How to Build a Neobank: Tips, Features, and Development Cost

Updated 12 Mar 2025

18 Min

1186 Views

How to start a neobank, and what does neobank mean? Neobank is a digital type of fintech that offers banking services through a mobile app or website. Digital banking offers core benefits like flexibility, convenience, and transparency. Neobank advantages provide a competitive edge over traditional banking, which still relies heavily on physical branches.

Neobank development is a trend in the banking sector and FinTech. Start-ups and financial institutions want to create web and mobile solutions to get ahead of their competitors. If you are curious about how to build a neobank, this article helps you get acquainted with all the key points to consider.

What Is a Neobank and Why to Build It

Neobank is a financial institution, practically similar to traditional banks, but their revolutionary impact implies operating exclusively online without the need to attach to physical branches. All financial operations can now be completed through mobile or web applications, avoiding time-consuming bureaucratic hassles or standing in line for hours. Building your own neobank may enable businesses to offer their clients flexible, convenient, and entertaining ways to store and operate their finances.

Anyway, usually, digital-only banks tightly cooperate with traditional banking institutions to facilitate more comprehensive regulatory compliance and significantly expand the range of financial offerings (holding customers' deposits, obtaining access to payment networks, providing customers with investment capabilities, etc).

Neobank vs. traditional banks

Neobanks have transformed the way people manage their money. Unlike traditional banks, which rely on physical branches, neobanks operate entirely online. This digital-first model enables faster, more flexible, and cost-effective financial services. Many businesses now aim to develop a neobank instead of following outdated banking models.

Let’s establish three key differences between neobanks and traditional banks:

Operational principle

Neobanks. Neobanks focuses on online with a digital-only presence, offering round-the-clock access and inclusive banking products. It mostly relies on innovations and technology within centralized applications.

Traditional banks. Even though a traditional bank may offer online banking as a service, the branches and brick-and-mortar presence play a central role in their operations.

Communication with customers

Neobanks. Digital banks prioritize customer self-service and digital communication channels (in-app chatbots, messengers, etc.) that enable users to solve their issues more swiftly.

Traditional banks. To successfully accomplish the neobank needs of most traditional bank services, the client will have to visit the physical branch for face-to-face interaction with a consultant.

Cost structure

Neobanks. As neobanks don’t have to additionally invest in physical branch maintenance, they operate with much lower overhead costs, resulting in lower fees and more competitive interest rates on savings accounts.

Traditional banks. In contrast to neobanks, traditional banking has a larger workforce and physical branches to maintain, leading to higher fees and less competitive interest rates for clients.

Neobank market potential

Neobanking is genuinely an innovative approach for businesses to engage with tech-savvy users who prefer high accessibility over traditional and often outdated banking service providers. This emerges as an opportunity for businesses to cater online banking services for previously underserved demographics, increasing the overall reach.

Neobank development allows your business to fulfill current customer needs for flexible, swift, and easy banking services, as traditional banks with limited and bulky online and mobile functionality usually fail to meet these expectations. Nevertheless, building your own neobank app may help you make your business more visible to investors, increasing your chances for solid future partnership opportunities.

Now is the best time to start a neobank from scratch. GVR reports that the market size of neobanking is projected to have a rapid growth of 54.8% by 2030. Besides the need to step away from overwhelming bureaucracy, the adoption of smartphones and other portable devices accelerates demand for adaptive and convenient tools for managing finances.

Explore our banking software development services to know how we can help you improve your banking system and streamline operational efficiency with a reliable FinTech software solution

Must-Have Features of Neobank Application

For sure, competitors' neobanking solutions research may hint you on functionality to include while developing a neobank from scratch. However, to not confuse yourself with everything at once, examine the list of key neobank features essential for every digital bank.

