How to Create a FinTech App: Types, Requirements and Development Stages

Updated 23 Dec 2024

23 Min

2443 Views

Building mobile apps for FinTech is an important step that may significantly aid you in penetrating the digital finance niche. Generally, FinTech is now one of the most promising sectors that allows for enhanced accessibility and convenience of financial services. By reducing reliance on physical banking, investment, or insurance branches, FinTech solutions empower users with efficient, fully digital finance tools. Developing such apps enables you as a business to deliver innovative financial solutions that meet customer expectations for speed and simplicity.

As a FinTech app development company with 13+ years of experience in the domain, we at Cleveroad are here to share our expertise and help you understand how to build a FinTech app, empowering you with the knowledge to develop your own platform and start profiting.

FinTech Industry Overview

To establish why it’s profitable to create a FinTech app, let’s take a brief glance at the overall FinTech solutions market and the most vibrant trends you may want to incorporate within your own FinTech solution.

FinTech market view

We provided several interesting stats to represent the high demands and potential of FinTech software development:

- Expert Market Research states that the global FinTech market is projected to reach $324 billion by 2028, indicating a compound annual growth rate (CAGR) of around 9.2%

- As for Demandsage, in 2024 an average of 64% of consumers worldwide have adopted FinTech services, with 75% utilizing payment and money transfer solutions

- According to Statista, the digital payments segment is expected to continue its expansion, with the number of users projected to reach 4.8 billion by 2028

- Exploding Topics claims that FinTech app revenue is booming, with the digital payments sector alone projected to generate over $10 trillion in global transaction value by 2027, fueled by growing e-commerce and mobile adoption

FinTech market promising trends

Let’s outline key FinTech industry trends that are currently shaping digital finance vector:

Embedded finance. Embedded finance is a concept that integrates financial services directly into non-financial platforms. Companies in diverse range of domains including e-commerce, healthcare, and even logistics now offer payment processing, lending, and insurance services within their platforms. By adopting this model, businesses gain increased customer loyalty and create seamless user experiences, making financial transactions almost invisible.

Artificial intelligence in FinTech. AI-powered solutions in FinTech are actively contribute in creating smarter, faster, and more efficient platforms. Use of AI in FinTech helps businesses offer tailored and secure services like advanced fraud detection systems and personalized financial planning tools.

Decentralized Finance (DeFi). DeFi eliminates the need to engage intermediaries like banks through blockchain-based solutions. It offers innovative services such as decentralized lending, staking, and trading, making financial systems more transparent. FinTech apps leveraging DeFi enable users to access financial services globally, without restrictions.

How to build a DeFi app? Read our guide to learn about DeFi app development process to seamlessly integrate this knowledge within your own FinTech app

Steps to Build a Fintech App

During FinTech app development you’ll need to leverage a lot of technical knowledge. To understand how to create a FinTech app, look at the main steps that we've outlined for you.

Step 1. Choose your FinTech niche

Choosing a niche is a crucial step when you decide to create a successful fintech app. Firstly, you should analyze the target market. Then, choose whether you want to create your own fintech app in 2025 or improve a ready-made one (reduce clicks' number for the operation, add integration with the social network, etc.).

If you want to be competitive, it would be good to build a fintech mobile app with complex features to engage more users. There are too many simple FinTech apps like budgeting apps, so you have to be unique. After you’ve chosen a niche, you can move on to finding app developers experienced in the fintech sector who can help you build an app tailored to your goals. For instance, expert teams in mobile banking app development can craft innovative, user-centric features to enhance your app's appeal.

Step 2. Select an experienced IT partner

Your next step is to find and hire an experienced tech partner to help you build a FinTech app. Here are the specialists are usually part of the FinTech app development team:

- Back-end developer

- Front-end developer

- Business analyst

- Project manager

- Designer

- Product manager

- QA specialist

If you choose a financial software development company, pay attention to the company's experience, hourly wages, and specialists' training level. also consider feedback from clients on platforms like Clutch or GoodFirms and vendor's portfolio with previously created projects. Another important factor is choosing the cooperation model you need. You can go for one of the following options depending on your needs and budget:

- Outstaffing. This option will suit you if you already have an in-house team but still need to fill the talent gap with a few specialists. For example, you need 1 iOS and 1 Android developer. In this way, you can utilize IT staff augmentation services to get the right people to work on your product in the shortest time.

- Outsourcing. This option will suit you if you need an entire FinTech app development team and are limited in time and budget. If you turn to an outsourcing software provider, you will get a full team of experts ready to start working on your product. This option will help you save money and time on hiring and maintaining an in-house team and get a high-quality product quickly. Moreover, this form of cooperation gives you the opportunity to hire specialists all over the world without being tied to a specific location and to find a partner who fits your budget.

We at Cleveroad provide FinTech development services for over 13 years. Learn more about our expertise and flexible cooperation models we offer to create your own FinTech app from scratch

Step 3. Pass the planning phase

The next important step is to engage in the planning phase with your software vendor. This step includes important processes such as:

- Market analysis. Your partner will provide data and analytics on the current state of the FinTech applications market, helping to identify the best market opportunities. The research will help identify gaps in the offering and potential target audience segments.

- Target audience identification. The vendor will also help define and understand your target audience by providing analytics and statistics on user behavior and preferences.

- Selecting a monetization model. Identifying the desired monetization model is equally important, as your developers will build a FinTech app with it in mind. Vendors can offer monetization models based on experience with other FinTech apps and knowledge of market trends. Among the most common options are usually paid subscriptions, transaction fees, and advertising.

Step 4. Decide on platform and feature set

The next phase of building mobile apps for FinTech is the discovery phase process. This stage aims to detail all the product’s requirements and create a clear development plan. This phase includes:

- Platform selection. In this phase, developers determine the key requirements for developing a solution for your chosen platforms or help you decide which platform is best suited to your needs for FinTech app development, such as mobile devices (iOS, Android), web apps, or cross-platform frameworks. They consider your requirements, the target audience's needs, and each platform's functionality.

