How to Find Investors for Your Business Idea: Full Guide for Startups

Updated 06 Jun 2023

11 Min

3284 Views

When a bright thought hits you like a punch, you don't have time to think how to find investors for a business idea realization. Still, it's one of the main things you should deal with. Did you know that only 20% of all startups get to the launch point? Only 30% of them survive 3 year barrier and 3% get into the fifth year. The main reason is insufficient funding. The today's article is a manual specifically designed for the first-time startups, who want to know how to get funding for app development and do everything right for the first time.

How to get investors for a startup: first steps

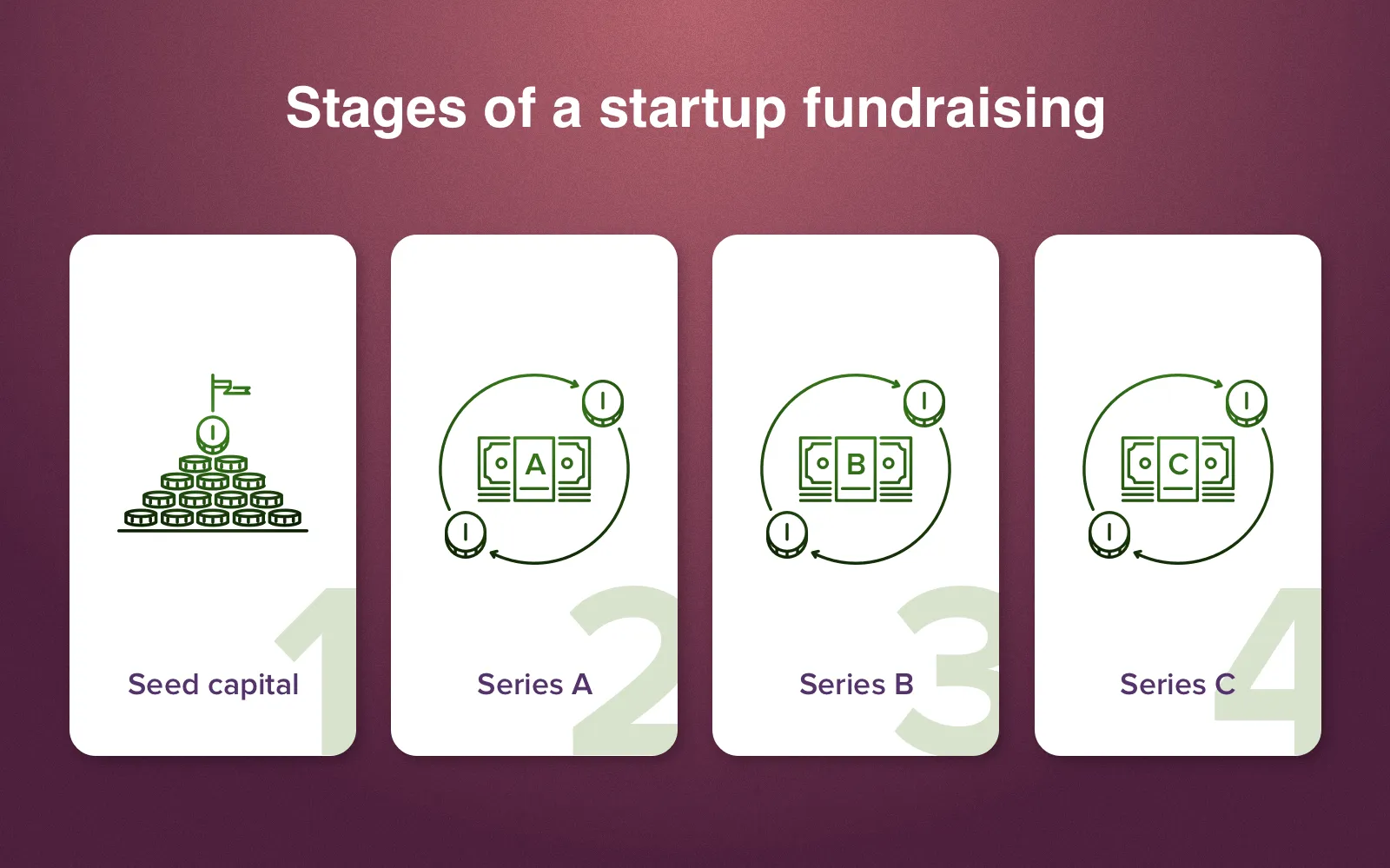

When you are trying to understand how to raise money for a business startup, it's difficult to find the point to start with. Let us show you this point. The first thing you need to remember is that the usual scheme of money raising consists of different phases, which are called rounds. Here are the common steps of a startup fundraising:

Fundraising strategy

The first round is a seed round. Seed round or seed capital is the sum which you have before addressing investors. In plain English, this is your money which you can spend on your startup or money of your family and friends who believe in you and are willing to help. If you have enough money and do not want to attract any other people and their capital, then you can bootstrap. Bootstrapping is a process of a startup development when a founder relies on his own money or on the money from the profit of this particular startup. It means that no third-party investors are going to be involved.

Series A implies you to meet first investors and get some money from them. Series B supposes you to have some significant results of your startup as a proof of your business viability. The next series requires even more significant results from you.

Choosing fundraising strategy

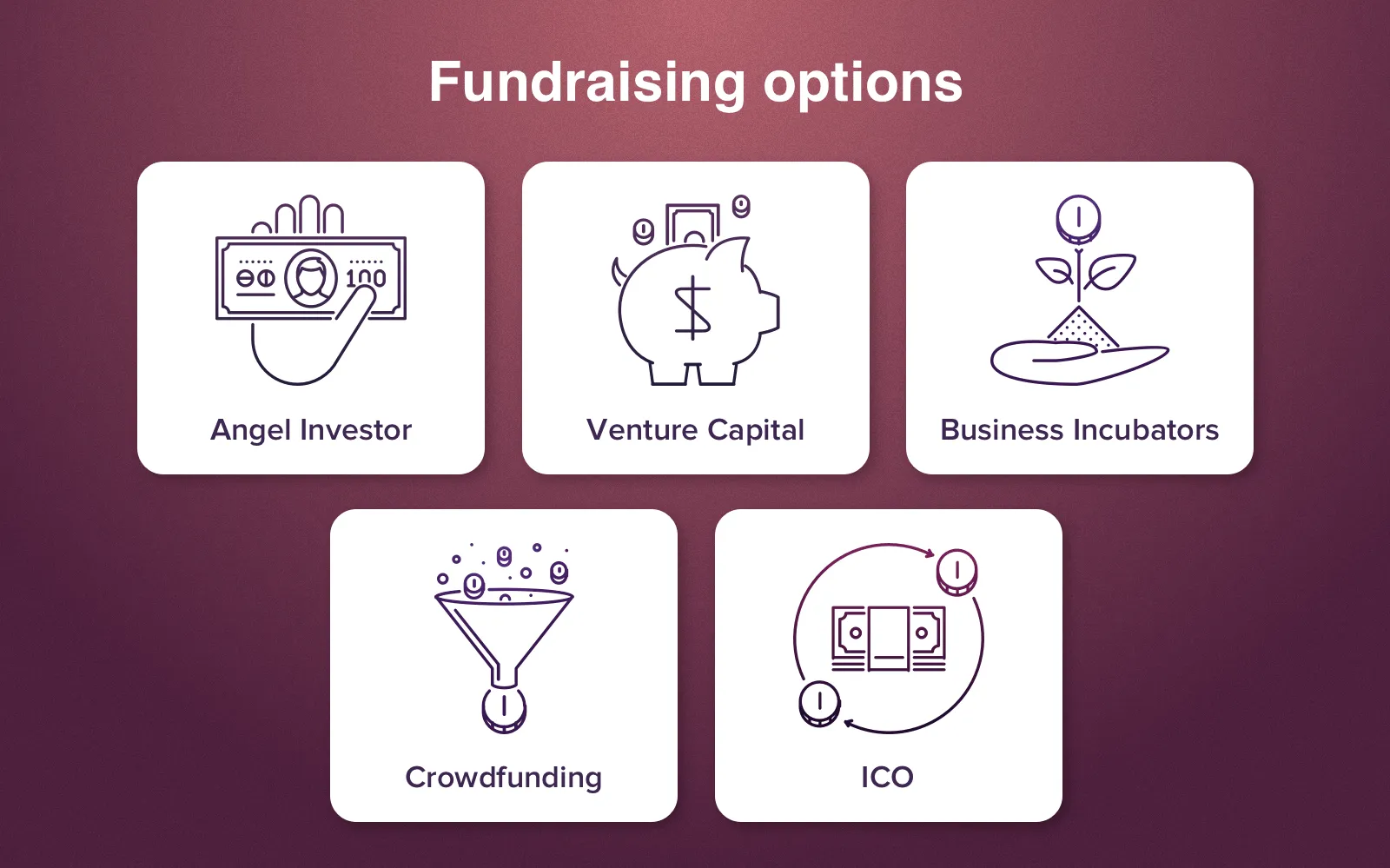

There are several ways for you to get funded. It also connected with the type of investors you want to work with. Moreover, you can appeal different investors during different phases of money raising. Here are the types of investors you need to know about, how to find investors for your startup and contact them:

How to get investors for a startup company - options

1. Angel Investors

Angel Investor is one person who is willing to invest in your enterprise. These people usually don't give much money and they can make high-risk investments with fewer profit guarantees. It's better to contact Angel investors during the seed session and session A.

How to get angel investors? You can find Angel investors on conferences concerning the related industry. Or, you can also find them online. The most popular platforms where you can arrange your first meeting with angel investors are Angellist, Gust or Angel Investment Network. All these platforms work in a pretty same way. Ordinary people along with individual businessmen are looking for promising startups to help them during their early stages.

2. Venture Capital

Venture Capital is a form of financing which companies or large funds provide startups with. An investment fund is an establishment which performs collective investment on behalf of a group of people or companies who entrusted their money to this fund. A venture capitalist is a person who has right to manage fund money and who invests this money in different projects.

How to start crowdfunding? There are a lot of various platforms which use different conditions of collaboration. For instance, GoFundMe is a donation-based organization which can help you raise fundraising for a business startup without any rewards from your side. Another option is Kickstarter, where you set a reward for being funded. You will have to give it only if your startup raised needed amount of money. Indiegogo platform uses another scheme. Here you need to pay up to 9% fee to be funded. You can raise needed sum or not, still, you'll have to pay.

Find out the basics of the Initial Coin Offering, how to launch your own fundraising campaign based on ICO and many more in our article!

