FinTech Software Development Services

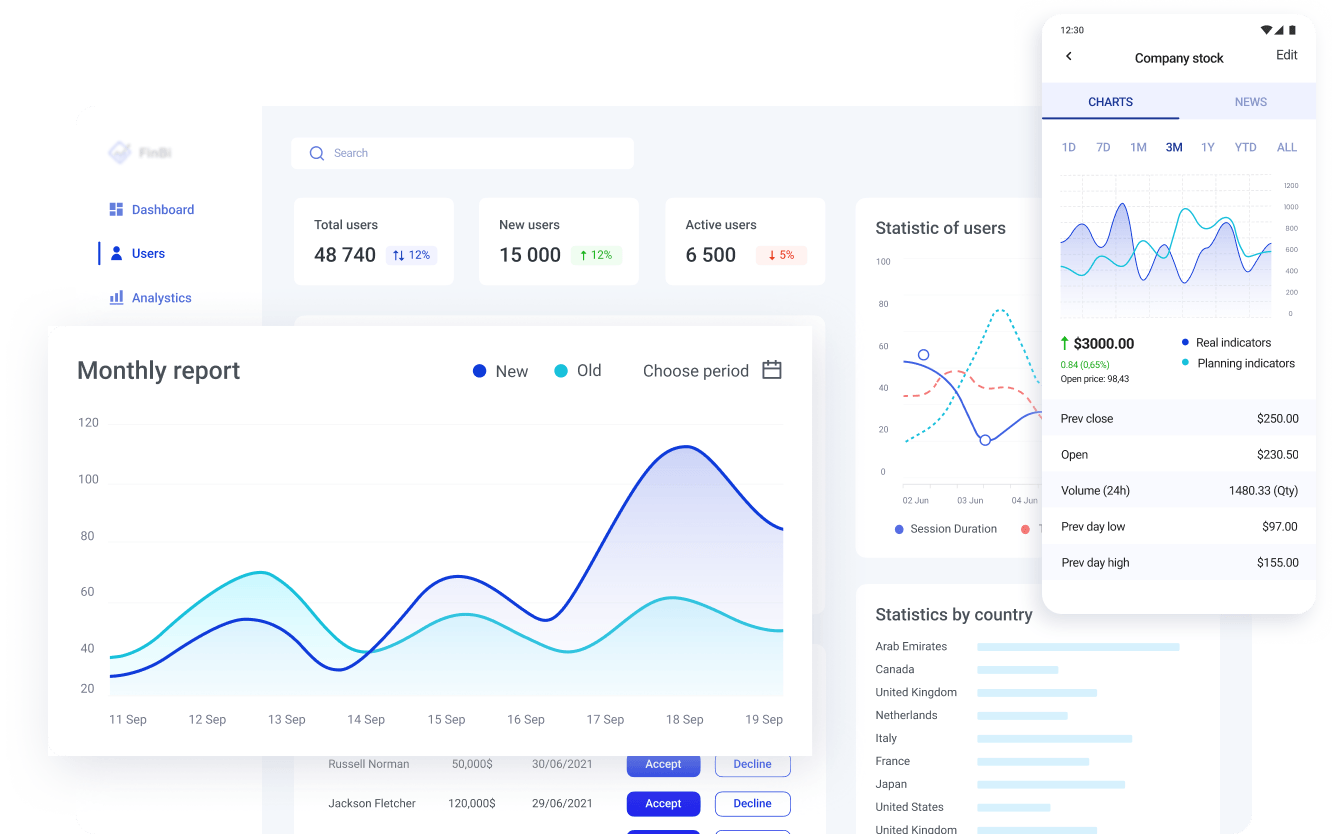

- Creating custom software to improve finance and banking

- Implementing payments in your FinTech applications

- Build better analytics to make smart business decisions

Featured Partners

Financial Software Services We Offer

Financial software development services we offer that you can leverage to boost your FinTech businessFinTech Solutions We Provide

FinTech software solutions we architect, build, and scale combine regulatory compliance and AI-native experiences

