Machine Learning in Fintech: Top 7 Use Cases You Need to Know

14 Oct 2025

17 Min

104 Views

Machine Learning (ML) in FinTech is changing how financial companies overcome fraud, assess risks, personalize customer services, and more. From smarter credit scoring to real-time anomaly detection in financial transactions, ML is driving efficiency, security, and customer satisfaction across the industry.

At Cleveroad, we have over 13 years of experience in developing FinTech software solutions, including secure payment platforms, micro-investment apps, digital banking systems, wealth management tools, trading and portfolio analytics platforms, and other financial products. Starting from 2021, we are actively implementing machine learning in our projects. So, we see firsthand how AI and ML reshape the way financial institutions operate. In this article, we’ll explain in clear terms:

- The role of ML in modern financial services and how it helps financial companies make smarter decisions, speed up processes, and build stronger customer trust

- The top 7 use cases of ML in FinTech, including fraud detection, risk management, credit scoring, algorithmic trading, compliance automation, chatbots, and robo-advisors

- Real-world success stories from global banks and startups that prove how leaders like JPMorgan, Wells Fargo, and fintech innovators benefit from machine learning adoption

- Steps to adopt ML in your FinTech project with a simple roadmap from setting business goals to preparing data, building a PoC, integrating models, and scaling

- Key challenges and legal factors to keep in mind, such as data quality, compliance, privacy, and fairness, that influence how businesses can apply machine learning in finance

The Role of Machine Learning in FinTech

Machine learning (ML) is a branch of artificial intelligence that enables systems to learn from historical data and make predictions or decisions without being explicitly programmed for each rule.

Within FinTech domain, ML acts as a core engine for interpreting huge financial datasets, automating decision-making, improving risk controls, and detecting patterns in transactional data that humans might miss.

The importance of ML in Fintech is growing rapidly. The global AI in FinTech market is projected to reach USD 76.2 billion by 2033, growing at a compound annual growth rate (CAGR) of ~20.5%. Also, surveys found that 92 % of financial firms are already investing in AI / machine learning technology (Source: ElectroIQ).

