11 Innovative RegTech Startups to Come Up With Business Ideas of Your Own

Updated 05 Apr 2023

10 Min

4485 Views

The bigger business becomes, the more responsibility falls on it's founders. We're talking not only about company management and task-solving but regulations at the State level. It's especially challenging for enterprises that provide financial services of different kinds. Fortunately, RegTech startups aim to make regulatory processes more painless.

In this article, we'll consider the most curious RegTech startups to draw your attention to this interesting niche and inspire you on the creation of own RegTech solutions.

What is RegTech?

Let's start with RegTech definition. This acronym stands for regulatory technology and implies technological solutions that intended to cover challenges related to regulations and compliance in different fields. In other words, RegTech companies collaborate with various institutions, as well as regulatory bodies.

Let's take bank as an example. This financial institution deals with the enormous amount of data that can be processed and used in it's favor. At the same time, it's quite clear that banks have lots of challenges connected with regulations. Let's say it was decided to hire one of RegTech firms specializing in data analysis to help this bank in reducing the number of regulatory failures.

Discover how to make a banking app and what you should take into account

Respectively, if talking about RegTech firms focused on data analysis, they may use predictive analytics to foresee the potential risk areas the bank should work on in order to reduce it's regulatory failures and rearrange resources allocated for their coverage. To better dive into the problem take a look at the statistics underneath.

RegTech banking can save lots of money

That's what RegTech actually is. It allows businesses to solve regulatory challenges saving their time and money. The example above is only one of the dozens of ways how RegTech companies can be useful for enterprises (scroll/navigate to Types of RegTech companies to learn more).

Top-notch RegTech startups

So, it's time to consider some RegTech startups that may inspire you on the creation of your own product.

1. Onfido

Onfido is a London-based RegTech startup that was founded by three graduates from Oxford. It uses machine learning in order to provide companies with instant access to robust checks of identity, as well as background checks for both customers and employees.

This platform interacts with a variety of databases that are available publicly and gives employers an opportunity to monitor person's employment, his or her criminal records, as well as verify identity.

The company's services can be easily integrated into mobile app or website with the help of their API and SDKs. That means web and mobile developers can integrate the features of Onfido into their projects.

That's quite an interesting approach to the management of company's inner processes. Knowing modern trends for security and confidentiality (especially in enterprises), such solutions shape the RegTech trends for the following years.

