How to Build a Health Insurance Mobile App and Benefit From It

Updated 08 Mar 2023

22 Min

1465 Views

If you are running an insurance business in 2024, the health insurance app development is a promising opportunity to generate revenue and increase user engagement. According to the Verified Market reports, the insurance mobile apps market size is projected to develop revenue and exponential market growth during the outlook period from 2023-2030. The 2023 Swiss Re Institute report states that health insurance premiums are expected to return to growth at 1.5% in 2024-2025, compared to the -0.6% growth that took place in 2023-2022. Isn’t that a great opportunity to invest in creating a health insurance app right now?

In this article, we’ll share insights how to create a health insurance app, its revenue models, features to implement, cost, and more. Let's get started!

Health Insurance App Development: Product’s Concept

Health insurance app development stands for a specific sector of the medical software development industry. This kind of solution can be an effective tool for automating working processes, promoting sales, and improving client relationships.

Mobile technologies in the health insurance sector empower people with faster access and effective services. Health insurance apps allow customers to address health-related needs, such as:

- Manage medical claims

- Find a reliable physician in the insurance network

- Get information about the most appropriate health insurance plan

- Initiate video consultation with healthcare consultants

- Receiving the insurance and coverage without unnecessary paperwork and more

Unlike other insurance digital products, health insurance app development has its own specificities relating to the following:

Data privacy

Security of medical records is critical to gaining the trust of target users. Policyholder’s health data leakage may lead to your insurance application being unused. Some steps to protecting medical insurance data can include:

- Ensuring compliance with legislation

- Cooperation with an experienced IT vendor

- Considering multi-tier QA testing

- Having specialists on your side to maintain data privacy policies

Data collection and usage

The increasing usage of wearable IoT devices leads to enlarged patient data collection. Health insurance organizations make use of Big Data analysis to detect possible health. These insights allow care providers to eliminate health issues by identifying the risk factors of various groups. Here is how you can collect clients’ data from your insurance app:

- Configure data gathering metrics

- Add 3rd-party app analytics tools

- Implement relevant HIPAA and HITECH artificial intelligence systems

Uptime reliability

Mobile solutions for health insurance demand constant availability because some customers may require forthwith insurance claim payment. However, delivering a reliable and performant insurance app is impossible without solid IT infrastructure. A poorly-managed backend foundation can result in frequent downtimes, making it harder for users requiring urgent care to access medical services. Since healtcare solutions relate to complex interconnected systems, it's better to implement cloud-based architecture to ensure interrupted business workflow.

Note: Though the characteristics mentioned above are applicable for all mobile insurance solutions, they're paramount in the health insurance niche.

Varieties of Health Insurance Apps

Every health insurance platform connects three stakeholders: healthcare providers, insurance agencies, and patients. Due to parties' diversity, the functionality and users' activities will differ depending on their use goals:

- Patient health insurance app development

- Health insurance mobile apps for medical providers

- Health insurance app development to assist insurance agencies

Let's take a closer look at each solution.

Health insurance apps for patients

This is the most popular approach to health insurance app development. Such platforms serve as a centralized solution where all the insurance-related data is stored. They allow clients to easily apply for a required insurance policy, make queries for claim processing, purchase or renew policies, schedule appointments with doctors, and much more. This way, people can spend less time overseeing their health and living a productive life.

Health insurance apps for medical providers

This type of app is not widely-used since healthcare consultants deal with numerous insurance organizations, which makes it hard to manage applications by them all. But if you’re wondering how to create a health insurance app for clinicians, you should carefully consider the product's functionality to meet their needs. We will look into the features required for this kind of app below.

Health insurance apps for insurance providers

Insurance companies are increasingly investing in health insurance app development for better operational and business process management. Such digital products allow insurance providers to automate and digitize their workflow, reducing paperwork and human mistakes. In addition, they help agencies to enhance customer interaction, fine-tune communication strategies based on analytics and teams' performance, engage new clients, and retain the old ones.

Revenue Models for Health Insurance Apps

The chosen monetization model has a direct impact on the product's rate of success. Therefore, it is essential to consider the business model early on to pick a suitable one for your product and audience.

Freemium model

This model works great for the mobile-only users. You build an app and provide a free insurance plan or health test for customer acquisition. The client base grows, and you polish your product and offer advanced features or upgrades. The Berlin-based healthcare startup Asana Rebel is an excellent example of how to create a health insurance app with a “freemium” model. The platform has gathered over 100,000 paying subscribers and raised $24.8 million in funding.

In-app advertising

You make a profit selling ads space for advertisers (e.g., Project Hospital). They pay some fees to promote their products via the app. However, you must remember that nobody likes the ads, so it’s vital to know the measure. Another source of income is payments from medical practitioners who offer their services to app users. For example, the CVS/pharmacy app, the platform for managing and refilling prescriptions, uses this mode to get revenue. The app makes about $5,000 a month on average in income.

