Mobile Application Payment Gateway in 2026: Everything You Need to Know

Updated 25 Dec 2025

13 Min

18902 Views

It's hard to imagine our lives without credit cards. These tiny pieces of plastic allow us spending enormous amounts so effortlessly that it's easy to get addicted to this process. It's no surprise that such a convenient payment method has migrated to mobile apps along with websites and literally took a monopoly position. If you've decided to create an app involving money operations and you know nearly nothing about the mobile payment gateway integration, then you clicked the right link!

In this article, we'll talk about how to integrate payment gateways in mobile applications and make the payment gateways comparison. Here’s what you’re going to learn:

What is a Payment Gateway?

Payment gateway services are the only way to purchase something through mobile applications. In fact, it's a mediator between the transaction a customer wants to perform and the payment processor (i.e. financial institution). Why there is a need for any sort of mediators? The direct interaction between the app and payment processors is prohibited regarding security reasons.

Learn how to create a mobile wallet app and get your benefits

So, payment gateway solutions serve as an element of the app that uses encryption to ensure the secure processing of sensitive data (e.g. PIN number) and actually makes mobile app payment processing possible. Payment gateways are great for businesses that don’t want to be responsible for keeping the private data in safety and need to add payment options to their applications.

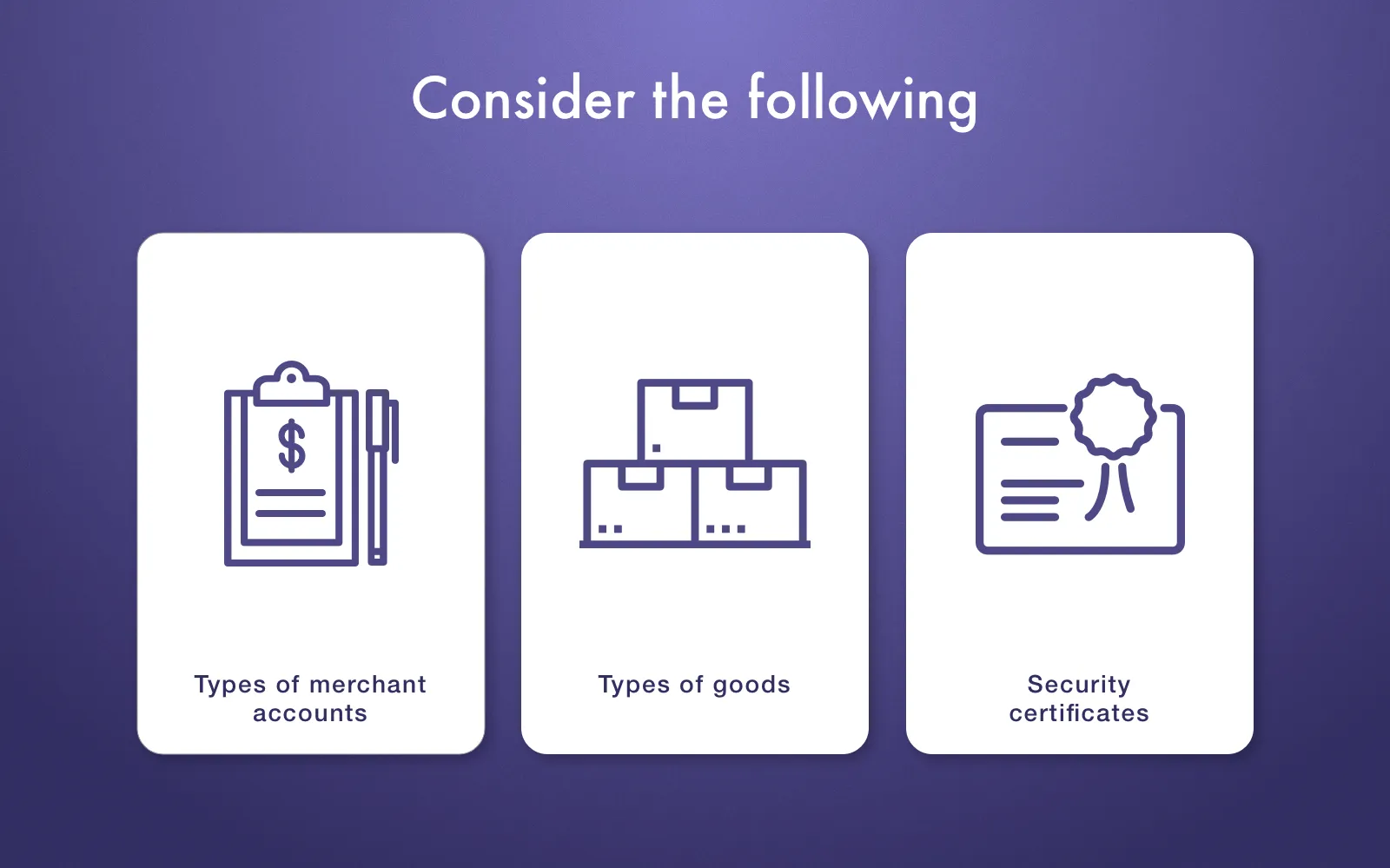

What to Consider Before Mobile Payment Gateway Integration

As we said earlier, there are certain peculiarities you should know about before integrating a credit card payment gateway.

Types of Merchant Accounts to Choose

First of all, let’s dive deeper into the notion of merchant account. Such an account enables you to accept online payments and essentially represents an online bank account for your business. It temporary holds the money you receive from sales in your app (typically 2-7 days) and then delivers them to your regular business bank account. In case you plugged a payment gateway system, the transaction is firstly verified by your provider and only then sent to your merchant account.

