Machine Learning in Insurance: TOP-4 Use Cases to Consider

03 Dec 2025

17 Min

143 Views

Machine learning in insurance industry refers to algorithms that learn from historical and real-time data to predict outcomes, automate decisions, and improve accuracy across core insurance workflows. ML helps insurers enhance risk models, accelerate claims, detect fraud earlier, and deliver more personalized customer experiences. These capabilities lower operational costs, reduce losses, strengthen compliance, and help companies operate efficiently at scale.

Here are TOP-4 use cases of ML in insurance:

- Automated claims processing with image recognition

- Real-time fraud detection during claims submission

- Risk scoring for instant policy pricing

- Predictive models for customer churn prevention

Cleveroad experts help insurance businesses build ML-driven solutions that work in real workflows. Our team has over 15 years of experience working with insurance companies, delivering projects that include policy management platforms, claims automation tools, customer portals, and solutions enhanced with machine learning and AI.

Over this time, we have completed many successful implementations that helped insurers improve efficiency and modernize their digital infrastructure. Based on this experience, we created this guide for you to know more about:

- How insurers apply ML across underwriting, claims management, fraud detection, and CX

- What business outcomes ML reliably delivers in real conditions

- The main challenges companies face when adopting ML and how to solve them

- A step-by-step plan to implement ML in your insurance ecosystem

What's Driving the Shift to AI and Machine Learning in Insurance?

If you're in the insurance business, you've likely felt the pressure to process growing volumes of data faster while keeping decisions accurate as risks evolve. Legacy systems can't track customer behavior, assess portfolio health, or detect risk signals at the speed today's market demands.

That's where machine learning in the Insurance industry comes in. Insurers are adopting ML to respond to the following issues:

- Growing volumes of data from claims, IoT, digital platforms, and external sources

- Rising compliance pressure and the need for transparent, explainable logic

- Pressure to improve loss ratios and modernize outdated underwriting workflows

- Demand for more adaptive and behavior-based insurance pricing

- Increasing fraud complexity that requires early detection and cross-source correlation

- Expectations for instant, personalized customer service across digital channels

By integrating machine learning into your insurance ecosystem, your team can explore new products, adjust pricing strategies in real time, and manage complex risk profiles with greater confidence. The right ML solutions help you stay agile, compliant, and competitive, even as the market shifts.

Major Benefits of Machine Learning for Insurance Companies

Machine learning helps insurance companies make smarter decisions faster. It automates manual tasks, spots fraud early, and personalizes products based on real customer data. Below are the key business benefits you, as an insurance provider, gain from implementing machine learning.

Key advantages of machine learning in insurance

Higher customer lifetime value

Machine learning and insurance connect well when you want stronger retention and healthier long-term revenue. You use machine learning to predict churn early, highlight customers who show interest in new products, and form clear sales priorities.

Machine learning algorithms enable your insurers to tailor offers to actual customer needs and boost cross-sell and upsell performance. AI and ML also support better timing, so you react to customer behavior before problems affect loyalty.

More accurate underwriting decisions

ML in insurance improves risk-based decisions by helping insurers score applicants more precisely and uncover hidden risk factors that traditional models often miss. Trained on large datasets, ML models provide a complete view of each profile.

According to a McKinsey report, insurers using predictive models in underwriting and claims reduced loss ratios by up to 20% and improved pricing accuracy and workflow efficiency. In auto insurance, AI also supports image-based property analysis, helping your underwriters make faster and more consistent business decisions.

Better protection against fraud losses

Machine learning applications in insurance help you spot irregular behavior early and reduce the impact of fraudulent claims. An ML algorithm can compare claims data with historical patterns and highlight cases that warrant closer review.

ML links people, events, and transactions, so your experts see hidden connections that often stay unnoticed in large datasets. These capabilities allow insurance teams to minimize financial exposure and concentrate investigative efforts where the risk is most significant.

Faster and more efficient operations

Operational efficiency grows when insurers use automation to remove repetitive work from daily routines. Insurance and machine learning work well together in this area because machine learning technology supports the underwriting process with cleaner inputs and more organized information across internal workflows.