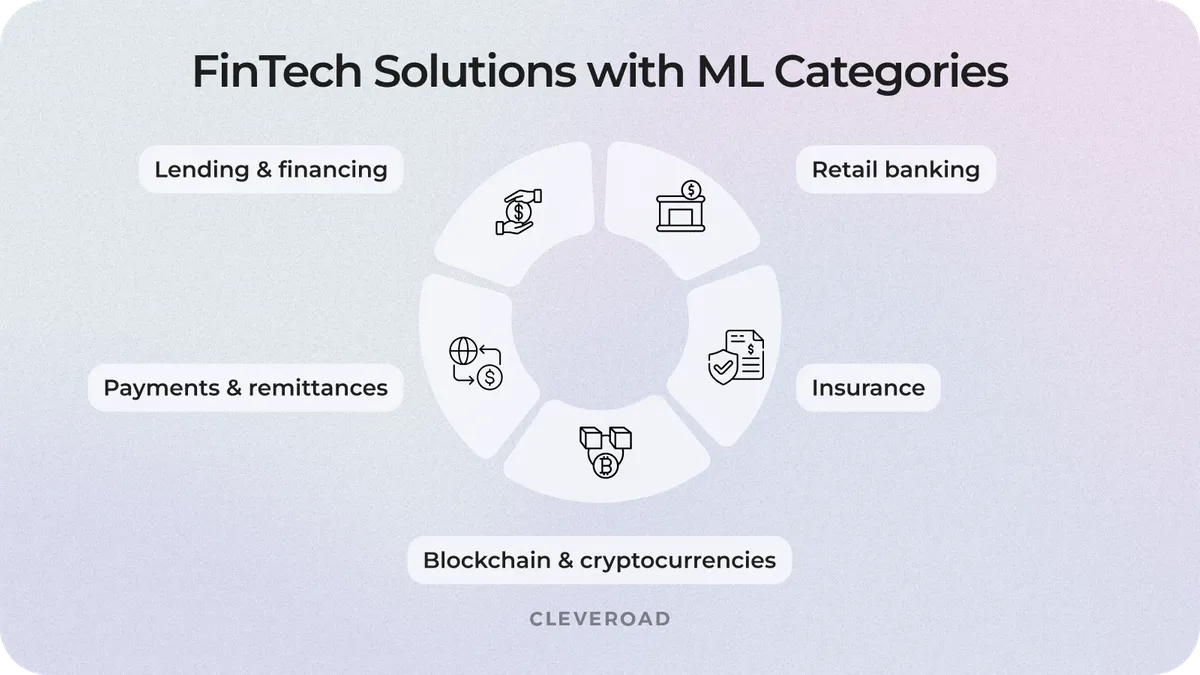

Categories of FinTech solutions using ML

Since FinTech companies involve applying technology to improve their financial products and services, their ecosystem spans many areas, including payments, lending, banking, insurance, and digital assets. Among them, several categories stand out as the most promising and investment-attractive for machine learning.

FinTech solutions using ML

Payments & remittances. Machine learning in Fintech helps process massive transaction volumes securely and efficiently, enabling real-time fraud detection, faster authorizations, and reduced operational risks.

Lending & financing. By analyzing both traditional and alternative data sources, ML models improve credit scoring, enable fairer lending decisions, and enhance portfolio risk monitoring.

Retail banking. Banks apply ML to personalize customer experiences, optimize financial operations, improve fraud prevention, and ensure data security across digital channels. Insurance. Fintech machine learning supports underwriting, claims processing, and risk assessment, making insurance services more accurate, efficient, and customer-centric.

Blockchain & cryptocurrencies. In digital assets, machine learning complements blockchain by analyzing large decentralized datasets, improving security, detecting anomalies, and enhancing transaction verification.

Machine learning benefits every type of FinTech solution by making financial operations smarter and more secure. From payments to blockchain, ML brings automation and personalized insights that enhance both efficiency and user trust. As a result, it has become a core driver of innovation across the entire financial technology ecosystem.

Top-7 Promising Use Cases of Machine Learning for FinTech

AI and machine learning in Fintech have become a practical toolkit for solving core industry challenges. By analyzing large data volumes and detecting hidden patterns, ML helps financial institutions improve customer experience and achieve better business results. Below are the key use cases of machine learning that are transforming FinTech today.

Fraud detection and prevention

Fraud remains one of the most pressing challenges in the financial sector, with billions lost each year due to account takeovers, fake identities, and payment scams. Traditional rule-based systems often fail to keep up with the constantly changing tactics of fraudsters.

Fintech machine learning models, especially when paired with AI anomaly detection, can analyze massive volumes of transactions in real time, learn what normal user behavior looks like, and instantly flag irregularities. Such an approach reduces false positives, accelerates response times, and helps institutions protect both their revenues and customer trust.

Risk management

Financial institutions face increasing uncertainty from volatile markets, global events, and complex portfolios. Legacy methods often rely on limited historical data and fail to anticipate new risks.

Machine learning algorithms enrich risk management by processing diverse datasets, from market indicators to customer credit behaviors, and uncovering subtle patterns. Thanks to deep learning, these systems can deliver early warnings, enhance stress testing, and support more informed decisions about capital allocation and portfolio adjustments.

Credit scoring and loan approval

Traditional credit scoring leaves millions of individuals and small businesses underserved, particularly those with thin or no financial histories. Such a problem results in unfair rejections and missed opportunities for lenders.

By integrating alternative data such as transaction histories, e-commerce activity, and even utility payments, machine learning-driven credit scoring creates a more complete view of applicant reliability. AI-based scoring engines can assess eligibility in real time, making lending faster, fairer, and more inclusive while lowering default risks.

Algorithmic trading

Financial markets generate vast amounts of data, and human traders often struggle to react quickly enough to capitalize on fleeting opportunities. Prices fluctuate within milliseconds, and even a slight delay in processing market signals can result in missed profits or increased exposure to risk.

Machine learning Fintech provides predictive models that detect micro-trends, while AI enables high-frequency trading systems capable of executing strategies in milliseconds. Together, they enhance market trends analysis, improve risk-adjusted returns, and give trading firms a competitive advantage in efficiency and precision.

Chatbots and customer support

Delivering fast and efficient customer service is a growing priority, yet staffing call centers around the clock is expensive and often unsustainable. Customers expect immediate answers across multiple channels, making automation essential for maintaining responsiveness and service quality.

