Insurance Mobile App Development: Features, Costs and Challenges

Updated 26 Mar 2024

18 Min

4530 Views

Insurance app development is no longer a luxury for the industry, but a necessity for staying competitive to boost client satisfaction. Customers expect seamless and convenient access to insurance services, and mobile application is the best way to meet these expectations. That's why insurance mobile apps not only streamline internal business processes but also foster stronger connections with customers, ultimately driving business growth and success.

This guide is created to help you discover more about insurance mobile application development, their major types, core functionality, challenges to overcome, average costs and much more.

Benefits of the Mobile App for Insurance Business

Insurance mobile applications offer users the convenience of accessing policy information, submitting claims, and managing their accounts anytime, anywhere, directly from their smartphones. Additionally, these apps streamline the insurance process by providing efficient problem-solving capabilities, enabling users to report incidents, upload documents, and receive real-time assistance, thus enhancing customer satisfaction and reducing administrative burdens for insurance providers.

Let’s find out the key advantages to use with insurance enterprise app development.

Streamlined claims processing

Traditional claims processing can be time-consuming and cumbersome, leading to delays and frustration for you as a policyholder. These consequences can not only impact customer satisfaction but also contribute to increased administrative costs for insurers.

To solve these problems, you can develop an insurance app and facilitate swift claims initiation and processing. Using the built mobile app for insurance services, your customers can easily submit documentation, track claim status, and receive real-time updates, significantly reducing processing times to enhance overall satisfaction.

Real-time communication

Standard communication channels may hinder effective and timely interactions between insurers and policyholders. Moreover, the dependence on customer service representatives for routine inquiries can lead to long wait times.

Due to the insurance app development, you can enhance real-time communication, allowing insurers to send your clients directly the important updates, policy information, and alerts. This ensures swift communication during critical moments, fostering transparency and trust. What's more, if you create an insurance application, it may empower your customers with independent task management options (e.g., policy inquiries), reducing the strain on customer support teams and providing a more efficient service experience.

Data security and privacy

Data security and privacy are significant concerns when dealing with sensitive insurance information. However, insurance mobile apps prioritize robust security measures such as encryption and authentication protocols, ensuring user data's confidentiality and integrity. This commitment to security helps build trust with policyholders and assures them that their information is handled with the utmost care and diligence.

Enhanced customer engagement

Maintaining active engagement with policyholders is a must for your business, and insurance mobile apps provide a needed direct and constant connection with your customers. By sending personalized notifications, providing policy updates, and offering interactive features, insurers can effectively foster continuous engagement, improve customer loyalty, and ultimately increase retention rates. With the help of insurance app development services, the insurers can confidently and assertively establish a strong relationship with their policyholders.

Why you should start insurance mobile app development

Major Types of Insurance Apps

We would like to help you find the best type of solution for insurance mobile app development that offers customizable workflows and improved customer services.

Life insurance applications

This particular type of such app is designed for consumer insurance coverage in case of death or disability. Life insurance app development enables users to explore policies, calculate premiums based on age and coverage amount, and apply for coverage directly from their smartphones.

Moreover, users can conveniently access policy details, view beneficiaries, and manage their beneficiaries' information. Some advanced life insurance apps offer features like policy performance tracking, premium payment reminders, and access to financial planning tools to help users make informed decisions about their coverage.

The famous life insurance products: Oscar Health, myCigna, Aetna Health, HDFC Life Insurance app

Health insurance apps

Health insurance app development focuses on providing policyholders with access to healthcare services and managing their health-related expenses with the help of mobile applications. They often include features like digital insurance ID cards for easy access during medical appointments, coverage verification tools, and directories of in-network healthcare providers. Users can also submit claims digitally, track claim status in real-time, and view their policy benefits and coverage details.

Additionally, insurance app development for health coverage may offer wellness programs, health tracking tools, and resources for finding preventive care services, promoting proactive health management among policyholders.

The famous health insurance apps: Blue Cross Blue Shield, UnitedHealthcare, Kaiser Permanente

Vehicle insurance mobile apps

Mobile applications for auto insurance are specifically created to obtain coverage for your vehicles. Through the car insurance app development, these solutions allow you to access insurance cards and other policy documentation through your portable gadget. In addition, vehicle insurance apps can offer emergency roadside assistance, submit and manage claims, and receive reminders for the expiration of coverage and premium dues. Some auto insurance applications also offer personalized savings based on good driving practices, car tracking, and driver behavior monitoring, which all contribute to enhancing driving experience and road safety.

