ICO Investment for Startup: Things to Know Before Launching Own Campaign

Updated 05 Mar 2023

10 Min

5233 Views

Many of companies over the world are faced with a problem of funding. In this case, size doesn't really matter because it happens to both beginners in the world of business and big players. Such companies as MailChimp, Shopify, Braintree had no money at the very beginning and got funded.

Nowadays, technologies make investments easier and it's not even necessary to look for investors in some cases. In this article, we will consider Initial Coin Offering (ICO) investment scheme.

What is ICO?

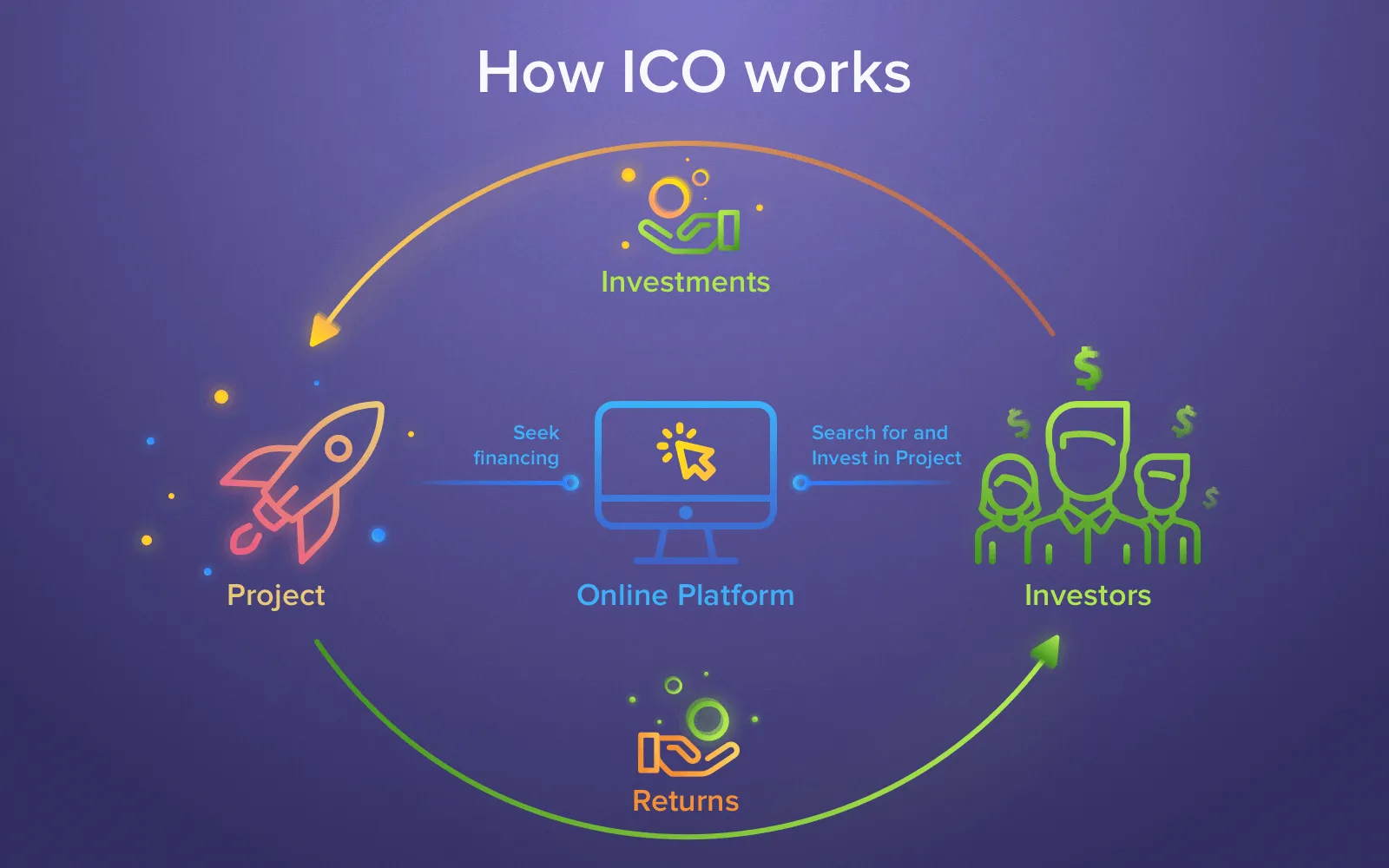

ICO is a new way to fund projects. The scheme is pretty similar to the traditional one with shares and has exactly the same purpose -- raise some money to grow the business. But instead of shares, investors or people who just want to support the project buy ICO coins (also known as altcoins) or tokens via Initial Public Offering (IPO).