- Choosing the features. An important step is to determine the functionality and features of your FinTech app. Your vendor will select functional elements based on the type of solution you want to create. Design concept. Design teams develop a design concept considering the user interface (UI) and user experience (UX). The design should be intuitive, attractive, and consistent with your company's brand.

Step 5. Ensure robust security

Your development team also focuses on security and compliance with regulations and standards in the financial industry (e.g., PCI DSS, GDPR, KYC, MiFIR, etc.). During app development for FinTech specialists take measures to protect user data and ensure compliance with legislation on economic activity. This includes implementing robust encryption protocols, conducting regular security audits, and integrating advanced fraud detection systems.

Moreover, the team keeps track of the global and regional compliance requirements, implementing DORA and other mandatory regulations, enabling businesses to expand into new markets without potential legal hurdles. Keep in mind that in digital finance, the role of data security and regulatory adherence has to be the number-one priority as this enable you to build trust and credibility with users.

Read our guide to learn how to become PCI compliant in order to deliver reliable and robustly safeguard FinTech app

Step 6. Go through the development and QA

The team can start FinTech application development once they pass all the preparatory steps. It is a good idea to start by building a Minimum Viable Product (MVP). MVP creation is an excellent decision to test your app idea before launching a full-fledged fintech product. With the MVP, you can launch an app without extra costs and save money on product development.

A minimum viable app includes enough features that users can try out at first and review your app. MVP building will allow you to easily attract investors, get feedback and minimize the risk that your idea won't pay off.

After launching your MVP app, the development process doesn't stop. You need to conduct an A/B testing stage to check customer reviews, based on which add new features or improve old ones (design, functionality).

Step 7. Launch and gather user feedback

Upon completing the FinTech app development, your software vendor will launch it on the selected platforms and provide you with all the documents. After establishing an app, you should collect feedback from target users and improve the solution through regular updates based on them. Improvements may include bug fixes or extension of the app’s functionality. Maintaining communication with users and making the application more convenient, safe, and functional is important.

Types of FinTech Apps

Fintech is a compilation of technologies and financial sectors like blockchain and banking platforms, or budgeting apps. With more expansion in recent years, this sector makes the business more customer-oriented.

If you want your team or the IT company you've chosen to make a FinTech app to understand your idea, you need to determine the value of your product to consumers.

Let's find out what types of fintech apps are and take a look at the most popular ones.

Insurance apps

This type of FinTech app is suitable for the insurance industry to speed up claims processing, policy administration and to reduce the insurance likelihood of fraud. Besides, it may be as basic an insurance website as a complex CRM.

Insurance app development should have such main features as payment processing, filing a claim, quotes, policy details, and the ability to search for policies by selected parameters.

If you want to create insurance app, check out the good examples:

- Geico Mobile. It's one of the best auto insurance apps with such key features as digital ID cards to access insurance policies, a virtual assistant that quickly answers questions regarding the policy coverage and billing, a parking locator that helps users find parking and make a reservation in advance.

- Lemonade. This app is designed to provide policies to homeowners and renters. Its unique feature is that it takes a maximum flat fee to run a business and any over premiums get distributed between different charities during a year.

Investment apps

It may be more preferable for your to choose this FinTech app type if you want to start working in the stock market. This app will allow you not only to research financial assets and invest in them but also to improve your investments' efficiency.

If you decide to create an investment platform, don’t forget about such main features as currency, savings, and credit management, product comparison, real-time alerts, and client support.

Here are some ideas for investment apps:

- Robinhood. Robinhood is a good solution for smooth trading. Its main advantages are quick access to the stock page, a trading, quick start by the instant delivery of the first $ 1000 of any funds deposited into the account, and a channel with stories from news and investment sites so that you can know the latest news.

- Wealthbase. Wealthbase is the best stock market games app. The app combines stock picking and social media, so you can see a feed of stocks that your friends or colleagues are choosing.

By the way, we at Cleveroad have created an investment application for Middle-East market. Read our Micro-Investment Platform with SAMA-Compliant case study to learn more about this solution.

Banking apps

Banking apps are designed so that users can independently and quickly manage their bank accounts and carry out financial transactions.

Many traditional banks assess mobile application development for FinTech to become more competitive. This is because all services are becoming mobile, and financial transactions are carried out faster and more conveniently.

Creating a banking app, you can integrate it with payment systems like Google/Apple Pay or PayPal like the UK financial company Monese did in its app.

Here is an example of several banking apps:

- Starling. The app allows customers to open an account for free and without documents quickly, manage overdrafts, and savings, draw up a budget, and transfer funds to bank accounts in 38 countries safely.

- Monese. This app is specially designed for expats who have moved to the UK. You can open an account anywhere in continental Europe and the UK even if you don't have a UK address, credit history, or fixed income.

Learn about how to create mobile banking app regarding key functionalities, development steps, cost, potential challenges and their resolution by reading our guide

Regtech apps

Regtech (Regulatory Technology) is designed for companies that deal with finance to help them meet compliance with the law set by regulatory bodies.

Regtech solutions help compliance departments to monitor risks, regulatory changes, and transactions, reduce the number of false non-compliance alerts, and build reports.

If you want to create a FinTech app like this, don’t forget to include the ability to identify risk management, and identification of financial crime.

Here are some good regtech app examples:

- 6 clicks. This platform is designed to help automate and manage risk identification, assessment, and analysis for all stakeholders of the risk management lifecycle.

- PassFort. This platform allows automating compliance checks with the principles of KYC (Know Your Customer), AML (Anti-Money Laundering), and others. It enables you to transform CLM (Closed-Loop Marketing) processes into digital automated onboarding tasks.

Lending apps

Lending apps make the processing of loan requests and the interaction between the borrower and the lender more efficient and faster. It’s a good way to improve businesses for both independent digital lenders and traditional financial institutions.