The famous vehicle insurance apps: GEICO Mobile, Allstate Mobile, State Farm mobile, Progressive

Property insurance applications

These apps for insurance sector can assist your clients (as homeowners or accommodation renters) to access policy documents, coverage details, and claim filing procedures from the mobile device. With the help of such an app, your customers can document property inventory, including photos and receipts, to streamline the claims process in case of theft, damage, or loss, as well as receive beneficial insurance offerings on their mobile devices.

Property insurance app development may also offer features such as weather alerts, home security tips, and maintenance reminders to help you prevent potential risks and maintain the integrity of your properties. Additionally, these apps can facilitate communication with insurance agents and adjusters, ensuring timely assistance and resolution of property-related issues.

The famous property insurance apps in both Apple App Store and Google Play: Lemonade, Liberty Mutual, Travelers

There are many kinds of insurance apps (e.g., one solving agricultural insurance issues), but we've enlisted the most common types of insurance apps you can apply to when considering the best one for business. In order to choose the type of insurance app which is the most appropriate for your business, you can apply to a skilled IT provider for insurance software development services. Provider's specialists will help you consider details necessary for a digital product development for insurance domain, like app type or feature list, and assist you in its proper implementation.

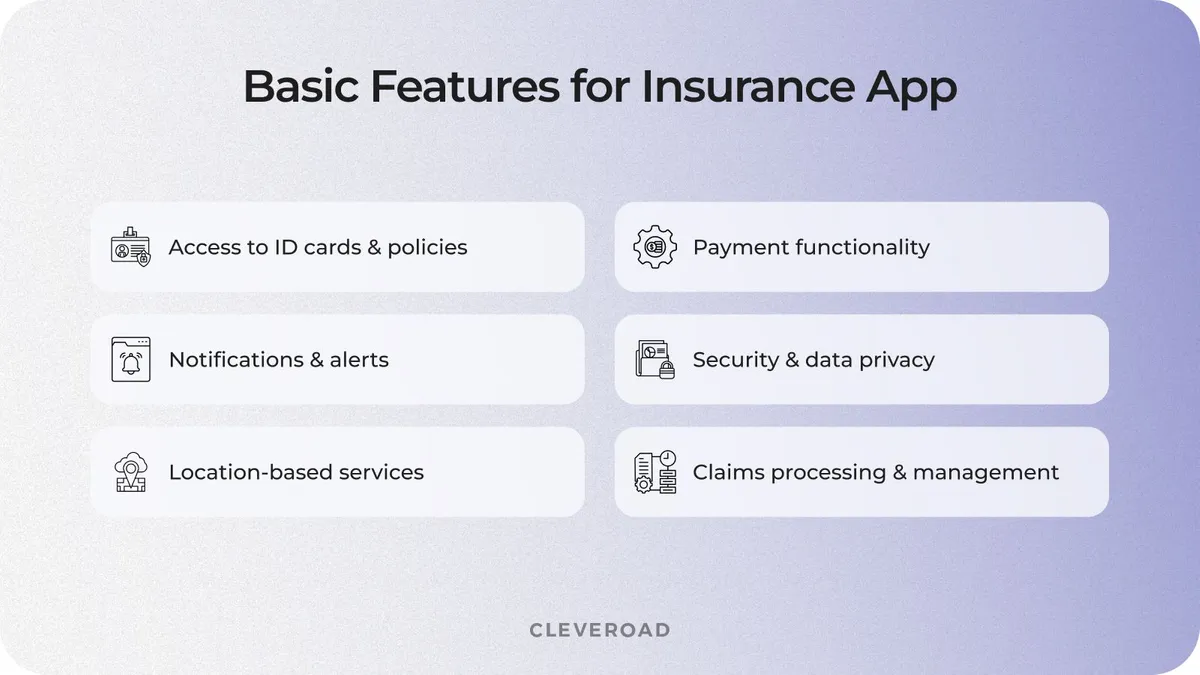

Core Features of Insurance App to Include

Mobile insurance apps can become efficient and irreplaceable tools that can save time for both of agents and customers since it will eliminate the necessity of personal visits to the office. In order to cost-effectively start your insurance application development, you should think about how to develop a Minimum Viable Product (MVP) for your app idea. It means you should choose functionality the most essential for your solution’s functioning.