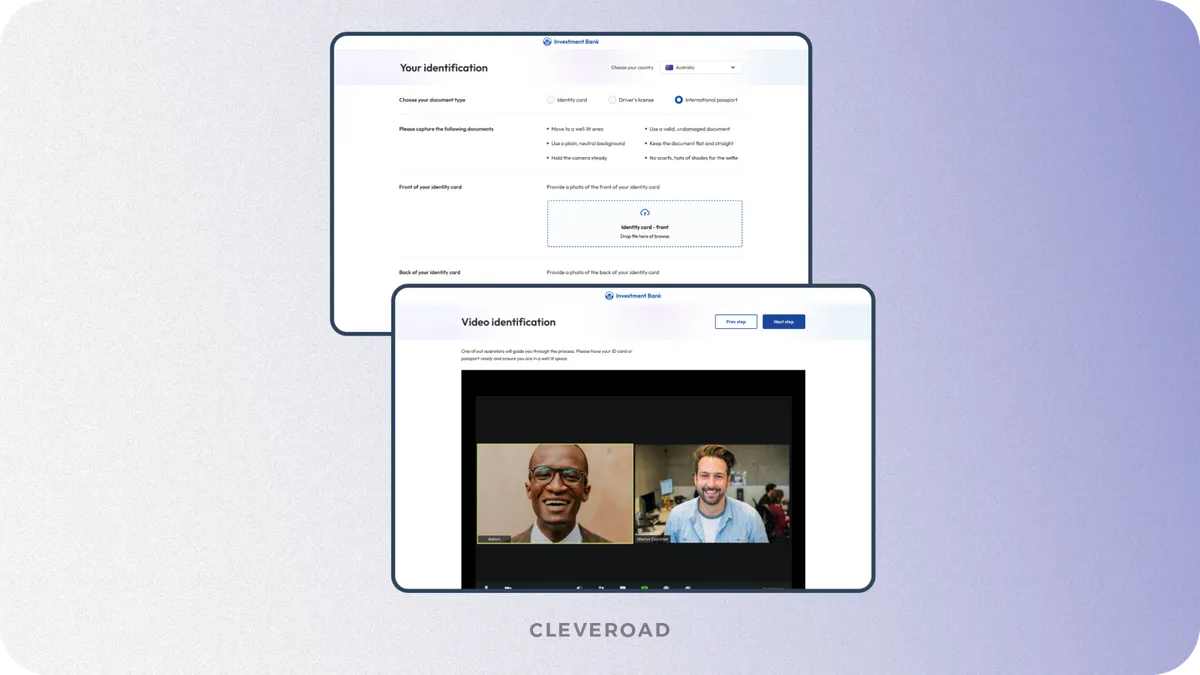

Quick account opening

The first step a user has to take to start using your neobank application is to open an account. Your main task is to make the onboarding process swift, easy, and paperless, so the only thing needed is their smartphone and internet connection. Besides, it’s vital to minimize the number of steps needed to create an account, requiring only essential information like a user’s facial recognition or secure document verification through a phone camera.

Mobile check deposit

This functionality allows users to deposit checks into their banking account by taking a picture of the front and back of the check using their smartphone within the neobank app. This completely eliminates the need to visit the physical branch or ATM to deposit checks and is supported with advanced image recognition and fraud detection technologies, ensuring secure transactions.

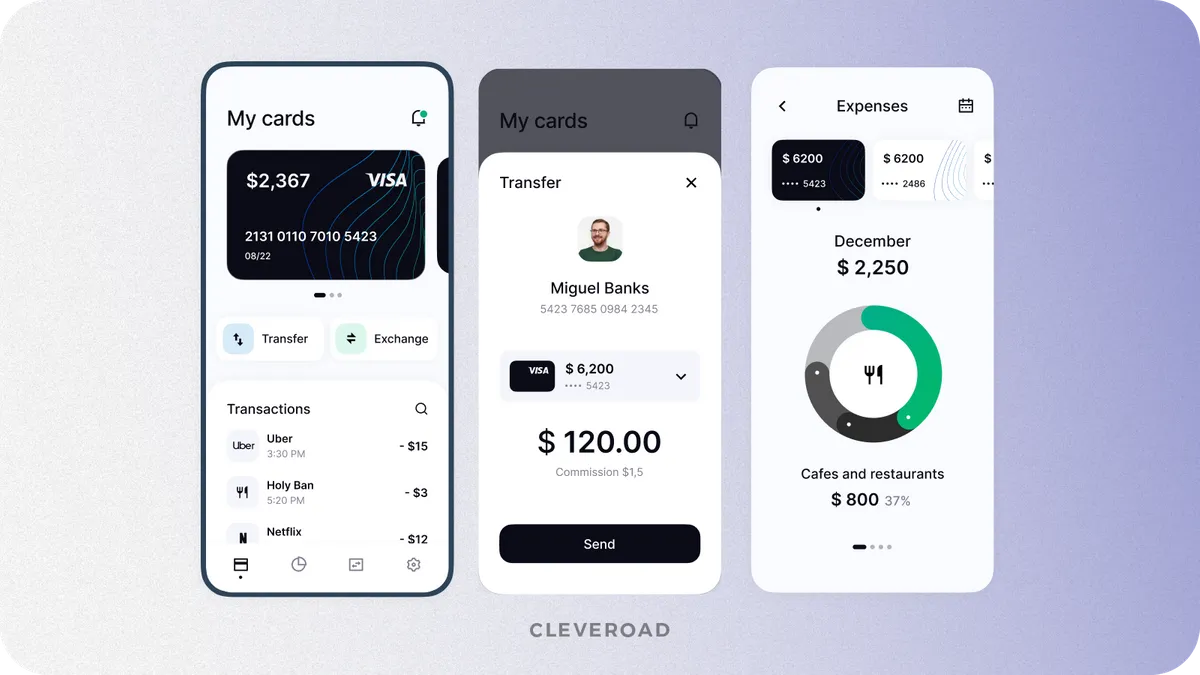

An example of a mobile banking information panel designed by the Cleveroad team (Source: Dribbble)

Secure authentification

While entering your e-banking solution, users must be assured that their bank account data is robustly safeguarded. There are several ways to establish this while neobank development:

- Multi-factor authentication enables you to add a security layer by combining several authentication methods (password, phone number, verification code sent directly to user’s devices, etc.)