While assessing how to create a money landing app, keep in mind that it may include features like credit score, loan application form, billing, and payment. You can also provide users with the ability to loan repayment right from the app.

Examples of popular lending apps are:

- Earnin. It’s the leader among fintech apps that provide low fees. This app stands out because it doesn't charge fees when you borrow money.

- PaySense. This platform provides short-term personal loans to salaried professionals within 5 hours of applying for a loan, affordable and convenient EMIs, and interest rates. It provides loans even to those with a low credit rating.

Consumer finance

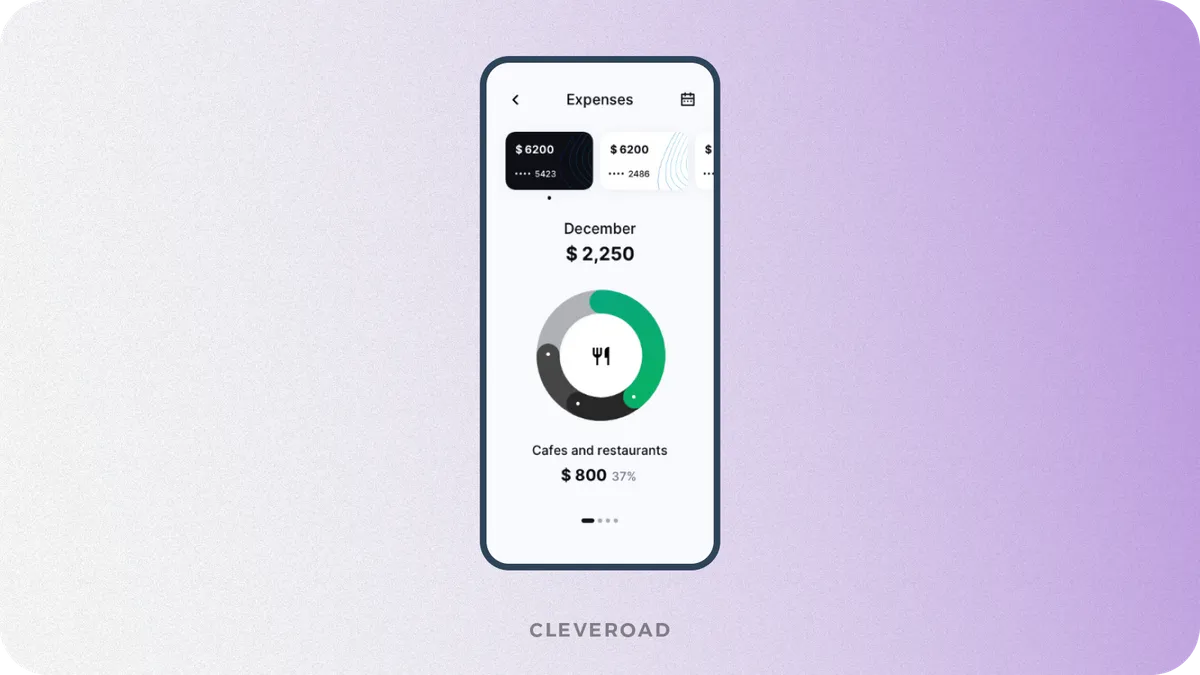

Consumer finance apps don’t usually offer payment processing services. They are designed to help users plan and manage their expenses, save money, and forecast future account balances so as not to spend more than planned.

Building a FinTech app of this type should include such features as financial goal setting, expense and bill tracking, investment analysis, payment categorization, fraud and identity alerts, etc.

Here are fintech apps that you can consider to understand how they work:

- Mint. It's a free app that allows users to budget, tand rack payments and enrollments. Mint can be synchronized with various credit cards, bank accounts, and PayPal.

- Money Patrol. With this app, you can oversee and manage your transactions, and savings, make effective financial decisions, data the app provides, reveal fraudulent transactions, and penalties for late payments.

Neobanks

Neobanks are applications that allow you to provide banking services without going to physical branches. They operate and provide services exclusively digitally through mobile applications or online platforms. The main focus of neobanks is to provide customers with convenient, innovative, and personalized financial services.

The core functions of neobanks include account opening and management, investments, lending and borrowing, and financial planning and transfers.

Some of the most popular examples of neobanks include:

- Monobank. Monobank is a Ukrainian neobank that provides financial services entirely online. This application allows users to create and manage accounts and investments.

- Chime. Chime is an American financial company providing mobile banking services. The app allows users to open accounts and manage debit, credit cards, and savings.

Learn about how to create a neobank, learning on comprehensive real-world examples in our detailed guide

Essential Features to Implement in FinTech Apps

While FinTech applications vary in types and features, now we will look at the must-have features that every successful FinTech solution should have.

Secure authorization and authentication

To keep your customer's data as safe as possible, you must provide functionality for secure user authorization. Use two-factor authentication to protect accounts from unauthorized access.

Authorization feature for FinTech app

Account aggregation

This feature enables users to consolidate and view information about their bank accounts, investments, and loans from various financial institutions in one centralized location, offering unparalleled convenience, enhanced financial control, and a streamlined approach to managing their personal finances efficiently.

FinTech app account aggregation

Budgeting and savings tracking

Here, users will find a comprehensive suite of tools for setting budgets, analyzing expenses, and tracking savings. These features empower users to take control of their financial health, plan effectively, and achieve their savings goals with ease and confidence.

