Why Python Is The Right Tool To Create A First-Rate FinTech Software

Updated 07 Jul 2023

12 Min

6880 Views

A penny saved is a penny gained. It is hard to disagree with this proverb. Today FinTech area makes an important contribution to the process of the proper dealing with financial flows. Financial technologies make it possible to optimize expenses planning and improve financial services. Thus, if you are already working in the financial area or you only plan to delve into the development of FinTech software, it is quite important to know how to create an appropriate FinTech app with the right stack of technologies.

FinTech app development service can be implemented using different programming languages, but Python language ranked first in the list of FinTech tools of many development companies, and Cleveroad is not the exception. The goal of our article is to spell everything out and prove to you why your FinTech app should be developed specifically in Python language.

Why is Python a more beneficial language for FinTech?

Let me tell you what Python is. This is a rather old but one of the most popular programming languages in the world. The development of Python started at the end of the 80s of the last century, and the first full-fledged version was released in 1991. As time goes by, this language is gaining momentum. Today Python is prevailing in FinTech software development due to a few good reasons you will find below.

According to the survey conducted by HackerRank among 20+ US-based companies involved in FinTech industry, you can see on the chart that Python language is a preferable for FinTech industry.

The list of the most popular languages in FinTech (Source: HackerRank)

eFinancialCareers (employment website from the Wall Street Journal) added Python to six best programming languages for the banking industry. Moreover, today this language is the most-taught in technical universities.

Python language has a very quick runtime, that is making the language a preferable option for FinTech area. Some functions can be implemented much faster using specifically Python. As an example, one function in Python can take about 10 strings of code, whereas C++ will require twice as many strings.

Why Cleveroad prefers using Python to other languages in FinTech

Each area, whether it be healthcare or social media, requires an individual approach and the selection of the proper development tools. Considering the large experience in the development of various software, Cleveroad programmers can safely say that Python could beat such giant competitors like Java, SQL, and C++ in the financial area for today.

Working with algorithms

To understand why it is the most appropriate language for FinTech, you should pay some attention to such technical challenge like an algorithmic problem and why Python helps our developers solve it easily.

The algorithmic problem can be the first trouble developers face during the development of any FinTech app. Since FinTech software is tightly connected with many figures, calculations and so on, the software should be very smart to work with a large number of math tasks. That is why it is highly important to choose the right programming language. And Python shows it's apparent advantages since it's syntax is the closest to math syntax that is applied in financial algorithms.

In the process of development, it can be necessary to assign value parameters, and Python syntax makes it possible to do it quite fast.

Considering all the above, I would like to draw your attention to some more technical particularities our company singles out in Python during FinTech software development.

Conversion

When it comes to dealing with math equations or any other task, Python allows our developers to convert any mathematical or algorithmic statement to simply one line of Python code.

See how FinTech software development services influence the future of various industries?

Vectorization

For example, you intend to order the development of FinTech software that will require math function to help your customers optimize different financial processes. To implement it, Cleveroad developers use vectorization features that can be achieved with NumPy - Python open-source library for math calculations and support of high-level math function. It will allow you to create 50,000 calculations within one code line and speed up the development process and quality of your FinTech app.

Performance

Here it is worth noting that Python comes along with a large number of auxiliary libraries that enhance the process of interaction with math tasks. The task of our developers is to choose the right Python library for using it in the financial app development to provide you with a high-performance FinTech software. Using the right tool, FinTech app in Python becomes much fasterthan it's counterparts written in other languages.

Quick compilation

And last but not the least advantage lies in the quick code compilation of the software being created. And some of corresponding Python libraries like Cython or Numba provide our developers with crucial functions that help compile Python code into machine code statically or dynamically. The processing speed becomes much faster and your software development is moving easier.