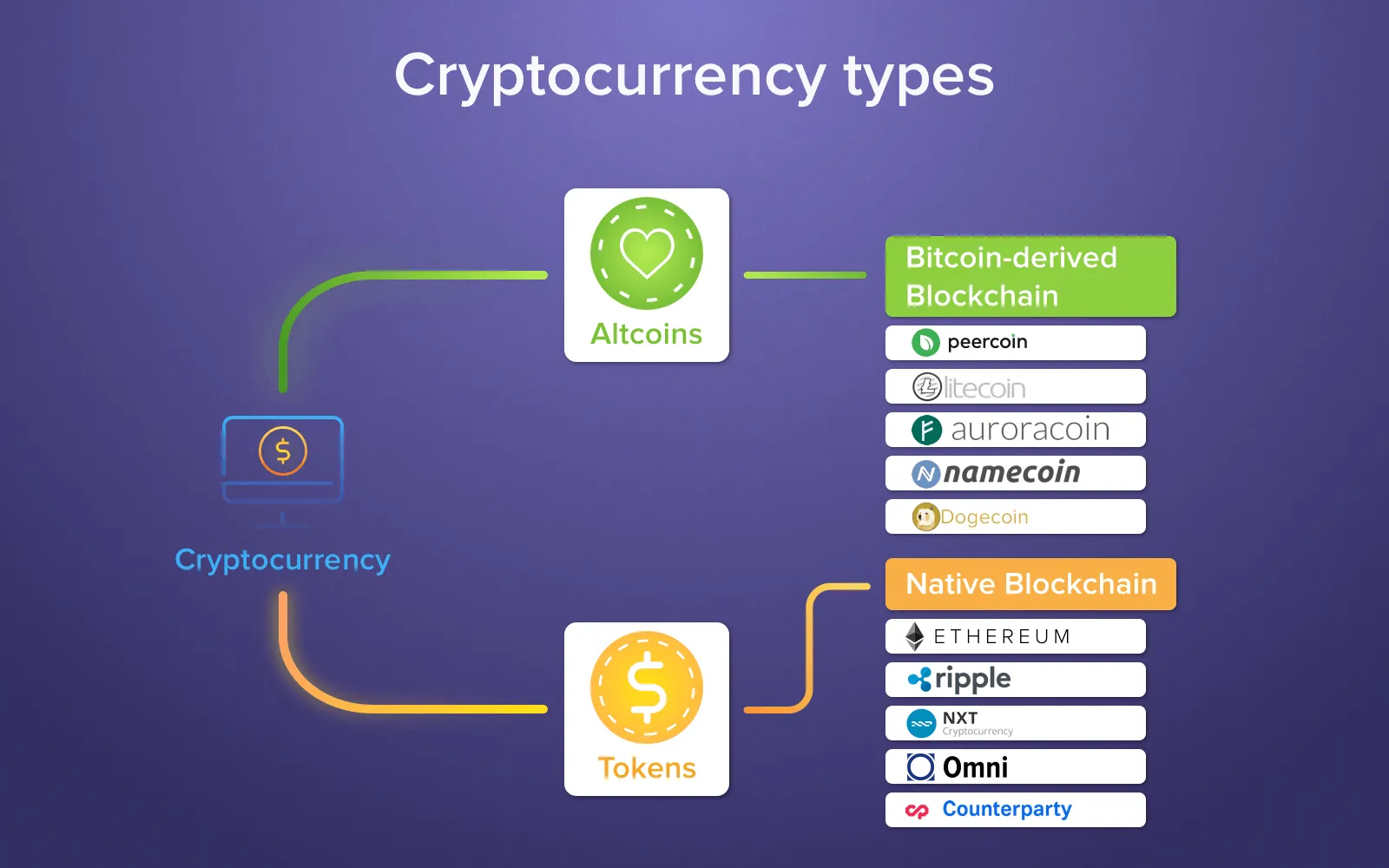

Both coins and tokens are cryptocurrencies but they vary. Before we continue moving forward let's find out what's the difference between crypto coin and token:

Coins

As it was mentioned, tokens and coins differ. Coin is a separate currency that has it's own blockchain. So, to create your own coin, you have to develop own blockchain from scratch. The examples of such coins are Ethereum, Ripple, Omni, and others.

Tokens

What is token? This is a category of cryptocurrency that functions on the top of a blockchain and doesn't have it's own. So, it takes much less time for a development team to build a token based on existing blockchain solution than to create one on their own.

Coins and tokens: Difference

Further in the article, I will use the term 'tokens' to avoid saying 'coins and tokens' all the time. We hope that we've managed to cover all questions related to 'what is initial coin offering' and 'cryptocurrency coin vs token'.

Let's continue to another frequently asked 'versus' question.

ICO vs IPO: Difference

One of the distinctions with traditional funding (IPO) is that tokens can be bought not only with the help of ordinary currencies like Euro or USD but with the help of cryptocurrencies like Bitcoin and Ethereum.

Talking about fundings, you might find interesting this guide on how to develop a crowdfunding app

