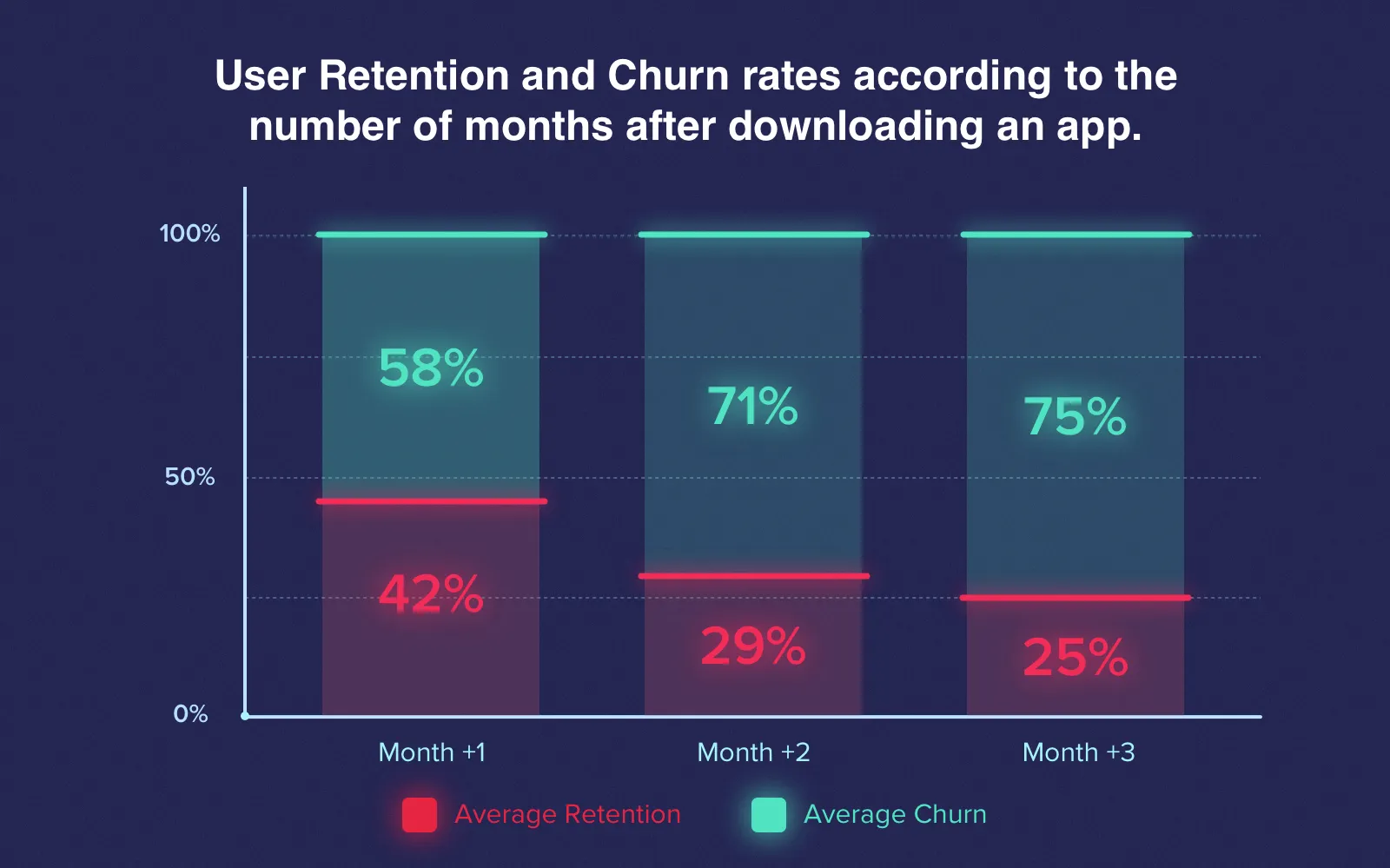

You can make sure of this trend below. Now we warn you for these figures may shock you:

User renention rates as of 2015, according to Localytics

Apps from various industries lose more than 70% of their users after 3 months after downloading. This happens because the consumers don't sense engaged with their apps. At the same time, they can't discover a suitable purpose to keep on using them. The apps don't offer a sufficient level of involvement, therefore, the consumers don't show a sufficient level of attachment. That's why mobile app personalization is so crucial today. It offers a contemporary way to increase the retention rates of users.

App personalization tools that will turn a regular software into the personalized one