Health insurance reimbursement

Mobile health solutions could get an additional source of income if they execute diagnostic tests or offer therapeutic services. If the physician prescribes an application (as is required by FDA laws), the medical organizations will be qualified for reimbursement under insurance plans.

There are use cases of this model already. For instance, the AliveCor Mobile ECG heart monitor, confirmed by the FDA, runs off the iOS platform. Like traditional ECG monitoring, this device can be prescribed and eligible for insurance payments. So, if you get state or local medical committees’ approval and convince caregivers to prescribe the app to patients, the revenue will be higher than other business models can generate. Only AliveCor Inc. has generated $35M in revenue as March of 2024; this is just one of the successful representatives.

Licensure model

Some wellness insurance apps are monetizing through licensing agreements. They surmise that tech companies transfer the rights for digital products for a period in exchange for a fee. This model is frequently practiced by enterprises (with $1 million in revenues and a steady user base) and hospitals modernizing their medical systems.

For their owners, the source income may include:

- Licensing a dashboard, service, or device to customers

- Collecting development fees, service sales, and sponsorship fees

- Selling devices/drugs through an app

Health Insurance App Development Features

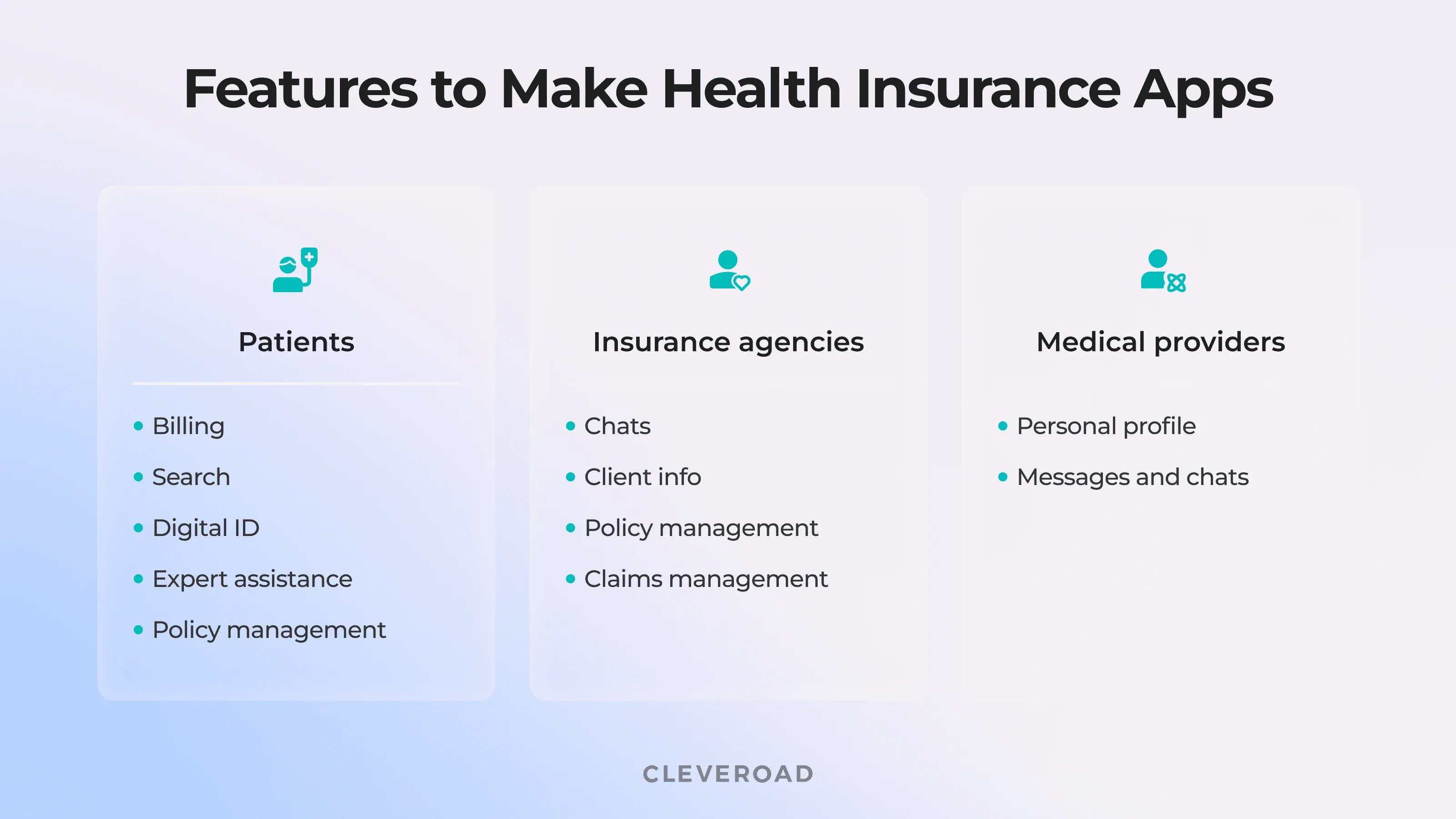

Let's discuss the must-have functionality required to build a health insurance mobile app. The feature list mirrors the needs of three users:

- Patients

- Insurance agent

- Healthcare providers

Health insurance app development functionality required

Features for patients

Virtual ID cards access

This feature allows users to access their profile with a digital ID to use medical and pharmacy services. For example, it makes it possible to look for medical providers and insurance coverage, view previous claims, interact with doctors/agents, etc.

Search

Search algorithms will allow patients to look through insurance coverage and healthcare providers. Clients should be able to review the info about the covered services clinics and copays. Given transparency, customers can plan their budget and pick an applicable policy.

Policy management

Customers should be allowed to review, cancel, or change a current insurance plan. In addition, allowing shifting between insurance providers might be a great advantage when you build a health insurance mobile app.

Purchasing and payments

This functionality will allow users to buy and renew policies/drugs within the application. Gateways, such as PayPal, Stripe, Braintree, etc., are the most suitable tools to add card payments to mobile apps. These solutions assist in processing online money transactions. However, remember that you must guarantee strong data security and fraud protection.

Communication and support

This feature enables patient-doctor communication. Clients will be able to urgently contact a physician or nurse and receive answers to basic health questions. When you create a health insurance app, it’s good to add an initial live chat with concierges. They will consult clients on insurance policies and direct them to the needed medical professionals.

Main features for insurers

Client information

This feature is necessary to monitor each client continuously. Therefore, insurance providers should be allowed to add clients through the app, edit their contact details, and review their billing history.

Policy management

Policy management is one of the key tasks in the insurance business. This feature allows agents to upgrade the information about policy, quotes, renewals, and loyalty programs if some changes are received.

Claim management

A document exchange option is required for each applied claim to be processed by an agent. This option simplifies and optimizes the workflow of insurance organizations.

Chats

Knowing how to create a health insurance app to bridge the gap between clients and insurers is essential. Customers should be able to contact agents via an in-app chat to discuss the policy details. It mitigates the need for an in-person visit, which benefits both parties.

Statistics

Analytics features will allow agents to collect statistics about what policies clients select, how they want to be contacted, the most frequent issues they face, and more.

Medical providers’ apps have to include personal profiles and chatting options. A health insurance solution for doctors can be a part of telemedicine service to enable virtual physician visits or can offer to schedule clinic appointments.

Note: We've listed the main (MVP) features needed to satisfy early customers and collect users' feedback. After that, your health insurance app can be expanded with more sophisticated features to deliver a better customer experience.

Advanced features to include:

- AI-based chatbots

- Video meeting

- Drug reminders

- Loyalty programs

- Clinic wayfinding map

- Wearable integrations

- Prescription management, etc.

Learn how healthcare software development services will help you build health insurance app to engage clients

5 Best Examples of Health Insurance App

Before initiating health insurance app development, it’s always good to consider market leaders to learn from their experience and develop an insurance health service that stand out.

UnitedHealthcare

The United HealthCare app is available on iOS and Android platforms to target mobile devices for both. The service includes a unique feature, GlobalMe, that allows for getting info about local health systems, finding physicians, directly paying to doctors, and issuing referrals to particular specialists.

The main app’s features:

- Health plan ID cards access

- Health insurance policy and prescription management

- Specialist, clinics, and pharmacy search and contact

- Medications cost estimation and price comparison

- Claims management and account balance checks

Aetna Health

Wondering how to create a health insurance app, it’s worth paying attention to the Aetna Health app. This product jumps out due to its wealth of health insurance plans. The service offers various types, including dental, pharmaceutical, and behavioral. There are around 39 million customers in the U.S. using this app, and they get a customized experience and a set of exciting features, like:

- Plan and claims administration (including sorting and payment)

- Medication refills

- Doctors and pharmacy search

- Plans and insurance coverage data monitoring

- Personalized cost estimation before care delivery

- Insurance ID–cards access whenever required

myCigna

Cigna is a US-based marine insurance company. The myCigna app is one of five successful app type the enterprise has built to address various healthcare needs. The apps enable handling information on the go and seeking medical insurance providers in a specific area.