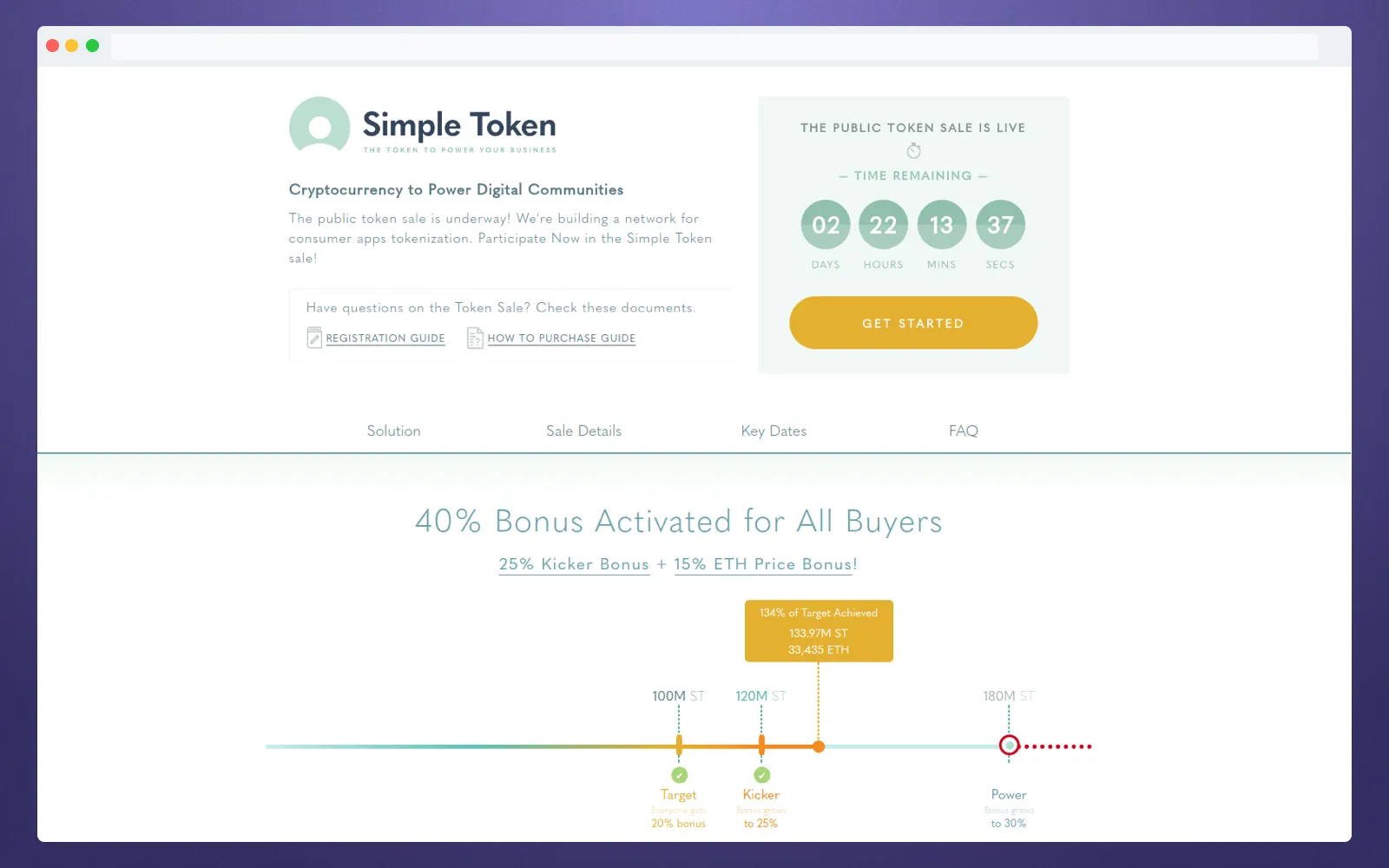

Besides, an ICO campaign has some set goals that indicate what amount of money a company should collect and for what timeframe. As we can see, the principles of ICO resemble crowdfunding campaigns on Kickstarter or Indiegogo.

Example of ICO set goals

In case the token investment goals are reached within the set period of time -- the company invests money into the business and starts distributing tokens to people who took part in funding. After that, these investors can start trading these tokens on cryptocurrency exchanges.

It's worth noting that just as in the case with shares, the price of tokens directly depends on the company's growth. In other words, that implies certain risks for investors. Let's take Ethereum (ETH) cryptocurrency as an example. The company raised $18 million in 2014 and since then it's coin grew in value from $4 to more than $450 at the moment of writing. I think that was a worthy investment for the company's supporters.

As a rule, the team that conducted a successful ICO campaign takes a portion of fundings (let's say 5-10%) and set them aside to cover the expenses related to UI/UX design and development. That's needed to keep working on a project all the time.

How Initial Coin Offering works

ICO funding to a startup: Is it real?

In short -- yes. ICO startup funding is real. However, it's vital to take into consideration all the peculiarities of the startup starting from the software to use ending with the mechanism of tokens pre-sales.