- Biometric authentication enables users to log in securely using fingerprints and facial recognition technologies in the neobanks like Face ID, etc.

- Secure password management implies offering tools to generate a strong password

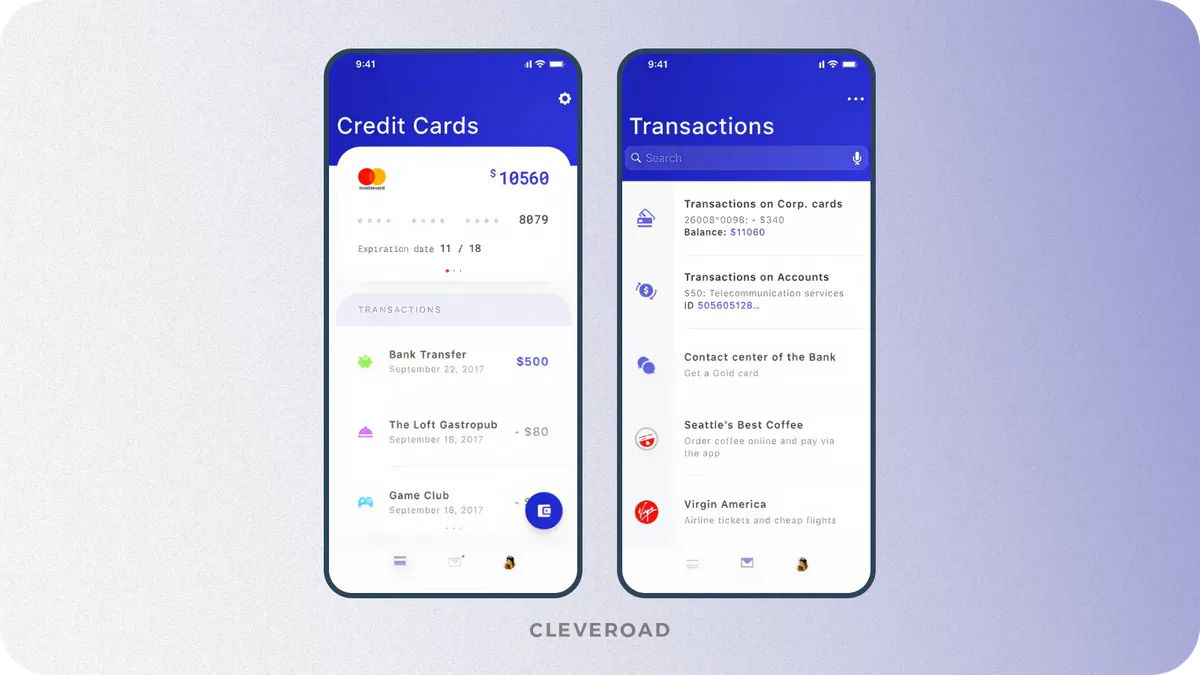

Card management

Card management allows neobank users to easily manage their debit and credit cards issued by neobank through an app. This includes viewing recent transactions and tracking spending patterns, setting spending limits, blocking and unblocking cards, changing PINs, requesting physical cards from the new bank, tracking their delivery status, etc.

An example of a banking app card panel designed by the Cleveroad team (Source: Dribbble)

Diversity of payment options

Another important aspect is to build a neobank that is going to be inclusive and convenient. Let users cover multiple financial needs by offering a diverse range of payment capabilities:

- P2P payments: Allows users to send and receive money from friends and family members instantly within a neobanking app

- In-built bill payments: With this feature, a user can pay bills and schedule payments for utilities, rent, and other expenses

- QR payments: Provide users with the ability to make contactless payments by scanning QR codes

- Mobile payments: By utilizing this, your neobank users can swiftly pay via Google Pay, Apple Pay, and Samsung Pay with the help of Near Field Communication (NFC) technology

- International payments: In other words, your users will be capable of sending and receiving money abroad with low fees and competitive exchange rates

Neobank security

Due to the sensitive nature of financial data, while building your own neobank, you must focus on facilitating outstanding security. Below, you can examine security methods for creating reliable and safe neobanking solutions that protect customer data:

- Temporary CVV enables you to prevent unauthorized transactions by generating temporary CVV codes that regularly change

- KYC/AML procedures ensure compliance with financial regulations by verifying user identities and monitoring transactions to prevent fraud and money laundering

- Fraud detection and prevention that utilized AI-powered algorithms to quickly identify and prevent suspicious activity

KYC verification feature developed by Cleveroad for the eBanking software system

Push notifications

Push notifications play a pivotal role in building a more personalized connection with a user. Here are what you can consider:

- Transactions alert: Alerts a user instantly about any account activity like withdrawals or payments

- Balance alert: Notifies users when their bank account balance falls below a set threshold

- Security alerts: Informs users about suspicious activity or logging attempts

- Personalized notifications: Users receive personalized notifications about upcoming scheduled payments, bill payment reminders, etc.

