How to Build an Accounting Software and Make a Go of It

Updated 13 Oct 2025

16 Min

11522 Views

The right approach to monetary issues means a lot. And when companies control their income and expenditures wisely, they will always be aware of the current financial situation. However, today we cannot rely solely on our brains, and digital technologies like accounting software can make significant progress in financial management. Still, not all existing software works for different types of businesses. That’s why many companies are looking for more advanced solutions, like building effective accounting software specifically for their needs.

We at Cleveroad, as an experienced Fintech development company, have prepared a comprehensive accounting software development guide. In our article, we will reveal how to create accounting software, provide a detailed review of types of accounting software systems, their features, and much more. Here, you’ll learn:

- Why ready-made accounting tools often fail to meet diverse business needs

- What types of accounting software exist, and how do they differ

- Which core features are essential in modern accounting systems

- The step-by-step process of developing custom accounting software

- Challenges and costs to expect during the development journey

What Is Accounting Software?

Accounting software is a digital tool that helps businesses record and manage their financial transactions. Instead of relying on paper reports or spreadsheets, companies use accounting systems to track income, expenses, payroll, and other financial data in one place. This gives both managers and accountants a clear view of the company’s financial health at any moment.

The real value of accounting software lies in the problems it solves for businesses. Financial operations involve huge volumes of data, and even skilled accountants can’t keep every detail under control. That’s where technology steps in. Modern solutions can speed up data processing and eliminate human errors in calculations. By automating routine tasks, they save time for your teams and ensure accuracy across all accounting operations.

Here are the specific business challenges accounting software solves, and how:

- Time management. Automated processes handle repetitive financial tasks, such as data entry, invoice generation, and reconciliations, allowing accountants to focus on strategic work.

- Faster data processing. Real-time data access and automatic report generation help business owners monitor their company’s financial performance without delays.

- Error prevention. Automated calculations and built-in validation rules eliminate manual mistakes and improve reporting accuracy.

- Efficiency and scalability. Accounting systems securely store large volumes of financial data and allow quick retrieval or updates, supporting business growth and multiple users at once.

- Transparency and control. Detailed dashboards and financial summaries give management full visibility into the company’s income, expenses, and overall performance.

Off-the-shelf vs. custom accounting software

When a company decides to build accounting software, the first question is whether to buy an off-the-shelf solution or invest in custom solution development. Both options help track finances, but they serve businesses in very different ways.

Off-the-shelf accounting software (like QuickBooks, Xero, or FreshBooks) is ready to use once you purchase a subscription. These systems usually come with standard features such as invoicing, expense tracking, and tax calculations. For small businesses and startups, off-the-shelf software can be a cost-effective and quick way to get started. The downside is limited flexibility. Off-the-shelf tools are appropriate for a broad audience, so they may not fully match the compliance rules or unique accounting needs of your company.

Custom accounting software, on the other hand, is developed specifically for your accounting processes. Such software can be tailored to integrate with your existing business systems (for example, CRM or ERP) and include unique features that standard tools don’t offer. The main challenges here are the higher initial development cost and longer development time. However, a tailored accounting solution will help you scale with business growth and reduce dependency on third-party vendors.

To make your decision easier, here’s a quick comparison below in the table:

| Accounting aspect | Off-the-shelf software | Custom software |

Setup speed | Ready to use immediately | Requires development time |

Cost | Lower upfront (subscription model) | Higher upfront, no recurring license fees |

Flexibility | Limited customization | Fully tailored to business needs |

Scalability | May struggle with growth | Scales with your company’s processes |

Integration | Basic, depends on vendor | Can integrate with any existing system |

Compliance | Standard, may not fit local laws | Built to match industry regulations |