Among the valuable functionality provided:

- ID access (email, fax, ID cards)

- Health fund balances, claims, and deductible costs checking

- Blood pressure, blood oxygen level, and other biometrics savings

- Doctors’ consultations and drug cost comparison

- Prescription refills

MyHumana

Humana started as a nursing home organization. Soon, they became the most prominent hospital operator in Kentucky and initiated their own health insurance plans. The service is present in 50 states and is found to be the largest insurer in the US. The MyHumana app offers a broad set of benefits and means for client satisfaction, from various health insurance plans to mail-order prescriptions.

The critical app's features:

- ID cards access, including fax

- Deductible expenses monitoring

- Local medication price comparison

- Plan and claims record management (status, summary, details)

- Doctor, dentist, hospital, urgent care center, or pharmacy search with filtering capabilities (by specialty, prices, zip code, or region)

HDFC Life Insurance

This is the last but not least example of how to create a health insurance app and make it profitable. HDFC Life Insurance is an India-based life insurance provider. The service allows users to browse multiple life insurance plans, review their benefits, and monitor policy issuance and payment renewal.

The app helps users:

- Buy insurance policies and renew them

- Manage claims and documents

- Locate the nearest branches for meeting with health insurance providers

- Calculate total protection value (TPV)

- Track fund performance and calculate net asset value (NAV)

Breaking down the cost to make an app from scratch: by driving factors, app types, and team hourly rates worldwide

Why to Create Health Insurance Apps?

Health insurance app development requires time, money, and constant enhancement of the results. However, it can be a profitable venture to invest in. To better understand how to create a health insurance app, it's essential to define what makes such solutions beneficial for various groups of clients.

Benefits for customers

Fast access to suitable plans

Due to numerous options, people find it hard to select the best suitable health insurance plan. For example, in Seminole County, Florida, ObamaCare clients can choose among 174 plans, which are many choices to steer through. The mobile apps make it easier to search for and pick the appropriate insurance plans excessing paperwork. Therefore, the core aim is to build a health insurance mobile app to be intuitive and user-friendly to engage maximum loyal clients.

Easy physicians search

Today, patients are desperate to find the best medical provider. To make the right choice, they need to scrutinize the doctor's proximity, expertise, reviews, acceptance of insurance policies, etc., which takes a tidbit of their time. Clients can access all necessary data using a health insurance app just a click away.

Such solutions have powerful search engines to make the in-app search as flawless as possible. Customers can filter their results by doctor specialty, symptoms, experience, language, and location. After that, the users will be presented with detailed insurance eligibility information and descriptions of every medical provider.

Optimizing of claim processing

In most cases, it becomes challenging and laborious for policyholders to receive claims for their medical spending. As a result, they have to cover the bill by themselves. However, health insurance platforms keep the patients' history, making it possible to get a due insurance claim. Thus, the client's satisfaction rate increases, reducing the workload for insurers.

Simplification of policy selection

With a variety of insurance policies, physicians, and pharmacies, it becomes harder to choose the best option for the “price-quality ratio.” Using health insurance apps, users don’t need to compare healthcare consultants’ rates, search for the medications that can be insured, or struggle to find a preferred insurance plan that would better cover their health-related needs. Having all the information packed into one platform will allow users to find the perfect fitting option for a reasonable cost.

Matthew Donaldson

CEO, BGL Group

I believe the consumer will win and that the desire for low-cost, transparent, high-quality digital services will have to be met.

Benefits for insurance companies

Increased productivity

About 78% of business owners agree that automating tasks within the company improves overall productivity. Moreover, manual operations align with human mistakes, lost documents, claims, etc. Modern health insurance platforms enable real-time data updating, automatic report generation, and sending reminders and notifications. Facilitating complex workflows and deriving the correct information for better decision-making are also among the positive outcomes of health insurance app development for insurance providers.

Business strategic focus

Digital solutions can lead to the escalating number of transactions managed and the volume of documents generated in the electronic format. Hence, instead of running routine tedious tasks, insurance agencies can concentrate on more essential tasks like acquiring new customers, client retention, new product/ delivery, and quality assurance of the services provided. Besides, paper elimination and center on case management automation can reduce the cost and settlement timeframes.

Increased revenue

Client experience is vital for high satisfaction rates and income streams. Health insurance mobile applications allow insurers to process consumer requests more effectively, trace all the pending messages, and integrate chatbots to address small questions. Additionally, insurance companies will get higher client flow due to customer reduction; thus, they will be able to earn money in the short term.

Steps To Build a Health Insurance Mobile App

To create a health insurance app, you need to enlist the support of an experienced IT company. Medical systems that handle vital services and sensitive data must be safe and fault-tolerant. Therefore, apply for dedicated development team services and approach this step-by-step plan:

Step 1. Research

The primary stage includes thorough research and planning. First, you need to study the market of medical insurance app: their main features, trends, type of insurance app, and solid and weak sides that will help you define the end user's needs. Careful analysis will allow you to determine your business model and integrate the functionality to meet customers' expectations and proof of demand. Considering as many details about your future product as possible, you're less likely to face project issues, last-minute changes, and unexpected budget expansions.