How to Create a Neobank From Scratch in 6 Steps

Now it’s time to start building your own neobank. Even though the final development roadmaps of the neobanks differ, below you can examine the list of 6 steps that can be taken as a basis for your personal neobank creation strategy.

Step 1. Define your business goals

This step is crucial and is often definitive to the neobank success. Assessment of neobank business goals may help you choose the direction for building a solution that will solve your problem or respond to your customer's pain points. Except for goals, you should define the functionalities and banking features. Here are some features that may help you determine requirements for your neobanking solution:

- Data collection techniques - user surveys, market research

- Identifying stakeholders - target audience, your employees, potential partners

- Requirements prioritization - categorizing functionalities and features based on importance

Step 2. Choose a reliable IT vendor

A very convenient and affordable option is to find an IT vendor who’ll help you build a neobank. This approach may help you access a wider talent pool of specialists in alignment with your project quality and budget requirements.

However, how do you find a bank partner with the fintech expertise level that will guarantee your neobank final success? We have prepared a short list of criteria to seek from your future IT partner:

- Experience in the FinTech industry. Cooperation with a company that has practical experience in providing FinTech software development services can significantly increase your chances of neobank development success. Besides, you can request a vendor’s portfolio to check if they’ve worked on FinTech solutions similar to your concept.

- Knowledge of FinTech regulations. As your neobank has to be safe and reliable, ensure your future IT partner has an excellent knowledge of industry regulation touching data security (GDPR, KYC, ePrivacy, etc.), financial legislation and regulations (AMLD, MIFID II, PSD2, etc.), industry methods and workflows (EMV, Central Limit Order Book, IOI/RFQ quotes, etc.).

- Wide experience with third-party integrations. Integrations you can include in your neobank can provide your customers with a wider range of financial services, automatically making it inclusive and appealing for them. Ensure the vendor offers basic integration options like payment gateways or customer support tools.

- Positive customer feedback. It’s important to know how the IT vendor of your choice heads Fintech software projects, what cooperation strategies are used, and how they behave with their customers. To establish this, check out platforms like Clutch or GoodFirms to access their past customers' feedback on the cooperation flow and project outcomes.

We provide IT Staff augmentation services to the FinTech company Penneo. Our client began trading on the Nasdaq First North Growth Market Denmark and became listed on the Nasdaq Copenhagen Main Market. Now, they have over 2500 clients in various industries, including Audit and Accounting, Finance and Banking, and Real Estate. Penneo gained the trust of great market players such as Jyske Bank, Deloitte, EY, KPMG, and Copenhagen Airports.

See what our customer from Denmark, Hans Jørgen Skovgaard, CTO at Penneo, says about cooperation with Cleveroad:

Hans Jørgen Skovgaard, CTO at Penneo: Feedback on Cleveroad's Cloud Infrastructure Services