Remember that if you have an intention to launch an ICO startup, you should prepare the whitepaper and publish it. What's a whitepaper? It's a document that should include the main features of your project, it's goals, timeframe etc. In other words -- any important technical information. It will keep your potential investors aware of your aims and they'll be able to form their opinion concerning the further potential of your company. Whitepapers are usually done in PDF format and placed on the company's website.

Also, you should clarify all the details connected with the legal issues of ICO campaign. You see, this type of fundraising stays partially or completely unregulated in many countries. That's why you should get acquainted with the pack of regulations (if they exist) of the country where you intended to launch ICO.

For instance, the SEC claimed the following in it's report:

Securities and Exchange Commission

(SEC)

This Report reiterates these fundamental principles of the U.S. federal securities laws and describes their applicability to a new paradigmvirtual organizations or capital raising entities that use distributed ledger or blockchain technology to facilitate capital raising and/or investment and the related offer and sale of securities. The automation of certain functions through this technology, 'smart contracts,' or computer code, does not remove conduct from the purview of the U.S. federal securities laws.

At the same time, ICOs are totally banned in China.

Many entrepreneurs who launched an ICO campaign claim that it's not necessary to deal with bureaucracy like setting up a company, opening a bank account etc. However, that's only in the case you intended to raise funds in cryptocurrency. In most cases, the legal basis will be needed only if you decide to convert collected cryptocurrencies into fiat money.