RegTech examples: How Onfido works

2. CheckRecipient

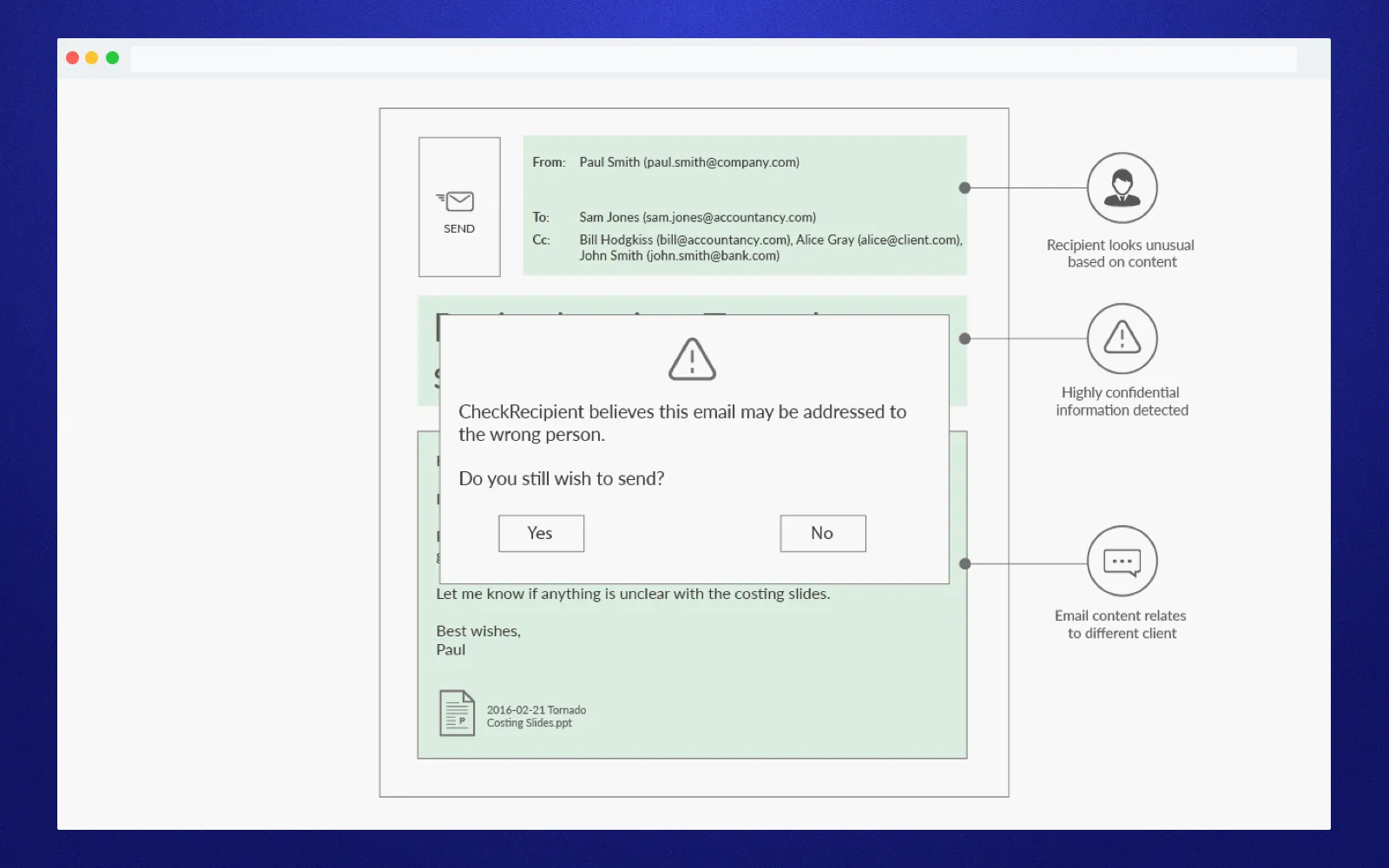

This RegTech startup is intended to prevent such terrible situation as sending emails with sensitive content to the wrong person.

The CheckRecipient's main product is called Guardian. It analyzes data from all over the company's email network to determine behavior patterns and prevent misaddressed emails. When algorithms detect odd email address or information which is potentially sensitive, they ask a sender to think twice before delivering this email.

Besides, this RegTech company provides a pack of resolving problems like protection of sensitive attachment, email rules compliance and audit. The platform can be integrated with a bunch of popular email platforms like Citrix and Microsoft Exchange.

Even the most qualified employee makes mistakes. For companies and institutions that operate with sensitive information (e.g. hospitals) this mistake can cost a reputation. That's why similar RegTech solutions will find it's customers.

RegTech AI example: CheckRecipient in action

3. Suade

It's a Software-as-a-Service product that facilitates compliance processes, as well as regulatory obligations. Suade gives companies which involved in the process of regulatory submission a platform that has automated workflows, as well as a single source of data. The platform's cofounder say they bring more transparency and efficiency to organizations through modern technologies.

4. FundApps

This is one of top RegTech companies that's focused on the pretty specific problems in business that are related to shareholder disclosure. The platform itself is a cloud-based solution for automation of shareholding reports.

FundApps combines relevant information about regulations from it's partner company Aoshpere with pre-filled documents. This way, this RegTech startup manages to reduce the number of human errors, as well as save some time to teams focused on compliance by automating the majority of their workflow.

5. Fenergo

This Irish-based RegTech compliance company was created in 2009. It's focused on banking sphere. To be exact, Fenegro deal with something called Know your customer (KYC). It's responsible for identifying and verifying the identity of company's customers.