When you build a mobile health insurance app, you have to ensure compliance with laws and regulations concerning medical services and data processing. Here are the main ones:

- HIPAA. Apps developed for the US market must strictly adhere to HIPAA requirements. This act guides standards for processing, recording, and storing PHI and ePHI data.

- PIPEDA. You must follow this law to create a health insurance app for the Canadian market. This document dictates the rules to guarantee the privacy of patients’ data stored.

- GDPR. Medical software solutions performing in the European market must comply with GDPR rules. They govern the collection and processing of personal data according to privacy regulations and human rights laws.

- PCI-DSS Compliance. You must be certified to PCI if you create a health insurance app with in-payment functionality. According to this standard, you must know all the cardholder's information you're going to store, including its retention period. In addition, all the data must be encrypted using industry-accepted algorithms (e.g., AES-256), tokenized, or hashed (e.g., SHA 256). All who accept card payments follow PCI DSS requirements, even if they're only mobile app integrations.

Note:

We'll guide you on medical legislation your health insurance app must meet. Our Health Business Analysts will review regulatory landscape, and then, our software engineers implement compliance measures technically.

Step 2. Discovery phase

This stage is vital for health insurance app development since clients and software developments may have different visions of the prioritized functionality. Having input information, Business Analysts scrutinize your business requirements and product concept. After that, they make the business plan and project specification that detail the app's technical demands, such as product architecture, technologies, features, APIs integration, etc. Simply put, this stage aims to discover how to make a product vision — a health insurance platform's roadmap. Finally, you receive a final estimate after all the data is analyzed.

Step 3. UI/UX design

UI/UX design should correspond to the different physical sizes of the devices used. The modern applications run on smartphones with a high aspect ratio (18:9) and bezel-less display. For example, Apple demands 1x, 2x, and 3x sizes of all icons and images, while Android developers must create a health insurance app compatible with six sizes — from 120 dpi LDPI to XXXHDPI.

Another challenge is the deployment of intelligent technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Augmented Reality (AR). Cleveroad’s specialists apply them actively, so our designers are competent to work with them. These solutions make the app's experience more interactive and engaging, and the design team needs to consider new patterns and virtual objects that may be added.

Additionally, the application should consider the physical characteristics of individual patients. Therefore:

- Follow WCAG 2.0 standards and online content accessibility best methods;

- Facilitate the adaptation process as possible by reducing the number of screens exceeding three;

- Keep in mind one-handed navigation and thumb-friendly user experience;

- Employ proper spacing: the tap area’s desired size is 7–10 mm.

Step 4. Health insurance app development

This is the most responsible and challenging part of health insurance app development. During this stage, a team of software engineers develop a backend and frontend of your health insurance app, APIs integrations, and transform attractive UI design into functional software. The process is divided into sprints (fix periods), during which the programmers must execute small portions of the application.