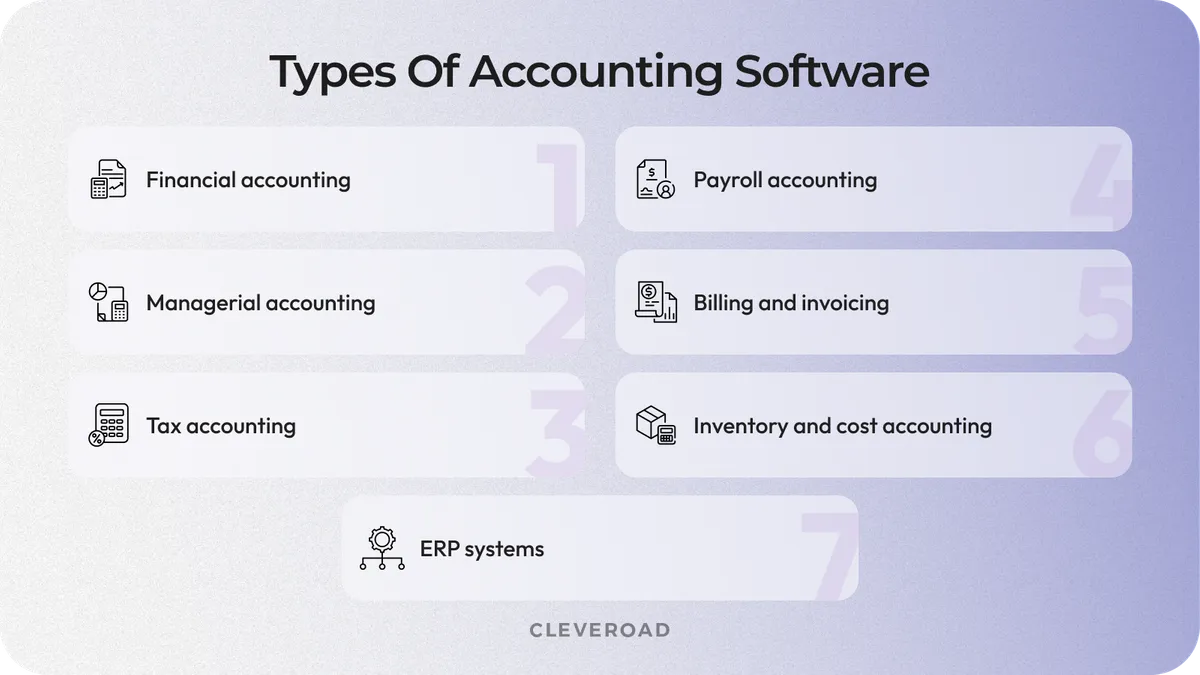

Types of Accounting Software

Businesses use different types of accounting software projects depending on their size, industry, specific needs, accounting tasks, and more. Below are the main categories of accounting software.

Financial accounting software

Financial accounting solutions cover the core financial processes of any organization. Such generic software manages the general ledger and financial reporting. Companies rely on financial accounting tools to maintain accurate records and prepare official reports. For those considering how to build an accounting software for enterprise use, this category is the foundation, as it ensures compliance and clarity in every transaction.

Managerial accounting software

Unlike financial tools focused on external reporting, managerial accounting software supports internal decision-making and analysis. Managerial custom accounting software development allows businesses to create a solution for running forecasts and analyzing performance trends. Leaders and managers use this software to plan ahead and evaluate investment opportunities.

Tax accounting software

Tax compliance is one of the most complex and time-sensitive parts of accounting. Tax software automates calculations and reporting, reducing the risk of errors and penalties. It also adapts to local tax rules, making it easier for businesses to stay compliant across different regions. This is especially valuable when developing accounting software tailored for companies that operate internationally.

Payroll accounting software

Payroll software manages everything related to employee salaries and benefits. They calculate wages, generate payslips, and ensure compliance with both labor and tax laws. Payroll modules can integrate with HR systems to streamline workforce management, which saves time for accounting departments and improves accuracy.

Billing and invoicing software

These solutions simplify cash flow management by tracking pending payments and managing receivables. For service-based businesses, billing and invoicing systems improve transparency with clients and reduce payment delays. Companies that want to make their own accounting software often begin by including invoicing as a first core feature. It is similar to the approach used when considering how to make medical billing software, where accurate payment tracking and automation are key to smooth financial operations.

Inventory and cost accounting software

For companies dealing with physical products, inventory and cost accounting software is essential. It monitors supply chain costs and the cost of goods sold (COGS). By integrating inventory with accounting data, businesses gain real-time visibility into profitability and can adjust pricing or purchasing strategies quickly. You can also integrate this type of accounting software as part of your inventory management system development to ensure all warehouse and financial processes work together seamlessly.