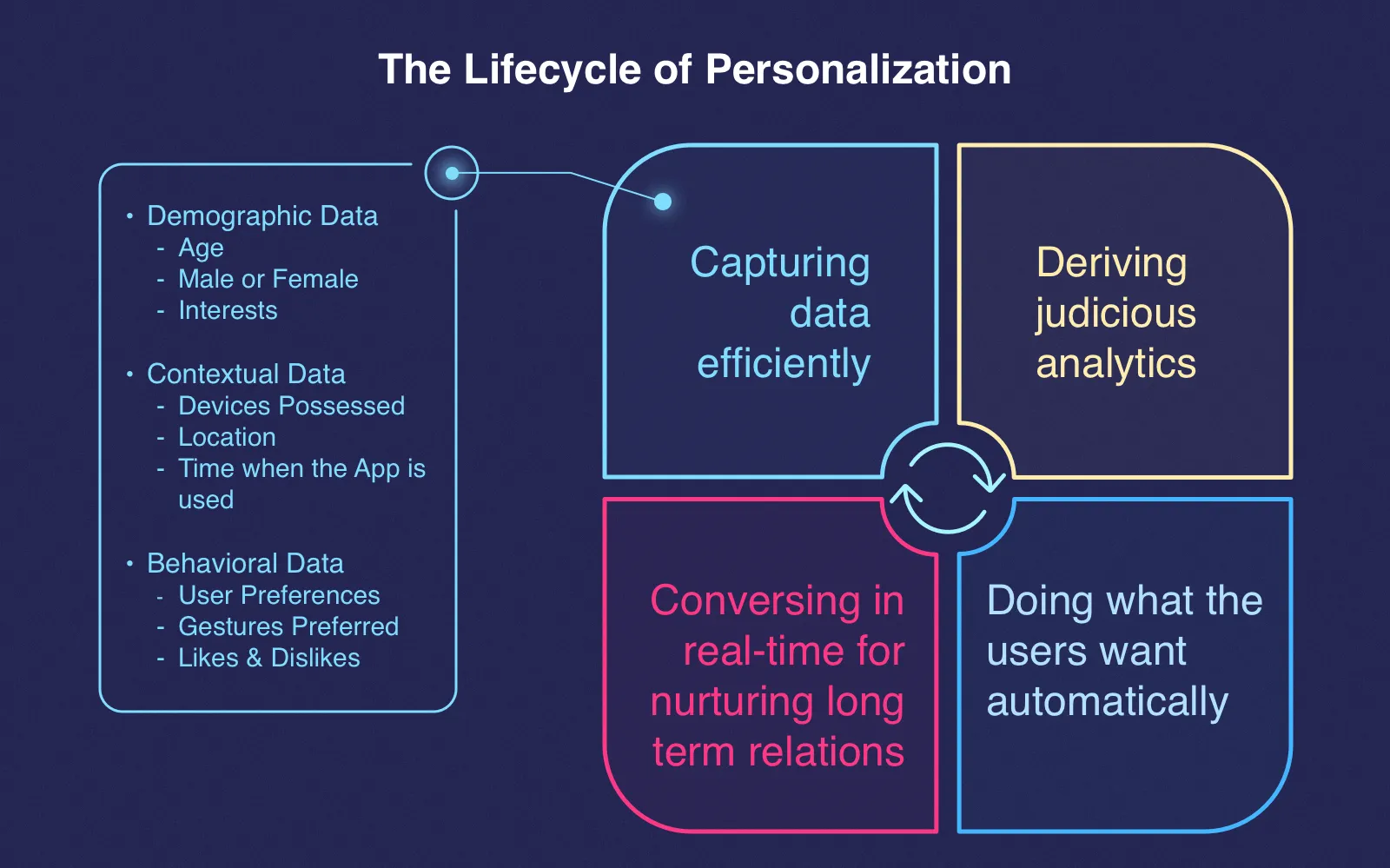

Here's how app personalization process looks like

There're a number of issues for consideration when making a personalized business app. Here are some of them:

1. Onboarding experience

The onboarding gives the first impression of your app and thereby should be your top priority. If the users didn't like your app from the first try, they would hardly return. Therefore, it's essential to apply for UI/UX design services to get an understandable and user-friendly design. Otherwise, the users may be unwilling to waste their time on finding the desired button in the unexpected location and just delete your app.

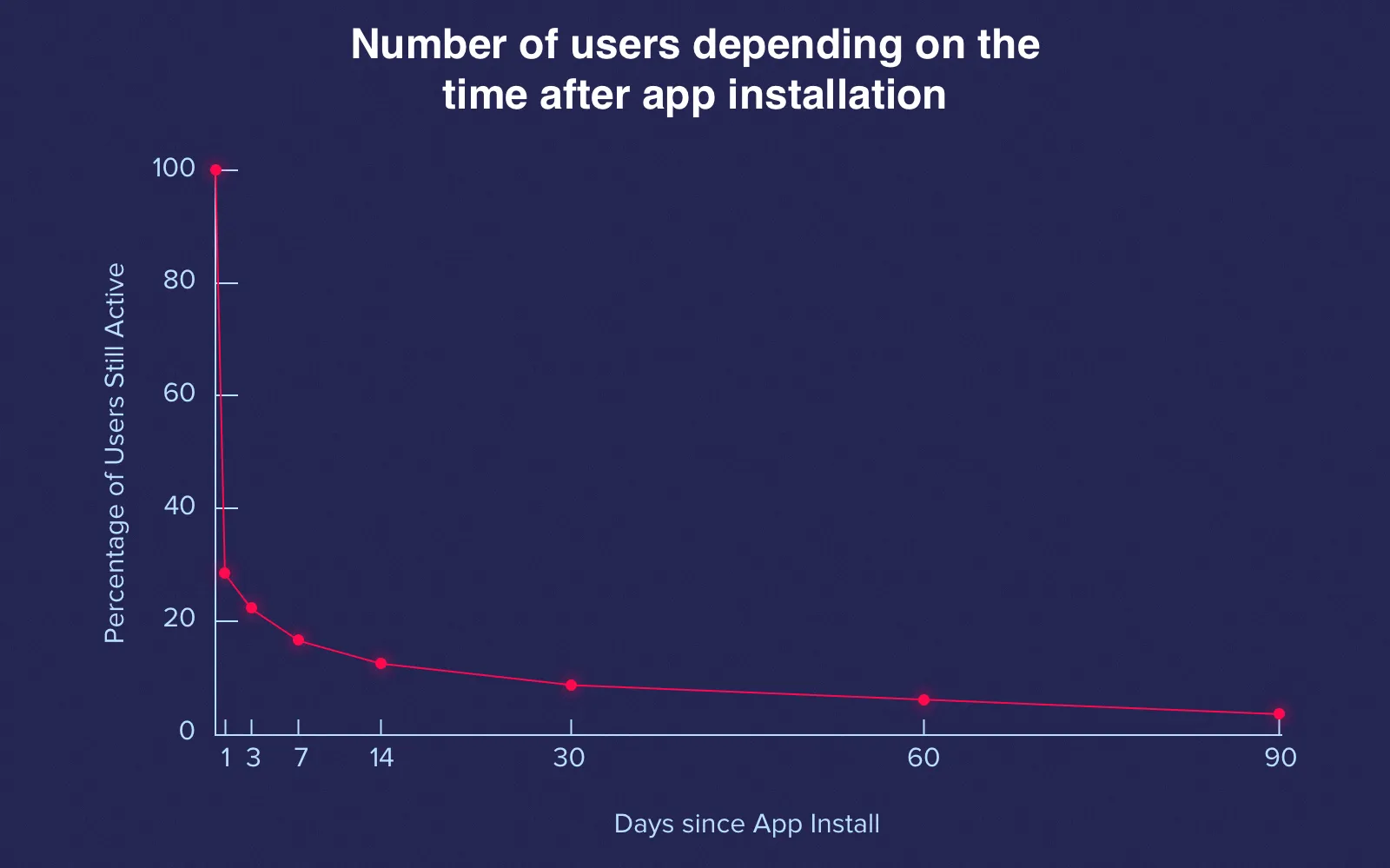

'An Ordinary app loses 77% of users in the three days after downloading' according to Andrew Chen from Silicon Valley. Just by making more comfortable to use your app from the very beginning, you can greatly increase the loyalty of your users.