The right MVP model will help you test your insurance mobile app idea to understand its viability, as well as gather valuable feedback from users, identify potential pain points, and iterate on the features that resonate most with your target audience.

Access to ID cards and policies

An insurance app provides the ability to access all policies quickly and conveniently, making it simple to review them while on the go. Vehicle insurance details are securely stored on your smartphone, eliminating the need for a physical proof-of-insurance card. Furthermore, you can easily update personal information and coverage details directly within the app, ensuring that your policy information is always accurate. In case of emergencies, the app allows for instant access to digital ID cards, facilitating seamless interactions with law enforcement or in accidents.

Notifications and alerts

Keep users informed about important updates, policy renewals, payment reminders, and relevant news through this insurance mobile application development feature. Personalize notifications based on user preferences, policy status, and location to ensure timely and relevant communication. Notifications and alerts help users stay engaged with their insurance policies and take timely actions to maintain coverage and manage risks effectively.

Location-based services

You can utilize geolocation technology to provide users with location-based services and information relevant to their insurance coverage. For example, users can receive alerts about severe weather events or natural disasters in their area, along with safety tips and instructions on how to file insurance claims in case of damage or loss. Leveraging location-based services enhances user engagement and provides valuable assistance during emergencies.

Payment functionality

Creating a user-friendly payment process is an important aspect to consider when developing a general insurance app. If you include a payment section you will provide your users with a capability to input their card information and set up auto-payment.

Moreover, integrating multiple payment options such as PayPal or digital wallets can enhance the convenience and accessibility for your customers with diverse preferences. Robust security measures like encryption and two-factor authentication may also ensure the protection of users' financial data, instilling trust and confidence in the app's payment functionality.

Security and data privacy

Prioritize the security and privacy of user data by implementing robust security measures and compliance standards within the app. Utilize encryption protocols, biometric authentication, and multi-factor authentication (MFA) to protect sensitive user information and transactions. Ensure compliance with data protection regulations such as GDPR, HIPAA, and so on to build trust and confidence among users regarding their data privacy rights and protections.

Claims processing and management

One of the key features of mobile insurance applications is the ability to easily submit claims in case of an accident. A mobile app enables insured individuals to quickly provide an accurate account of an incident and pin video or pictures there. Additionally, the solution has the capability to track location, enabling them to receive assistance more efficiently. Customers will experience quicker claim processing as a result.

MVP features to implement in insurance mobile app development

Insurance App Development Cost

An insurance app development cost ranges from $50,000 to $500,000+. But in order to define how much it costs to build your insurance mobile application in detail, you should consider key cost-forming factors, like the ones below.

Feature complexity. Basic features like user registration, policy management, and claims submission are relatively simple to develop. However, integrating advanced functionalities such as AI-driven chatbots for customer support, real-time policy quotes, and data analytics for risk assessment can escalate costs due to their intricate development requirements and the need for specialized expertise.

UI/UX design. A well-designed interface enhances user engagement and satisfaction, but it often requires extensive research, prototyping, and iterative testing. Complex designs with intricate animations, personalized dashboards, and seamless navigation can increase development costs as they demand more time and resources from designers and insurance mobile app developers.

Security and compliance. Implementing robust security measures such as encryption protocols, secure authentication mechanisms, and compliance with regulations like GDPR or HIPAA involves additional development efforts and costs. Moreover, regular security audits and updates are essential ongoing expenses to safeguard the app against evolving threats and maintain regulatory compliance.

Integration with third-party systems. Insurance mobile apps often need to integrate with various third-party systems such as payment gateways, custom CRM development and integration, different backend systems for insurance needs, etc. Each implementation adds complexity to the development process, requiring custom APIs, data mapping, and compatibility testing. Moreover, licensing fees or subscription costs associated with utilizing third-party services contribute to the overall development expenses.

Regulatory compliance and legal support. Engaging legal experts to navigate complex regulatory landscapes, drafting compliant privacy policies, and implementing mechanisms for user consent and data governance contribute to development costs. Moreover, ongoing compliance monitoring and updates to adapt to regulatory changes incur additional expenses.

Choice of development vendor. This aspect significantly influences the overall cost of insurance mobile app development. Opting for an experienced vendor with a proven track record in developing complex mobile applications, particularly in the insurance domain, may entail higher upfront costs but often results in a more robust and high-quality product. Factors such as vendor location, expertise, reputation, and project management approach impact development costs. But in order to economize, you can apply to outsourcing IT providers typically offering lower rates but requiring thorough due diligence to ensure quality and reliability.