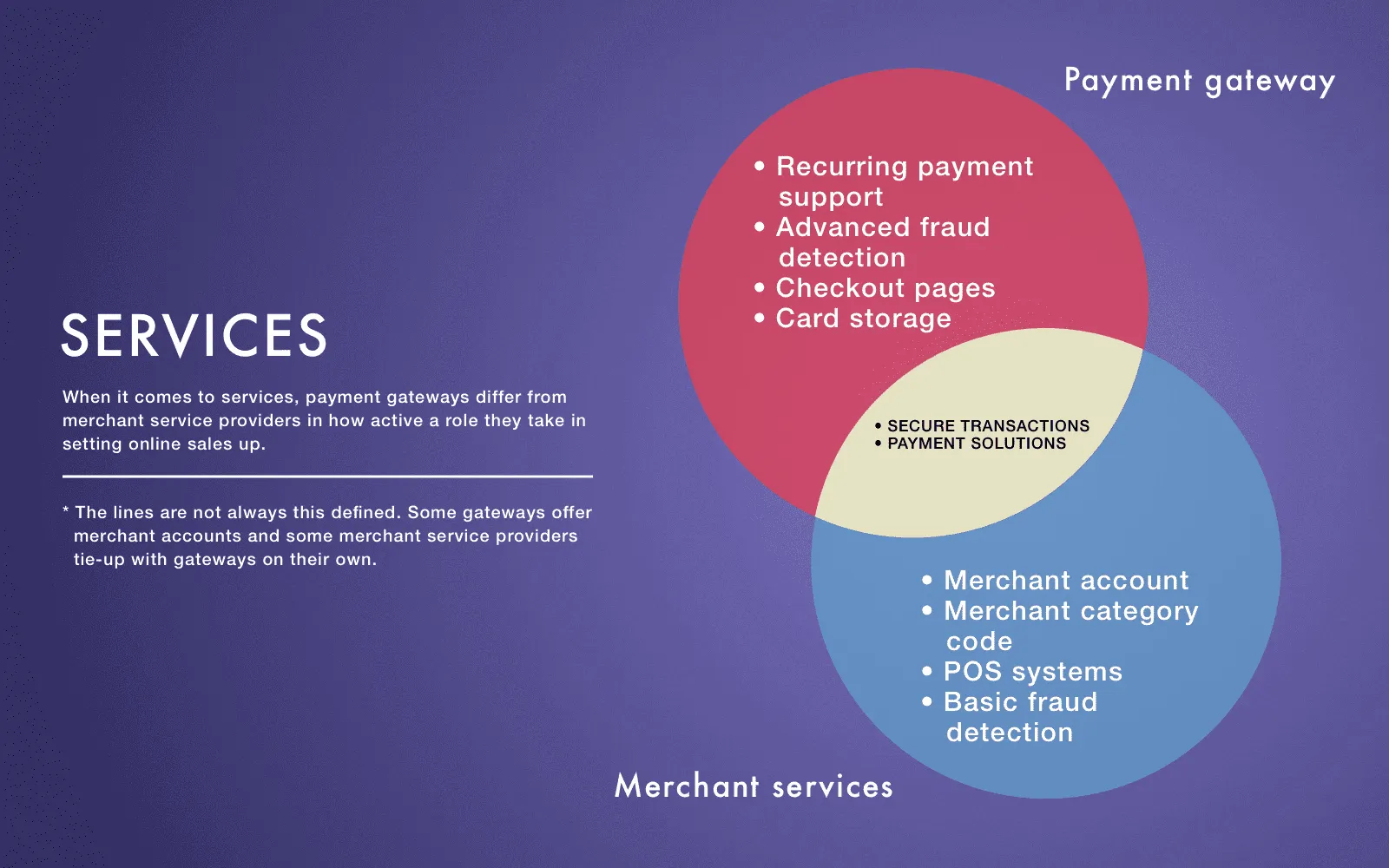

It’s worth mentioning that payment gateway solutions help to facilitate payment processing and maybe an optional choice. In fact, they act as security software which helps to prevent frauds and extend the online payment functionality (e.g. subscription support). At the same time, most merchant accounts allow it's customers to make use of basic online payment functionality and security capabilities.

The merchant account can be opened in banks and integrated with payment gateways if it's necessary and supported by the bank. Another option is to use one of credit card payment gateway providers that offer their customers an all-in-one solution and support merchant accounts (e.g. PayPal and Stripe).

The difference between the payment gateway and merchant account (Source: Chargebee)

Finally, here are two types of merchant accounts you should choose from depending on your needs.

Dedicated merchant account

This type of merchant account is allocated solely for your business. It's a quite expensive and time-consuming option. Most of the time will be spent on going through numerous checks including security checks.

Though this option provides you with a higher level of control over your finances. For example, you can count on custom payment processing fee rates which depends on your sales volume. Respectively the more you sale, the lower your fees are and vice versa. Among other features are increased speed for money transfers (up to 3 days vs. 2-7 days in other account types) and more flexibility for financial operations which includes account debiting, correction of transaction errors etc.

Aggregate merchant account

This type of merchant account implies that the money your business generates is pooled with other businesses. Think of it as a bank cell that’s shared among several people.

This means the level of control over your finances is limited and money withdrawal to the business account may take longer. On other hand, this option isn't so expensive and time-consuming.

Types of Goods You Sell

Goods you're selling are also an important aspect to consider in terms of mobile app payment integration. If you intend to sell digital content then you're going to deal with Play Store or App Store policies for in-app purchases. The app that's distributed from those marketplaces can't use third-party services. This way, all transactions must be made via Apple ID or Gmail.