The number of users depending on the time after app installation

To enhance this parameter pay a thorough attention to the installer of your app - where the user found your app, what he/she was looking for, why the person has downloaded it? This way, you'll be able to design a custom trip within the app that makes each user feel that his/her opinion is heeded.

For instance, many mobile apps use registration via social networks accounts instead of email registration that requires receiving unwanted confirmation emails. You can apply for QA services and run the A/B testing of your app to improve your registration or other features.

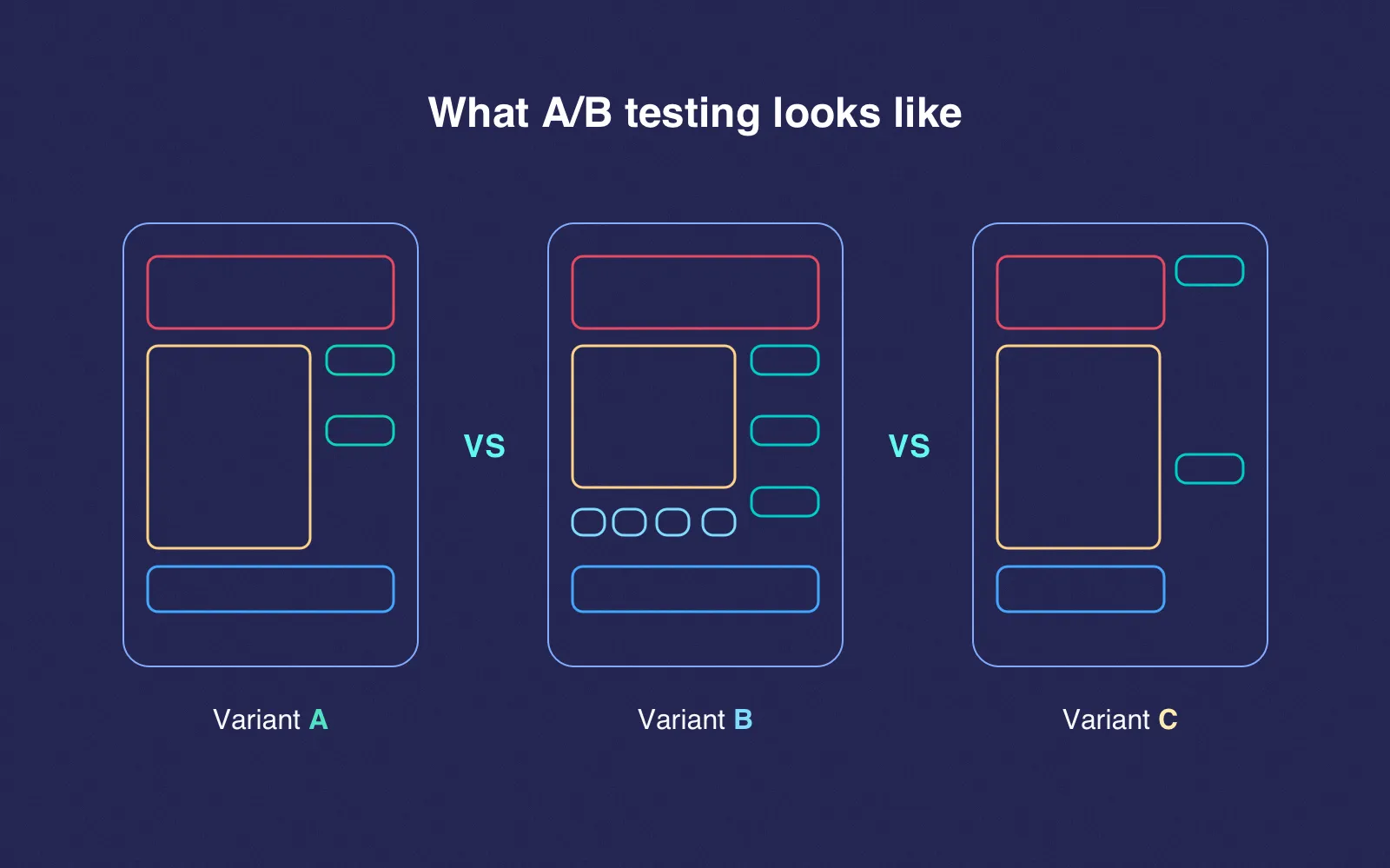

A/B testing is an experiment of showing two or more variants of a web page to different users to define which one delivers a better result (it may be performing, engaging, converting, etc.).

A/B testing can be used to personalize your software by showing different variants of the same page of your app

By doing this you may identify that registration using social networks is favored by a specific part of your users. Then you can personalize this feature to this specific share of users. As a result, all of your users will be satisfied. Registration via the social networks will be shown to those who prefer this method and invisible to the others.