Every insurance solution is unique in its characteristics, and should be estimated separately. You can contact us to have an estimate for your insurance application idea.

Insurance App Development Process

Let’s discuss what the insurance mobile app development flow looks like. Preparing for it, you should understand that such a software creation is a complex thing due to the need to balance intricate technical requirements with user-centric design and stringent regulatory standards. Thus, understanding the multifaceted nature of insurance app development is crucial for navigating its complexities effectively. That’s why you need the help of an IT outsourcing vendor – a software development company with enough expertise to help you develop your insurance app.

So, how to choose the right software development company to help you succeed with the solution creation for an insurance company?

- Evaluate their expertise in insurance software development, ensuring they possess a deep understanding of industry-specific challenges (like compliance regulations, insurance app integration with legacy systems, or a complex business logic) and user expectations.

- Assess their technological capabilities, including proficiency in mobile app development frameworks, security protocols, and integration with backend systems and policy management platforms.

- Consider their ability to provide ongoing support and maintenance services post-launch, as the insurance landscape is continuously evolving, requiring updates to stay competitive.

- Prioritize insurance mobile app development vendors who emphasize collaboration and communication throughout the development process, ensuring alignment with your vision.

After you’ve chosen the insurance app building provider, they’ll start working with your app idea. We’ll explain how this workflow will pass on the example of our Cleveroad SDLC.

First contact

To start our collaboration, you can visit our website and submit a request detailing your insurance enterprise app development concept. Our Senior Business Delivery Manager will review the request and get in touch to discuss any needed clarifications.

Solution workshop stage

The Solution Workshop stage is intended to align your business requirements with technical execution of insurance app creation, which is done freely by the Solution Team.

The aims of this stage are the following:

- Identifying the features scope for your insurance app

- Defining your business needs and problems

- Calculating the estimate for the required development efforts

- Clarifying the expectations from your insurance product

Our Solution Team consists of certified business analysts, experienced solution architects, and creative UI/UX designers with expertise in various industries. They work to define an insurance application’s project scope as well as a necessary functionality list for your app, based on your business goals and challenges. As a result of the Solution workshop stage, you get a proposal that includes a high-level functionality list, different diagrams (e.g., architecture diagram, value stream diagram), Solution Architecture Document (SAD), and so on.

Discovery stage

Our Discovery Phase services can help speed up insurance app development and improve product quality. In this phase, we outline your business processes and further develop the requirements. This includes identifying platforms for your insurance app to cover, specifying features, and addressing other necessary details. The team documents technical and business decisions in the Software Architecture Document to create an insurance project cost estimate using the information gathered during the Discovery phase.

Moreover, the UI/UX designers start working on creating the user interface wireframes and prototypes. Rendering the UI/UX design services, they ensure a seamless and intuitive user experience for your insurance app

App development and QA services

We utilize the Agile methodology to create and enhance our insurance solution for optimal success. Our team follows an iterative process for your project, working in two-week intervals known as sprints under the guidance of our Project Manager. The work scope for the next two weeks will be determined collaboratively by you and the development team.

The development team implements pre-defined functionality as part of the process of your insurance mobile application development. QA engineers are responsible for testing the functionality of the insurance system project until its release, ensuring that all features built in each sprint are thoroughly tested. Particularly, they test the front-end and back-end simultaneously and provide results that software developers may use to address bugs.

Find out more about QA testing process at Cleveroad

Insurance app release, support and maintenance

Our team also completes the release of your insurance application. At the day of the app’s release, the QA team is conducting smoke tests to ensure stability. Developers, in their turn, are working on any critical issues and providing hotfixes as needed. Then, we will help you to implement and deploy the insurance solution in your digital business environment.

In case you need support and maintenance services, our team keeps working with you the following way: we make further adjustments to the insurance software based on your app users’ feedback and provide ongoing maintenance for your solution for insurance needs, which includes enhancements and adding new features.

If you have got any other tech questions as to insurance app development solutions, you can contact us. Our IT experts will provide you with all the information you need to start the insurance application creation process, from initial consultation to final deployment, ensuring that your insurance app meets your specific requirements and complies with industry standards and regulations.