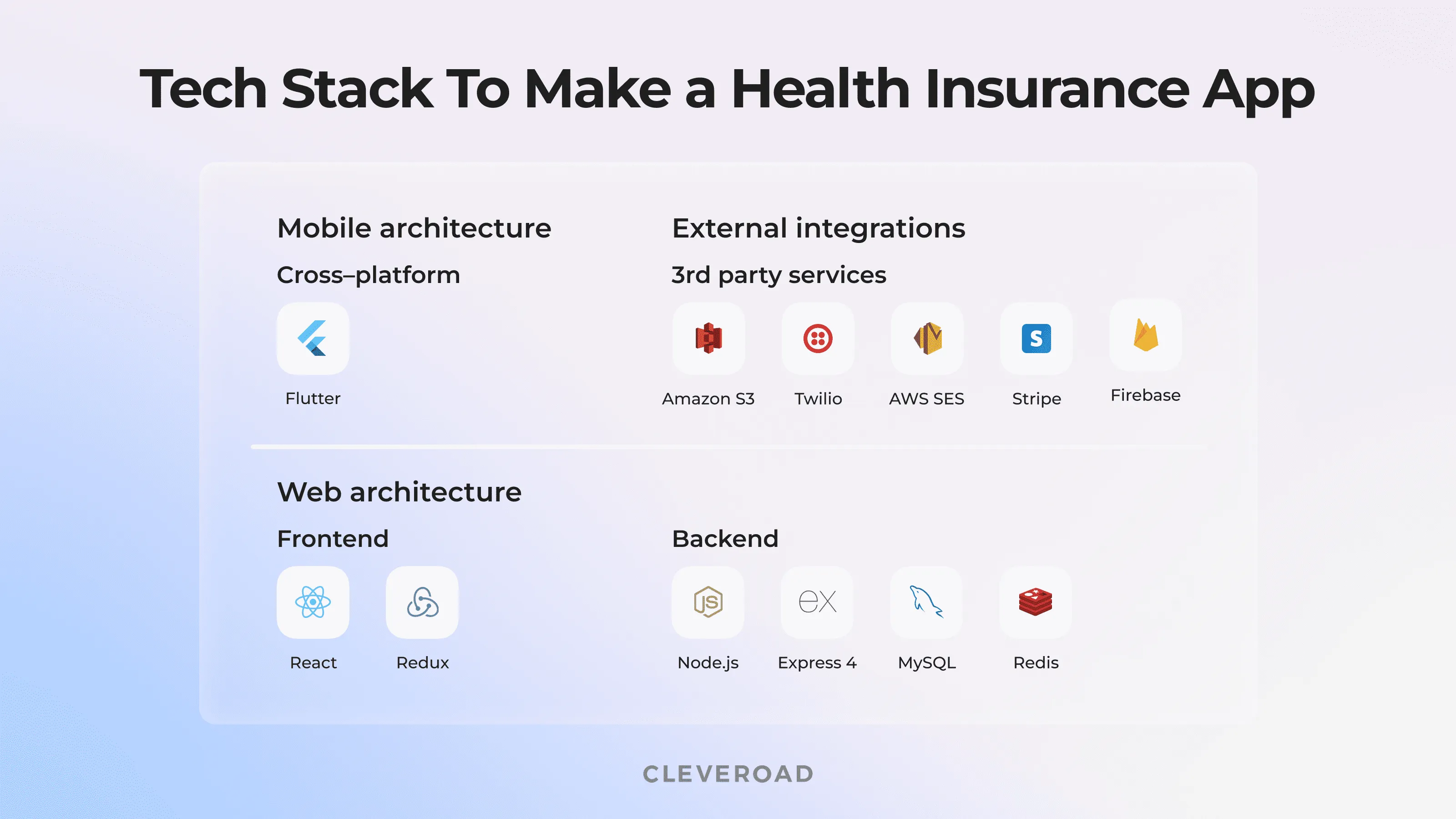

Technology Stack

The tech stack depends on the choice of the platforms. You can choose native app development for the one/two platforms or the cross-platform one. The official framework for creating apps for Apple (macOS, iOS, watchOS, and tvOS) is Swift. If we are talking about Android-based apps, they require Kotlin or Java. If you want to suit both iOS and Android devices, the React Native cross-platform framework is the right choice.

Building a health insurance mobile app with Flutter is a smart approach for developing custom solutions that don’t heavily depend on native functionality. Its gains are that it is open-source and has a substantial memory allowance. Moreover, Flutter app development services allow you to cut the development expenses by up to 40 percent and shorten the time to market.

APIs Integration

You can apply ready-made tools to enrich your app capabilities and speed up project development. For example, deciding to create a health insurance app, you may consider the following integrations:

- DocuSign for allowing digital signing’

- Integration with EHR/EMR software, healthcare CRM development, and other clinical systems to facilitate data exchange between patients and insurance companies;

- Twilio to connect with doctors virtually over video chat, phone call, or SMS.

- VIDYO enables real-time communications between patients and medical providers;

- Google Maps APIs for integration of geolocation and mapping services to find the nearby doctor

Technology stack to develop health insurance mobile app

You should also integrate payment gateways into mobile applications to enable automatic payment from the customer to the health insurance app provider (monthly or annually). This will mitigate the risks of losing coverage on the insurance policy, as there will be no delay in releasing payments. Additionally, policyholders will be able to pay doctor’s bills instantly after their appointment.

Step 5. Testing

At this stage, testing experts carry out multiple manual and automated tests to ensure the app fulfills the most strict quality standards (including security and regulatory compliance) and meets project requirements. At Cleveroad, we offer full-range mobile app services and various testing types to guarantee your product's high quality and user adoption. After you have built and tested the app, you are ready to supply the product and move it to app stores.

Post-release maintenance

It's not sufficient to build a health insurance mobile app and sell it to consumers. Keep in mind that iOS and Android roll out the upgrades every year. Thus, it's vital your application is up–to–date and runs correctly on the latest platforms. Therefore, comprehensive product maintenance and support services will ensure scalability, quick implementation of new features, smooth interaction of the software with the user, and bring new clients and stable revenue.

How Much Does It Cost To Create Health Insurance Apps?

When searching for how to create a health insurance app, you probably have two questions: “How to build such a solution?” and “How much money does it require?”. However, due to the product specificity, it's challenging to tell the exact cost until the requirements are defined.

