How Can Machine Learning Protect Your FinTech App From Fraudulent Attacks?

Updated 08 Nov 2022

10 Min

4702 Views

Artificial intelligence is sneaking closer and closer, and soon our planet will be enslaved by neural networks that are much more clever than any human being. Are you scared? Come on, it is just a joke, of course. At the moment, AI has only promising perspectives for mankind and user software in particular. It means that machine learning can protect users from maleficent infringements prepared by light-fingered people.

What should your app have in the first turn? It should have a high-level security during the custom software creation. Your customers want to know that their data is safe when they use your app. And machine learning as a part of artificial intelligence can protect your software from fraudulent attacks with the help of special patterns and models. Besides that, a reliable protection will increase the trustworthiness of your users. So we recommend you find out more about the methods to protect your financial data using machine learning. Let's go!

What is a financial fraud?

Fraud particularity lies in cheating people. There are many different ways to do it. But if we speak about the financial field, there are a few widespread manipulations like:

Carding

Counterfeit banking card skimming. Hackers are installing special devices on ATMs that read card data;

Maleficent software

Viruses are not sleeping. Hackers create viruses that can simplify the process of stealing money. But in most cases an antivirus can detect such software;

Phishing

A type of Internet fraud that allows criminals to steal the confidential data of users. Sometimes it can be a fake copy of your website, for example, where you input all your personal data but then falls into bad hands;

Mobile fraud

A maleficient virus can read all information you input in your mobile app and steal important financial data.

What types of financial fraud your app may fall under?

See how you can apply machine learning in your business. Read How to use the advantages of machine learning in your business?

Generally, all types of a financial fraud can be divided into 4 main groups:

- falsification of financial accounting;

- misuse/appropriation of company property;

- abuse of an official position;

- fraud in e-systems.

In some cases, if it is about abuse of power or something like this, the administrative measure can be applied. However, when business processes that are in the fraud risk group are processed in informational systems, administrative measures can be useless. That is where anti-fraud systems come in.

Anti-fraud system and how it works

Such systems represent specialized fraud prevention software or software and hardware systems that monitor, detect and manage fraud levels. Primarily, systems are developed for banks, telecommunication service providers, payment systems and so on.

Cyber attacks of today are focused more on online banking services, maleficent software for mobile devices and special-purpose fraud in automated payment systems known as internal and insider fraud.

So, to fight all mentioned threats to information security, software called financial fraud detection system or anti-fraud system is applied. By the way, our developers already have experience with the development of fraud detection systems.