2. In-app and push notifications

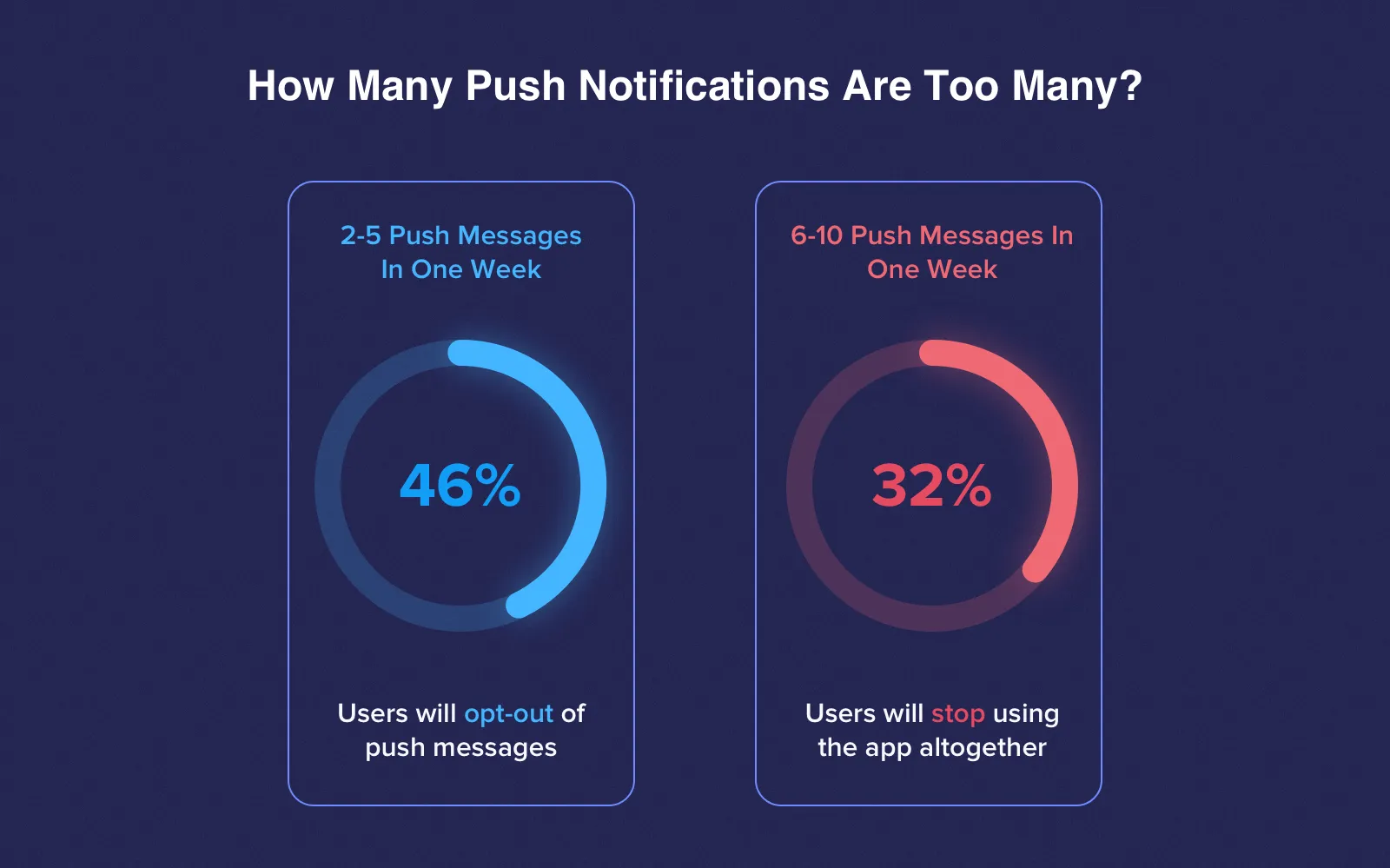

It goes without saying that constant interaction with your users is a must-have. If you don't communicate with your users by means of notifications they may feel unengaged or unable to swiftly find the function they need. In both cases, it makes them more likely to quit.

Grab their attention by keeping them aware of hints how to use your app better, new features it recently received or recommend an in-app purchase. But make sure that notifications are not obsessive and pop up to the appropriate segment of the user base. As a rule, In-app notifications extend the overall time that a user spends in your app.

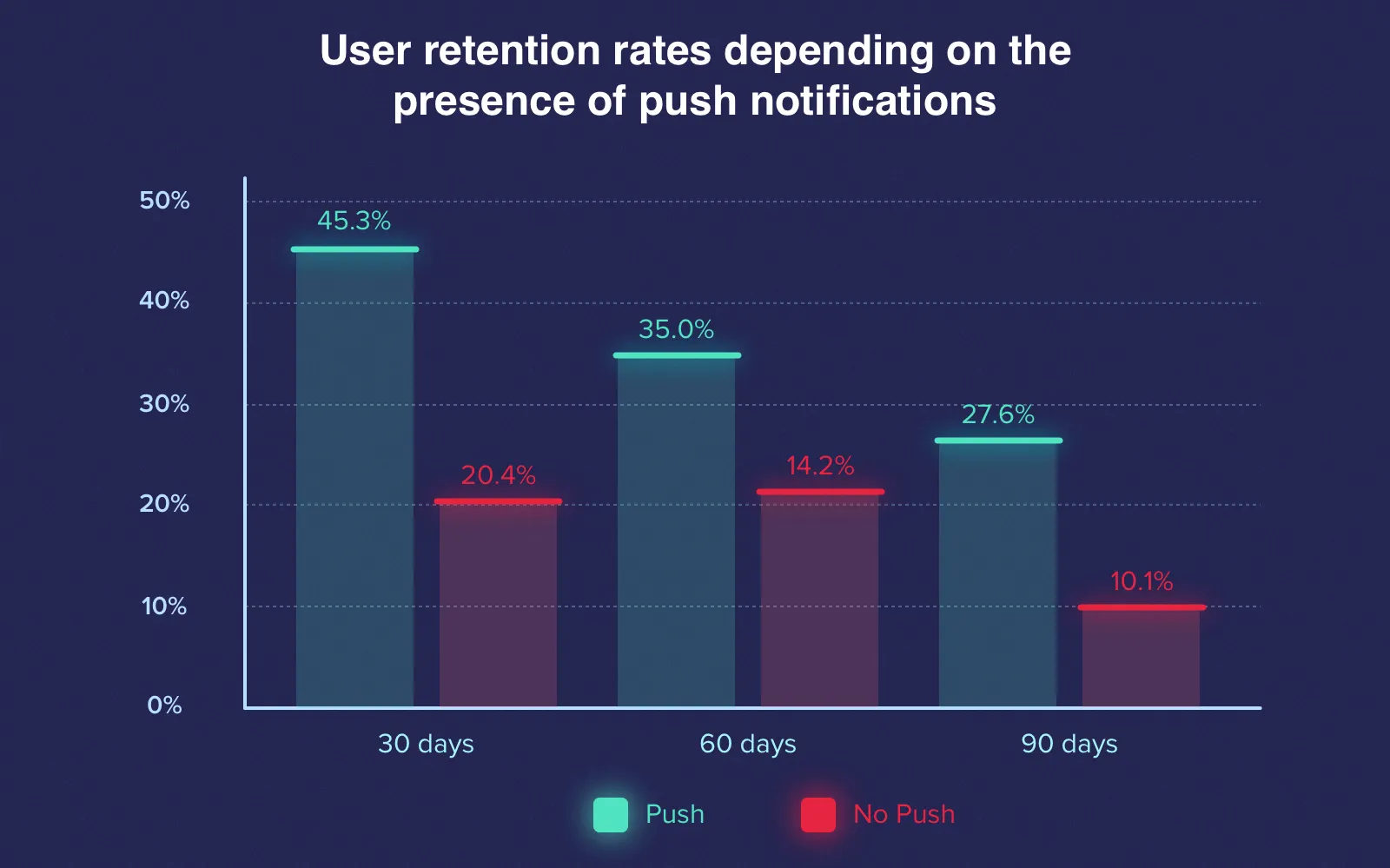

Push messages almost triple user retention rates concerning a term of 90 days or longer

As for push notifications, they attract a user to go for an extra session. It's like they were meant to remain in their memory for a long time and motivate them to use the app again. But to respect your users' ability to choose, make it simple for them to disable these notifications. You can embed personalized notifications into your app using such services as Onesignal, Batch or Amazon SNS.