Both companies provide developers with guidelines and appropriate tools. Apple suggests iOS developers to use a specialized framework, while Google prepared a dedicated API for Android developers. Thus, all transactions will be performed by the App Store or Google Play.

On the other hand, if you're going to sell physical goods, both platforms recommend using mobile payment gateway providers. A payment gateway connects to your application through specialized APIs as well.

Security Certificates

To deal with customer banking data, you have to be PCI DSS certified. This certificate is a must even if you're using a very secure payment gateway. In order to get certified, you need to go through a complex verification procedure.

How to protect your Fintech app from fraudulent attacks? Unveil Machine Learning fraud prevention capabilities and benefits

The first thing you should do is to make sure your information system containing the customer credit card data is compliant with the demands of PCI DSS. The next step is addressing vulnerabilities that were found by pentesters.

After all the fixes are made, your company will be carefully audited by one of the firms having the status of a Qualified Security Assessor. Respectively, they conclude whether to certify your company or not.

Payment gateway integration in mobile application: Things to consider before implementation

Top 5 Payment Gateway Providers

Now, when you have a general idea of merchant accounts and security certificates, let's take a look at the world-leading mobile application payment gateway you can select from.

1. PayPal

Fee: 2.9% + $0.30 per transaction

PayPal is probably the most well-known payment gateway solution, so let’s start with it. The company provides mobile payment services for customers from over 200 countries and accepts 25 different currencies. It also provides additional services such as PayPal Payments Pro and PayPal Express Checkout.

PayPal stands for hosted payment solution. In turn, PayPal Payments Pro is a paid version you can obtain to integrate checkout directly into your app. PayPal Express Checkout is a simple option, it allows you to place a PayPal button on the app page.