Read more about blockchain common myths and their application in small and medium-sized businesses or watch our video on this topic

Again, you better talk with a lawyer or approach to one of the services specialized on launching ICO campaigns (e.g. Argon Group or TokenMarket) since there can be some pitfalls.

How to launch an Initial Coin Offering?

Of course, to launch ICO you should firstly develop the back-end infrastructure. In other words, you have to build a token that you'll furtherly distribute to the investors.

Probably, the most reliable and widely-used solution for this purpose is Ethereum. Besides, there are plenty of other platforms that'll help you and your team to reach your goals if Ethereum doesn't satisfy you as a platform for the creation of Initial Coin Offering.

However, let's leave the technical stuff to developers and skip to frequently asked questions from entrepreneurs who want to know how to launch a successful ICO.

How the price of tokens is determined?

The initial price is based on the amount of money you want to raise, as well as the number of coins you will allocate for purchasing. Let's say to cover all the expenses including development, token launch, marketing and get the profit you need to gain $55M. At the same time, the amount of created tokens is equal to 220M. Respectively, if to apply basic maths we get the price in $0.25 per token.

However, you should remember that just as in the case with shares, usually not all the ICO assets are allocated to the community. There can be other partners that invested in your business and you may want to hold a certain amount of tokens on your own. For instance, you keep 30% of tokens and your partners keep 20%.

So, you should set clear goals for the community. If to take the previous example as the basis, you should inform them that there are only 50% of total tokens available for sale. Accordingly, your fundraising goal is $27.5M while the implied market cap is $55M.

Example of ICO asset distribution

As soon as your tokens get to cryptocurrency exchanges, their price starts to be dependent on a variety of factors like the total trust in a project, relevant information about the project and how investors reacted to this information.

How to sell ICO?

Practically any ICO campaign implies reaching the fundraising goals as fast as possible. Fortunately, there are lots of resources that can accelerate it.

For instance, service called Earn.com may help your team in reaching potential investors through paid emails.

Is your project connected with app development? Discover 7 ways to promote your app for free

However, you shouldn't ignore other resources where your target audience may hang out on and where you can leave info about your Initial Coin Offering. That can be any popular blogs or services connected with cryptocurrencies. I've listed several of them underneath:

- Coindesk

- Cointelegraph

- Bitcoin Magazine

- TokenMarket

- etc.

Also, bear in mind that Poloniex, Bitfinex, Kraken are the most popular platforms for trading cryptocurrencies.

ICO examples

It's time to consider several ICO campaigns that brought thousands of dollars of profit to it's investors and were successful for the companies that launched them.