ML-powered natural language processing enables AI chatbots to interpret queries, resolve frequent issues, and escalate complex cases when necessary. Enhanced with generative AI, such bots learn from every interaction, becoming more accurate over time, and provide instant, personalized responses that improve satisfaction while cutting operational expenses.

We’ve explained how to make a chatbot. Check our comprehensive guide to learn more

Regulatory compliance and reporting

Compliance with regulations like AML and KYC requires continuous monitoring and detailed reporting, a process that consumes vast resources when handled manually.

Fintech machine learning applications automate much of the regulatory compliance and reporting work by identifying suspicious behavior across accounts and transactions. Meanwhile, AI ensures compliance rules are updated in line with evolving regulations. Such application of machine learning reduces costs, minimizes human error, and accelerates the reporting process, allowing the FinTech firm to stay ahead of regulatory compliance and leverage modern regulatory technology solutions.

Robo-advisors and personalized financial advice

Most retail investors lack access to affordable and tailored financial guidance, which makes wealth management services seem exclusive to a small segment of the market.

Machine learning recommendation engines supported by AI analyze a user’s goals, financial habits, and market conditions to deliver customized investment strategies. These robo-advisors use machine learning to offer low-cost, data-driven guidance at scale, helping individuals make informed decisions while giving financial institutions new ways to engage clients.

Real-World Success Stories of Implementing AI and Machine Learning in FinTech

AI and machine learning in FinTech have shifted from innovation to necessity. These technologies now power risk management, automation, and hyper-personalization across the financial sector. By using advanced analytics, natural language processing, and predictive algorithms, banks and FinTech companies can reduce operational costs and deliver better customer experiences.

Below are five real-world examples of how leading financial institutions have adopted AI and ML in FinTech to solve critical business challenges and achieve measurable results.

JPMorgan Chase

JPMorgan’s legal teams once spent thousands of hours manually reviewing complex loan contracts — a slow, error-prone process that delayed deals. To solve this, the bank developed COIN (Contract Intelligence), an AI-powered platform using machine learning and natural language processing to analyze legal documents. COIN identifies key clauses and standardizes review workflows.

This AI system can analyze around 12,000 credit agreements in seconds, cutting review time from weeks to minutes and saving the bank about 360,000 staff hours annually. With near-zero error rates, COIN freed legal teams to focus on higher-value work and set a benchmark for automation by machine learning in banking operations (Source: Harvard Business School).

Credgenics

Debt collection is often inefficient, relying on repetitive manual calls and low recovery rates. Credgenics, a FinTech startup, built an AI-driven collections platform that segments borrowers by behavior and predicts their likelihood to repay. Its fintech machine learning models determine the best outreach channel and timing while AI voicebots automate early contact stages.

As a result, Credgenics’ clients saw 20–27% higher debt recovery rates and 25% faster collection cycles, with lower operational costs. The platform also improved customer experience through more personalized, data-driven interactions (Source: Credgenics).

Visa

In global payments, preventing fraud while minimizing false declines is a constant challenge. Visa integrated advanced AI algorithms into its VisaNet network to detect anomalies across thousands of transactions per second. Its machine learning models analyze spending patterns and location signals, and device data analysis in milliseconds to flag suspicious activity with precision.

In 2024 alone, Visa’s AI systems prevented more than $350 million in fraudulent payment attempts while maintaining a smooth user experience. By reducing false declines, Visa improved customer trust and transaction approval rates, showing how AI and ML in FinTech strengthen security without adding friction (Source: Finextra).

Upstart

Traditional lending models often exclude people with limited credit history. Upstart, a FinTech lender, introduced an AI-powered underwriting system that evaluates thousands of data points, from education and employment to spending behavior, to assess true creditworthiness. The model continuously learns from loan performance data and is regularly audited for fairness.

The AI model approved 35% more Black borrowers and 46% more Hispanic borrowers than traditional systems without raising default rates. Around 70% of Upstart loans are now issued through fully automated processes, reducing costs and expanding fair access to credit. This approach proves how AI and machine learning in FinTech can make lending more inclusive while maintaining strong risk control (Source: Finextra).