FinTech app budgeting feature

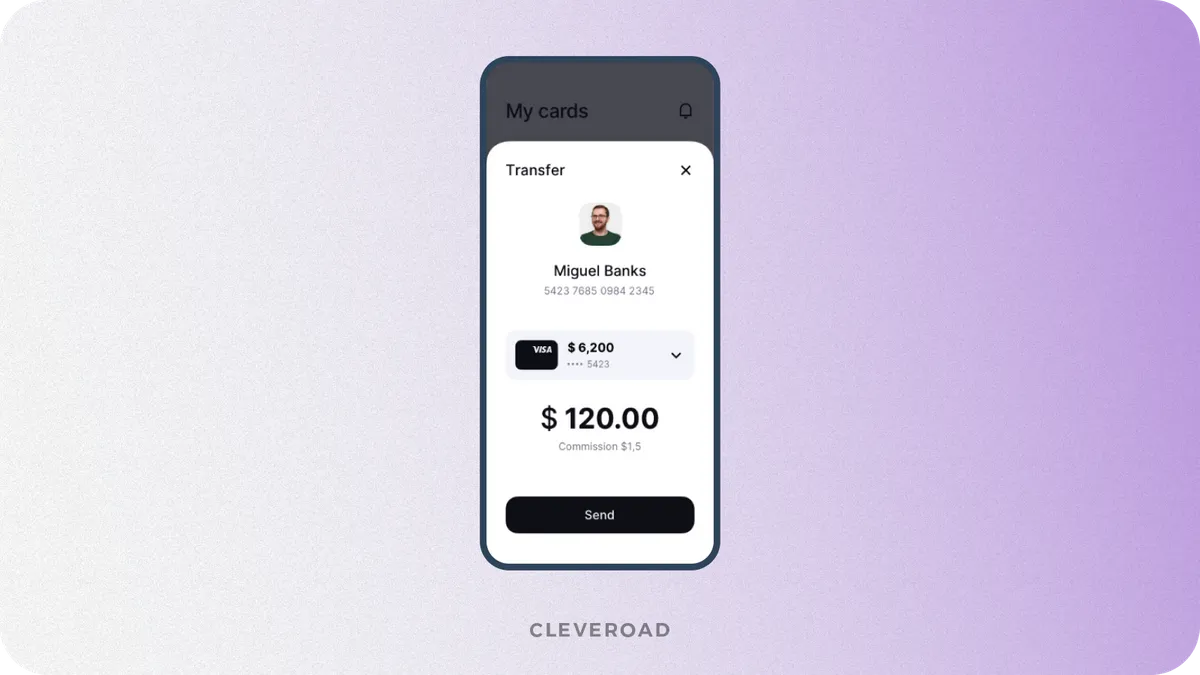

Payments and transfers

These features will empower users to quickly and effortlessly make payments or money transfers in just a few clicks, enhancing convenience and saving time. By streamlining financial transactions, your app can offer a seamless and user-friendly experience that meets modern expectations.

Payment feature for FinTech app

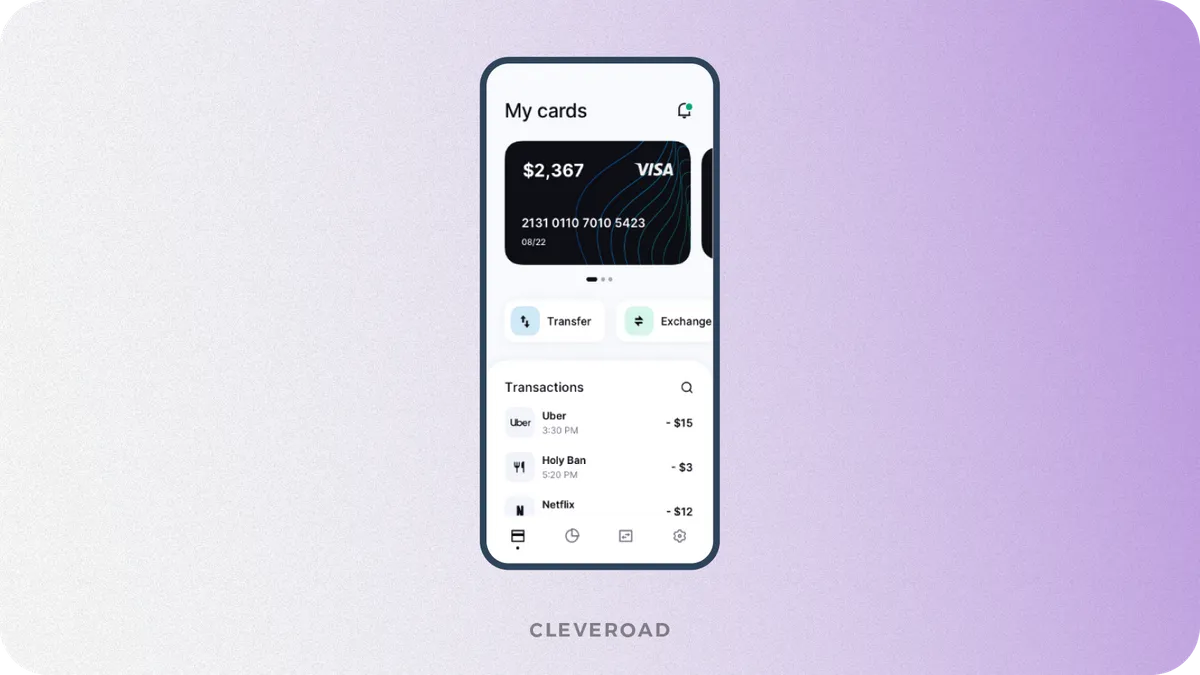

Card and account management

Provide comprehensive account management features, including the ability to lock and unlock cards, set and modify spending limits, view detailed transaction histories, and manage personal identification settings, ensuring a secure and user-friendly experience for seamless financial control.