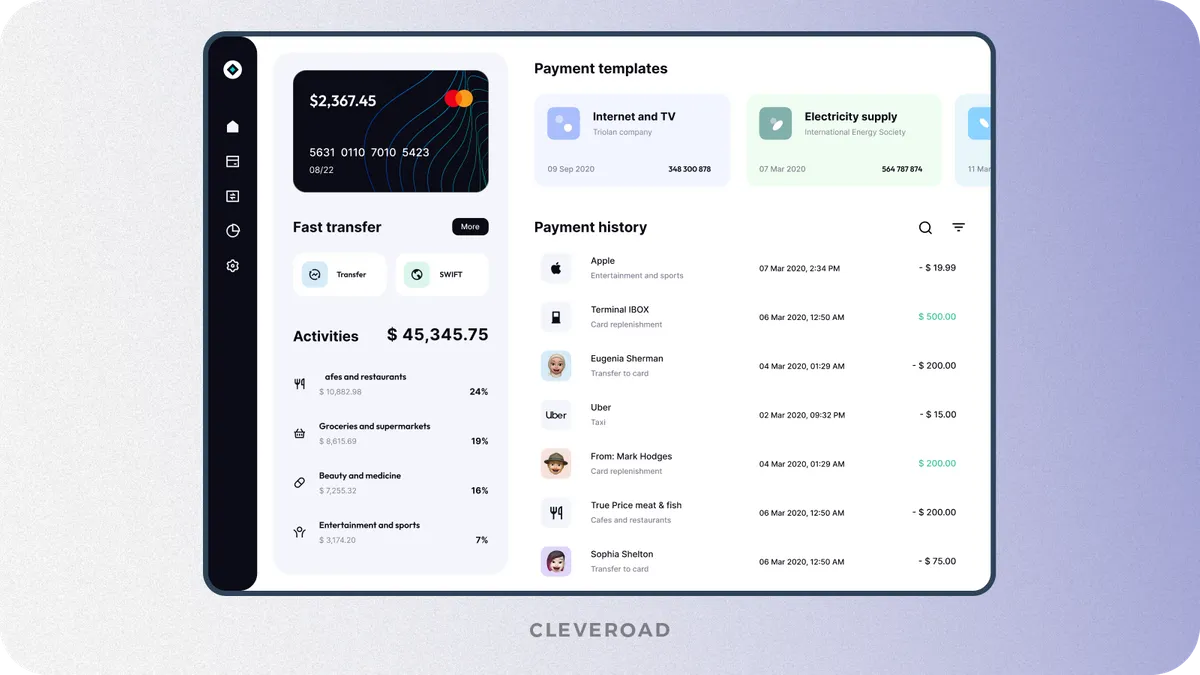

Step 3. Craft intuitive UI/UX design

Another distinctive thing about Neobanks is its appealing but intuitive and simple design that sticks to your mind. Your e-banking solution has to be structured and easy to use to enable users to utilize it swiftly. Minimize user registration and authentication tiers to make the onboarding process more simple. Also, the design of your neobank has to be responsive and adaptable for various devices, including desktops, tablets, and smartphones.

Neobank development UI and UX concept by Cleveroad (Source: Dribbble)

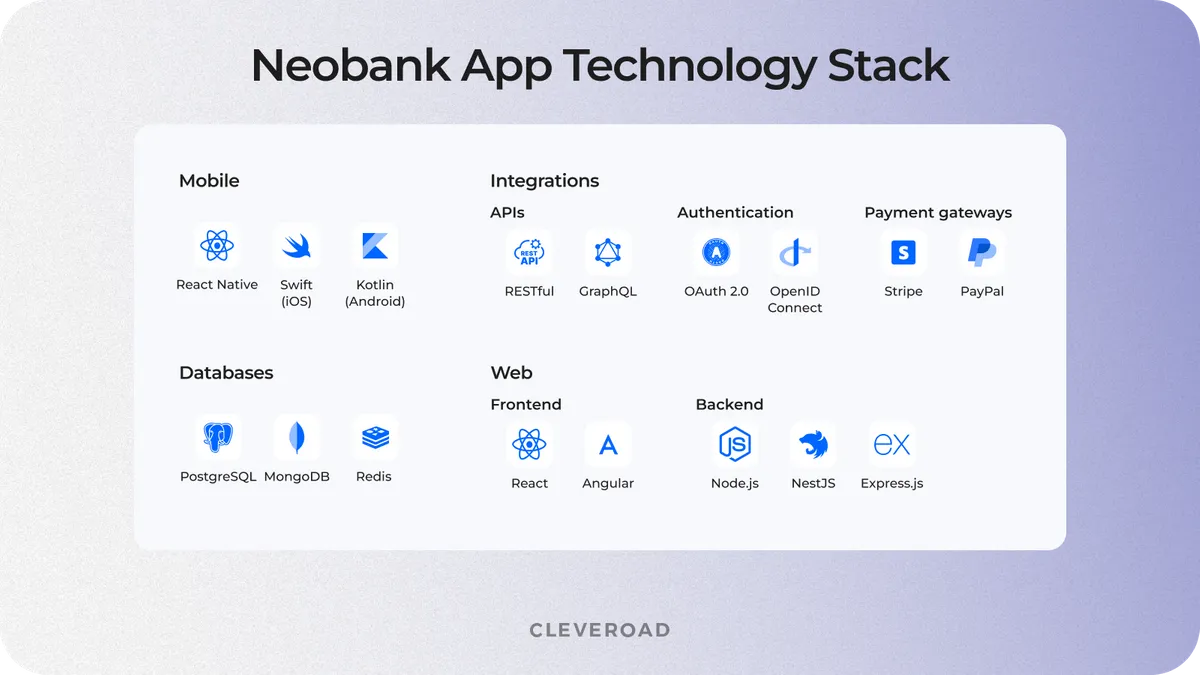

Step 4. Decide on the tech stack

Your software development team will help you select the most relevant tech stack that will align with your neobank's scale and technical requirements. It's crucial to choose technologies that not only fit your platform but also ensure seamless integration of key functionalities, security, and scalability. The right stack will support future growth, optimize performance, and enhance the user experience, making your neobank competitive in the market.