The costs are influenced primarily by:

- The app's technical complexity

- The number of features provided

- Customization of UI/UX design

- Platform's types

- Backend infrastructure

- App maintenance costs

- The team's hourly rates

To make it easier for you, our business analysts calculated the average price of making a health insurance app (based on the hourly rates of each team member). The estimate covers key features only.

| Team member | Task | Approximate hours | Approximate cost ($) |

Frontend (45$/h) | Front-end functionality development | 1090 | 49050 |

Backend (45$/h) | Backend part development | 920 | 41400 |

UI/UX Designer (35$/h) | Wireframes and mockups creation | 320 | 11200 |

Project Manager (35$/h) | Development process overseeing, development reports | 540 | 18900 |

QA (35$/h) | Testing, bug reporting | 900 | 32200 |

DevOps (45$/h) | Development process automation, implementation of DevOps methodologies | 150 | 6750 |

Business analyst (35$/h) | Discovery phase, creation of final estimate and specification | 520 | 18200 |

Team Lead (50$/h) | Project architecture development, code review | 320 | 16000 |

Total | 4760 | 193700 | |

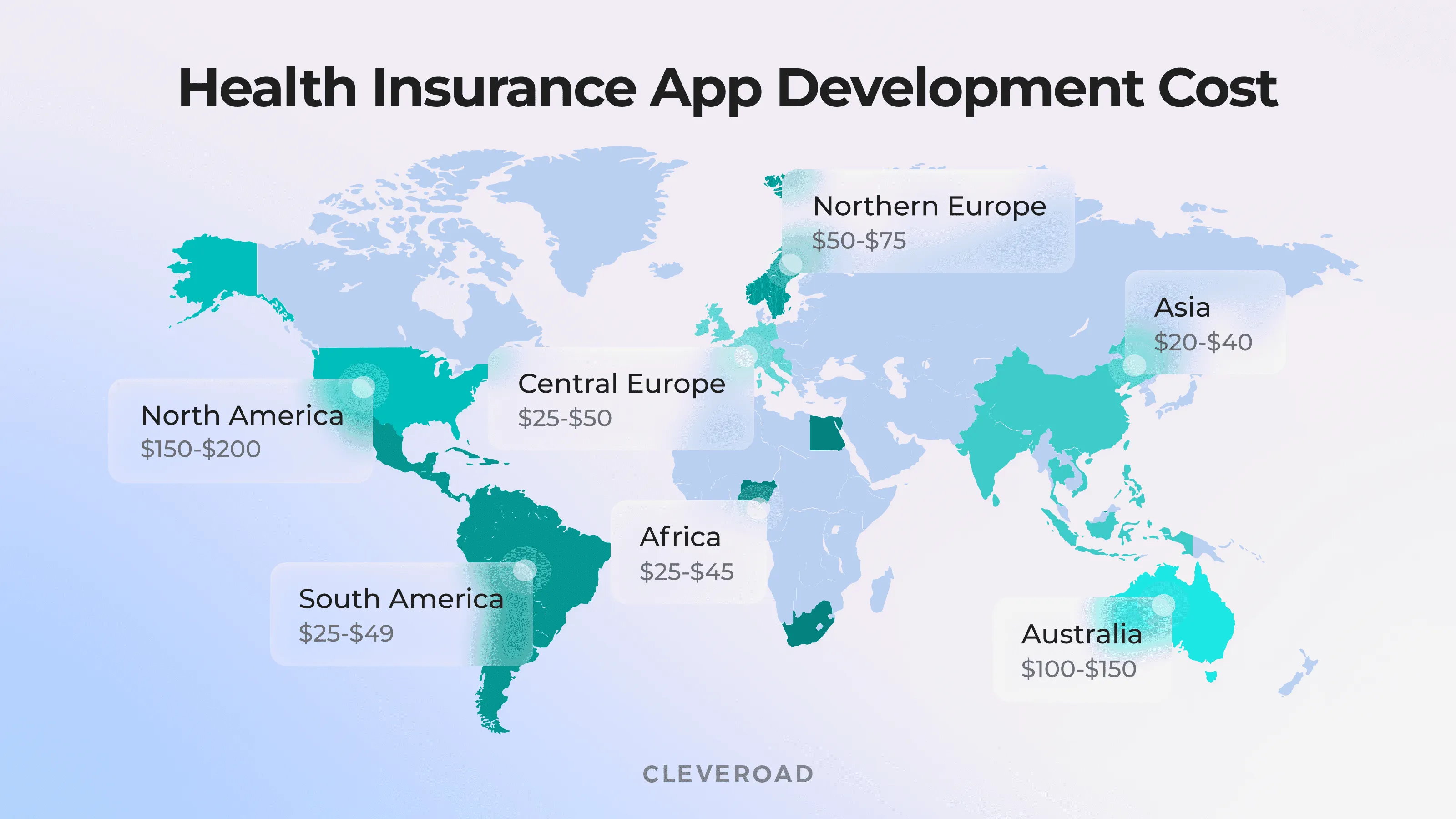

It should be noted that these numbers are approximate and based on a $50/h rate. It’s an average insurance mobile app development rate in Central/Northern Europe. This region is known for most affordable prices, providing you with high-grade experience specialists. The estimate can be different depending on the geographical location of the selected IT provider. Generally, the health insurance app development price can range from $55,000 to $250,000+.