Innovative digital payment

Embedded finance and PaaS

Real-time payments and ISO 20022 rails

Super apps and mobile wallets

Biometric and passkey authentication

Contactless and IoT payments

AI-powered risk systems

Next-gen fraud detection engines

AI-driven credit scoring

Predictive risk analytics

RegTech automation

AI-powered document verification

Trading platforms

Robo-advisory 2.0

Digital brokerage platforms

Tokenized assets and fractional ownership

Market intelligence dashboards

Social and gamified trading

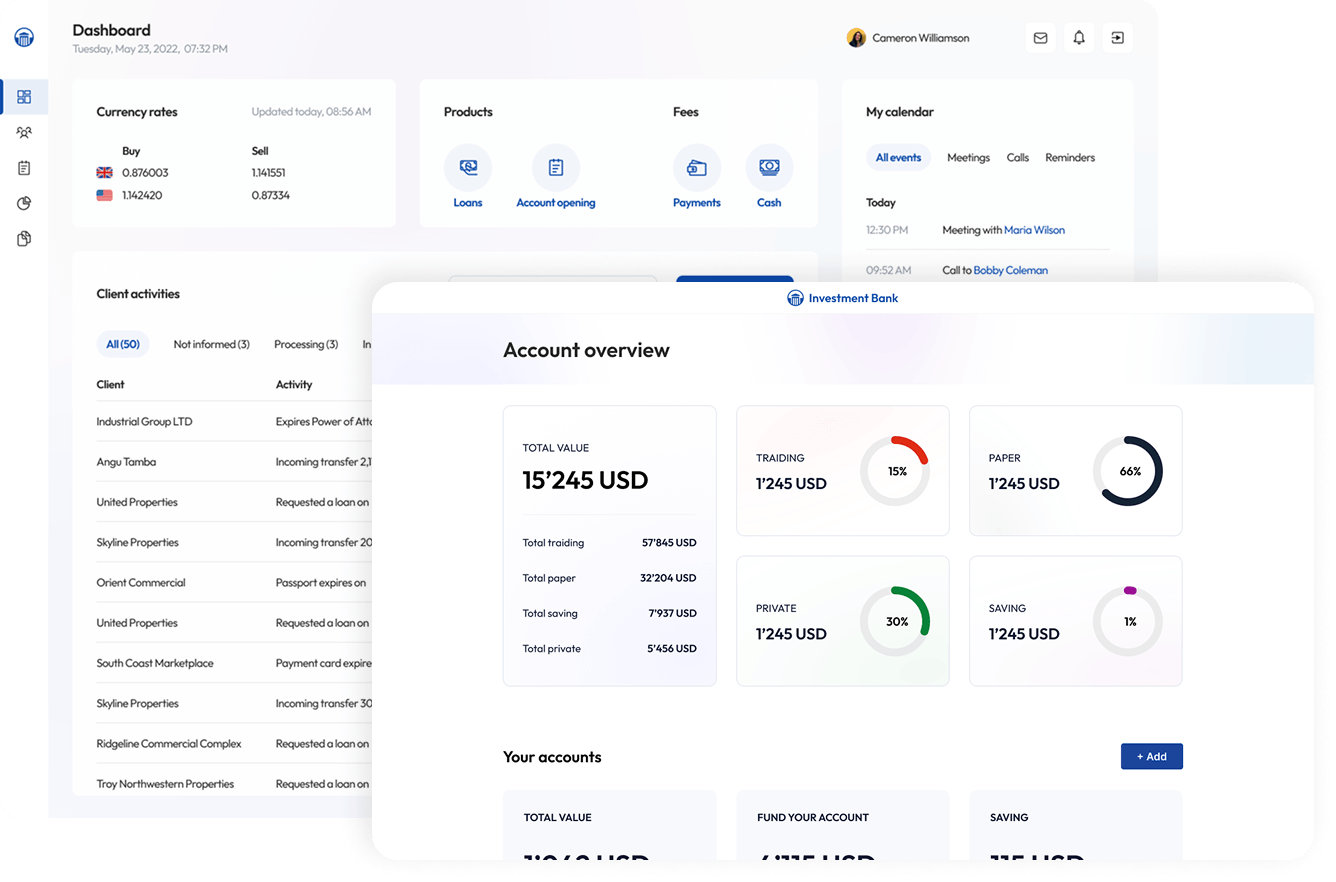

Banking-as-a-service

API-driven core banking modernization

Digital onboarding journeys

Omnichannel mobile-first banking

Personal finance management

SME and corporate banking portals

Digital asset solutions

DeFi protocol development

Crypto payment gateways

Central bank digital currency enablement

Identity and credentialing on blockchain

Asset tokenization platforms

Embedded risk solutions

Usage-based insurance

Parametric insurance platforms

Claims automation with AI

Embedded insurance

Digital risk assessment tools

Cleveroad’s Fintech Software Projects

We individually approach each Financial solution, find the best ways to implement it, and help the client optimize time, budget, and efforts