Explore our custom AI advisor to discover tailored machine learning use cases designed specifically for your FinTech company

Steps to Adopt Machine Learning in FinTech

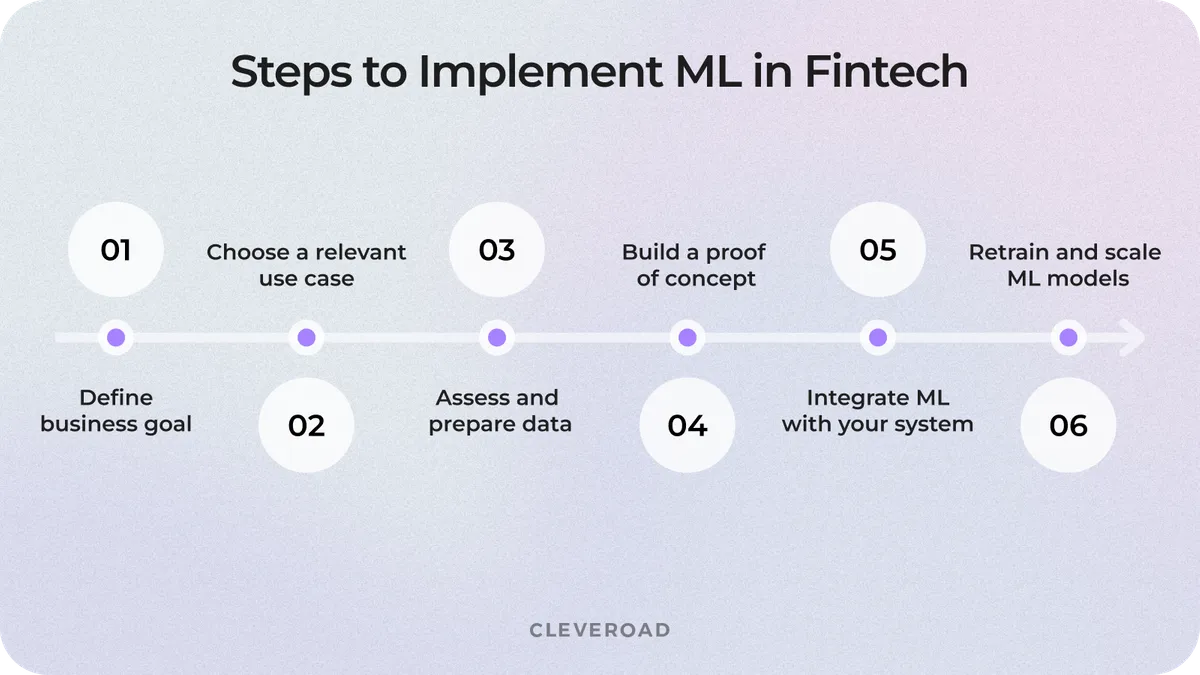

Introducing machine learning in FinTech requires a structured and transparent process. Many projects fail not because of technology limitations but because teams rush into development without a clear business goal, reliable data, or proper integration planning. Let’s check our proven flow that helps FinTech companies adopt ML solutions safely.

Step 1. Define business goal

The first step in implementing machine learning for FinTech is to define a concrete and measurable business objective. Companies need to identify a specific challenge, for example, reducing fraudulent transactions or improving credit scoring accuracy. The goal should connect to clear success metrics, such as time savings, cost reduction, or higher prediction accuracy.

A well-defined goal helps prioritize resources, set realistic timelines, and align ML outcomes with broader strategic objectives. It also ensures that every model developed contributes directly to business performance rather than being a purely technical experiment.

Step 2. Choose a relevant use case

Once the goal is set, it’s crucial to determine where ML will deliver the most impact, whether in payments, lending, compliance, or trading. Selecting the right use case defines the project’s scope, complexity, and expected outcomes.

At Cleveroad, we help FinTech companies identify and validate high-value use cases during the AI workshop — a structured session where our experts analyze business challenges, available data, and potential ROI. Acting as a machine learning consulting partner, we guide clients toward use cases that bring measurable improvements and align with their strategic vision.

Step 3. Assess and prepare data

Data is the foundation of every machine learning in FinTech initiative. Poor-quality or inconsistent data leads to unreliable outcomes. The data assessment phase focuses on identifying available sources, cleaning records, and structuring them for training and validation.

Cleveroad’s data engineers build secure pipelines that aggregate data from payment gateways, banking systems, and third-party APIs. We remove duplicates, apply normalization, and ensure compliance with financial regulations such as GDPR and PCI DSS. This guarantees that ML models are trained on accurate, unbiased, and compliant datasets.