According to a Forbes Technology Council article, insurers that embraced AI-driven automation have improved efficiency by up to 60%. AI and ML adoption is shifting from isolated use cases to large-scale transformation across entire operations, as insurance experts approach 2026.

Smarter pricing and more relevant insurance products

Your insurers get stronger pricing strategies when they use machine learning to understand real customer behavior and product performance. Property insurance, auto insurance, and other product lines benefit from dynamic insurance policies that adapt to driving habits, home conditions, and lifestyle patterns.

Implementing machine learning helps your company build usage-based offerings that better match each customer. These improvements transform the insurance market and give insurers tools to launch tailored offers with clear competitive advantages.

Better customer experience at every step

ML helps you respond to customer needs faster and more accurately. The system analyzes behavior patterns to predict what customers need before they ask.

For example:

- A customer browsing life insurance pages gets a callback offer within minutes

- Someone stuck on a claims form receives a chat prompt with help

- Policy renewal reminders arrive at the moment customers are most likely to respond

Your team also gets real-time alerts when customers show signs of frustration, so they can intervene before the customer leaves. This reduces churn and improves satisfaction scores across all channels — mobile apps, web portals, and phone support.

Real-world results show the difference: McKinsey reports that UK-based insurer Aviva deployed more than 80 AI models across its claims operations, which led to a 23-day reduction in complex liability assessments and a 65% drop in customer complaints. These outcomes reflect how well-designed ML systems improve clarity, responsiveness, personalization, and overall customer satisfaction.

Choose our Machine Learning Development Services to enhance your insurance workflows with accurate analytics, smarter decisions, and faster support

TOP-4 Machine Learning Use Cases in Insurance

ML solves real problems across underwriting, claims, fraud detection, and customer service. It automates manual tasks, spots patterns in messy data, and speeds up decisions that used to take hours, improving accuracy and operational efficiency.

We break down the domain use cases where machine learning delivers measurable impact.

Major machine learning use cases for insurance

Underwriting and risk assessment

Underwriting is one of the first areas where machine learning brings clear value to insurers. It helps your team assess risk faster and more accurately, which directly impacts profitability. You can analyze large datasets such as financial history, driving behavior, property details, and even scanned documents using ML in insurance.

Models like Gradient Boosted Trees and image-based AI help automatically score applicants and evaluate property conditions. These tools integrate into your quoting system to adjust premiums in real time. And with explainability tools like SHAP, your decisions stay transparent for auditors, regulators, internal stakeholders, and your customers.

Key enhancements in underwriting workflows through ML include:

- Real-time risk scoring based on enriched profiles

- Automated classification of underwriting documents

- Image-based property risk analysis

- Explainable model outputs for regulatory compliance

Such improvements make underwriting faster, more consistent, and easier to defend, especially in high-risk segments.

Customer experience and marketing

Customer engagement is one of the most dynamic insurance applications for machine learning, improving how companies interact with clients. ML helps insurance teams personalize offers, anticipate needs, and deliver proactive service across channels for mobile apps, contact centers and more. Business analysts can segment users by behavior, preferences, or life events and use machine learning to forecast when someone may need support or a new product.

Machine learning algorithms used in this space include clustering techniques and deep learning models that process lifestyle data, driving behavior, and home conditions. These insights support usage-based products, dynamic pricing, and tailored communication. Such models integrate into CRM and campaign engines to automate content personalization and timing.

Claims processing

Machine learning for insurance companies improves the entire claims journey by delivering fast and data-backed assessments. Claims teams use prediction models to estimate reserves and detect patterns that may influence claim development. Computer vision helps experts evaluate vehicle and property damage with higher accuracy and lower review time.

How ML transforms your claims process:

- NLP models pull structured insights from unstructured FNOL statements, reducing manual review

- Computer vision spots visual damage within seconds, helping assess severity on the fly

- Intelligent triage routes complex cases to senior adjusters, and simple ones to auto-approval

- Real-time scoring flags potentially fraudulent claims before payouts begin

Application of ML and AI gives insurers the insight they need to reduce paperwork, shorten settlement cycles, improve claim accuracy and support teams with clear analytical inputs.