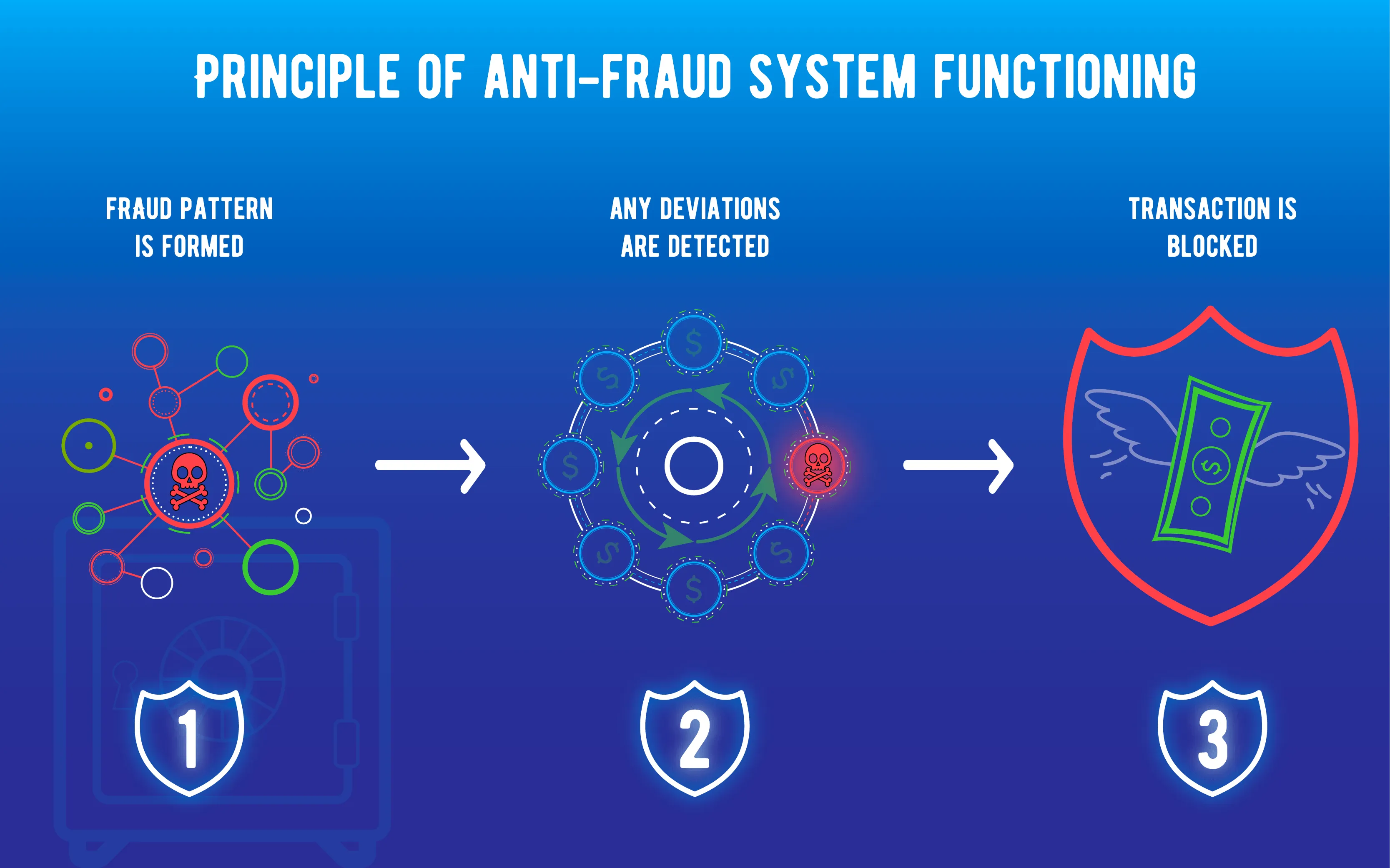

Principle of functioning

Now then, let's look at these systems and explore how they function and how efficient they are at fraud detection.

Basics

Various developers create algorithms that may vary from similar ones in other software since they can be implemented in a different way. But the basic principles anti-fraud systems are working on remain permanent. First of all, it is a search of abnormalities like atypical actions in procedures with large data arrays that often recur.

The majority of developed systems have a basic range of actions that should be adapted to each specific case. So it may be better to create your own system from scratch.

Thus, the main signal of fraud lies in atypical actions and it helps understand how to control frauds.

It is necessary to arrange a working procedure with the fraud-detection system:

- You need to form ordinary and habitual actions users perform;

- You should adjust automatic notifications;

- If there are any deviations from the habitual working process, notifications will be activated.

How anti-fraud system works

But depending on your scope of activity, the formation of algorithm patterns for fraud detection may vary, so keep that in mind.

Analyzing the data

In each specific case, the array of analyzed data will be different as well. So an anti-fraud system should analyze data collected from financial systems like automated banking systems, transaction databases for payment systems in your software and so on. Machine learning in banking industry, as well as any other industry, can become really necessary.

Criteria for selection should be fixed individually by you in your software or we can do it upon the completion of development process according to your requirements.

Figure out more about MLaaS platforms. Read 7 machine learning as a service platforms for beginners and PhDs

Architecture

A fraud detection system as a full-fledged product for a large company will be oriented to the client-server structure. Technical features will depend on the design of a specific software developer and in the IT infrastructure the software is integrated into. But on the whole system will contain such components like:

- system core kernel;

- database;

- client modules;

- management servers.

Machine learning and fraud detection - how they can be combined

Smart anti-fraud systems installed in industrial data centers or server locations inside their algorithms use math models of the typical working day, while the formation of private behavior models (developed for business processes of a specific customer) occurs on the basis of machine learning technology with Big Data.