Here's what Cleveroad's FinTech developers typically use for neobank app creation:

Neobank application technology stack

Step 5. Neobank development

Exactly at this stage, your fintech software development experts start crafting the core of your neobank. Engaging predefined tech stack, your developers create and implement features functionalities and also work on third-party integrations. The list of third-party integrations may vary depending on how you identified the unique banking needs, however, here are the key ones you can consider before opening a neobank:

- Payment gateways (Stripe, PayPal, Braintree)

- Identity verification (KYC/AML)

- Budgeting tools (Mint, You Need a Budget)

- Financial data aggregation (Yodlee, Personal Capital)

- Lending and credit products (Kabbage, Avant)

- Fraud prevention security (Sift, Riskified), etc.

Step 6. Neobank release and maintenance

As your business grows, your neobanking app may encounter more massive user traffic loads and will require continuous support and maintenance after you launch a neobank. Your IT provider may assist you in keeping the neobanking solution reliable, well-operable, and scalable, not depending on outer conditions. Here is what software engineers usually do at the release and maintenance stage:

- Bug fixes

- Code optimization

- Performance monitoring and optimization

- Security updates and patching, etc.

Points to Consider Before Developing a Neobank

Apart from learning about starting a bank that works digitally, you also should know about several aspects to be aware of during the creation process.

Target audience definition

It’s vital to focus on the audience segment you are going to serve. This can be technologically proficient modern communities, underserved communities, or businesses with specific financial goals. To enable this, conduct thorough research on your target audience's pain points, demographics, financial habits, and demands. Besides, you can conduct surveys to gather user feedback and analyze data about current market conditions to build a neobank that stands out and fully satisfies users' needs.

Moreover, you should pay attention to the competitors to comprehend that neobank development is going to be successful and will meet users' demands. This may significantly hint you on current neobank functionality tendencies, tailor your financial services to users’ preferences, and establish robust market penetration and ongoing presence.

Marketing strategy

Attracting customers to a neobank requires a targeted, data-driven approach. Traditional banks rely on legacy trust, but even if you choose the right business model, digital-only banking services must build credibility from the ground up. Before you create a neobank app, define a clear value proposition that highlights the unique advantages of neobanks — higher interest rates, fee transparency, or superior user experience.

Strong digital marketing fuels growth. Leverage performance-driven ads, SEO, and partnerships with influencers in personal finance. Engage users with personalized content, educational resources, and financial tools that provide real value. A well-structured loyalty program retains users and increases customer engagement.

Read our article about how to create a banking app and learn more about banking app development strategy

Monetization model

Neobank development may not only be convenient but also profitable for you as an owner. Let’s focus on the most commonly utilized monetization models for neobank platforms:

- Transaction fees. Neobanks often charge transaction fees for activities like international money transfers, expedited payments, or operations with cryptocurrencies.

- Premium accounts subscription. Some neobanks offer users the choice of a premium subscription-based tier, access to advanced functionality, a specific card status, and benefits or services.

- Partnership and referral programs. Through collaboration with other financial service providers, neobanks can earn commissions or fees for promoting and facilitating third-party services.

- Foreign exchange fees. Digital banks charge users fees for foreign exchange services, especially for international transactions and currency exchanges.

Regulatory requirements and licensing

The banking industry requires additional attention to complying with regulatory requirements. This is a crucial condition for being able to operate legally. This may be considered a main bone in the throat when building your own neobank because of the fact that financial regulations are constantly evolving. Here is a short list of banking and FinTech regulations by region:

- United States: BSA, GLBA, OCC, CFPB, etc.

- European Union: PSD2, GDPR, EBA, etc.

- United Kingdom: FCA, OBIE, PRA, etc.

- Australia: APRA, ASIC, etc.

- Canada: OSFI, FINTRAC, etc.

- India: RBI, NPCI, etc.

Security and fraud prevention

Security remains a top priority when you build a neo bank application. So, you should be ready to protect the data and financial assets of more than a million customers by using strong encryption methods. End-to-end encryption methods ensure your neobank sensitive information stays unreadable to unauthorized parties. Conduct regular penetration tests to identify weaknesses before fraudsters can exploit them. Penetration testing allows you to simulate real-world digital attacks and track how your neobanking app is capable of resisting.

Fraud prevention requires more than strong security measures. Use AI-driven fraud detection to analyze transactions in real-time. Machine learning models can recognize unusual activity, flagging potential threats before they escalate. Businesses often rely on AI development services to implement advanced fraud detection and automated security responses. Multi-factor authentication (MFA) in neobanks also strengthens access controls, preventing unauthorized account takeovers.