5 benefits of using Python in FinTech

Successful FinTech projects written in Python

In addition to the advantages of Python, it would be better to show your real examples of how famous brands got their benefit from using Python. Fintech projects that were created using Python - there are a large number of them, but I will list the most popular and successful in this field. Also, some of them can motivate you to order the development of something similar but already with your unique additional features.

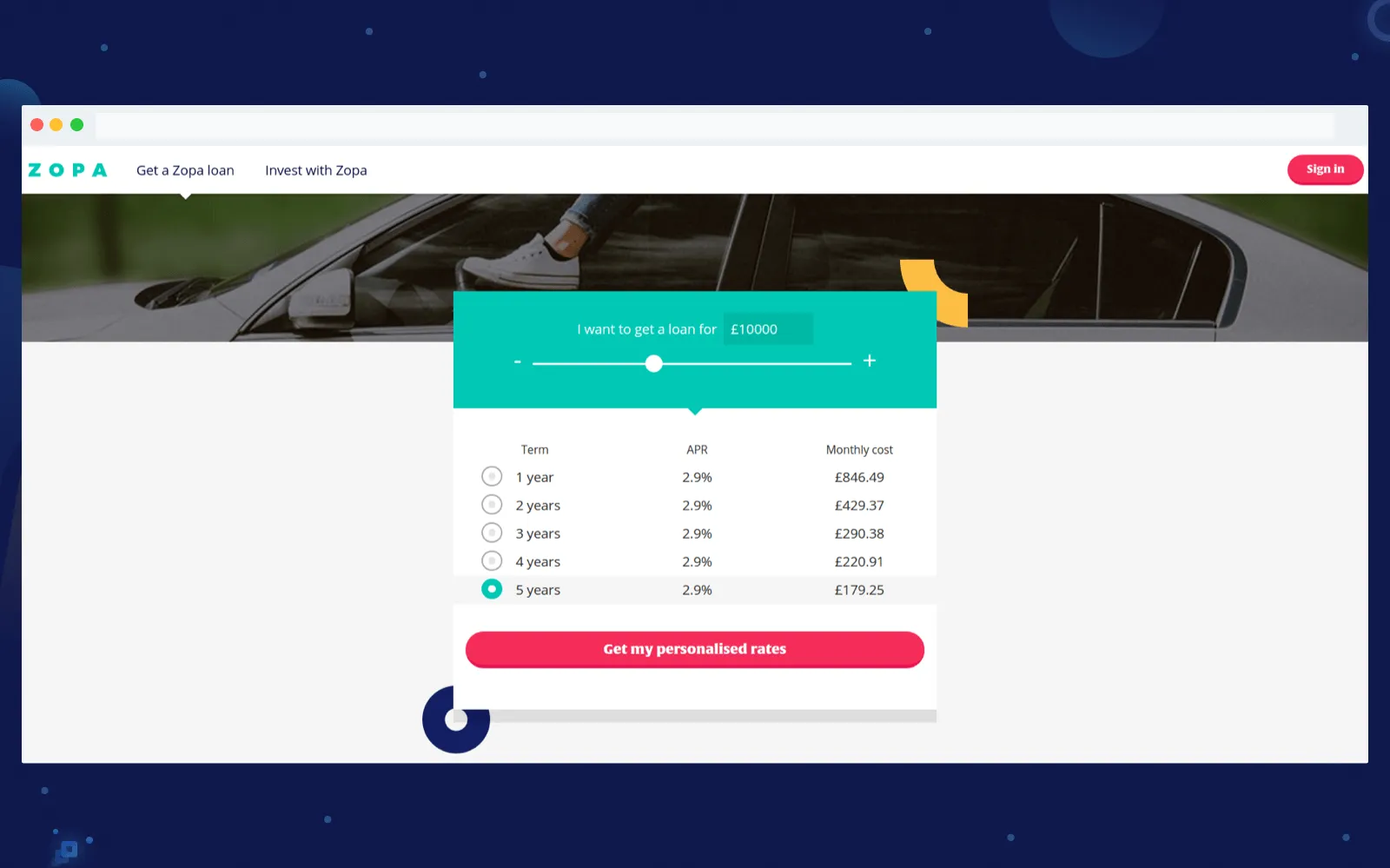

Zopa

This is a P2P lending platform and it was created in 2005. It is a personal finance peer-to-peer platform that made the revolution in the finance area. Now you don't need to look for banks to take a loan, go there, sign many documents and so on. The P2P platform is going to replace them, where borrowers and lenders can make a deal with each other directly without any intermediaries. For the moment, the total amount of loans made using Zopa exceeded GBP 2 billion.

Zopa P2P lending software

Technical features

- The Zopa website and the mobile app were created with the help of Python, C# and Java mixture;

- Zopa developers themselves note that Python language is the most important in this field because it helps implement complicated algorithmic models, so they use such Python libraries like Django, Flask etc.;

- Apart from this, developers integrate machine learning models to make the software smarter, and here such framework as Keras from Python comes to the rescue.

Stripe

The US-based company that is developing solutions for receiving and processing of payments. In most cases, it is used in mobile payments processing and Stripe system is one of the most popular solutions along with such competitors like Braintree and PayPal. The company was founded in 2011, but by now it has achieved a great success. Many mobile apps use this system for payments processing, and even such giants like Facebook.

Stripe solution for payments processing

Technical features

- Stripe developers use Python libraries actively. One library is used during the authentication process and it sends keys in each API key request;

- Auto-pagination feature in Stripe system is implemented due to Python's capabilities that simplify this process;

- Apart from Python and it's libraries, the system uses Ruby and Scala in it's technological stack;

- Due to Python, Stripe is one of the most favorite payment systems for developers since it has a detailed and well-thought documentation, a lot of client libraries, testing environment and attractive elements of user interface.

Explore how FinTech software development company can use Python to create financial software

Do you need a payment gateway in your app but you don't know how to integrate it? Watch our video that will answer your questions:

How to integrate a Payment Gateway into an App?

Venmo

A unique US-based service that represents a social media and payment service in one. Using Venmo, you can transfer money to another account, you can use it for payment in stores, or you can simply chat with your friends. The service was launched in 2009, and it's first goal was to split the bill between friends to pay for taxi, cinema or dinner. All information can be displayed on the Facebook news feed. Now the system was modified and today it offers you full-fledged payment system with social media capabilities.

Venmo social media to make payments

Technical features

- Django library from Python was used to create Venmo payment service;

- If you are a developer and active GitHub user, you can find there many Python frameworks and libraries in Venmo repository;

- Developers note that they use Python since it is an agile and fast language, and it is the most suitable language for the development of different solutions related to finances and math.

See how AI protects your FinTech software from being hacked. Read How can machine learning protect your FinTech apps from fraudulent attacks?

Of course, this list is far from being full. But I think that these projects will surely be interesting for you if you plan to develop a FinTech software of your own. Python developers from Cleveroad are always at your disposal.

Financial areas Python can be used in

The financial sector is really large and it consists of many areas. Each area can be a source of your potential profit if you intend to immerse in the world of financial technologies. But where is Python used mostly? In this section, I will provide you with the ways of Python language application in FinTech field.

Python for banking software

In this area, I can include both apps for online banking and payment systems. As you saw above, Python's capabilities are quite acceptable for this segment. In addition, due to a math syntax of Python, software for ATMs is written in this fascinating language. It allows developers to integrate algorithms for faster processing of payments.

Data analysis

Here comes the Pandas package. Pandas is a high-level library that turns Python into a powerful tool for data analysis. Financial modelling in Python can also be performed quicker with the use of Pandas package. For the moment, it is the most advanced tool with high performance for data analysis and processing. So, when Python developers work with the large amounts of data, they need to analyze it to get useful information for further activities. Pandas library makes it possible to visualize all data received, so you can use Python for statistical calculations. Machine learning libraries like PyBrain and Scikit-Learn also can be used for machine learning models to generate predictions. Ways of application are unlimited, as you can see.