Card and account management feature of a FinTech app

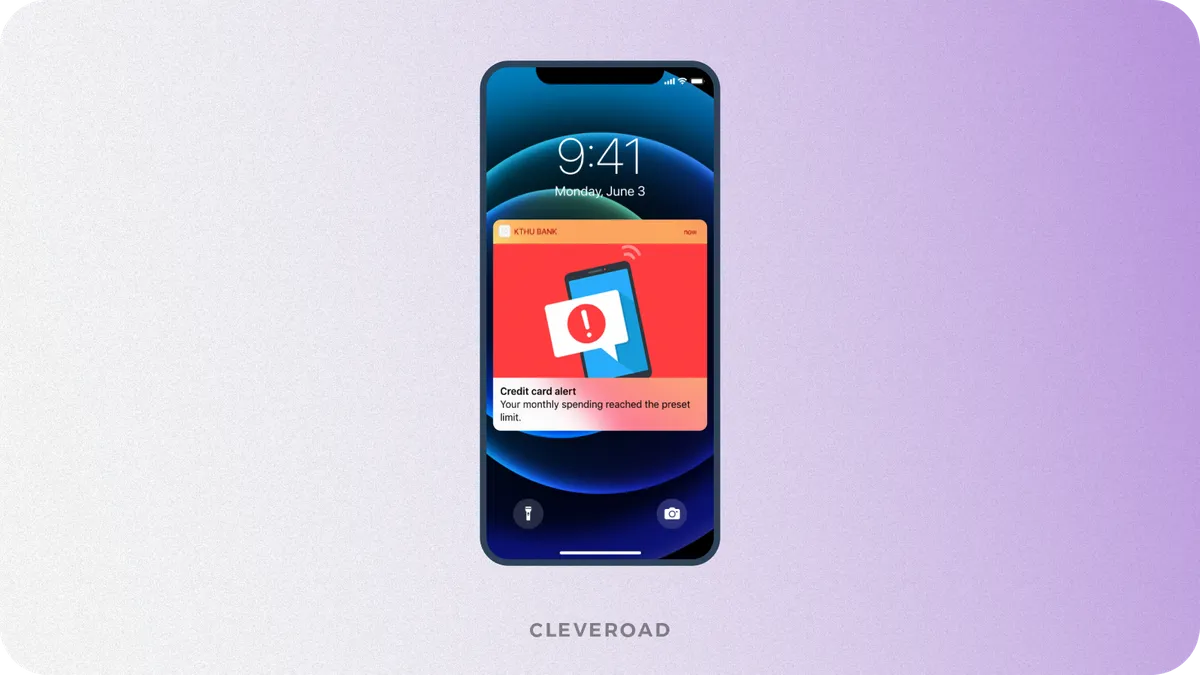

Custom notifications

Allow users to tailor notifications to their specific needs, such as receiving alerts for in-app updates, account transactions, investment status, promotional offers, or reminders. This personalization enhances user engagement and ensures they stay informed about relevant activities within the app.

Custom notifications of a FinTech app

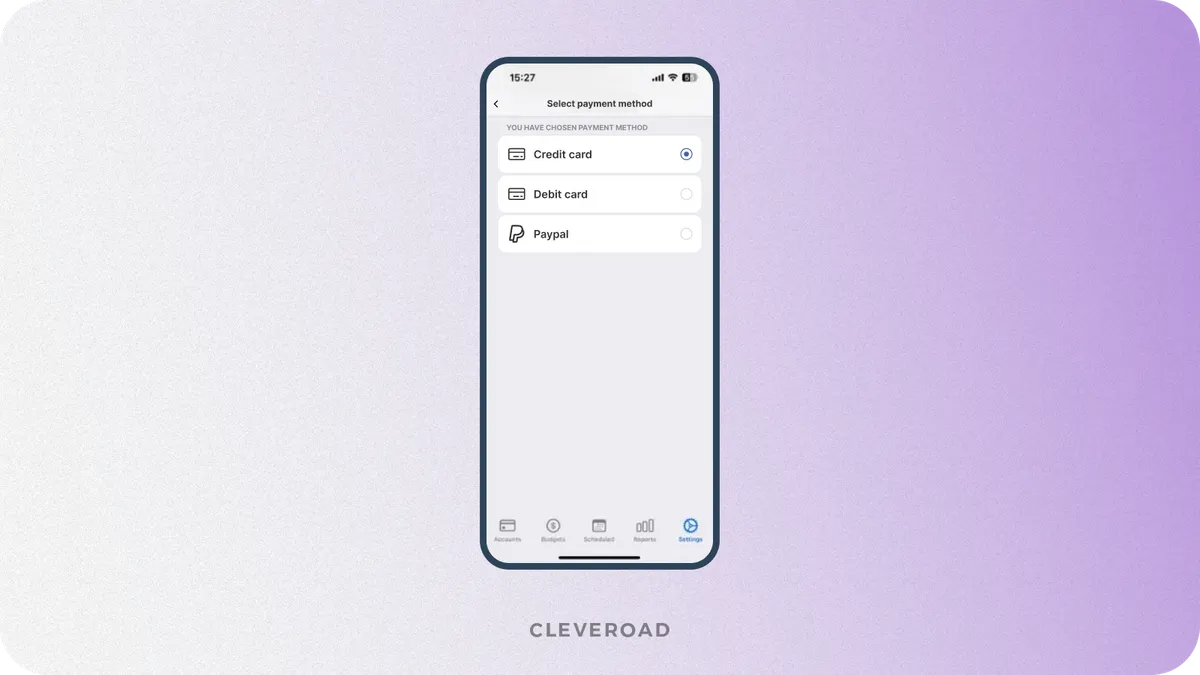

Integration with payment gateways

You need reliable payment gateways to ensure safe and secure payments within the app. We have covered the basic features required to build a FinTech app. This list can be supplemented depending on the selected type of solution and its characteristics.

Payment integration for a FinTech app

Customer support

In the case of FinTech app development, customer support is important as users may have difficulties or questions at any time. You can provide round-the-clock customer support with AI chatbots to advise customers and answer their questions.