Discover our cutting-edge AI development services and know how we can improve your neobank user’s experience and operational safety

Partnership and integrations

While building a neobank from scratch, it’s always easier to reach success via establishing partnerships with fintech service providers like traditional partner banks, fintech companies, payment processors, loyalty programs, etc. A neobank depends on integrations to offer essential services, including payments, lending, and compliance, and to build trust between the bank and the customer. Without strong partnerships, the bank may struggle to provide a seamless user experience. Entrepreneurs researching how to start neobank operations must identify strategic partners early.

Entrepreneurs must also consider API compatibility when selecting partners. Open banking APIs improve flexibility, making it easier to scale services. Before finalizing any agreement, conduct thorough due diligence to confirm reliability, compliance, and long-term viability. The right partnerships determine the neobank’s ability to scale and compete effectively in the market.

Neobank Development Cost

Neo bank development cost consists of various factors and is very hard to predict initially. This strongly depends on the functionality you want to implement, its complexity, whether you plan to create a neobanking software from scratch or need to layer more advanced features, etc. Besides, your outsourcing neobank development team composition and location influence the final price a lot.

At Cleveroad, we can offer you the following options:

- Developing a neobank from scratch and primarily building an MVP (Minimal Viable Product) to test the neobanking solution with the minimum functionality in real-world conditions

- Restructuring existing digital banking solutions within software modernization services

- Refining your neobank by enhancing some parts of your neobank functionality

The timeframe needed to build a neobank differs depending on the service you require. On average, we complete basic neobank MVP development in 3-6 months.

Depending on the neobank project complexity, the development team composition may be different and may also impact the fintech app development cost. Also, if you need certain experts but not the whole team, you can utilize staff augmentation services to quickly onboard tech-savvy and responsive FinTech software experts into your project.

Anyway, here are the basic hourly rates of neobank experts depending on the region:

| Neobank dev specialists | CEE | Western Europe | North America | South America | Asia | Australia |

Software developers | $30-$100 | $50-$150 | $60-$180 | $30-$80 | $15-$70 | $40-$140 |

UI/UX designers | $40-$80 | $70-$120 | $80-$140 | $40-$70 | $20-$60 | $60-$100 |

Business analysts | $50-$90 | $80-$130 | $90-$150 | $50-$80 | $30-$70 | $70-$120 |

Solution architects | $60-$110 | $90-$160 | $100-$180 | $60-$90 | $40-$80 | $80-$140 |

QA engineers | $25-$70 | $40-$100 | $50-$120 | $30-$60 | $10-$50 | $30-$90 |

DevOps experts | $40-$90 | $60-$130 | $70-$150 | $40-$70 | $20-$60 | $50-$110 |

Project managers | $50-$100 | $70-$140 | $80-$160 | $50-$80 | $30-$70 | $60-$130 |

As you can see, the specialists’ salaries greatly differ. Experts from North America and Western Europe offer high-quality development but demand higher expenses. In contrast, Central and Eastern Europe (CEE) provides lower total development costs without quality reduction.

Embracing all the factors, the neobank app development cost is varying from $90,000 to $300,000.

However, to get more precise information about the cost of developing your neobank concept, you can feel free to contact us. We’ll help you decide on key neobank software development criteria, consult you about the pricing, and answer any of your questions.