Challenges solved during the creation of a Cross-Platform App to Manage Micro-Investments and Savings:

- Developing from scratch a cross-platform Flutter app for micro-investments management

- Achieving compliance with local financial regulations, including SAMA requirements for security and reporting

- Implementing advanced functionality with multi-factor authentication and automated KYC verification

Challenges solved within the building of an Online Services Ecosystem for the European Investment Bank:

- Replace the outdated MVP with a custom eBanking software ecosystem for B2B and B2C customers

- Ensuring compliance with European financial regulations, including FINMA and FMIA, through secure architecture

- Improving UI/UX design to simplify account opening, resulting in user retention rate increased by 20-30%

Financial Businesses We Serve

We partner with various businesses across the financial sector, providing tailored software solutions

Financial data vendors

Fintech startups

Credit unions

Payment processing firms

Insurance firms

Wealth management firms

Brokerage firms

Investment funds

Private equity funds

Our Clients Say About Us

CTO at NURSING

"The team is very organized, communicative, and proactive. They keep the project on track and provide excellent suggestions to improve the product."

Automating FinTech Operations With AI

We integrate core AI technologies into financial platforms, enabling institutions to innovate faster and strengthen compliance in a rapidly evolving market

Computer vision

Enhance security, compliance, and customer experience through visual intelligence

Biometric KYC and facial recognition for digital onboarding

Document scanning and verification (IDs, contracts, etc.)

Fraud detection via image/video analysis (e.g., counterfeit documents)

Recommendation systems

Drive engagement and revenue with hyper-personalized financial services

Intelligent product recommendations based on use patterns

Personalized investment suggestions aligned with user risk profiles

Adaptive cross-selling engines for banking, insurance, and trading apps

Forecasting & predictive analytics

Enable proactive decision-making with accurate financial predictions based on historical data

Market trend forecasting for investment and trading strategies

Credit risk prediction and default probability modeling

Demand forecasting for financial products (loans, insurance, etc.)

Natural Language Processing (NLP)

Transform customer interactions and compliance processes with language intelligence

Conversational chatbots and voice assistants for 24/7 support

Automated compliance monitoring through document

Sentiment analysis of customer feedback for decision support

Anomaly detection & risk intelligence

Strengthen compliance and operational resilience with AI systems that detect irregularities before they escalate

Real-time anomaly detection in transactions to flag potential fraud

Anti–money laundering (AML) monitoring with adaptive ML models

Risk scoring engines for early detection of credit defaults

Generative AI for financial insights

Unlock new efficiencies by using generative models to streamline analysis and client interactions

Automated report generation for investors and internal stakeholders

Natural language query systems for instant access to complex data

Personalized financial insights delivered directly to customers

Our Financial Software Building Process

We follow an established software development life cycle to build FinTech software tailored to your business operations that meets current market trends

- Define needs

- Solution design

- Delivery setup

- Development

Define needs

We analyze your FinTech product idea, market niche, and target audience to define functional requirements, compliance needs, and business goals. This stage ensures a shared vision of how the product will generate value and meet regulations.

Key outcomes:

Product vision document

Compliance checklist

Preliminary estimate

Product creation roadmap

Solution design

Our experts create a scalable system architecture, define data flows, and prepare clickable prototypes of user journeys such as onboarding, payments, and risk checks. This ensures the product’s usability, security, and long-term growth potential.

Key outcomes:

Feature list and MVP scope

Technical project plan

Technology stack selection

Architecture design

Interactive prototypes

UI/UX design concept

Delivery setup

We assemble the development team, plan sprints, and set up infrastructure, CI/CD, and design systems. This stage ensures transparent processes, predictable releases, and smooth collaboration between designers, developers, and QA.

Key outcomes:

Sprint and delivery roadmap

Team allocation plan

Infrastructure and process setup

Risk and dependency map

Development

Developers implement core FinTech features, from payment processing and KYC to analytics and reporting, following agile methodology. QA engineers perform continuous testing, while DevOps ensures secure deployment and smooth release.