Pricing: You pay as little as 2.9% from the total amount of transaction plus $0.30 additionally per each transaction. International transactions are 3.9 percent plus a fee depending on the currency used. Payments Pro subscription is $30 per month. The cashcharge amount is $20 for all transactions.

2. Braintree

Fee: 2.9% + $0.30 per transaction

Braintree is a subsidiary of PayPal. This mobile payment provider has built-in fraud protection, payouts in two days, and live customer support. The main difference between Braintree and PayPal is that the first one offers individual merchant accounts for buyers. Braintree is present in 40 countries and supports about 130 currencies. This mobile application payment gateway comes with software development kits (SDK) written in seven programming languages, featuring iOS and Android support.

Pricing: As a PayPal, Braintree charges you 2.9% and $0.30 per each online transaction. Additionally, the service provides ACH Direct Debit transaction processing at a fixed price of 0.75% per transaction, but no more than $5 per transaction.

Companies that generate about $80K per month can get custom processing on various fees. Nonprofits pay 2.2% + $0.30 per transaction. You’ll pay 3.9% of the total amount of the transaction plus $0.30 based on currency per international transaction.

3. Stripe

Fee: 2.9% + $0.30 per transaction

Stripe provides authorization, a checkout feature for mobile and desktop, analytics, and many more useful options. The interesting feature here is Stripe.js which is the company's secure transmission standard for web development. Stripe offers SDKs written in seven programming languages. So, it's not a problem to integrate Stripe's API into your app.

Pricing: There are no setup fees. The price is the same — 2.9% and $0.30 per transaction. Businesses that process $80,000 per month can get a discount. International card charges add 1 percent to your standard fee. But the service also provides a custom solution and a pricing package for enterprises. The cashcharge amount is $15.

Need a more detailed comparison? Here we compare Stripe, PayPal, and Braintree

4. Dwolla

Fee: quotes-based

Dwolla payment gateway provider is famous for its pricing policy. It offers the full package of payment options. Among them are: the ability to pay thousands of people at once (if it comes to the payroll) and invoice up to 2,000 people. Dwolla works with all popular operating systems using an oAuth and RESTful API.

Pricing: The pricing is based on quotes. It offers three pricing plans: Free, Predictable, and Custom. The free option allows users to create integration with mobile apps in the Dwolla sandbox. The Predictable plan means that the users will pay a specific price per each money transaction. This option also goes with volume discounts. The Custom plan stands for “pay-as-you-grow.” It means that the cost per transaction will rise in step with business growth. Dwolla claims it is a good business approach to define the optimal price.

5. Authorize.net

Fee: $25 per month and 2.9% + $0.30 per transaction

Authorize.net is one of the most reliable payment gateway solutions existing in the U.S. and Canada. In the case with Authorized.net, you will be given a dedicated merchant account. If you already have a merchant account or you want to choose a provider on your own, the company has the Payment Gateway Only plan.

Authorize.net provides the gateway software for both websites and mobile apps. What's more, it offers built-in fraud detection, information management, recurring billing, and PCI DSS compliance with it's tokenization technologies.

Pricing: You have to pay the monthly gateway fee of $25. If you don’t have a merchant account, there is $49 for registration. And, of course, you will be charged 2.9% + $0.30 per transaction.