Don't send more push notifications than needed

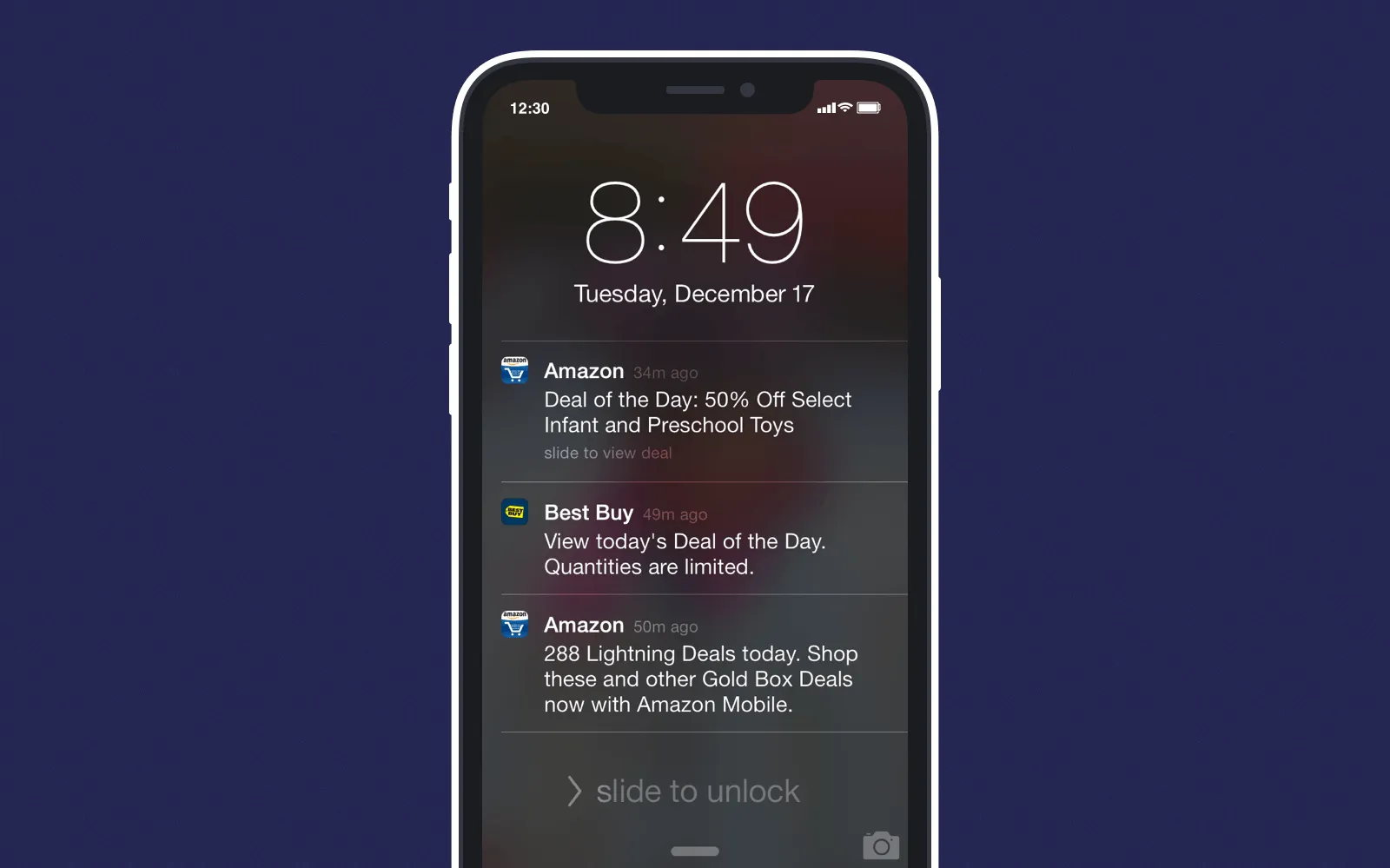

Here's one of the personalized experience examples. Amazon and Best buy apps regularly analyze user's profile and demonstrate the best merchandise per day according to his/her preferences via push notifications.

Apps like Amazon and Best Buy send daily personalized notifications

3. Build the community of your app's users

Another effective way to hook the users and boost the retention rates of your app. Community lets your users communicate with each other, share impressions and even find fixes to the common bugs together. It's like a passive income that doesn't need your constant activity but generates you profit 24/7.

The modern trend is to build in-app communities instead of using social media for community management. It can help to prolong the time users spend in your app. It also reduces the possibility of losing data between two different platforms.

Take advantages of in-app communities by offering a relative and personalized app content to your users, sharing hints and providing them a place to network among themselves.

4. Propose some activities

This is often done for some weak spots of your app where users lose attention or there's a shortage of interaction. Embed an activity that helps them to finalize the desired action. For instance, it could be proposing the gift cards or unlocking the special feature for them

In particularly, Siftr Magic gives a possibility for users to earn reward points each time they utilize the app to share photos on WhatsApp.

5. Get the users involved in app enhancements

Isn't it great when businesses care about users' opinion and react to it on a regular basis? It's a win-win approach both for users and businesses. With the help of the appropriate well-timed messages, you can ask your users about the features they like and dislike in your app. This will give you the precious suggestions for your app improvement.

You should certainly choose only suitable and achievable suggestions for you. Don't forget to keep the users informed about the history of upgrades and give them hope that your app will get better once in a while. Then you can enjoy your skyrocketing retention rates.

For instance, Facebook informs the users about the updates from time to time. Despite that amount of changes is not huge but their commitment to fixing the common bugs sure makes them feel comfortable.

Personalization examples in famous mobile apps

We hope that these first-class personalization software PROs will give you the proper inspiration to build the mobile software better in the nearest future.