Key outcomes:

Working FinTech product

QA and security reports

Deployed infrastructure

Handover documentation

Maintenance and support plan

Tech Stack We Use for FinTech Solutions

Tools and integrations for FinTech software that we use in development enhance the solution functionality, optimizing the project’s budget

Financial Domain Regulations Expertise

FinTech software developers from Cleveroad design solutions in line with industry rules, ensuring compliance and data security

Security & data standards

- DORA

- ISO/IEC 27001

- GDPR

- KYC & AML practices

- ePrivacy Regulation

- PCI DSS (incl. PCI Secure Software Standard)

Trading methods & workflows

- Central Limit Order Book (CLOB)

- IOI / RFQ / Quote workflows

- EMV

Digital identity & signatures

- SES

- UETA

- QES

- ESIGN Act

- AES

- UNCITRAL Model Law on Electronic Signatures

Financial regulations

- MiFID II

- SAMA

- PSD2

- BSA

- FINMA

- GLBA

Certifications

We keep deepening the expertise to meet your highest expectations and build business innovative software

ISO 27001

Information Security Management System

ISO 9001

Quality Management Systems

AWS

Select Tier Partner

AWS

Solution Architect, Associate

Scrum Alliance

Advanced Certified, Scrum Product Owner

AWS

SysOps Administrator, Associate

Flexible Engagement Models We Offer

We offer flexible engagement models for our FinTech development services, so you can choose a collaboration option that suits your needs and budget

IT staff augmentation

Problem to solve:

Extend your team with the required tech expertise

Value delivered:

Expand your tech capabilities with the required IT experts

Fully manage specialists�’ work as they are in your in-house team

Scale your team with a single developer or a full-stack unit

Dedicated team

Problem to solve:

Hire a development team for your FinTech project

Value delivered:

Get a pre-assembled, self-managing development team

Maintain direct communication for progress updates

Adjust team size flexibly based on project needs at any time

Custom development

Problem to solve:

Receive end-to-end FinTech development services

Value delivered:

Develop a tailored software solution aligned with your needs

Ensure a smooth development from idea validation to release

Build a scalable, high-performing product for long-term success

Industry Contribution Awards

Leading rating & review platforms rank Cleveroad among top software development companies due to our tech assistance in clients' digital transformation.

70 Reviews on Clutch

4.9

Award

Clutch 1000 Service Providers, 2024 Global

Award

Clutch Spring Award, 2025 Global

Ranking

Top AI Company,

2025 Award

Ranking

Top Software Developers, 2025 Award

Ranking

Top Web Developers, 2025 Award

Ranking

Top Staff Augmentation Company US, 2025 Award

Cleveroad as Your FinTech Development Company

Expertise with advanced technologies

Our team applies the latest technologies to deliver innovative financial solutions. We integrate artificial intelligence into FinTech products for predictive analytics, fraud detection, customer personalization, and process automation, helping businesses gain a competitive edge

Proven track record in FinTech delivery

With 13+ years of domain experience and dozens of successful FinTech projects, we know how to address industry-specific challenges. Our portfolio includes custom payment solutions, trading platforms, and mobile banking apps, proving our ability to deliver reliable products on time.

Best practices and compliance with industry security standards

We build FinTech solutions fully aligned with the latest global regulations and security standards such as GDPR, PCI DSS, SEPA, PSD2, and other domain-specific requirements. Our approach ensures financial data safety, system reliability, usability, and seamless interoperability

Full-cycle FinTech development coverage

We provide full-cycle FinTech software development services that cover every stage of the process, from Discovery and UI/UX design to MVP development, delivery, improvements, and ongoing support, ensuring scalable products that grow with your business goals

Questions you may have

Answering popular questions about FinTech mobile and web app development services

- Outsourcing grants cost-effective access to top-tier FinTech expertise and qualified talent

- On-demand tech experience: from FinTech mobile app development to AI integration

- Much lower software development process cost

- Your in-house staff can focus on more critical tasks, such as financial management

- Chatbots

- Robo-advisors

- Fraud predictions

- Risk assessment and lending

- Better insurance recommendations

- Improved analysis of investments

- Lending software(loan origination and commercial loan)

- Banking software(online banking services and mobile banking apps)

- Insurance software(CRMs and software for agencies)

- Investment management software

- Payment processing software(payment apps)

- Personal finance software

- RegTech(risk management and fraud detection)

- FinTech solution grants valuable tools for automating workflows and making them more efficient

- Companies can receive valuable customer insights for smarter decision-making

- The client base can be increased thanks to additional interaction with the financial facility