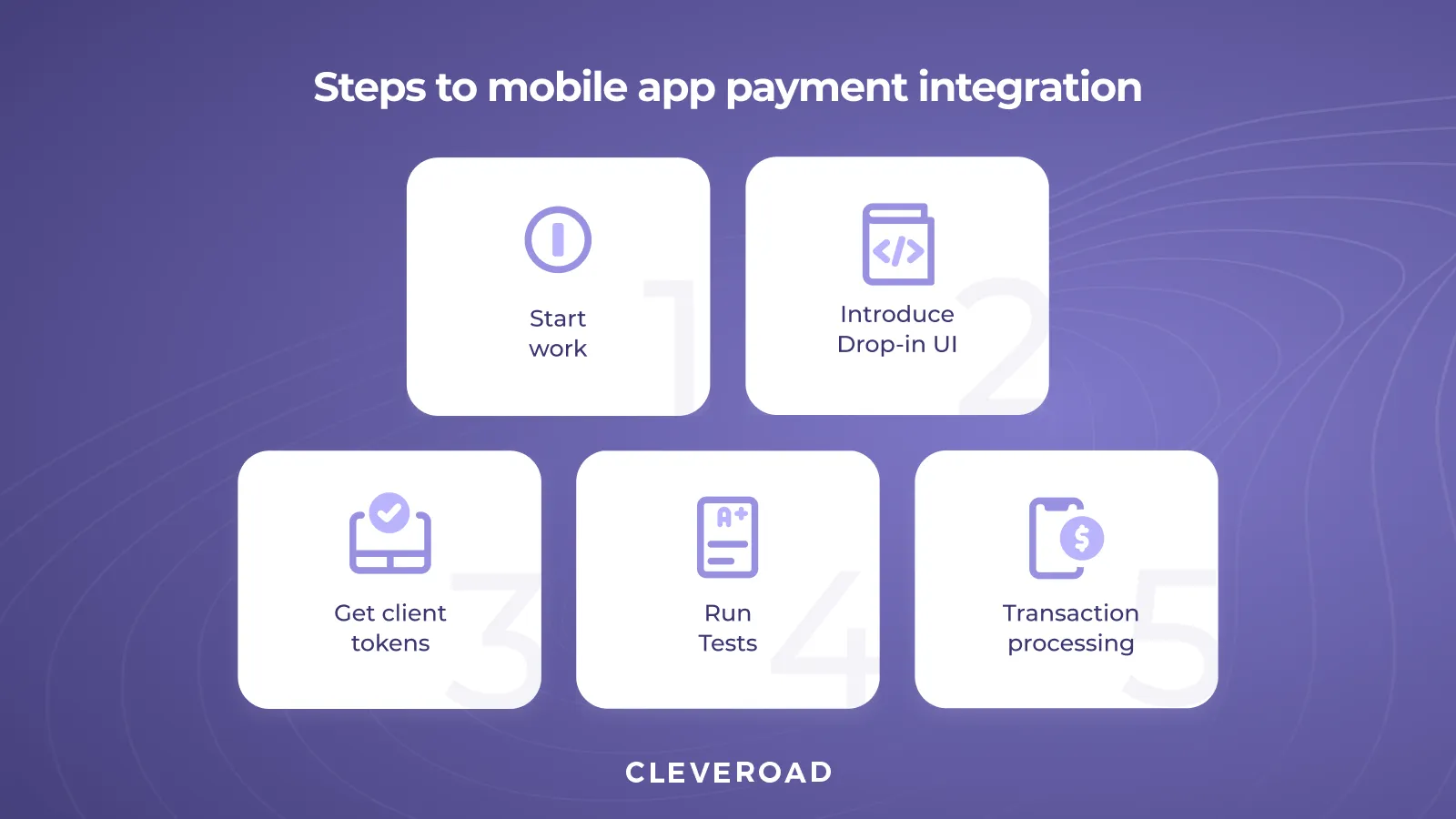

Steps of Payment Gateway Integration into Mobile Application

To demonstrate how to realize a payment gateway solution, we took an example of implementing Braintree service in iOS and Android platforms.

Braintree is a PayPal-based service that provides tools and resources to develop streamlined purchasing solutions. Using the Braintree SDK, the mobile applications will be able to accept both credit cards and other payment methods (PayPal, Apple Pay, etc.).

Now, let’s consider how to integrate payments into apps in essential steps (iOS-based):

Mobile app payment integration steps (both for iOS and Android)

1. Start work

The programmers need to add Braintree to the project utilizing the build systems like CocoaPods, Carthage, Swift Package Manager, etc.

2. Present Drop-in UI

Add some lines to the code. However, you can build a custom UI and tokenize the credit card data directly. Tokenization keys allow customers to tokenize purchasing information directly, so there is no need to create a new key for every session.

3. Obtain client tokens

You need to get a client token generated by your server based on the request from your app. Make new client tokens every time your app restarts. The tokens hold the entire configuration, and authorization details enable customers to initialize the SDK.

4.Test how the integration performs

To run tests utilize Braintree test card data and single-use numbers. Here you need to register a Braintree sandbox account. Your credentials will involve Sandbox merchant ID, public and private keys.

5. Transaction processing

When processing a transaction, use the one-time payment method on your server. It works as follows: after you receive the client’s card data, you move it to the server, and it uses the information to carry out the transaction.

The steps to Android app payment gateway integration are the same. The difference is that software developers need to use the individual Braintree library built for the Android SDK setup.