Fraud detection

Fraud detection and prevention remain critical for insurers that want to control losses and eliminate blind spots in the insurance value chain. Machine learning models analyze claims, customer data, network connections, and third-party records to surface suspicious behavior before it escalates. Deep pattern analysis helps detect organized fraud rings and coordinated anomalies that would typically go unnoticed in manual review processes.

Insurance and machine learning work especially well in this area, where predictive accuracy and real-time detection are essential. For example, graph-based ML uncovers hidden links between entities, while anomaly detection models flag outliers in structured and unstructured datasets.

Machine learning in life insurance also plays a role in identifying policy manipulation or forged documents, often before the insurance agent even completes the initial review. By applying machine learning in the insurance fraud detection workflow, your team can reduce false positives, improve investigator focus, and cut financial exposure from fraudulent activity.

Challenges of Implementing Machine Learning for Insurance

Despite the proven benefits of machine learning for insurance, successful adoption still comes with serious challenges, both technical and regulatory. Insurers must deal with fragmented systems, legacy data pipelines, explainability mandates, and evolving compliance demands. These are not just technical issues but business-critical risks that affect pricing accuracy, regulatory standing, and customer trust.

At Cleveroad, we support insurers through the entire lifecycle of ML adoption. Our domain experts can help you address integration, governance, and auditability risks, making sure your machine learning applications for insurance meet industry standards and deliver long-term value.

Here are four core challenge areas and how we solve them:

Data integrity

The effectiveness of any machine learning insurance model depends on the quality of its data foundation. It often means reconciling legacy databases, inconsistent schemas, and missing values across systems: a common obstacle in applying machine learning across insurance systems.

For example, insurance carriers offering casualty or life coverage may store customer and claims data in incompatible formats, leading to unreliable training inputs. Furthermore, advanced techniques like generative AI in insurance require massive amounts of high-quality, structured data to prevent the generation of misleading or biased outputs.

Our team helps implement reliable insurance for machine learning applications by applying advanced data and feature engineering practices:

- Data cleansing and deduplication

- Missing value handling

- Consistent schema mapping

- Building training-ready datasets from multi-source insurance claims

We also create unified data layers to support supervised models for use cases like fraud scoring or personalized insurance offers. Thanks to machine learning, your team can finally extract consistent insights from scattered records and deliver faster, more accurate service to your insurance customers.

Fairness and discrimination

When applying machine learning and insurance models to core business decisions, it’s critical to ensure fairness across demographics. Insurers can use ML tools to improve pricing and risk assessment, but without proper controls, models may unintentionally introduce bias, especially in sensitive areas like claim approvals or policy eligibility.

This risk is particularly relevant in property and casualty insurance, where decisions affect large and diverse customer groups. To reduce unfair outcomes, Cleveroad embeds fairness metrics such as demographic parity and equalized odds into our model evaluation process. These techniques help surface hidden bias in both ML and AI models, whether used for pricing, underwriting, or automated claims triage workflows.

By using deep learning responsibly and validating model behavior across the insurance value chain, we help insurers stay compliant, build trust, and support ethical automation at scale.

Transparency

Interpretability is a non-negotiable requirement in insurance, especially for models that affect coverage decisions or pricing. Complex artificial intelligence systems must produce justifiable outputs for internal confidence and external compliance. In the machine learning insurance industry, regulators and customers alike expect full transparency on how decisions are made.

We help insurers integrate explainability frameworks such as SHAP and LIME and, when needed, deploy interpretable models like monotonic gradient boosting or rule-based scoring. These tools allow underwriters, auditors, and compliance teams to understand how individual features shape predictions, critical for maintaining trust in everyday insurance practice and audit readiness.

Compliance and security requirements

Regulations like GDPR, SOC 2, and ISO 27001 set strict expectations for how insurers manage data in environments such as claims handling, pricing, and customer interactions. Compliance must be integrated into every part of your ML infrastructure, including data collection, consent management, model monitoring, and pipeline updates.

At Cleveroad, we design production-ready ML pipelines that meet the specific requirements of US insurance firms and other regulated markets. This includes encryption, access controls, audit logging, and robust leakage prevention during both training and inference. Whether you're using machine learning algorithms for rating or deploying machine learning in insurance claims, we help ensure your models stay aligned with both legal obligations and ethical standards.