Enterprise accounting software (ERP systems)

Large enterprises require comprehensive solutions that bring everything under one roof. Enterprise Resource Planning (ERP) software integrates accounting with HR, supply chain, CRM, and other business modules. These platforms are complex but offer unmatched scalability. Organizations that want to create their own accounting software at an enterprise scale often choose ERP-level systems to ensure growth support and compliance across multiple markets.

Types of accounting software

Basic Features of Accounting Software

If you’re wondering how to build accounting software specifically for your needs, create a list of MVP features first. We hope that our list of basic features can help with this process.

VAT calculations

Accounting software should undoubtedly calculate all VAT payments after each tax period. It saves accountants’ time and helps to avoid mistakes. In addition, automated VAT handling reduces the risk of penalties from tax authorities and ensures that reports are always filed on time. For businesses that plan to create their own accounting software, this feature is essential because it guarantees compliance and accuracy across every transaction.

Payroll processing

All companies have employees whose salaries should be monitored and managed. Accountants can input the required salary amount per day or per month for each employee. Accounting software helps with calculating the total pay for the indicated time period, including bonuses and taxes. Automated payroll modules also minimize human errors and save time by generating payslips instantly.

Reports

When you decide to create accounting software for your business, you shouldn’t forget about the reports feature. All accountants must create monthly, quarterly, and annual reports (the number depends on the business area) and send them to the tax service. Accounting software for medium-sized or large businesses allows specialists to automate this process, making it much faster.

Processing of invoices

Accounting software makes it possible to deal with invoices. It lets users easily handle all invoices and put them in order. You may also add the Print button to print invoices. Using software, specialists can simply send invoices through the app itself. In addition, a custom accounting app stores all customers' names, addresses, and other details. (Source: BRAC)

We’ve explored valuable lessons from insurance app development. Check out our article to see how these insights can be applied to building efficient accounting software

Electronic payments

We live in a time of high technology and digital payment. Thus, your custom accounting system should allow electronic payments (via credit card or PayPal). Customers will pay directly from their bank accounts. Adding this feature when you build accounting software also improves customer experience by making transactions faster, safer, and more convenient.

Credit monitoring

This feature helps enterprises control the credit limits of their customers. It comes in handy for P2P lending app owners. The credit monitoring option makes it possible to control customer debts and send reminders automatically. For businesses that decide to create an accounting software, such a function strengthens financial discipline and reduces the risk of unpaid debts.

Multiple access levels

Security is twice as important when you want to create accounting software. Usually, devs create a few access levels like ��‘admin’, ‘manager’, and ‘accountant’. Still, we suggest developing a more flexible system with more than 2-3 access levels. It works for large companies with hundreds of employees, and accounting software allows for the delegation of different rights according to their position.

Integration with other systems

Middle and large-sized companies rely on multiple programs like CRM or e-commerce platforms to run their business. Even if you’re wondering how to develop a simple accounting software, keep in mind that it should not be isolated from other software. Accounting systems are usually compatible with online banking services and electronic filing systems. It also simplifies the accountants’ workflow.

Expenses tracking

Business can be successful only when all expenses are controlled. So accounting software should make it possible to put all receipts in order, calculate expenses on the basis of regular payments, and so on. When companies develop accounting software, they often prioritize this feature because it provides full visibility into spending patterns and helps optimize budgets.

Linking of bank accounts

When users can link bank accounts of the enterprises, they can deal with funds on all accounts quickly and efficiently, transferring money without delays. This feature not only simplifies day-to-day money management but also ensures real-time synchronization of balances across different accounts. Companies that want to make their own accounting software usually include this functionality early, since it boosts transparency and reduces manual work for accountants.

Graphics

The last but not least feature is the conversion of figures into graphics. When accountants have a lot of figures in their reports, it’s very useful to transform figures into pie charts or any other type of graph. This way, an accountant can see a structured report in one graph. For teams building an accounting software, visualization tools are vital because they turn complex financial data into insights that enable to make data-driven decisions.

Choose our Fintech development services to build a robust, innovative accounting software solution that will help take your business to the next level

Accounting Software Development Process Step-by-Step

When you’ve picked the type of accounting software you plan to build, it’s important to think over all the necessary steps. The accounting software development process contains the following stages:

Step 1. Define your goals

Before diving into developing accounting software, clarify what you want your system to achieve. Are you building it to automate routine bookkeeping, ensure the software complies with tax laws, or integrate financial data across multiple departments? Defining your goals will shape the scope, required features, and budget for your project, allowing you to plan your resources effectively. Clear objectives also prevent scope creep and help align stakeholders from the start.