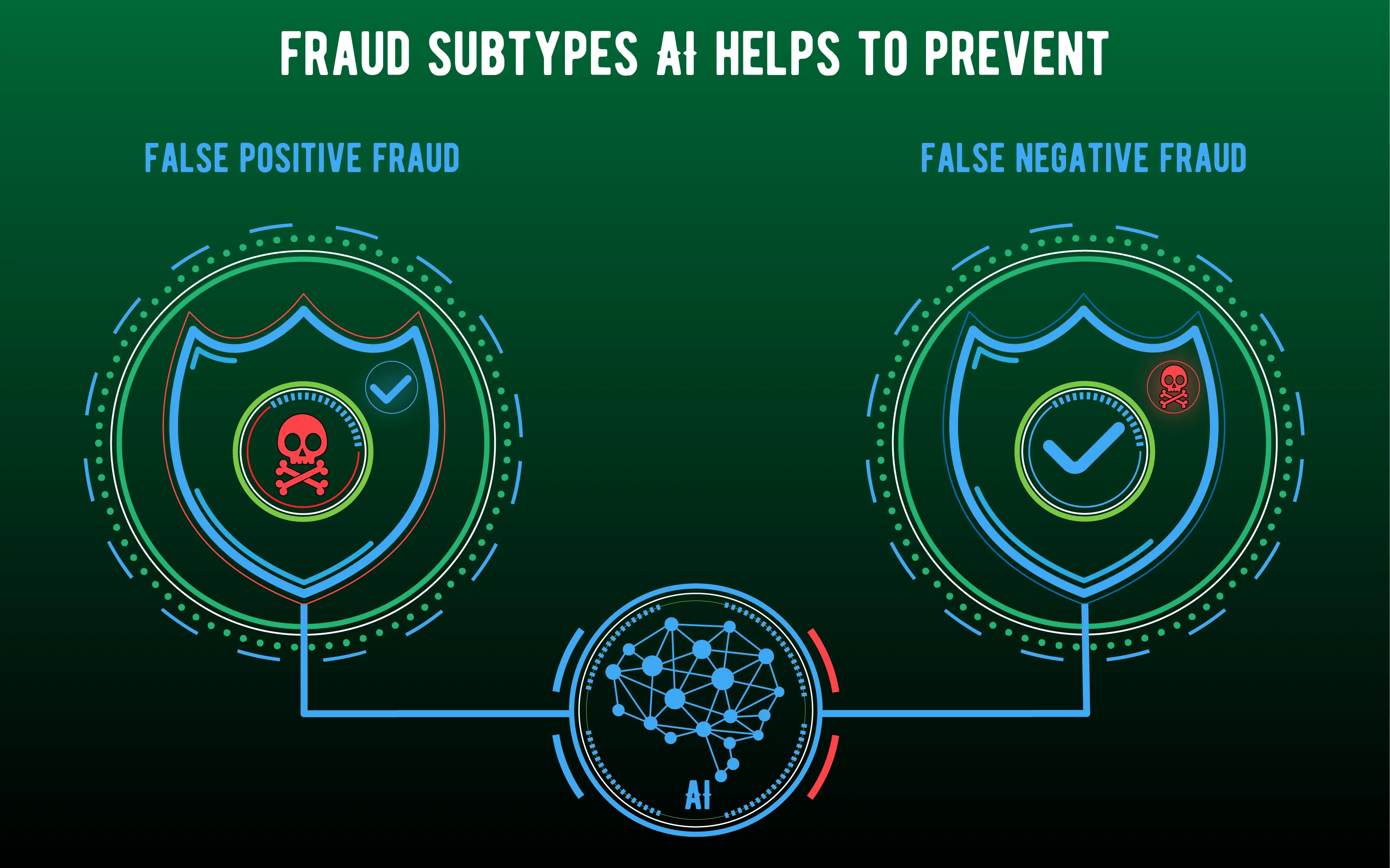

The advantage of machine learning lies in self-learning. Considering the data accumulation from self-learning systems makes it possible to reduce the probability of false positive and false negative frauds in the financial sector. And it has a positive influence on the efficiency of the system.

False positive fraud means ordinary legitimate transactions that were detected as dangerous and were blocked. It may seem better than if a real danger was ignored, but in fact, it may substantially slow down the business processes of the user. And time is money, don't forget it.

False negative fraud means a real fraud that was ignored and caused serious losses and damage to the payment system and the user in particular. So the system should use machine learning to constantly improve it's functioning constantly.

False positive and false negative frauds

Besides that, keep in mind that risk of ignoring fraud is always real. Cybercriminals create more and more crafty ways to attack payment systems worldwide. So that is why machine learning technology is a must-have feature in your software to protect it from any financial manipulations.