The table below sums up key implementation barriers and the practical ways Cleveroad helps overcome them.

| Challenge | What it means for insurers | How Cleveroad helps |

Data integrity | Inconsistent data from legacy systems leads to unreliable training inputs | We clean, unify, and engineer datasets tailored to insurance ML use cases |

Fairness and discrimination | Bias in pricing, eligibility, or claims decisions can lead to legal risks | We embed fairness metrics to reduce discriminatory outcomes |

Transparency | ML models must be interpretable to meet regulatory and audit standards | We use SHAP, LIME, and other algorithms showing how predictions made |

Compliance and security | GDPR, SOC 2, and ISO 27001 require controls over data access | We build secure ML pipelines with encryption, access control, audit logging |

How to Implement Machine Learning in Your Digital Insurance Ecosystem

To implement machine learning in insurance, companies need more than algorithms, as well as structure, data, and domain expertise. Effective ML adoption starts with clean, unified data, continues with building explainable, domain-specific models, and ends with integrating them into existing insurance systems. Below is a realistic roadmap you can follow to adopt ML.

Step 1. Define purpose and prepare data

Effective machine learning insurance implementation starts with a focused business goal, whether that’s lowering fraud risk, optimizing churn prediction, or streamlining underwriting across various insurance product lines. Identifying the right target allows your team to prioritize ROI and align stakeholders early.

From there, you’ll need to assess and prepare your learning data. Many global insurance organizations still rely on outdated systems and fragmented sources, which makes model accuracy difficult to achieve. To build performant AI algorithms, your data must be consolidated, cleansed, and enhanced with context-aware features.

An experienced ML partner like Cleveroad can help you structure this process, define data priorities, and engineer features that align with real-world insurance objectives. We help teams adopting AI start strong by defining a precise use case and preparing high-quality training data. Whether you're using AI and ML to score risk or personalize quotes, this foundational step ensures your models produce results that matter.

To set up a strong foundation for your ML initiative, you need to complete several essential data and modeling activities, including:

- Defining a use case (e.g., fraud scoring, claims triage, quote personalization)

- Mapping structured and unstructured datasets

- Resolving missing values and data duplication

- Engineering predictive signals like claim frequency, payment behavior, or risk tiering

Step 2. Start cooperating with an ML-experienced tech partner

Most insurance companies don’t have strong in-house expertise in machine learning. Hiring a few data scientists isn’t enough: you also need the right infrastructure, tools, and workflows to bring ML models into real business use.

Partnering with a reliable ML development company helps close this gap. At Cleveroad, we support insurers through every stage of their ML journey: from data preparation and model training to integration, monitoring, and compliance.

When choosing a partner, look for a team that:

- Understands insurance data such as claims, policies, and customer records

- Can manage the full model lifecycle, from development to continuous improvement

- Pays attention to security, fairness, and model transparency

- Knows how to integrate ML with legacy insurance systems and cloud platforms

Working with the right tech partner ensures your machine learning projects move from experiments to stable, business-ready solutions.

Step 3. Choose ML model and start training

Model development starts with clean, well-prepared data and a clear business goal. Depending on your use case, risk scoring, price optimization, or document classification, your team will experiment with different algorithms such as gradient boosting, neural networks, or support vector machines.

Model training is an iterative process. You’ll split data into training, validation, and test sets, adjust model parameters, and evaluate performance using relevant metrics. Continuous testing helps ensure that the model generalizes well and delivers stable results in production.

If you're still evaluating feasibility or ROI, launching focused AI PoC development services can help you validate the model before committing to full-scale deployment.

Key metrics and activities you should monitor while implementing ML in insurance:

- Supervised learning with train/test/validation splits

- Hyperparameter optimization (e.g., grid search)

- Use of domain-relevant metrics (e.g., Recall for fraud, RMSE or MAE for pricing)

- Early-stage MVP for internal evaluation and feedback

Step 4. Test the machine learning model

Before going live, the model must prove itself in real insurance conditions. That means running in shadow mode, validating results on unseen data, and checking for compliance risks, like fairness, transparency, and bias.