Step 2. Select credible FinTech software developers

Choosing the right accounting software development company is one of the most important steps. Look for a vendor with proven technical experience in web and mobile software engineering, a track record in FinTech projects, and knowledge of regulatory requirements in your market. Industry-specific expertise, a strong portfolio, and positive client reviews on platforms like Clutch are signals of reliability. Make sure your partner can provide the full team you’ll need, from business analysts to UI/UX designers, and keep that team consistent throughout the project. This ensures deep product knowledge and smoother collaboration.

Cleveroad has extensive experience in providing Fintech software development services. Recently, we helped our client, Penneo, a Danish software-as-a-service company specializing in digital signatures and KYC/AML, scale its AWS cloud platform quickly. They needed a senior DevOps professional with deep AWS skills, strong English proficiency, and a secure partner. ISO 27001 compliance was a key factor they were looking for.

Cleveroad sent the candidates’ CVs in 24 hours and ran a tight interview flow. Our engineers joined and took on core tasks, such as Grafana DB migration, a separate node group for Prometheus, IAM setup for ECR access, IaC with Terraform, CI/CD support, SSO with Okta, and ongoing monitoring. We kept a stable cadence with weekly and biweekly calls.

As a result, Penneo strengthened the stability of their cloud infrastructure and ensured continuous platform scalability to support business growth. The collaboration allowed the company to maintain uninterrupted operations, enhance internal DevOps efficiency, and deliver a smoother experience for its 2,500+ clients. The client praised our speed and expertise and chose to continue the partnership.

Here’s what Hans Jørgen Skovgaard, CTO at Penneo, says about collaboration with Cleveroad:

Hans Jørgen Skovgaard, CTO at Penneo: Feedback on Cleveroad's Cloud Infrastructure Services

Step 3. Conduct a thorough planning stage

The planning stage transforms your initial idea into a structured roadmap for development. At this step, we define the project scope and outline the business goals in detail. This process also includes analyzing essential business processes, preparing a detailed feature list, creating first UI/UX concepts, and identifying third-party integrations. By the end, you receive cost estimates, a timeline, and a clear vision of the product, documented in detailed project materials such as the Software Architecture Document (SAD), business architecture diagrams, and other technical specifications.

During the Discovery Phase, the Cleveroad team will guide you through requirement analysis and feature listing, ensuring your accounting software matches your business goals

Step 4. Prioritize security

Financial data is highly sensitive, so security cannot be an afterthought. At a minimum, your accounting software must utilize strong data encryption, implement role-based access control, and support two-factor authentication to safeguard user accounts. Firewalls and network monitoring provide an additional layer of protection, while regular updates patch vulnerabilities before hackers can exploit them. Finally, don’t forget about compliance, such as GDPR (EU), CCPA (US), PIPEDA (Canada), LGPD (Brazil), or other regional laws, which may apply depending on where your business operates. Maintaining these basics will ensure your software is both secure and trustworthy.

Step 5. Software Development and QA

Accounting software development process is rather complex, and it takes hundreds of hours to create a high-quality product. Developers start by creating a functioning version of accounting software. If necessary, accounting software can be developed using a test-driven development approach. It means that developers and QA engineers write test cases for software before it's actual development. It helps with avoiding possible bugs in the future.

During this stage, one of the most important decisions is made is where to host the software. There are 3 options to choose from, each with its own pros and cons:

On-premises solution

This option is one of the most popular. However, this type of accounting software requires additional costs and a solid infrastructure to manage it effectively. Another weakness of this solution is that local solutions are much more difficult to update and maintain. And the more complex the update is, the higher the price tag will be for such a software development lifecycle.

Web-based software

This option’s main idea is that there are separate hosts that provide space on their servers for your software. When hosting your system on a remote server, you need to pay certain software fees, which are required by the hardware provider. A huge plus of this option is that the accounting software based on the web is many times more flexible and easy to customize and update. And the easier it is for you to maintain the software, the fewer costs will be spent on this process.