Selecting the Right Technology Stack to Build FinTech App

Here is where your FinTech software development services provider apply their expertise to select the best suiting set of technologies and tools to build a Fintech app for you. To orient you on this, here the tech stack Cleveroad team usually uses for fintech app development:

Front-end

The front end part of building mobile app for FinTech serves as the user interface, creating the first impression of your FinTech app. It ensures smooth navigation, responsive design, and accessibility across devices. A strong front-end stack is essential for delivering an intuitive, visually appealing user experience that keeps users engaged with the app’s features and services.

For mobile development, technologies include:

- Swift for native iOS app development, ensuring smooth performance and adherence to Apple’s design standards.

- Kotlin for Android, providing a modern, efficient language for robust apps.

- React Native to deliver cross-platform apps with a single codebase, reducing development time while maintaining quality.

- Flutter for crafting visually appealing, high-performance apps compatible with multiple platforms.

Back-end

The back end powers the FinTech app’s core functionality, ensuring smooth data processing, transaction handling, and system integrations. It operates behind the scenes, enabling the app to deliver secure and reliable financial services.

Technologies for FinTech back-end creation include:

- Node.js for real-time processing, essential for features like payment updates and notifications.

- Django (Python) for developing secure and scalable financial platforms.

- Spring Boot (Java) for enterprise-grade financial applications.

Third-party integrations

Third-party integrations within building a FinTech add essential features to your app without extensive development. They facillitate advanced capabilities such as secure payments, real-time notifications, and analytics. Leveraging these tools saves time and significantly enhances the app’s overall functionality.

For FinTech apps, the following integrations add to functionality:

- Plaid for secure bank account integration.

- Stripe or PayPal SDKs for handling transactions.

- Firebase for real-time user engagement via notifications and analytics.

Databases

Databases are the backbone of a FinTech app, storing and managing critical user and transactional data. They ensure data is handled efficiently, securely, and with high availability. Choosing the right database technology ensures the app performs reliably under heavy financial workloads.

Here’s what Cleveroad’s specialists most commonly use:

- PostgreSQL for complex queries and reliability.

- MongoDB for flexible, unstructured data like user activity logs.

- Redis for caching and improving performance.

Testing

Testing ensures the FinTech app is reliable, secure, and compliant with industry regulations. It validates that the app performs as expected under various scenarios, helping to identify and fix bugs before deployment. A rigorous testing process guarantees quality and builds user trust.

Testing tools include:

- Selenium for automated browser testing.

- JUnit for robust backend code testing.

- OWASP ZAP for identifying and mitigating security vulnerabilities.

How to choose the right technology stack for mobile application? Read our guide to learn about appropriate tech stack for your exact FinTech app type

Challenges of Building Mobile Apps for FinTech and Solutions

The fintech sphere is complex enough so let's consider how and what features help you to succeed with your startup. Let's look at the requirements for fintech app development.

Regulatory compliance

FinTech apps operate within a highly regulated environment, requiring compliance with stringent laws like GDPR, PCI DSS, and MiFIR. Adhering to these region-specific and constantly evolving regulations can be a complex, time-consuming process that delays development, increases costs, and poses risks of legal penalties if not properly addressed.

Solution: Partnering with experienced FinTech developers familiar with regulatory landscapes ensures compliance from the start. Implementing automated compliance tools and regularly updating to meet evolving standards helps avoid legal risks and penalties while building user trust.

As an experienced IT vendor with multiple cases of delivering FinTech solutions, Cleveroad strongly focuses on strict alignment with essential regulations and legal aspects within digital finance software development, including PCI DSS, GDPR, ePrivacy, etc. Moreover, we have been certified with ISO/IEC 27001:2013 – a standard stating the alignment of our approaches to software development with the leading world data security practices.

Data security

FinTech apps handle sensitive user data like financial information, making them attractive targets for hackers and cyberattacks. Maintaining robust security is critical, as breaches can result in severe reputational damage, legal issues, and loss of user trust. Balancing usability with stringent security measures can be particularly challenging for developers.

Solution: Employ advanced security measures to ensure solid data protection. For instance, we at Cleveroad secure FinTech applications with industry-specific data encryption, multi-factor authentication, automatic logouts, biometrical authorization, real-time threat monitoring, etc. Conduct regular security audits and penetration testing to identify vulnerabilities. Leveraging a security-first development approach ensures robust protection for user data and transactions.

Integration with legacy systems

Many financial institutions depend on outdated legacy systems that are incompatible with modern FinTech applications. Integrating these systems while maintaining operational continuity can be difficult, requiring significant time and effort to bridge technical gaps and support seamless data flow between old and new infrastructures.

Solution: Use middleware and APIs to bridge gaps between old and new systems. Collaborate with skilled developers who can customize solutions for smooth data flow and compatibility, minimizing disruptions while modernizing legacy infrastructure.

Multi-platform support

Delivering a consistent and high-performing user experience across multiple platforms while building a FinTech app, such as iOS, Android, and web, increases the complexity of FinTech app development. Ensuring seamless functionality, compatibility, and user satisfaction across various devices and operating systems demands significant time, resources, and technical expertise.

Solution: Utilize cross-platform frameworks like React Native or Flutter to streamline development while maintaining performance. Adopt responsive design principles and conduct thorough testing on various devices and platforms to ensure a seamless user experience.

How Much FinTech App Development Costs?

The pricing of FinTech app development is a complex matter that is influenced by multiple factors. For example, your digital finance app MVP is going to be significantly lower in price than a full-size, complex app with incorporation of complex technologies like blockchain or advanced AI algorithms. It will considerably impact the FinTech app complexity and wiil require extra effort from your development team, adding to the longevity of the overall development. However, here are other key aspects that may risen the FinTech app price tag:

- Development platform: native apps are more expensive than cross-platform ones

- UI/UX design: Complex and multi-layered design will cost more

- Third-party integrations: Their quantity and complexity impact the price

- Deployment: It’s usually required to pay fees for app deployment to app store

- Team size, expertise and location: Developers’ rates vary depending on region and expertise level, etc

So, what is FinTech app development cost? If you plan to create a FinTech app with basic features, development can cost you anywhere from $40,000 to $300,000+. These numbers are indicative and depend on your requirements, required features, development time, etc.