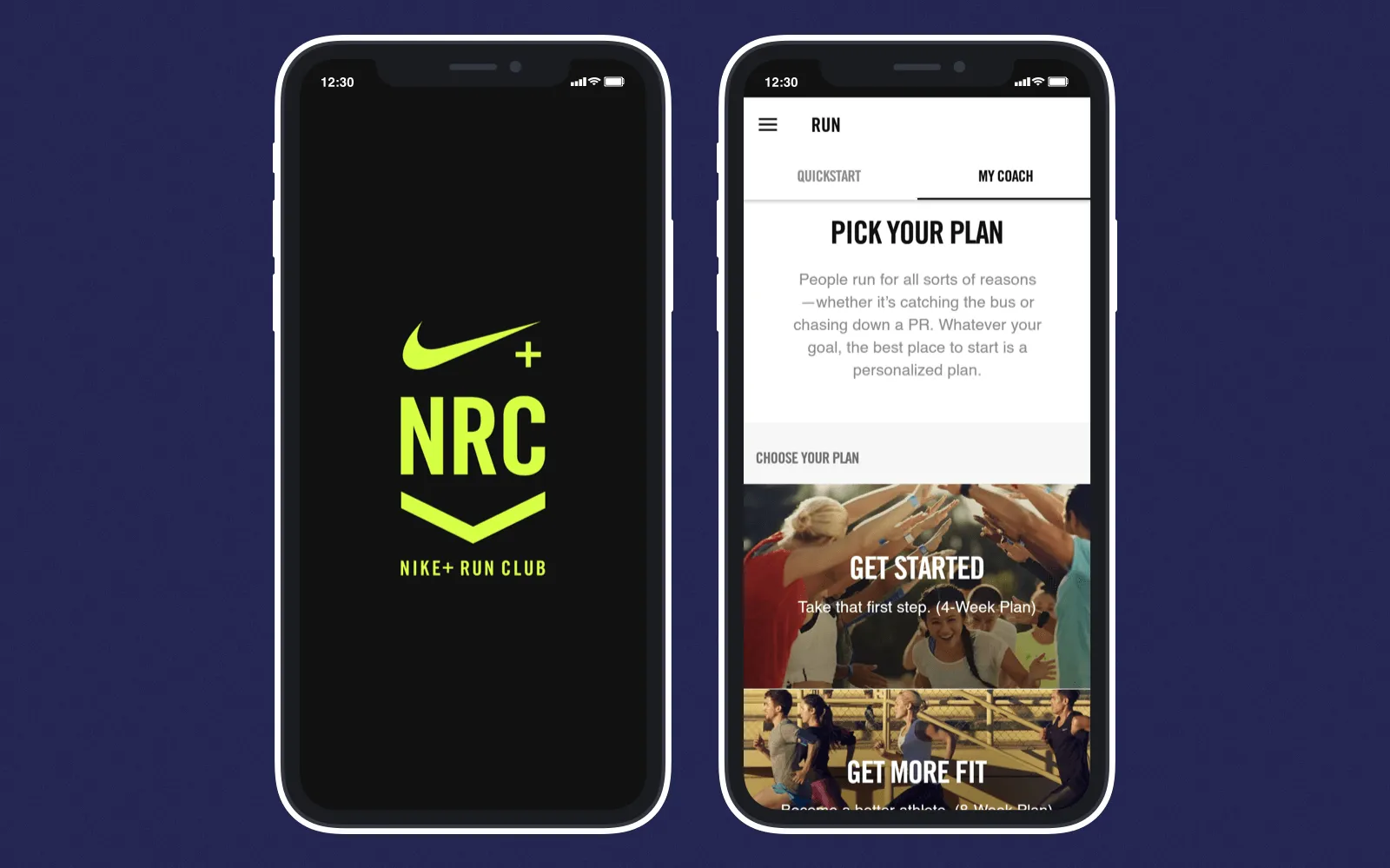

#1. Nike+ Run Club

Nike Run Club is a personalized app that is almost a fitness trainer in your hand

This software for fitness experienced a total redesign in 2017. It beame a personalized workout app that allows choosing the personal workout plan, which regularly adjusts to the person's training speed.

Do you want to know how to create your own fitness app

Nike Run Club has become almost like a real sports trainer in your hand. This approach to physical training is vital because each person's athletic abilities are different so is the amount of time people can spend on a workout.