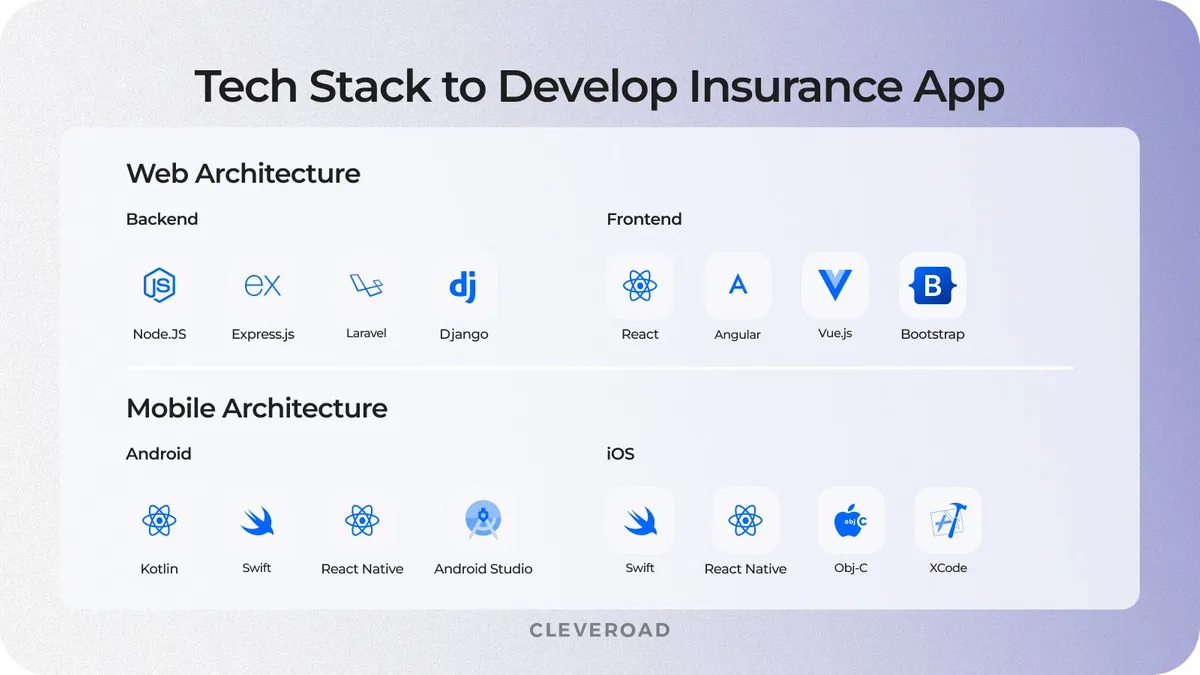

Technology Stack For Insurance Mobile App Development

We’ll enlighten the common tech stack our developers would use to create a mobile application for your insurance company.

Insurance mobile application development tech stack

NB! Please kindly note that this insurance application development technology stack is approximate. You can know more about the detailed one applying to our domain experts that will make it on the basis of your app feature set.

Discover how to choose the right tech stack for mobile application through our insight!

The Major Challenges of Insurance Mobile App Development

Developing an insurance mobile app comes with its own set of challenges, spanning various aspects from technical to user experience. Here are the most common challenges you may encounter.

Security and compliance

Insurance apps deal with sensitive personal and financial data, making security a paramount concern. Thus, ensuring end-to-end encryption, secure data storage, and robust authentication mechanisms are vital when you cooperate with an experienced insurance app development vendor.

Additionally, compliance with regulations like GDPR, HIPAA, or regional insurance laws adds another layer of complexity to your insurance app creation process. Balancing usability with stringent security measures without compromising user experience is a significant challenge, and the skilled vendors like Cleveroad can solve it: we have been successfully working with such regulations and standards as FMIA, ACORD, PIPEDA, GDPR and HIPAA.

User experience and accessibility

Designing an intuitive and accessible user interface during the insurance app development process is crucial for engaging users and encouraging insurance app adoption. However, the processes to cover insurance needs can be inherently complex, involving intricate policy details and legal jargon. Simplifying these processes while providing comprehensive information and options can be challenging. Ensuring accessibility for users with disabilities further also adds complexity, requiring adherence to accessibility guidelines and standards.