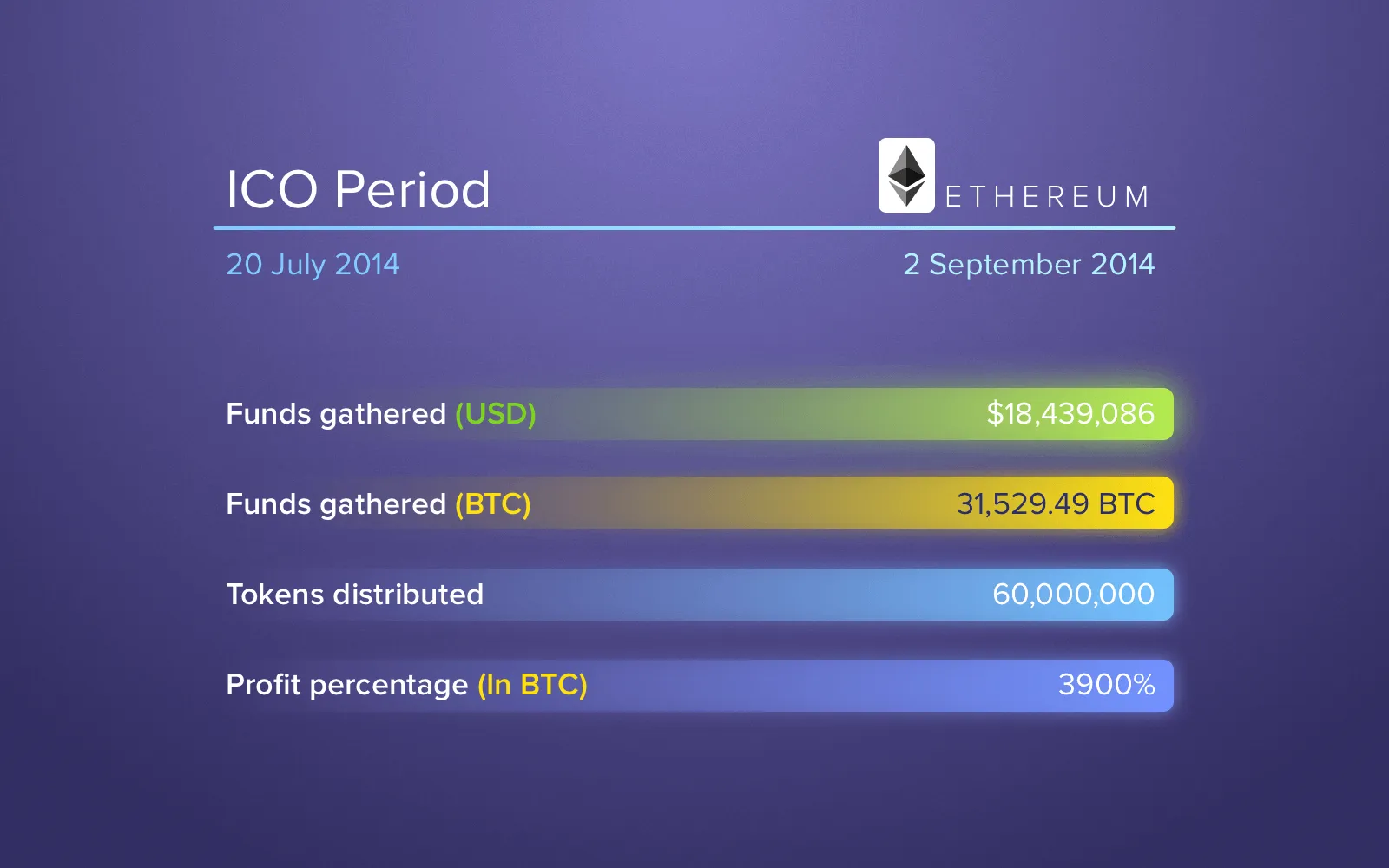

Ethereum

Ethereum is a blockchain-based platform that specializes in smart contracts. It's coin is called Ether and it can be mined with the help of Proof of Work protocol. Originally, the ICO campaign of Ethereum was launched on July 20, 2014 and lasted until 4th of September. The team held funds in Bitcoins that as a result lead to big losses because of volatility. During it's ICO campaign, the company managed to collect over 31 thousand of Bitcoins that were worth of $18M that time.