Cloud hosting

The last hosting option slightly changes the vector of your software. Cloud-hosted accounting software is delivered as a service to end-users, eliminating the need for expensive infrastructure investments and overheads. In addition, such software has excellent scalability, which allows you to modify it so that the software always meets the current business requirements.

Step 6. Integrate accounting solutions into your workflows

Accounting software development doesn’t end with release. Once the product is launched, the next challenge is to ensure that your accounting system fits seamlessly into existing operations. Smooth software integration prevents disruptions and helps employees adapt quickly, which is especially important for companies handling sensitive financial data on a daily basis.

For maximum efficiency, accounting software should also integrate with other business systems to ensure that all financial and operational processes run smoothly. This approach eliminates data silos, reduces manual entry, and provides decision-makers with real-time insights across all departments. Typical integrations include:

- CRM systems to synchronize customer data, invoices, and payments

- ERP systems to align accounting with inventory, HR, and supply chain processes

- E-commerce platforms to automatically record online transactions, sales, and refunds

- Banking APIs to enable instant transaction tracking and reconciliation

- Payroll and HR systems to keep salary, tax, and benefits data accurate and up to date

At Cleveroad, we provide post-release support to make this transition effortless. Our team helps businesses set up workflows, trains staff to work with the new software, and ensures that integrations run smoothly. As your company grows, we also assist in scaling the system and adding new features so that the solution evolves alongside your business goals.

How Much Does It Cost to Build Accounting Software?

As we already know how to create accounting software, its types, features, and security issues, it’s high time to find out how much this highly effective system will cost.

How much does it cost to build custom accounting software? As a basis for the estimate, we took the financial system project we’ve created for a Scandinavian company, which they needed for accounting. Let’s see what development modules are available.

| Accounting software module | Approx time (h) |

Registration | 60 hours |

Dashboard | 192 hours |

Bank Reconciliation | 80 hours |

Invoice creating | 337 hours |

Quote creating | 176 hours |

Recurring invoice | 176 hours |

TAX Functional | 149 hours |

Accounting | 136 hours |

Export data | 243 hours |

Contacts | 68 hours |

Profile | 112 hours |

Bookkeeping | 80 hours |

Reporting | 64 hours |

Total development time | 1873 hours |

Keep in mind that software developers aren't the only specialists you need on a team to build such a complex product. Here's the full team composition you'll need:

- Front-end developer

- Back-end developer

- UI/UX designer

- Business Analyst

- Project Manager

- QA engineer

- DevOps engineer

- Team lead

Given that team composition and the amount of work, accounting software will cost you approximately $165,000 - $220,000. Contact us to get an exact estimate for your accounting software, taking into account its scale and specific business requirements.

There is also an option to optimize the budget. You can build work on an outstaff model and hire only developers. In this case, all non-development costs are excluded, but for effective delivery to the set deadlines, you will need to perform the functions of PM, UI/UX, QA, and DevOps specialists.

In conclusion, we can say that when you want to build accounting software you should be prepared that the development process is not easy nor fast. But with a clever approach, the final product will be highly competitive and advantageous on the market.