Performance and scalability

As your insurance company’s user base grows and usage patterns evolve, ensuring optimal app performance and scalability becomes critical. Balancing server load, optimizing database queries, and leveraging caching mechanisms are essential for maintaining responsiveness under varying loads for your insurance mobile app. Additionally, accommodating spikes in traffic during peak times, such as open enrollment periods, requires robust infrastructure planning and scalability measures.

Customer trust and engagement

Building trust in the app's reliability, security, and transparency is crucial for fostering long-term customer relationships. Communicating effectively about data usage, privacy policies, and security measures with your IT vendor is essential to duly implement them in your insurance application and consequently instill confidence in users. Moreover, providing personalized experiences, proactive notifications, and responsive customer support can enhance user engagement. However, you should perform careful implementation to avoid being intrusive or overwhelming.

Addressing these challenges requires a multidisciplinary approach, involving collaboration between developers, designers, security experts, and compliance officers. The skilled insurance mobile app development team like our Cleveroad specialists can properly solve all the said issues.

Major challenges of insurance mobile app development

Cleveroad Expertise in Insurance App Development

This app development requires a profound understanding of all the insurance domain peculiarities to create a powerful software solution helpful for your business. In this case, collaboration with a skilled insurance app development vendor like our Cleveroad company is necessary.

Cleveroad is an outsourcing Fintech software development company (including insurance software development) that has been working to provide you with the domain mobile solutions (e.g., underwriting/quoting software, omnichannel CRMs, mobile apps for insurance adjusters, etc.) of any complexity since 2011.

Working with us, you will get:

- Custom insurance app development for effective dealing with brokerage as well as insurance agencies' management

- The free Solution workshop stage to connect your business needs and their technological integration

- Rethinking your existing insurance applications through legacy software modernization services to meet the latest industry standards (e.g., usability, security and interoperability)

- Non-Disclosure Agreement (NDA) signing to protect your insurance app concept uniqueness per your wish

- In-depth experience of working with integrations for your insurance application such as Actico and Ondato for fraud detection, Adobe Sign and DocuSign to establish electronic signatures, PandaDoc and DocFactory for insurance document management, etc.

- End-to-end insurance software development process with the help of the innovative tech stack to deliver the flawless app that is tailored to streamline insurance operations, enhance customer experiences, and ensure robust security measures for sensitive data protection.

One of our successful fintech app development projects delivered is an Online Services Ecosystem For Managing Auto Insurance. Our customer, a vehicle insurance company from the USA faced challenges with an inefficient company app hindering their business growth. To address this, we needed to replace their outdated car insurance web app with a modern, comprehensive system. The new system should offer improved services for insurers and their employees, as well as enhanced the insurance experience for our customer's clients with a new mobile app.

Consequently, our customer has gained a resilient platform tailored to their business needs, enabling them to generate revenue by offering their services online. This comprehensive solution includes a robust web app and a mobile app, enhancing their online presence and attracting new clients to their insurance business.

We are also ready to develop robust and resilient fintech and insurance applications for your own business. All you need is to contact us providing our IT specialists with your insurance app concept details to start our collaboration.

Digitize your insurance processes with us

Apply to Cleveroad domain experts for insurance app development services and streamline your operations through a modern and resilient domain app

An insurance mobile app is a digital application designed for smartphones and tablets to access various insurance services (e.g., policy management, claims filing, customer support, etc.) and features on-the-go. Users can conveniently access their insurance information, initiate claims, receive updates on the status of their claims, and communicate with their insurance provider directly through the app.

In order to create the insurance application, you should find an appropriate tech partner that is skilled in software development intricacies for this domain. To find them, you should make a list of potential insurance app development providers, analyzing their experience in developing insurance-related software, understanding of regulatory compliance requirements, track record of delivering secure and scalable solutions, and ability to integrate with legacy systems. Additionally, consider their approach to user experience design and their communication and support processes to ensure a successful partnership.

The demand for insurance is increasing rapidly, necessitating the creation of a robust mobile app to meet users' needs effectively. Building a robust insurance app allows for individualization, tailoring information to users' specific requirements while streamlining the insurance selection process. This not only contributes to the success of the insurance business but also addresses the demand for insurance in a prompt and efficient manner. Moreover, app development for insurance enables quick interaction, facilitating seamless application and claims processing from anywhere in the world.

An average cost of developing an insurance app ranges from $30,000 to $500,000+. But you should understand that to know the detailed price estimate, you need to consider different price forming factors like features complexity, security measures, UI/UX, and so on.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article