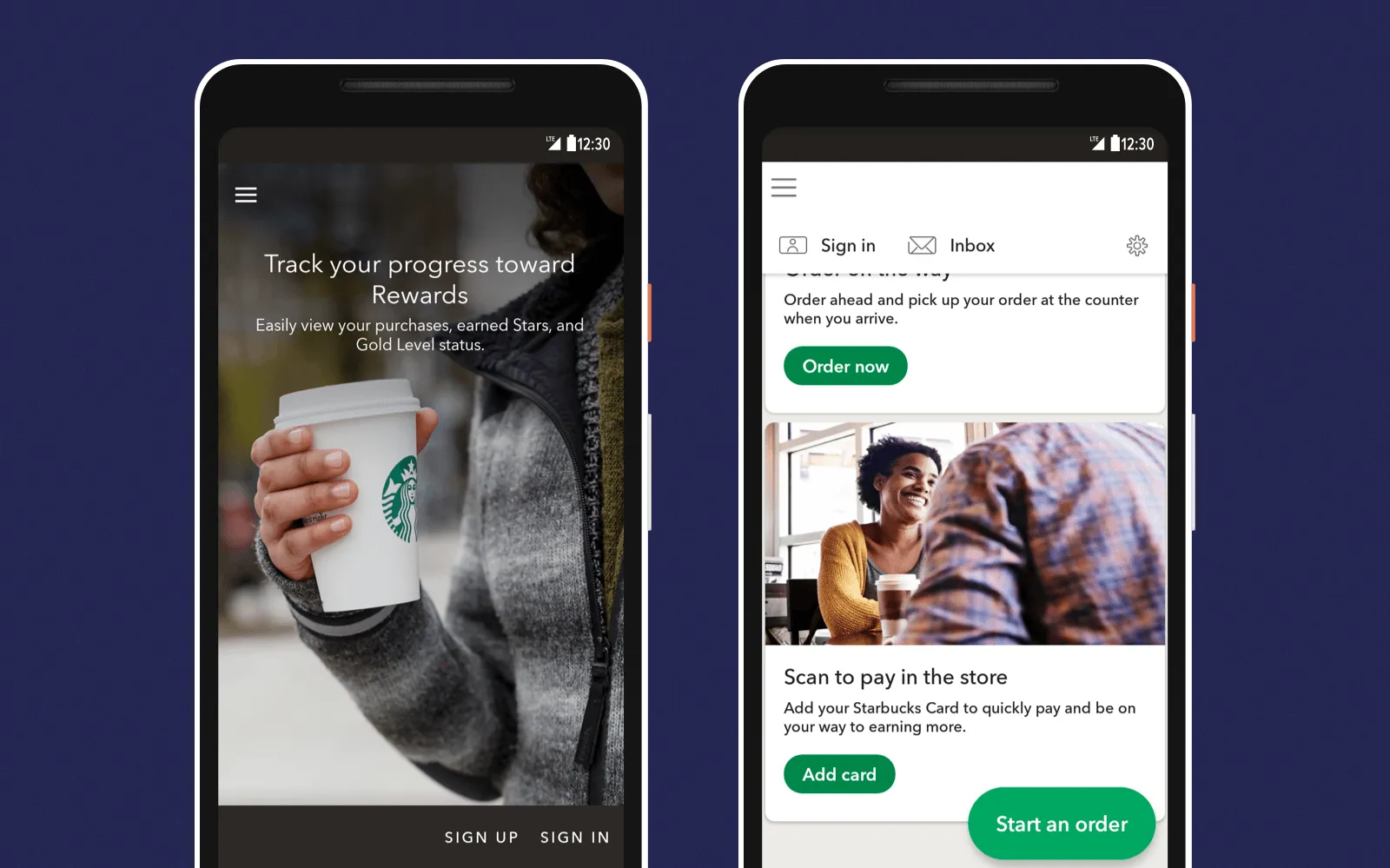

#2. Starbucks

This app proposes similar products based on your previous orders

The world famous cafe developed a mobile app which is a great personalization example. Starbucks' app investigates the tastes of customers to propose special promotions. A customer that prefers latte will receive recommendations for similar products when he/she comes near the store. This app also makes it easier for customers to monitor their loyalty program and draws attention by using the song that usually plays within the cafe.

Starbucks plans to conquer other devices with their app such as smartwatches and laptops. The global chief strategy officer, Matthew Ryan says some inspiring words about personalization: 'Any screen can become a personalized screen moving forward'.

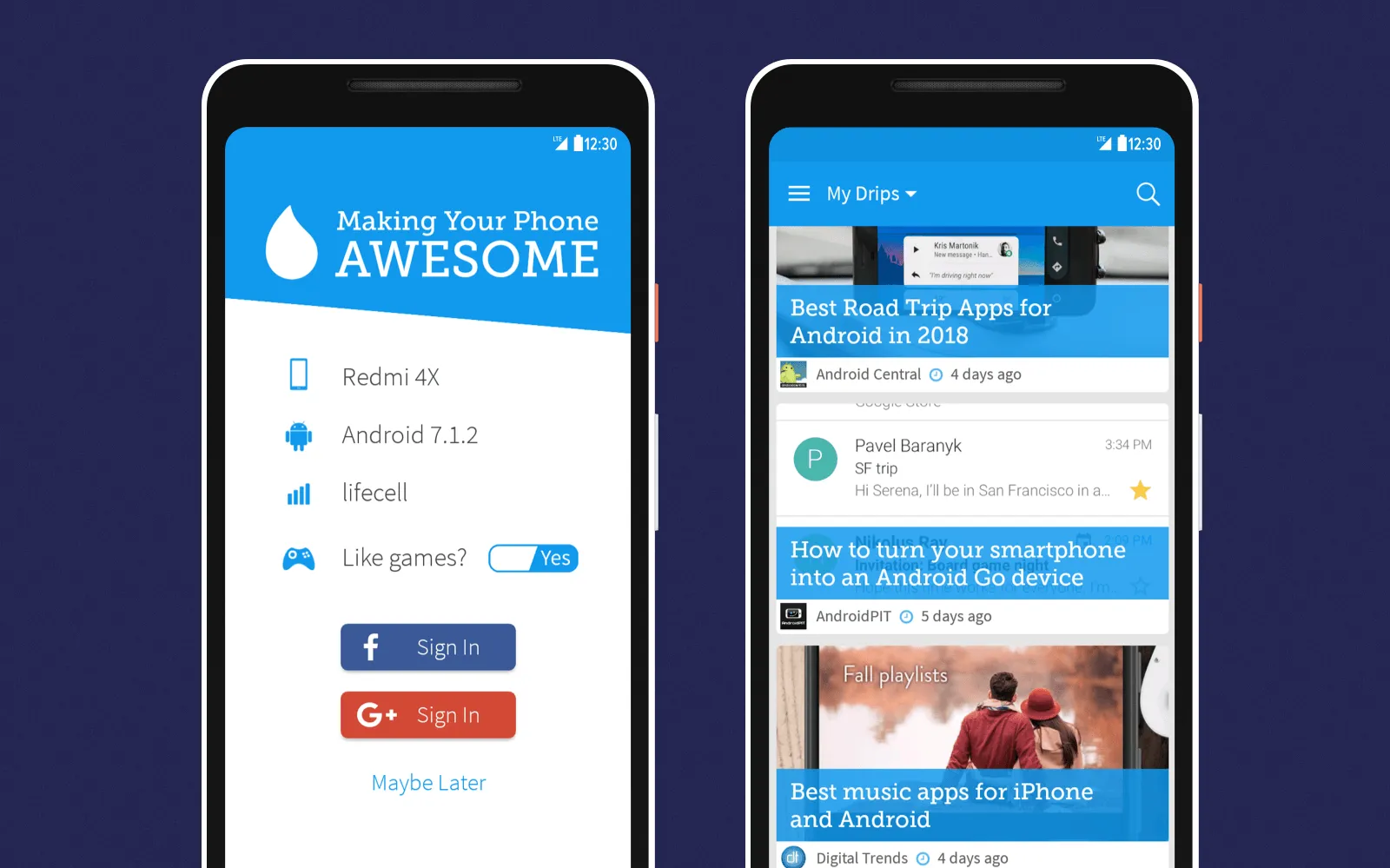

#3: Drippler

It is a personalized app that sends relative articles concerning updates for your smartphone

This personalized business app offers tips about the user's smartphone. It examines your gadget's characteristics to form a list of articles concerning updates for your smartphone and for every application you've installed. Thereafter, it explores the articles browsed and the ones ignored by you. Then, Drippler uses this data in order to adjust upcoming hints based on those preferences. Drippler has become a very popular app because a prevailing quantity of apps doesn't have tools to track version changes easily. Thus, it helps to improve smartphone capabilities and, based on consumers' feedback on the App Store, they're very grateful for this.