Cleveroad Expertise in eBanking Software Development

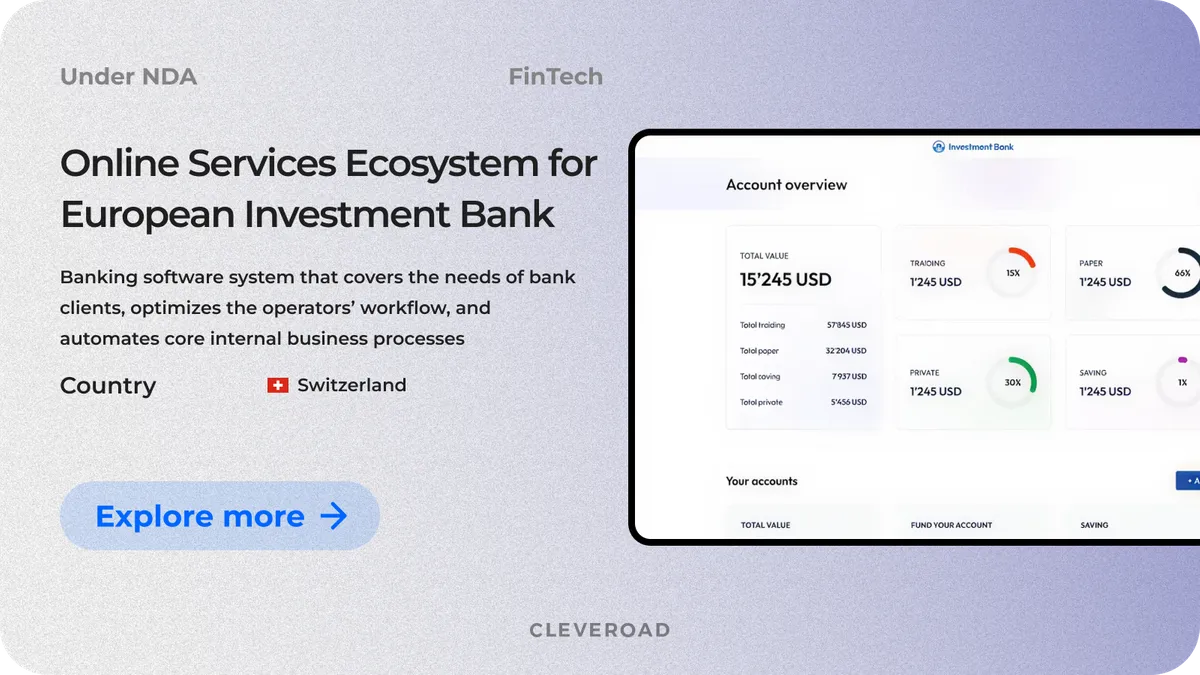

Cleveroad has comprehensive experience in eBanking solution delivery. To prove our expertise, examine our recent case - an Online Services Ecosystem for the European Investment Bank.

Our customer, a Swiss-based bank, provides financial services for clients in the B2B and B2C sectors. They’ve encountered significant issues with scaling up the existing software to growing business needs. Time-consuming sign-ups, challenges in operating trading accounts, and overall software inflexibility lead to client loss.

We’ve replaced the outdated and incomplete MVP system with full-fledged software that could cover the needs of B2B and B2C clients and the bank's internal team. Besides, we’ve improved the software user experience (UX) to make it easier for users to create and operate their digital accounts and sign up boundlessly. Also, the delivered software had to be compliant with FMIA.

As a result, the creation of a new eBanking system enabled our customers to increase client attraction and retention rates by up to 20-30%. As the eBanking software meets FMIA regulations, the customer can now freely operate under a banking license, providing clients with secure banking services and fostering trustworthiness. Besides, to keep the solution scalable and flexible, we still maintain it and recently created a mobile app and robo advisory for the customer.

Now, let us tell you more about our company.

Cleveroad is a fintech software development company located in the CEE region with over 13 years of experience in the domain. Since 2011, we have built custom banking and FinTech software for businesses and enterprises of various scales to help them successfully penetrate the FinTech niche and create a solution that will help them embrace innovations and attract a new customer base.

Here are the key benefits you’ll obtain while collaborating with us:

- Cooperation with a vendor with a strong knowledge of FinTech and banking regulations like PCI-DSS, GDPR, PSD2, and much more to guarantee the final FinTech solution's sustainability

- A partner with ISO 9001:2015 (quality) and ISO 27001:2013 (security) certifications proving the top proficiency in delivering reliable fintech software solutions

- Access to a wide range of banking software development services, including custom fintech software development, existing fintech software modernization, third-party integrations with internal systems and external aggregators, etc.

- You can utilize our managed IT services, and we’ll handle your IT operations partially or entirely, taking this burden of your in-house specialists

During the collaboration, we prioritize clear communication, responsiveness, and robust tech knowledge to help our clients keep the set level of software solution performance and high quality even after the cooperation ends. We choose an individual approach to understand how to craft software that aligns with unique business demand and will help you optimize budgeting, time, and effort.

Start your own neobank app with a reliable vendor

With 13+ years of experience in FinTech software development, our engineers will help you create a tech-savvy and reliable neobanking app that enables you to penetrate the digital banking niche

To set up a neobank, you should know about several aspects to be aware of during the development process:

- Target audience definition

- Marketing strategy

- Monetization model

- Regulatory requirements and licensing

- Security and fraud prevention

- Partnership and integrations

Best neobanks face people with transformed ways of managing their money. Unlike traditional banks, which rely on physical branches, neobanks operate entirely online, which revolut the industry. This digital-first model enables faster, more flexible, and cost-effective financial services. Many businesses now aim to develop a neobank instead of following outdated banking models to increase rapid customer acquisition.

If you’re developing a neobank from scratch, here is a list of six steps that can be taken as a basis for your personal neobank creation strategy:

- Step 1. Define your business goals and requirements

- Step 2. Choose a reliable IT vendor

- Step 3. Craft intuitive UI/UX design

- Step 4. Decide on the tech stack

- Step 5. Neobank development

- Step 6. Neobank release and maintenance

The neobank app development cost depends on different factors, such as the size and scope of must-have neobank features, the time to launch the product, and the development team's hourly rates. Embraci

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article