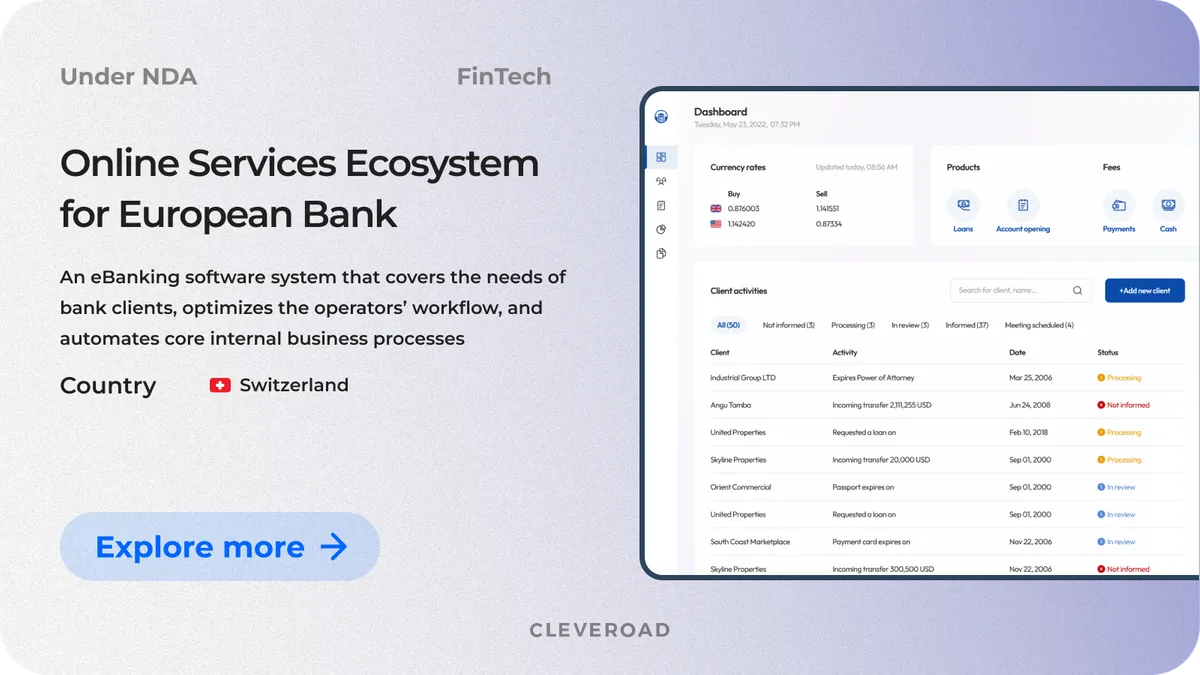

Cleveroad Experience in Creating Software Solutions for Fintech

For this time, our team has built many software solutions for banks and financial institutions. Here’s one of our latest projects we want to share with you.

Our customer is a Swiss bank that offers online investment, loan lending, and trading services to clients from the B2B and B2C sectors. Its current solution in use was inflexible and didn't allow business scaling. The bank needed a technical partner to:

- Replace an outdated MVP version and instead create a complete system that will satisfy the needs of B2B/B2C clients, optimize internal processes, and will be capable of enlarging and creating new abilities for global business.

- Boost the user experience (UX) in terms of registration, digital account opening, and work in the eBanking portal, helping become and remain bank clients, and increasing retention rates.

- Work according to regulatory compliance for bank investment software. That means making the new system comply with FMIA (Financial Market Infrastructure Act), following all data rules.

The Cleveroad team has built and designed a custom eBanking ecosystem with all the functionality required to cover the needs of B2B and B2C clients, including: user-friendly sign-up, digital account opening system including KYC pass, and online banking portal.

The new system meets regulations and requirements stated in the FMIA. Now, the bank can now freely operate under its license and provide clients with secure banking at the level of Swiss standards, known for their rigor. It resulted in the increase of user retention by 20-30%.

Cooperation with Cleveroad will give you a transparent and reliable software development process, accompanied by a personalized approach. Our specialists are equipped with robust technical skills and will help you to determine the main goals of a project. A flexible team is always ready to provide you with a quick response to new requirements integrates into existing workflows.

Looking for an Fintech developer?

Contact us! With 13+ years of experience in the Fintech domain, we are ready to help you create a tailored and reliable accounting solution that will boost your financial business performance

Usually, the development of custom accounting software contains the following stages:

- Step 1. Define your goals

- Step 2. Select credible financial software developers

- Step 3. Conduct a thorough planning stage

- Step 4. Prioritize security

- Step 5. Accounting software development process and QA

- Step 6. Integrate accounting solutions into your workflows

Here is a list of core accounting features software you need to implement:

- VAT calculations

- Payroll processing

- Reports

- Processing of invoices

- Electronic payments

- Credit monitoring

- Multiple access levels

- Integration with other systems

- Expenses tracking

- Linking of bank accounts

- Graphics

Accounting software development cost is approximately $165,000 – $220,000, but the final price always depends on factors such as project scope, feature set, and integrations.

Developing accounting software that meets your business needs usually takes 4 to 9 months, depending on the complexity of key features, integrations, and compliance requirements.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

2 commentsOne of the best post on accounting software, As a business owner I can truly understand how it important to have an user-friendly accounting software to track all of business financial data. Can you please also suggest which programming language is best for accounting software if I am willing to create our one accounting software?

Thank you so much. Im looking forward to make a system with you