Direct Credit/Debit Cards Payment Gateway Integration

Some payment gateway providers enable customers to make money transactions through debit/credit cards using the API of the mobile app. API-hosted payment gateways allow users to post their credit or debit card data straight to the merchant's checkout page. Payments are processed with API or HTTPS queries.

Direct credit/debit card payment gateway integration has both advantages and disadvantages. Let’s consider them in detail.

Pros:

- Customization option. The merchants have complete control over the user experience and the UI of the payment processing

- Integration capability. It can be applied to various mobile devices (smartphones, tablets, etc.)

- All required action in one place. Buyers can purchase and pay for goods without leaving your app.

Cons:

- The merchants are entirely responsible for ensuring the security of the payment transactions. That’s why they should be PCI DSS certified and get an SSL certification

- While embedding the API, they need to provide the security of electronic transactions

- The merchants are also in charge of clients’ data hacks and frauds

Integrating SDKs Into an Application

As we already mentioned above, every provider offers it's own SDKs. Usually, you can find them on the official website of your payment gateway provider. Those SDKs include strong mobile libraries that facilitate the work for your software development services provider since the credit card data is processed by them. It means that your team requires less time for integration and you’re not that exposed to PCI compliance.

Below you’ll find the list of technologies a mobile payment gateway integration requires.

Programming languages and frameworks:

- JavaScript

- React

- Redux

- .NET

- GO

- Java

- Node.js

- PHP

- Python

- Ruby

Supported client SDK platforms:

- iOS

- Android

Mobile app payment processing also needs API integration. Each payment provider offers its own APIs, and which the software developers should choose depends on the payment gateway solution the client has picked. For example, Braintree uses GraphQL API and REST API.

Again, if your mobile app sells digital content, your team will have to work with platform-specific payment gateway solutions. These are Apple Pay for iOS and Google Pay for Android.

Wrapping Up

Wondering how much time it takes to integrate payments into the app? Commonly, it takes 40 hours to connect the payment gateway with your app (regardless of payment providers).

Next, the software developers need to test iOS-, and Android-based mobile apps with updated functionality of the providers. It takes 20+ hours. Plus, payment gateway solutions require continued technical support. Be ready to add 5-10 hours monthly.

If you have an app idea and don't know where to start from or just need to integrate a payment gateway, you're at the right place! As a software development company with extensive experience in mobile app payment integration (since 2011), we have helped hundreds of startups and businesses worldwide implement their ideas.

Need some help with payments?

Our software engineers will be glad to help. Fill in a short contact form, we'll contact you in 24h.

Every provider offers it's own SDKs. Usually, you can find them on the official website of your payment gateway provider. Those SDKs include strong mobile libraries that facilitate the work for your software development team since the credit card data is processed by them. It means that your team requires less time for integration and you’re not that exposed to PCI compliance.

Typically, those SDKs help to create payment forms for collecting user data. For example, Stripe offers two options: you can either use their pre-built form component or build it on your own from scratch. That's good news because you have full control over UX.

Again, if your mobile app sells digital content, your team will have to work with platform-specific payment gateway solutions.

In fact, it's a mediator between the transaction a customer wants to perform and the payment processor (i.e. financial institution). Why there is a need for any sort of mediators? The direct interaction between the app and payment processors is prohibited regarding security reasons.

So, payment gateway solutions serve as an element of the app that uses encryption to ensure the secure processing of sensitive data (e.g. PIN number) and actually makes mobile app payment processing possible.

There's no one-size-fits all answer to this question. You should choose the provider according to their fees and security measures. In our opinion the most reliable solutions are:

- Paypal

- Braintree

- Stripe

- Dwolla

- Authorize.net

You can't really say how many payment gateways are there in the world. However, we can highlight several time-tested ones. Here they are:

- Paypal

- Braintree

- Stripe

- Dwolla

- Authorize.net

To choose the appropriate payment gateway you have to conduct research. The main points to pay attention to are fees. For example, PayPal charges 2.9% + $0.30 per transaction. In its turn, Braintree charges 2.9% + $0.30 per transaction after your earnings exceeded $50K.

You can create your own payment gateway if third-party systems don't match your needs. However, integrating a payment system on your own requires close attention to security protocols. It's better to search for an experienced software development company that will deliver a secure and reliable solution.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article