Banks have separate teams dedicated to this process and in many cases they work non-stop. That's because each customer has own unique situation and the regulations vary depending on jurisdiction. KYC is a must-have process in case banks want to avoid money laundering. For this purpose, they monitor customer's transactions along with blacklists, as well as check whether clients are who they say they are.

Fenegro RegTech startup automates the entire this process with the help of such technologies as Artificial Intelligence and blockchain. Statistics of using this service is quite impressive -- one global bank has managed to increase it's efficiency on 37% with the help of Fenergo.

RegTech industry: Banks that trust this Fenegro

6. Perfios

This RegTech compliance solution was founded in Bangalore in 2007. The killing feature of this service is the opportunity to analyze someone's financial background in minutes. As you understand, it allows banks and FinTech companies to save plenty of time. One of the use cases for this technology is a home loan that can be established in just one click. It means as soon as the user authenticated to the bank account, the system will analyze his or her bank statement and through several seconds determines whether the customer is capable of paying back the loan.

At the moment, the Perfios RegTech company is largely focused on the Indian market, so you have enough space to create a product like that and tailor it to the realities of your market.

RegTech startups: Perfios main features

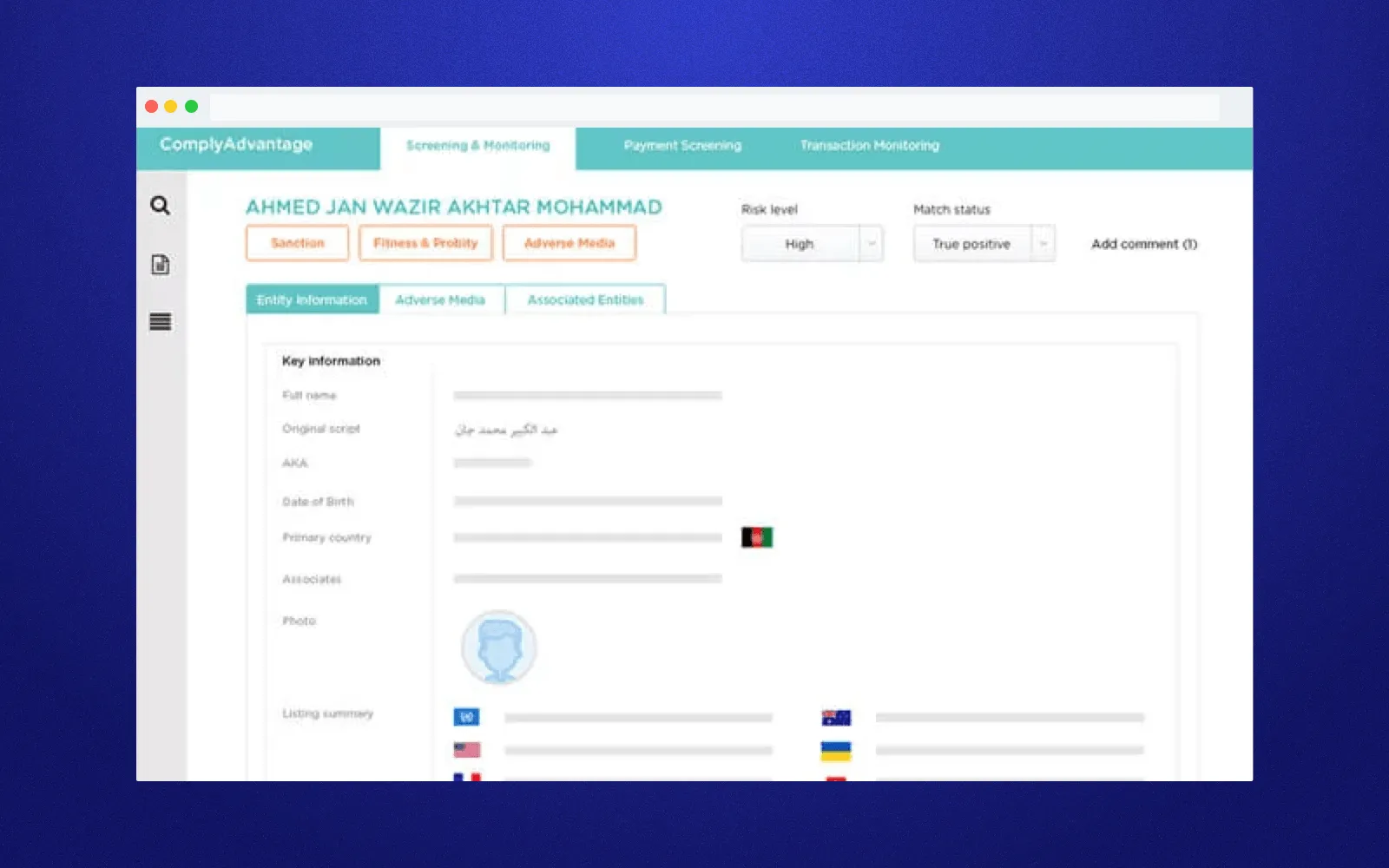

7. ComplyAdvantage

ComplyAdvantage is a RegTech compliance company based in New York that specializes in Anti Money Laundering (or just AML). The company managed to build the global database. They did it with the help of machine learning and trained it to spot bad people. It monitors over 5 million pages in media daily to see whether there are any people connected with crime among your customers.

Read how to cut expenses on machine learning features with the help of MLaaS providers or watch our related video underneath

This technology can save tons of money that could go to waste since according to statistics, about 90% of all AML alerts are false positive.

RegTech in financial services: ComplyAdvantage interface

Types of RegTech companies