Step 4: Build a Proof of Concept (PoC)

A Proof of Concept (PoC) is a simplified version of an ML solution that uses limited data and functionality to test whether the model can deliver expected results in real business conditions. It’s a low-risk way to validate both the business idea and the technical feasibility.

At Cleveroad, we create small, functional prototypes using real datasets to evaluate model precision, performance, and security. The PoC phase allows clients to see tangible results early, such as how a fraud detection model identifies anomalies or how a risk scoring engine predicts portfolio exposure, before investing in full-scale implementation of machine learning in Fintech.

Opt for our AI PoC services to validate your machine learning idea and check if it brings real value to your financial business

Step 5. Integrate ML with existing FinTech systems

Once the PoC proves successful, the next step is to integrate ML models into live financial environments. Integration ensures that predictive insights are available across the company’s workflows and digital platforms.

Cleveroad’s specialists connect ML models with systems like CRMs for personalized customer management, ERPs for financial planning, and payment gateways for fraud monitoring. We also integrate with mobile banking apps, investment platforms, and credit management tools. Seamless implementation enables AI and ML in FinTech to enhance existing business logic, improve automation, and deliver real-time intelligence within secure, scalable infrastructures.

Cleveroad specialists have extensive experience working with a wide range of FinTech projects. To prove our expertise, we’ll show you our recent case.

Penneo, a Danish FinTech company offering digital signature and KYC/AML compliance solutions, turned to Cleveroad to scale its AWS-based cloud infrastructure and strengthen its internal platform team. Our client needed certified DevOps engineers with expertise in Infrastructure as Code and multi-account management to optimize performance and ensure compliance across its SaaS products.

Cleveroad specialists enhanced Penneo’s existing systems by automating deployments, configuring integrations with Grafana, Prometheus, and Okta SSO, and collaborating closely with Penneo’s development, QA, and integration teams.

As a result, our customer obtained a fully scalable, secure, and efficient cloud infrastructure that supports faster delivery, higher reliability, and seamless operation of FinTech solutions. You can learn more in our case study.

Here is what Hans Jørgen Skovgaard, CTO at Penneo, says about cooperation with Cleveroad:

Hans Jørgen Skovgaard, CTO at Penneo: Feedback on Cleveroad's Cloud Infrastructure Services

Step 6. Monitor, retrain, and scale ML models

After deployment, continuous monitoring is vital to maintain performance and compliance. Over time, models can drift as data patterns evolve, for example, when customer behavior changes or new fraud schemes appear.

Cleveroad establishes a long-term maintenance cycle that includes automated performance tracking, retraining with fresh data, and incremental scaling based on system load. This approach ensures ML fintech applications remain accurate, efficient, and adaptive to changing financial environments.

Steps to Implement ML in Fintech

Challenges and Legal Limitations Influencing AI and ML in FinTech

Adopting machine learning in Fintech is not without obstacles. Such technology opens new opportunities for efficiency and customer experience, but also introduces challenges related to data, compliance, security, and fairness. You need to address these issues to build a trustworthy machine learning-powered solution that meets Fintech industry standards and protects customers.

Data quality and availability

Fintech machine learning models depend on the quality and volume of the data they are trained on. In financial services, data often comes from fragmented systems, legacy infrastructure, or external providers, which creates problems of inconsistency and bias. Incomplete or inaccurate datasets can lead to poor predictions or failed fraud detection (Source: IJECER).

At Cleveroad, we build robust data pipelines with automated validation, cleansing, and monitoring processes to ensure only relevant and accurate inputs reach ML systems. We design architectures that integrate with multiple data sources securely, apply anomaly detection to filter noise, and prepare training datasets that reflect real user behavior. This approach helps our clients achieve higher model accuracy and reliable performance in production.

Financial industry legal requirements

The financial sector is one of the most regulated industries worldwide, making compliance a core concern when adopting machine learning. Models used for credit scoring, transaction monitoring, and customer onboarding must align with frameworks such as Anti-Money Laundering (AML), Know Your Customer (KYC), GDPR in the EU, and PCI DSS for payment security.