Cryptocurrency markets

If you are engaged in dealing with cryptocurrency, you should know the right way to conduct the analysis of cryptocurrency markets to see predictions for the future and current situation as well. Python language is not the last language that can help do it. Developers create special scripts in Python to obtain and analyze all data and make visualizations as well. Using Anaconda - data science ecosystem from Python - you can then retrieve Bitcoin or Ethereum pricing data and analyze it. Thus, the majority of special web apps created for analyzing cryptocurrency is developed with the help of Python language.

Start developing your own Bitcoin wallet right now. Read Bitcoin wallet app development: right MVP model and proper APIs to start with

Algorithmic trading

Stock markets require the knowledge of trading and here you can use appropriate software that simplifies this process. Python comes to the rescue again to let you solve this problem. Python makes it possible for developers to build correct strategies for trading quickly and provide with useful tips regarding the future of that or another market. With Python, your software for algorithmic trading can be more beneficial than the same one built using another language. To create FinTech apps for algorithmic trading, we use Django framework from Python since it uses analytics tools, math and quant models that are necessary for the trading process used in the stock exchange.

Financial areas where Python is your assistant

Wrapping up, what else could I say? Python is a FinTech programming language that seems to be an ideal technology for building financial software, doesn't it? It has a lot of advantages like clear syntax, cool development strategies, and also it is user-friendly, that is why Cleveroad developers like to deal with it. In addition, Python can boast about the availability of plenty frameworks and libraries that enhance the development process of any financial service. As a result, you get a high-quality product of your dream. That is what developers from Cleveroad can do for you with Python. Contact us and your dream will become a reality. Keep in mind to subscribe to our blog as well - look at the button on the right side!

The financial area where Python is used mostly are:

- Banking software

- Data analysis

- Cryptocurrency markets

- Algorithmic trading

Banking. Due to Python's math syntax, software for ATMs is written in Python due to its math syntax. It lets developers integrate algorithms for faster processing of payments.

Data analysis. The pandas package (Python data analysis library) is the best tool for high-performance data analysis and processing. With its help, you can visualize all data received and use Python for statistical calculations.

Cryptocurrency markets. Using Anaconda — a data science ecosystem from Python, you can analyze cryptocurrency markets. Moreover, you can retrieve Bitcoin or Ethereum pricing data and analysis as well.

Algorithmic trading. Python is the most preferred language for algorithmic trading, and that’s why:

- It’s possible to develop a correct strategy for trading as quickly as possible

- It takes less time to build a trading platform using Python compared to C/C++

- Python developers can extend the code due to dynamic algorithms for trading

There are several benefits of Python in FinTech:

- Quick conversation. Python lets you convert any mathematical or algorithmic statement to one line of Python code.

- Appropriate syntax. Python helps you face technical challenges like an algorithmic problem since its syntax is the closest to math syntax used in financial algorithms.

- High performance. Python comes along with a large number of libraries that speed up the process of interaction with math tasks. You just need to choose the right tool to faster your FinTech apps.

- Vectorization. NumPy (Python library) lets you develop 50,000 calculations within one code line and enhance FinTech apps' quality.

- Quick compilation. With the help of Python libraries like Cython or Numba, it’s possible to compile Python code into machine code quickly.

The top 5 companies that use Python in their tech stack are:

- Zopa

- ThoughtMachine

- robinhood

- Kensho

- Newable Business Finance

Python is a core language for calculations and math-related tasks, thanks to a rich ecosystem of libraries and tools. It’s used to write software for Cashpoints/ ATMs as well as to speed up payment processing.

Python is the best choice for financial data modelling. It lets you modify and analyze Excel spreadsheets that are widely used in financial modelling. For example, you can automate copying data from one spreadsheet to another and enhance the search for errors.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article