ICO: Cryptocurrency Ethereum statistics

Nxt

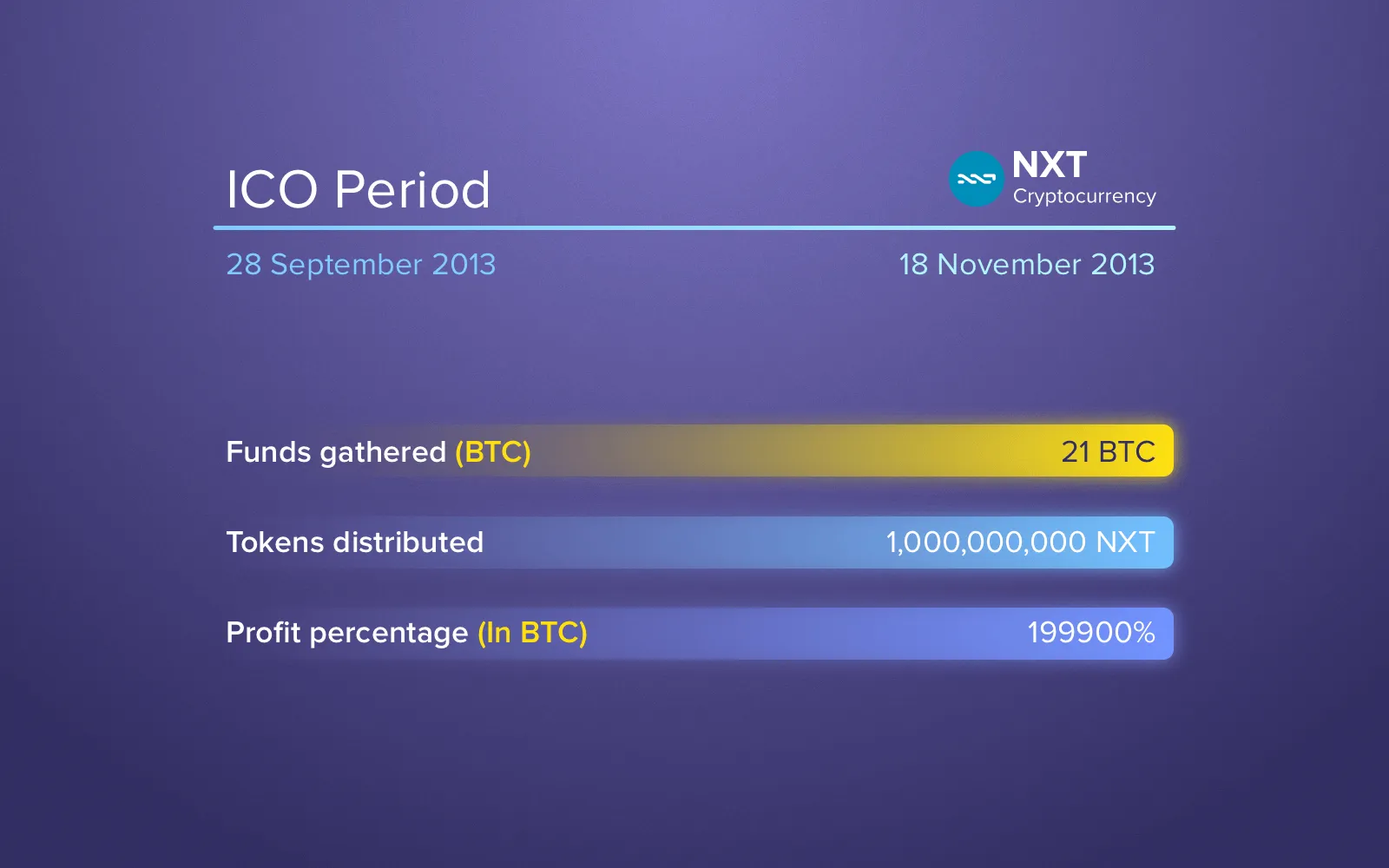

This platform gives it's users an opportunity to issue assets along with cryptocurrencies that can be easily exchanged with the help of Nxt platform in a decentralized way. Except for these, users are able to add plugins, as well as reach the platform's API. This ICO campaign lasted less than a month (September 28, 2013 -- November 18, 2013) and brought it's team 21 Bitcoins that costed approximately $14K if take into account exchange rate of that days. Yes, it's relatively small amount of money but even though this ICO was successful for the company.