Cleveroad develops ML-driven financial solutions with a compliance-first design. We integrate explainable AI techniques to provide clear insights into decision-making, implement audit-friendly reporting tools, and embed regulatory requirements into workflows. Our engineers follow ISO 27001-certified practices, ensuring that every ML project for FinTech clients meets strict legal and industry standards while maintaining transparency for regulators.

Depending on the project scope, our engineers apply Google Cloud AI, AWS SageMaker, and Azure Machine Learning frameworks, as well as specialized financial models such as credit risk scoring and anomaly detection algorithms tailored for transaction monitoring and AML compliance.

Security and privacy concerns

Financial data is highly sensitive, making security and privacy top priorities in every ML implementation. The challenge lies in processing large volumes of personal and transactional data without exposing it to cyber risks. If left unprotected, training datasets and deployed models could become targets for breaches or misuse (Source: IJAER).

To mitigate security risks, Cleveroad employs multi-layer encryption and role-based access controls for handling financial datasets, among other measures. We also adopt privacy-preserving approaches such as federated learning and differential privacy where appropriate, ensuring that customer data never leaves secure environments. Our security team continuously monitors threats and updates practices so clients can safely deploy ML algorithms without compromising trust.

For FinTech projects, our engineers use models and frameworks that meet strict data protection standards, including Google Cloud AI’s Vertex AI, AWS SageMaker with integrated KMS encryption, and TensorFlow Privacy for secure model training.

Bias and fairness in ML models

Bias in training data can lead to unfair outcomes, such as discriminatory credit scoring or unequal access to Fintech services. Since machine learning systems learn from historical records, they can unintentionally replicate past inequities in lending, insurance, or investment recommendations.

Cleveroad addresses bias and fairness in ML models by running fairness audits and bias detection tests throughout the ML lifecycle. We apply techniques like balanced sampling and scenario-based validation to identify and correct biases early. Our teams collaborate with clients to build diverse datasets and ensure human oversight in sensitive decision-making, helping financial companies maintain fairness, inclusion, and compliance with ethical AI principles.

Cleveroad’s Expertise in FinTech and ML Development

Cleveroad is a skilled Fintech software development company headquartered in Estonia, the Central and Eastern Europe region. We have in-depth expertise in AI development, enabling our clients to implement advanced, AI-driven solutions tailored to their financial needs. Our team develops a range of AI solutions for FinTech, including AI-based fraud detection and risk management, automated trading software, personalized finance assistants, NLP-powered chatbots for customer support, and more.

Choosing Cleveroad to implement artificial intelligence in your FinTech business, you’ll get:

- Reliable AI development services such as AI consulting, custom AI application development, model training, evaluation, and fine-tuning

- Skilled team of AI engineers who are experienced in such cutting-edge technologies as machine learning, natural language processing, computer vision, and more

- AI Workshop and AI Consulting Services that help you identify the most valuable use cases and create a practical technical execution plan

- AI POC services to validate and refine the compatibility and performance of a new technology solution with your FinTech business IT ecosystem

- Partnership with an ISO-certified company that adheres to ISO 27001 security standards and implements ISO 9001 quality management systems

- A high level of expertise in providing cloud services and top-tier ML and AI technologies, proven by Amazon Web Services (AWS) Select Tier Partner status within the AWS Partner Network (APN)

- A partnership with a company that leverages advanced AWS tools like SageMaker and Bedrock to build secure, scalable, and AI-ready cloud solutions