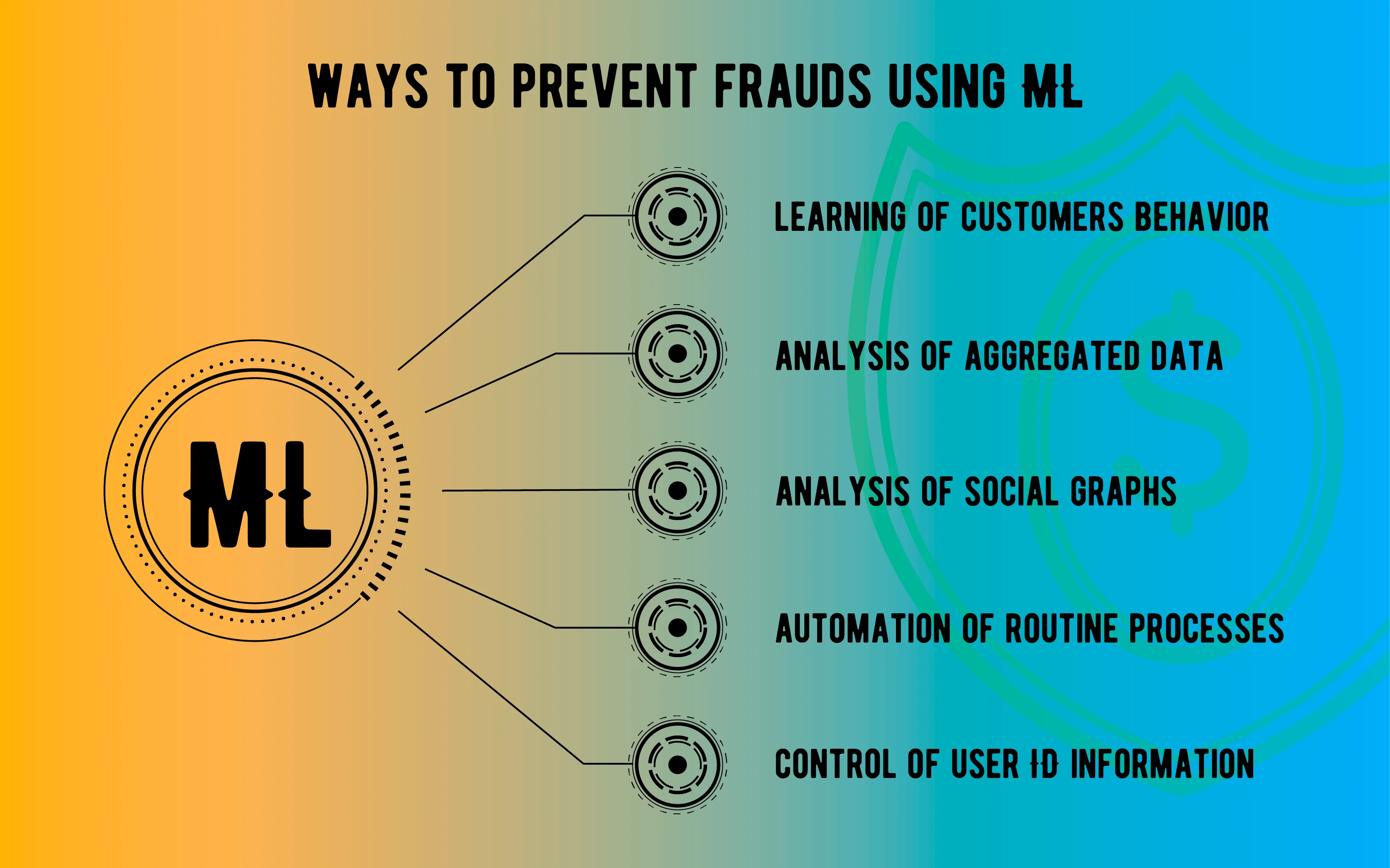

Ways to prevent frauds using machine learning

There are a few main ways to prevent financial frauds using machine learning. You should know them if you plan to create your own anti-fraud system.

Learning the behavior of customers

You should integrate systems based on Know Your Customer (KYC) behavior. That is, it is necessary to analyze each customer in detail, models don't always orient on the history of all every transaction, but on actions of a specific customer, learning his or her typical features and actions. If the customer makes a transaction that is far from his habitual behavior pattern, the system will notify you about it, and it means you need to verify why it has happened immediately.

Thus, all the customer's actions can be divided into the categories of ordinary and suspicious.

The advantage of this method lies in the fact that models stop depending on data received in the process of machine learning. Data can collect unnecessary information that has nothing in common with the specific customer, or there might not be enough data.