If to dig a little deeper, you'll see there are lots of free space to create your own RegTech startup. Let's consider several fields where RegTech companies are active in.

Operations risk management

Companies from this category provide tools for operational risks management in financial organizations. Risk management includes reporting, data storage, tracking of issues, identification of incidents, as well as compliance obligation monitoring. To companies dealing with this kind of management can be referred Rsam that provides GRC (governance, risk, and compliance) software along with NetGuardians which provides tools that facilitate identification and management of incidents.

RegTech industry: Operations risk management

Government & legislation

RegTech startups from this category provide it's customers with software solutions for monitoring and managing of current or approaching regulations (e.g. reforms, legislation). It helps companies from different industries to keep up with the relevant regulations and act in accordance with applicable law. Such platforms as FiscalNote and TrackBill are focused on real-time regulatory analysis, as well as legislation tracking.

RegTech industry: Government & legislation

Healthcare

RegTech companies in this sphere focus on the regulations that are specific to this industry. We mean protection of patient information, practices of patient care, as well as some other requirements. For instance, the InvisALERT company allows hospitals to track patients safety with the help of wearables, while another company called Qualtrax facilitates management of accreditation, testing, and documents for labs.

RegTech industry: Healthcare

Security & cybersecurity

This category consists of companies aimed at identification of threats to company's cybersecurity, Internet security, as well as information security. They remediate threats, conduct vulnerability management, and send notification concerning the latest security protocols in order a company could stay up-to-date. To this category, we can include the RiskIQ RegTech company that monitors and determines the patterns of users' behavior in order to detect threats of different types, including the violation of company's policy and various anomalies.

RegTech industry: Security & cybersecurity

Is it a good idea to fund a RegTech startup?