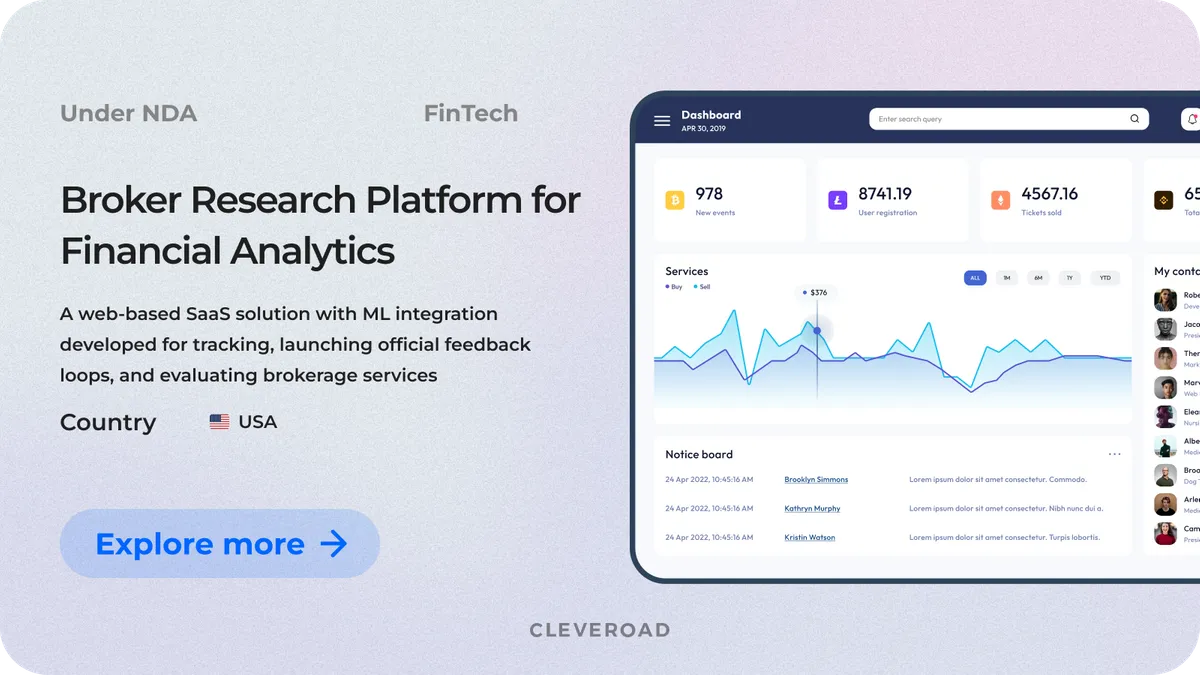

We have practical experience in successfully developing solutions for the FinTech sector, and one of our recent case studies clearly demonstrates this expertise.

Cleveroad developed a broker research platform for our client from the USA, who is providing consulting, research, analytics, and technology services for financial institutions. They needed a SaaS web-based platform for tracking, launching feedback loops, and evaluating services from brokers in terms of business value and cost.

We developed a web-based SaaS platform tailored for brokerage research management and performance evaluation within the financial sector. The solution automates brokerage research management, allowing users to track, evaluate, and compare broker performance in terms of business value and cost while fully complying with MiFID II regulations. The Cleveroad team built a secure, scalable ecosystem with several integrated portals for buy- and sell-side participants, featuring modules for voting, commission management, event tracking, and service provider communication.

To extend platform intelligence, we implemented an ML-driven analytics engine that processes historical interactions, market data, and broker ratings to predict service value and recommend optimal brokerage partnerships.

As a result, our client obtained a compliant, data-driven SaaS solution that accelerates research evaluation, increases transparency between brokers and asset managers, and strengthens the company’s position in the EU financial market.

Extend your Fintech business capabilities with ML

Contact us! With 13+ years of experience in the Fintech domain, we are ready to help you get the full potential of machine learning for your financial business to take it to the next level of growth

Machine learning is one of the branches of AI technologies that enables systems to learn from historical data and make predictions or decisions without being explicitly programmed for each rule. For the FinTech workforce, solutions powered by machine learning offer a core engine for interpreting huge financial datasets, automating decision-making, improving risk controls, and detecting patterns in transactional data that humans might miss.

The most promising machine learning use cases in finance, where such technology is transforming FinTech today, are: Fraud detection and prevention Risk management Credit scoring and loan approval Algorithmic trading Regulatory compliance and reporting Chatbots powered by machine learning Robo-advisors and personalized financial advice

Machine learning in financial services fuels fintech innovations by helping financial companies detect fraud faster, assess risks more accurately, and automate complex processes like credit scoring or compliance checks. These machine learning solutions also enable personalized customer experiences and smarter, data-based decisions, enhancing efficiency, security, and profitability across banking, lending, and investment services.

The best practices for integrating machine learning in FinTech include starting with a clear business goal and selecting high-impact use cases such as fraud detection or risk scoring. In financial technology, companies should:

- Ensure high-quality, reliable data for model training and validation

- Prioritize regulatory compliance at every stage of development

- Apply supervised learning techniques to train models on labeled, accurate datasets

- Integrate machine learning applications in FinTech securely into existing infrastructures

- Continuously monitor and retrain ML models to maintain accuracy and performance

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article