A/B testing can help compare model performance against existing rules or systems. It's also essential to monitor explainability: insurers must justify each decision to regulators and customers alike. If the PoC performs reliably during testing, its scope is typically expanded into a full-featured insurance solution integrated across the relevant domain workflows.

Best practices of testing the ML model:

- Shadow deployment behind live system

- A/B tests vs baseline model or business logic

- Explainability testing using SHAP or LIME

- Stress testing across different customer segments

Step 5. Integrate ML in your Insurance system

Once validated, the model is deployed into your insurance ecosystem: whether that’s a policy issuance platform, CRM, claims system, customer portal, or mobile app. This stage requires solid MLOps infrastructure, secure APIs, retraining automation, and active monitoring.

Cleveroad helps teams from the insurance domain build scalable, compliant ML deployment pipelines with built-in tools for version control, drift detection, and model retraining. In production, the model is either served via API or embedded into internal systems. Performance is monitored continuously for latency, accuracy, and data drift. Alerts are triggered in case of anomalies, and retraining workflows are scheduled to refresh the model with new data when needed.

Major steps to implement ML in insurance

How Much Does It Cost to Implement Machine Learning in Insurance?

The cost of insurance ML varies widely depending on data complexity, integration depth, and overall scope. Whether you’re validating a one-off pilot or embedding models into core systems, it’s essential to treat ML not as a generic toolset, but as a targeted solution that fits your infrastructure, workflows, and business case.

As a subset of artificial intelligence, ML uses statistical learning techniques, starting from logistic regression or advanced AI models like CNNs and LSTMs, to solve domain-specific challenges across insurance applications. AI and machine learning in insurance not only streamline operations but also unlock measurable long-term value.

Here’s a rough breakdown based on our experience delivering real ML solutions in insurance sector:

| Solution tier | Estimated сost ($) | Description |

Proof of Concept (PoC) | $25,000-$40,000+ | A simple, isolated model trained on a clean dataset to test technical feasibility and value; typically targets a single use case like claim categorization or churn |

Production-ready ML module | $60,000-$120,000+ | Includes full data prep, model training, testing, explainability, and API integration into business systems; suitable for fraud scoring or personalized pricing |

Enterprise-grade ML ecosystem | $150,000-$300,000+ | Covers multiple models, MLOps pipelines, compliance, and retraining; designed for real-time underwriting, claims automation, or regulated auditability |

But the accurate cost of implementing ML in insurance systems depends on:

- The quality and volume of your structured and unstructured data

- The number of models you plan to train and maintain

- Integration with legacy or cloud-based insurance platforms

- The level of automation and governance required for long-term MLOps

- Internal vs. external support for monitoring, scaling, and compliance

Every machine learning project is unique, but insurers that connect ML to financial outcomes like reduced loss ratios, better pricing precision, or faster claims processing often see a strong Return on Investment (ROI).

If you are curious how that could look for your insurance business, our AI development team can help you scope the right ML solution, estimate timelines and costs, and align it with your goals. Contact us to get started.

Cleveroad as Your Experienced Insurance Software Development Vendor

Cleveroad is an insurance software development company with 15+ years of domain experience. We help insurers automate core processes by building solutions for claims handling, policy administration, customer engagement, and compliance management. To increase the value and intelligence of these systems, we integrate machine learning algorithms that enhance prediction accuracy, streamline manual tasks, and support data-driven decisions.

Over the years, we have delivered numerous successful projects across health, life, and P&C insurance, including platforms with automated underwriting, fraud detection modules, and real-time analytics dashboards. Our team knows how to work with complex insurance data, ensure regulatory compliance, and design secure architectures that scale with business growth.