If we take fintech app development with basic features (MVP) as an example, the average time to build such a solution is 750-1500 hours. However, it is hard to provide you with exact numbers without knowing your product requirements. Feel free to share your idea with our experts to get a detailed FinTech app development estimate.

Our Experience in Developing FinTech Applications

Cleveroad is a FinTech software development company with more than 13 years of experience. We develop a wide variety of digital solutions for startups and businesses. Among our services, we create financial software that facilitates online payments, financial analytics, and banking, ensuring security, legal compliance, and data protection.

Choosing us for FinTech app development, you will get:

- Practical expertise in custom Fintech app development to enhance finance and banking (e.g., trading platforms, digital wallets, financial management apps, etc.)

- Experience building FinTech software solutions compiant with GDPR, ePrivacy, MiFID II, KYC, etc.

- Experience in integrating FinTech software with a wide range of third-party services such as Paypal, Braintree, financial APIs, etc.

- Full consultation with our FinTech subject matter experts on FinTech app engineering

- Signing a Non-Disclosure Agreement (NDA) during the initial stages upon your request to preserve your project idea

- Flexible cooperation models depending on your needs: IT staff augmentation, Dedicated Development team services and Project-Based Cooperation

To demonstrate our domain expertise, we want to introduce our featured FinTech project:

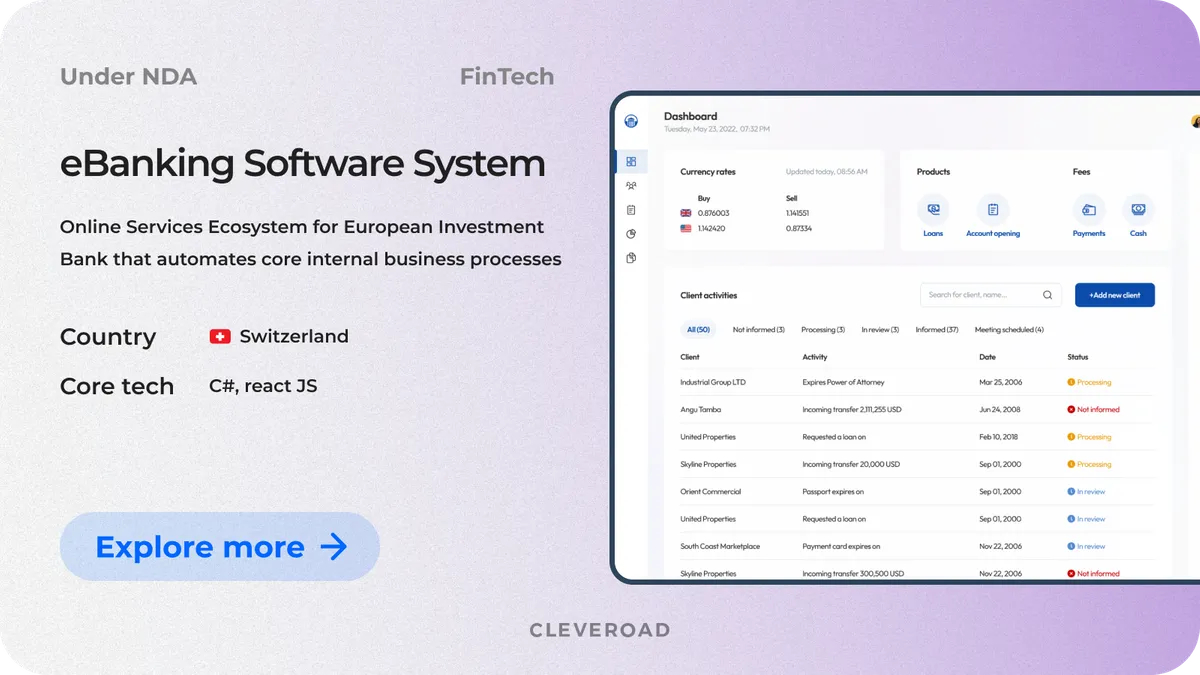

eBanking software system

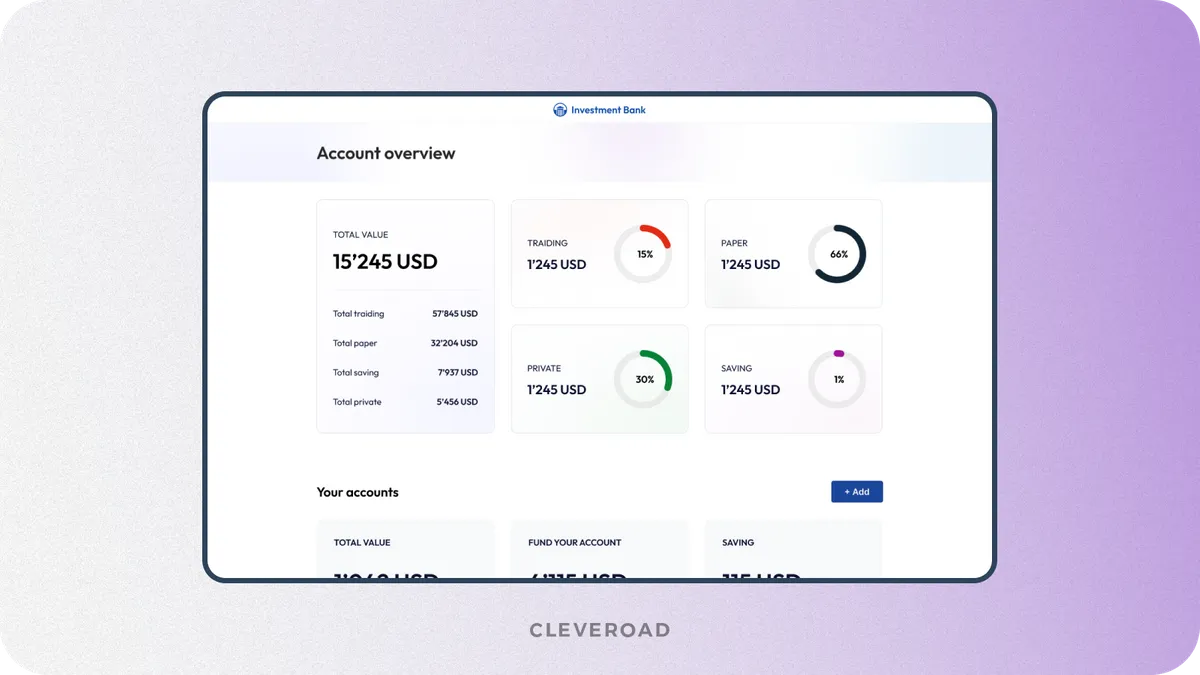

Our client is a Swiss bank offering online investment, lending, and trading services. They turned to the Cleveroad team to help us create a flexible system that could expand their business and attract new customers. To accomplish the task at hand, we:

- Replaced a legacy software MVP and created a holistic system that would support the needs of B2B/B2C clients and operations teams, automate key internal workflows, and enable the bank to build new global business opportunities.

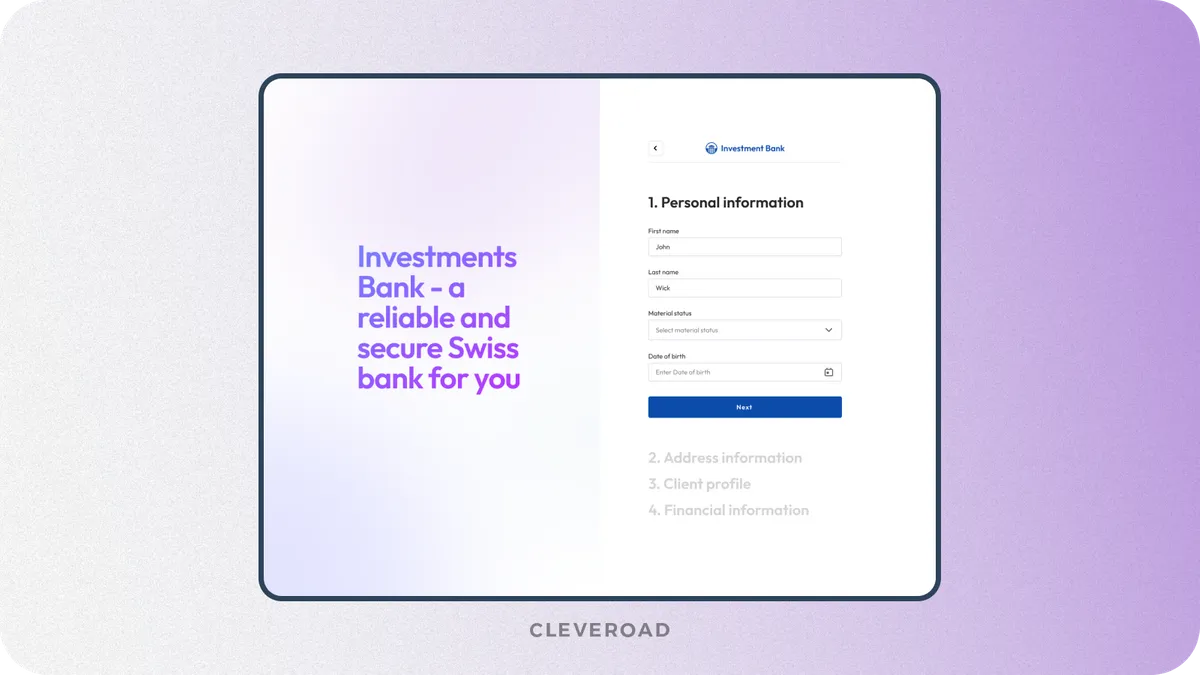

- Improved the user experience (UX) for registration, digital account opening, and e-banking portal so that users complete the registration process and become and remain customers of the bank, increasing retention rates.

- We created the software considering all regulatory requirements for investment bank software. Namely, the new system and operational processes must be FMIA compliant, and the development team must comply with operating and data processing rules as part of a "need-to-know" access control framework.

As a result, the client received a new eBanking system that helped to ensure client acquisition and retention rate growth by 20-30% due to improved UX. Moreover, thanks to continued practical cooperation, the customer received business process improvement, acceleration of operators' work, and tech staff free-up.

Create a FinTech app with our experts

With over 13 years of experience in FinTech domain, our digital finance experts are ready to provide you with full-fledged FInTech development services to improve your financial services provision

A FinTech app is a software application designed to provide financial services or solutions, such as digital payments, budgeting, investing, lending, or banking, by leveraging advanced technologies like AI, blockchain, or data analytics to enhance user convenience, security, and accessibility.

Key FinTech app features include:

- Secure authorization

- Account aggregation

- Budgeting and savings tracking

- Payments and transfers

- Card and account management

- Custom notifications

- Customer support

- Integration with payment gateways

To build a FinTech app, follow these steps:

- Step 1. Choose your FinTech niche

- Step 2. Select and experiences IT partner

- Step 3. Pass the planning phase

- Step 4. Decide on platform and feature set

- Step 5. Ensure robust security

- Step 6. Go through the development and QA

- Step 7. Launch and gather user feedback

If you plan to create a FinTech app with basic features, fintech mobile app development can cost you anywhere from $40,000 to $300,000+. These numbers are indicative and depend on your requirements, required features, development time, and the need to support both iOS and Android platforms. Fintech companies and fintech startups focusing on innovative solutions, such as a payment app, may face varying costs based on complexity and scale.

If we take fintech app development with basic features (MVP) as an example, the average time to build such a solution is 750-1500 hours.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article