Find out about AI impact on business. Read Artificial intelligence in business: perspectives and impact

Learning a customer's behavior is a very popular method for today where machine learning is used. Many websites and mobile apps have started using it for prevention of frauds. It helps fight fraud since the system remembers the behavioral and buying patterns of customers and responds to abnormalities.

Analysis of aggregated data

The second method represents the detection of suspicious financial manipulations through the analysis of all available data. Advantages of this approach are a higher quality and more accurate models since it is learning a large array of various information and it is using deep learning for fraud detection.

But machines can still come across false positives transactions that are not breaking the law but the algorithm detects it as illegal. So, today machine learning algorithms cannot exist completely autonomously. Specialists need to verify all operations that the algorithm detected as fraudulent, and fix the problem if it is a false alarm.

Analysis of social graphs

Analysis of social media is becoming more popular since it helps detects many dangerous and maleficent operations. And all accounts can be visualized as a social network where a payment transaction is equal to a personal message. The goal of the algorithm is to detect where money is vanishing from in a suspicious manner - one of the most widely spread frauds in banking sector, for example.

Automation of routine processes

Apart from the detection of fraudulent schemes, machine learning can help automate some routine processes of a financial job like the creation and preparation of reports, mailing notifications, and improving and accelerating the accounting process. As a result, efficiency grows, and labor intensity, as well as operational costs, are decreasing.

Machine learning cannot cover all financial areas in full but it substantially simplifies the work of employees that can pay more attention to investigation and prevention of other illegal schemes. And the more false positives signals specialists will see and mark as false, the smarter machine learning-based system becomes. And one day it will be able to detect all illegal actions with 100% accuracy.

Control of user ID information

According to research conducted by the IBM corporation, everyday damage for financial industry caused by fraud is equal approximately to $80 billion USD. And machine learning helps to reduce this figure exponentially.

Due to newly developed solutions, you can analyze the history of transactions for building a model that can detect fraudulent actions. And machine learning technology is also used by fintech companies for the biometric authentication of the user.

Before signing into the account, the user takes a selfie using an ordinary camera. But inside this camera, machine learning software analyzes the selfie and identifies the user by the map of veins in the whites of the eyes and other individual particularities of eyes.

Fraudsters can counterfeit user data, speak on behalf of the user, but they cannot create a precise map of the user's eye. So machine learning moves in on every front.

Main ways how can machine learning help in fraud prevention

What do we think?

Based on all the above, you should determine what you exactly need to protect users of your software. Machine learning in your app will help you save your reputation and make the software more trustworthy for your users.

In our opinion, artificial intelligence can be really useful in our lives. We just need to control it and guide it in the right way. Machine learning helps to prevent really serious attacks on users' finances, and today you may not even be aware that machine learning has just blocked a few attacks on your account. So is it worth the candle? Definitely, yes.

Check out how AI is used in farming. Read Mixed reality and AI in farming: cost-effective models to enhance agribusiness

Today software development companies (and Cleveroad is not the exception) create ML-integrated software that is constantly improving and modifying itself and implements a lot of necessary tasks. Are you ready to create something special like this? Cleveroad is at your disposal. Do you have any doubts? Just contact us and we will prove it.

Don't forget to subscribe to our blog as well.

Keep in mind to watch our video:

What is IoT?

The advantage of machine learning lies in self-learning. Considering the data accumulation from self-learning systems makes it possible to reduce the probability of false positive and false negative frauds in the financial sector. And it has a positive influence on the efficiency of the system.

Fraud particularity lies in cheating people. There are many different ways to do it. But if we speak about the financial field, there are a few widespread manipulations like:

Carding. Counterfeit banking card skimming. Hackers are installing special devices on ATMs that read card data;

Maleficent software. Viruses are not sleeping. Hackers create viruses that can simplify the process of stealing money. But in most cases an antivirus can detect such software;

Phishing. A type of Internet fraud that allows criminals to steal the confidential data of users. Sometimes it can be a fake copy of your website, for example, where you input all your personal data but then falls into bad hands;

Mobile fraud. A maleficient virus can read all information you input in your mobile app and steal important financial data.

Fraud detection software is vital in detecting illegal and high-risk online transactions .

There are a few main ways to prevent financial frauds using machine learning. You should know them if you plan to create your own anti-fraud system:

- Learning the behavior of customers

- Analysis of aggregated data

- Analysis of social graphs

- Automation of routine processes

- Control of user ID information

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article