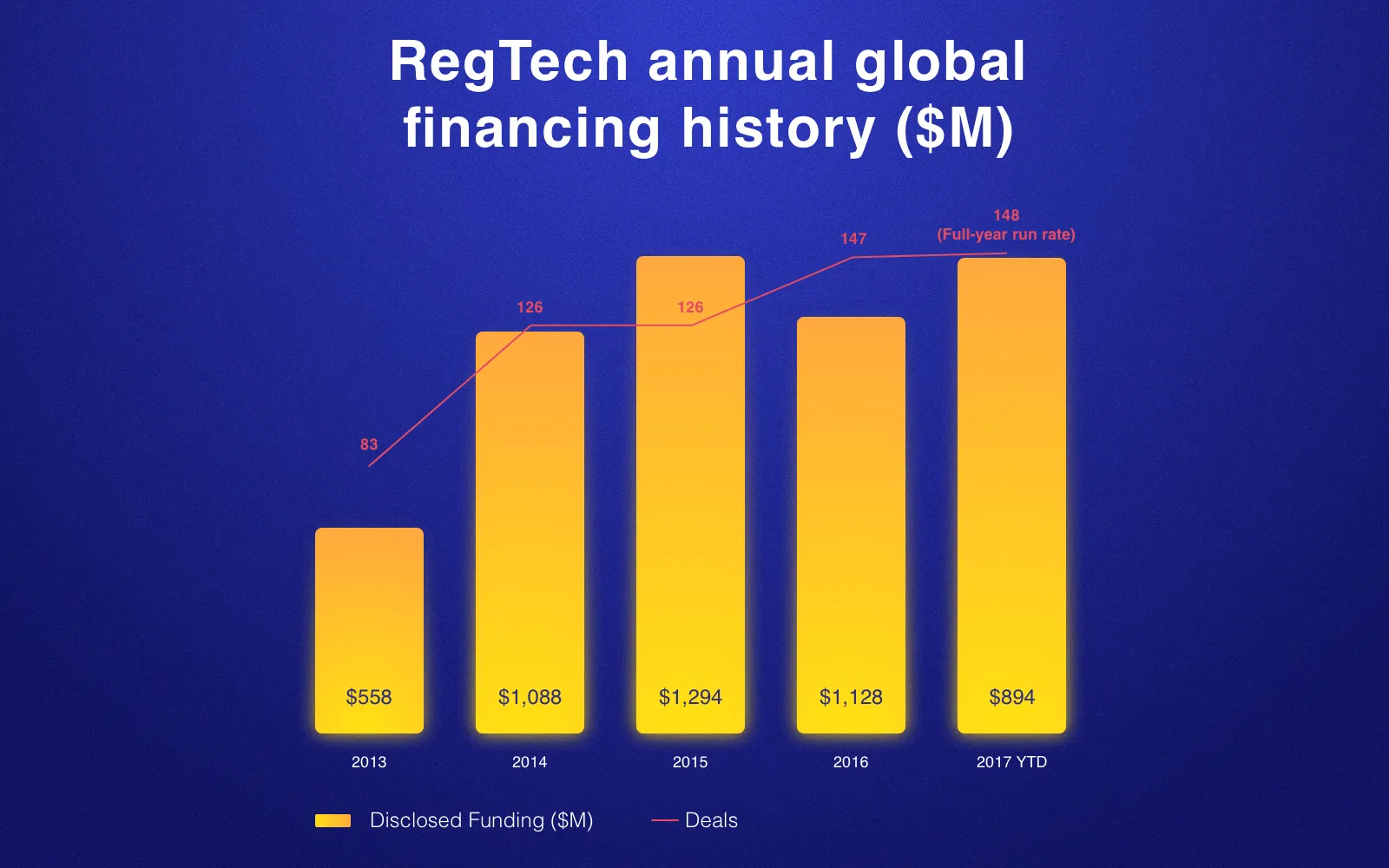

The best way to answer this question is to consider the RegTech market size and how fast it actually grows.

The research conducted by CB Insights shows that in 2017 there were about 148 disclosed deals related to equity funding with the total worth of over $1B. If to compare this results with 2016, we'll see they keep growing from year-to-year.

RegTech market size: Annual financing

These statistics clearly show that investors are interested in this niche and ready to help with funding. So, if you're intended to fund a RegTech company with an interesting idea behind, you can count on the financial support. For instance, Druva cybersecurity company got one of the largest investments in 2017 -- $180M. You may go further and create, let's say, the next breakthrough RegTech blockchain solution.

Let's build next breakthrough startup together! Contact our managers to learn all the details of cooperation and get your free consultation.

Also, subscribe to our newsletter by filling in the form on the right or at the end of the page (for smartphones). No spam, we promise. Just one letter a week to your inbox with the latest videos and blog posts from our team!

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article