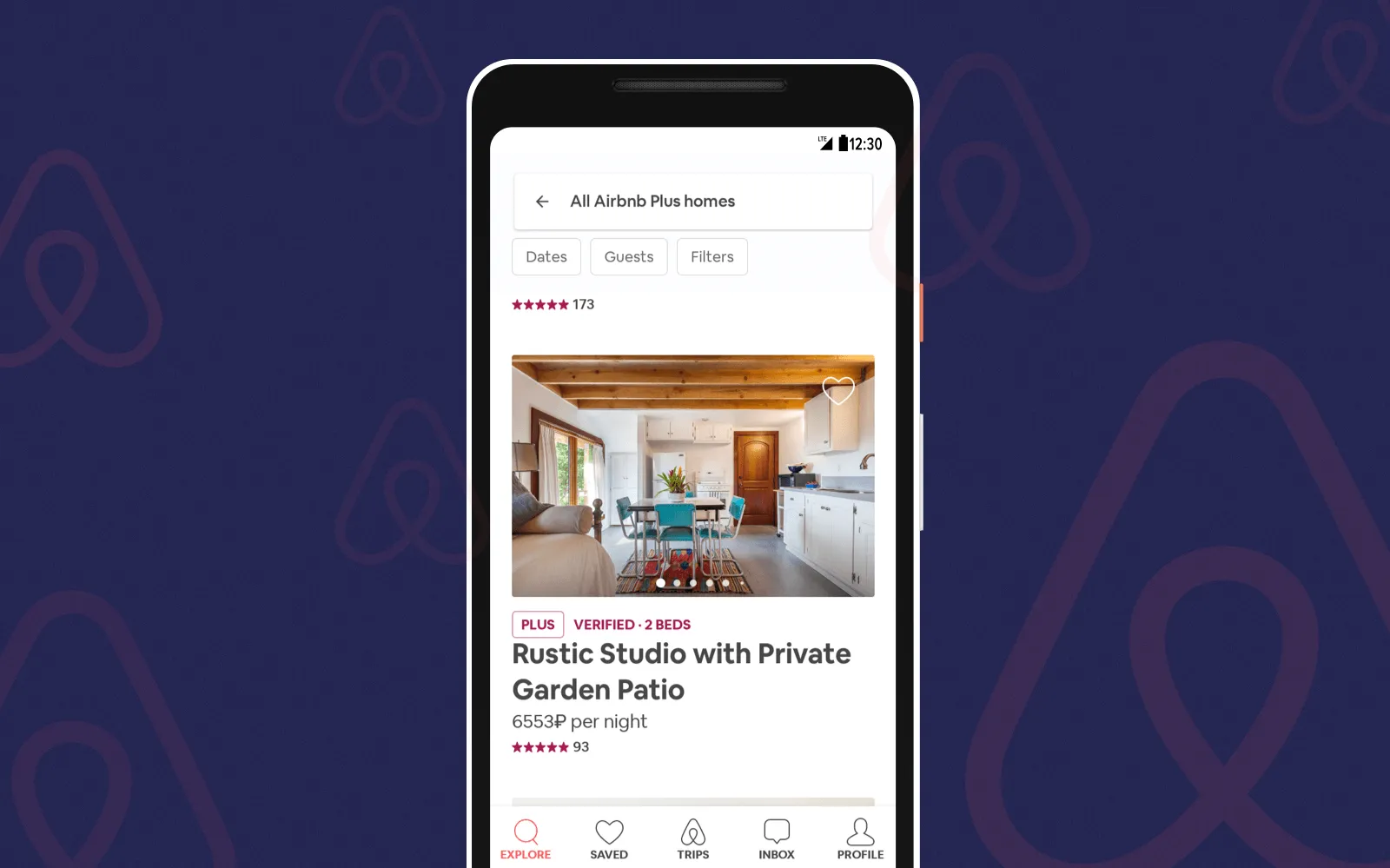

#4. Airbnb

Airbnb doesn't only pick you personalized appartments but also offers interesting places to see.

Another great personalization example is Airbnb app which tracks user's traveling preferences, former and upcoming trips to pick the relevant accommodations.

Do you want to know about the benefits that can bring developing a travel app for your business? Find out about it in our guide on travel application development.

But it's not the only purpose of Airbnb. Furthermore, it shows individual recommendations for selecting places to see, cafes, entertainment establishments, etc. If watching movies is in the list of your favorite activities, Airbnb will suggest you a cinema or a theater, in place of a football stadium.

Drawing the line

Mobile app personalization, where the app performs the biggest part of work compared to a user is the fundamentally new but obligatory step in the app evolution. Of course, it requires accurate planning, well-timed monitoring and a decent amount of technical knowledge. But it can also bring breathtaking benefits to your business.

Cleveroad is in the top 10 software development companies in Ukraine. The company has a solid experience in creating high-quality personalized mobile software. You can contact our managers to discuss every detail you need and also receive a free project estimation.

If you like this article -- subscribe to our newsletter to get more exclusive content to your inbox. No spam, just one letter a week with the latest articles and videos from our team!

Apps from various industries lose more than 70% of their users after 3 months after downloading. This happens because the consumers don't feel engaged with their apps. At the same time, they can't discover a suitable purpose to keep on using them. The apps don't offer a sufficient level of involvement, therefore, the consumers don't show a sufficient level of attachment. That's why mobile app personalization is so crucial today. It offers a contemporary way to increase the retention rates of users.

Here are the steps to make your app standout among others:

- Provide a unique onboarding experience

- Interact with your user through in-app and push notifications

- Build the community for your users

- Ask your users to help you improve the app

Here are the apps that stand out among their rivals due to personalization:

- Nike Run Club

- Starbucks

- Drippler

- Airbnb

Grab users’ attention by keeping them aware of hints how to use your app better, new features it recently received or recommend an in-app purchase. But make sure that notifications are not obsessive and pop up to the appropriate segment of the user base. As a rule, In-app notifications extend the overall time that a user spends in your app.

Airbnb app tracks user's traveling preferences, former and upcoming trips to pick the relevant accommodations. Then, it shows individual recommendations for selecting places to see, cafes, entertainment establishments, etc.

Starbucks app investigates the tastes of customers to propose special promotions. A customer that prefers latte will receive recommendations for similar products when he/she comes near the store. This app also makes it easier for customers to monitor their loyalty program and draws attention by using the song that usually plays within the cafe.

To make the onboarding process smoother, pay thorough attention to your app's installer - where the user found your app, what he/she was looking for, why the person has downloaded it? This way, you'll be able to design a custom trip within the app that makes each user feel that his/her opinion is heeded.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article