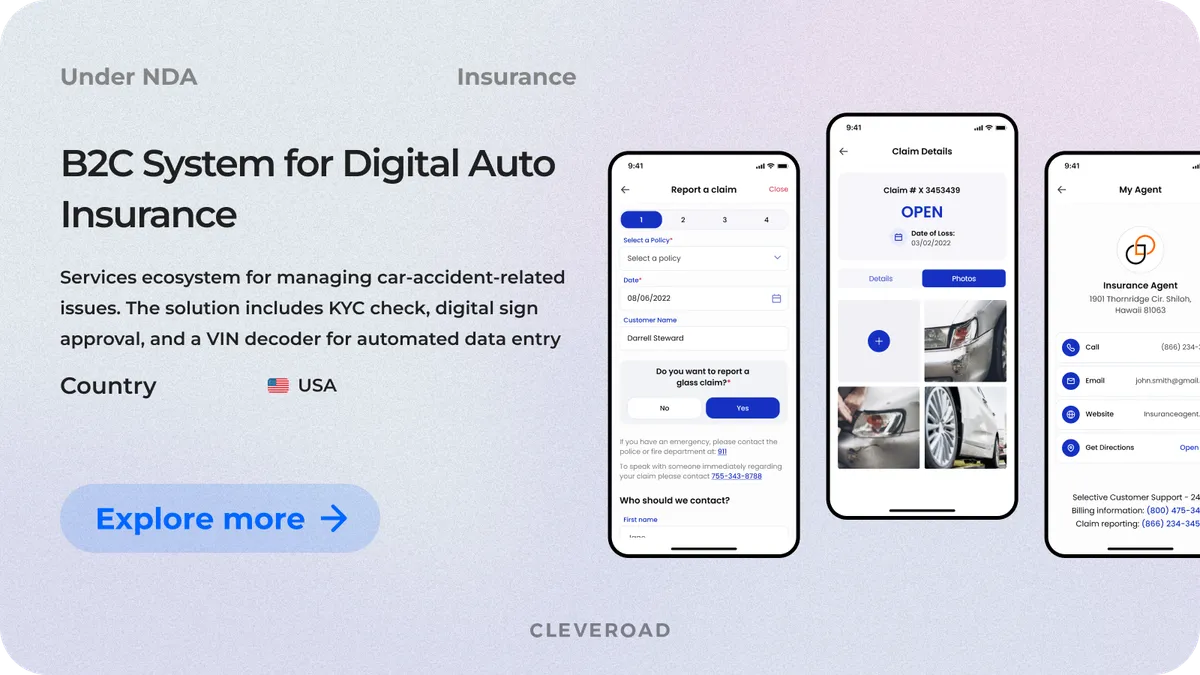

One of our recent projects involved building an Online Services Ecosystem for Managing Auto Insurance. Our client, a US-based car insurance company, was initially focused on policy management, document exchange, and driver verification. However, their current insurance solution was obsolete, rigid and inefficient. They asked Cleveroad for help, and our team redesigned the entire system architecture to create a flexible, scalable web-based platform.

We implemented modules for customer onboarding, policy administration, and claims tracking, including a claims component structured to support ML-based triage and prioritization in the future. All flows were integrated with third-party data providers and internal services. The solution improved operational speed, enhanced user experience, and laid the groundwork for future expansion with features like telematics and ML-based risk analysis.

As a result, our client received a modern insurance ecosystem that streamlined daily workflows, reduced processing time, and positioned the company for future innovation with built-in readiness for AI-driven claims automation and risk intelligence.

Create your own insurance ML solution

Build your insurance system with integrated machine learning. Our team helps you validate the right use case, prepare insurance data, and embed ML models directly into real operational workflows

Machine learning in insurance refers to the application of machine learning methods to automate and improve tasks like underwriting, claims processing, and fraud detection. For example, in P&C insurance, these models help evaluate risk and personalize policies more accurately than traditional approaches. Insurers also adopt deep learning techniques to analyze unstructured data from images, documents, and sensor feeds, driving smarter and faster decisions across operations.

The role of machine learning in insurance is to enhance decision-making by analyzing complex data, predicting risk, and automating key processes like claims handling and underwriting. It helps insurers improve accuracy, reduce operational costs, and deliver more personalized customer experiences.

Here are key use cases of machine learning for insurance:

- Underwriting and risk assessment

- Claims processing

- Fraud detection

- Customer experience and marketing

Implementing machine learning in insurance works best when companies follow a clear, structured roadmap instead of jumping straight into model development. Below are the five essential steps that guide insurers from defining a use case to fully integrating ML into daily operations:

- Step 1: Define purpose and prepare data

- Step 2: Partner with an ML-experienced tech team

- Step 3: Select ML models and start training

- Step 4: Test the model in real conditions

- Step 5: Integrate ML into your insurance system

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article