ICO: Cryptocurrency Nxt statistics

Stratis

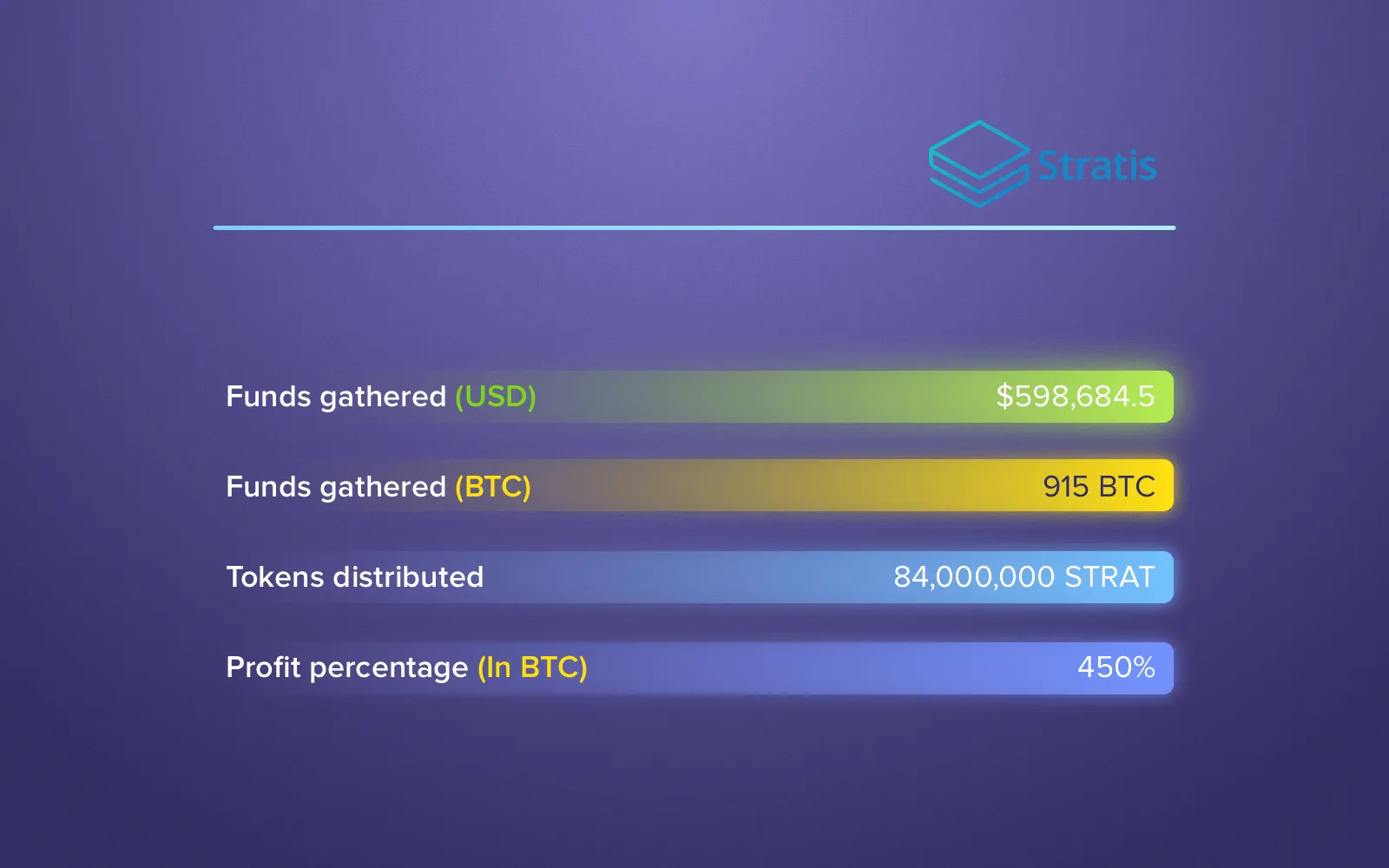

This platform is a blockchain as a service solution intended to allow their customers create custom blockchains of their own (private or public) to cover certain business needs. With the help of the Stratis platform users are able to combine features from a variety of other blockchains and test different blockchain features, as well as specifications. The ICO took place in June-July of 2016 and collected 915 Bitcoins.

ICO: Cryptocurrency Stratis statistics

So, ICO (Initial Coin Offering) is a new way to gather funds for your project. However, this method is relatively new that implies some pitfalls in a variety of aspects including the organization of such a campaign and law issues.

If you are only considering the opportunity to create your project and seeking for professionals in the field of mobile and web development -- contact our managers to get the free consultation.

By the way, subscribe to our newsletter to get our latest articles and videos to your email once a week. You can do so by filling the form you see on the right or at the end of the page in case you're reading our blog on your smartphone.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article