Why outsource health insurance app development

You can reduce app development cost and speed up the market launch by choosing app development outsourcing. That’s because all necessary specialists are available, and their skills are tested accurately. The team is gathered according to the project requirements and responsible for full-cycle software development services: from Discovery Phase to post-production support. Among other advantages of project outsourcing are:

- Cost-effectiveness. Most outsourcing software development agencies offer first-rate services for a reasonable price. The software development costs decrease, and the product and performance quality remains high.

- A price that suits your budget. This option opens the door to world hiring. This way, you can find affordable yet required expertise.

- No hidden payments. You pay only for the “job done”. There is no need to buy equipment, rent space, or pay for leave days. You’re aware of the set and formerly negotiated project price.

However, the cost to outsource health insurance app development varies depending on geographical location. Therefore, we've analyzed hourly rates in different regions, including on-demand outsourcing destinations like Central and Northern Europe.

Cost to build a health insurance app worldwide

As you can see, the rates are different across the globe. However, the high price doesn’t always guarantee quality services, and cheaper isn’t more profitable in the end.

Central and Northern Europe seems to be a golden means charging $50-75 hourly while ensuring a high level of competency. For example, you can outsource mobile development services to Estonia to save costs and get qualified experts. Among the benefits are competitive rates, first-class education, and systematic support of government grants to IT startups. This country has third place in Europe for the number of IT workers, accounting for 300,000 experts.

What's next?

Now, when you know how to create a health insurance app and what investments the engineering process require — the next stage is to find a competent and trustworthy healthcare technology provider. The Cleveroad team possesses the nessesary experience and qualification to build mobile solution to automate health insurance procedures. Let us tell you more about our company and how you can benefit from our insurance software development services.

Our Expertise in Insurance HealthTech

Cleveroad is an Estonian IT outsourcing company with 12+years of expertise delivering custom medical solutions and 250+ successfully implemented projects in the Healthcare and Insurance industry.

Our team has hands-on experience in legislation-compliant mHealth app development, such as health insurance apps, telemedicine software, EHR, EMR, ERP & patient portals, appointment scheduling, medical billing, and more.

By cooperating with us, you’ll get:

- A broad scope of healthcare IT services, such as mobile insurance app creation, medical IT consulting, IT modernization, cloud migration, medical IT support, etc.

- Software solutions comply with the latest standards regarding security, patients’ data safety, usability, and interoperability: GDPR, HIPAA, PIPEDA, and more

- Full-cycle mobile app development for telemedicine to benefit tech-enabled healthcare in the shortest time

- A team of certified experts helps health insurance providers select the best suiting tech stack and advise on architecture for better outcomes

- Signing Non-Disclosure Agreements (NDA) per your request

- All-out Project Management Office for overseeing your projects to perform them on time, within the budget, and in line with your business demands

- Mature quality management proved by an ISO 9001 certificate to meet the quality needs of your health insurance app

- ISO 27001-certified security management based on confirmed policies and processes to solid medical data security

Get mobile health insurance app from domain experts

Write us, we’ll assemble a team of the experienced tech talents to build a health insurance app - call us and get full assistance

The project success will depend on the experience level of the chosen tech development company. When looking for an IT provider ensure it has proven expertise in insurance software development services backed up with implemented projects in telemedicine and healthcare.

Generally, the cost to build a health insurance mobile app for both platforms can range from $55,000 to $250,000+. The final project estimate can be outlined after analyzing project requirements, including platform’s type. If you want to serve iOS and Android devices, the React Native cross-platform framework is a smart choice. Flutter app development services allow you to cut the application development expenses by up to 40 percent and shorten the time to insurance market.

First, you need to study the market of healthcare insurance solutions: their main features, trends, and solid and weak sides. Careful analysis will allow you to determine your business model and integrate the functionality to meet customers' expectations. After that you appeal to an experienced software development company and your mobile app for health insurance goes through the traditional SDLC process.

To create a health insurance app, you need to go over the following app development process:

- Step 1. Do research

- Step 2. Go through the planning phase with the chosen IT vendor

- Step 3. Work with UI/UX designers as to the app's interface and user experience

- Step 4. Build a health insurance mobile app

- Step 5. Testing

- Step 6. Post-release maintenance

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article