Venture capitalists are usually very demanding, they invest in reliable small or early-staged firms (startups) or vice versa, in dying companies with the intent to sell it to the highest bidder. Venture capitalists don't invest in a risky business. That is why it is so difficult to get their support, especially in the early stages of a startup development.

How to find venture capitalists? The best way to have a meeting with potential investors of this type is to be introduced by one of them. Of course, you can contact them directly but you have very little chances to be invited to a real meeting. VCs can find you by themselves if you already started gaining profit.

It is clear that the absolute newbies have no links to such companies. That's why there's another option for you. It's to contact a startup incubator company.

3. Business Incubators

Business Incubators are the establishments which help young startups and companies to launch and get funded. First of all, these companies can provide you with seed capital. Second of all, they teach you. BIs can organize lectures, invite famous businessmen to meetings and share the insights with you. And, of course, they can introduce you to the Vs after a while.

Compare the prices for software development in Europe and choose the option which would fit all your needs. Watch our small video and discover the best price-quality ration!

The Cost of Software Development in Europe

Where to find business incubator? One of the most famous companies incubators is Ycombinator. This company has raised more than 800 startups. They worked with Reddit, Airbnb, Dropbox and many others. Twice a year the company chooses the most interesting startups and invest $120K in them. After that, the chosen ones move to Silicon Valley for 3 months. During this time, Ycombinator organizers teach startup owners how to manage all business issues. After this period, startups meet investors who are willing to find their gold mine.

4. Crowdfunding

Crowdfunding is a form of money raising with the help of various platforms which offers different conditions. There are some platforms where your startup can get donations from people free of charge, without any reward. This approach can really work if your startup is somehow connected with a charity or any other noble purpose. The other platforms allow you to raise money in exchange for different bonuses from you.

5. Initial coin offering

ICO is a new hype in the investment world. ICO is used instead of usual percentage in the company which you offer in order to get funding. You sell this cryptocurrency to your investors. The system is easy but at first, you need to create ICO, which means you will need to find an expert in web and mobile app development services for this task. The easier way is to create not coins themselves but tokens based on existing cryptocurrencies.

You can find thousands of various platforms which may help you with funding and investors on the Internet. No matter what option you choose, you need to be fully equipped and ready for all sorts of questions. Let's consider what things you need to prepare yourself before getting a meeting with investors.

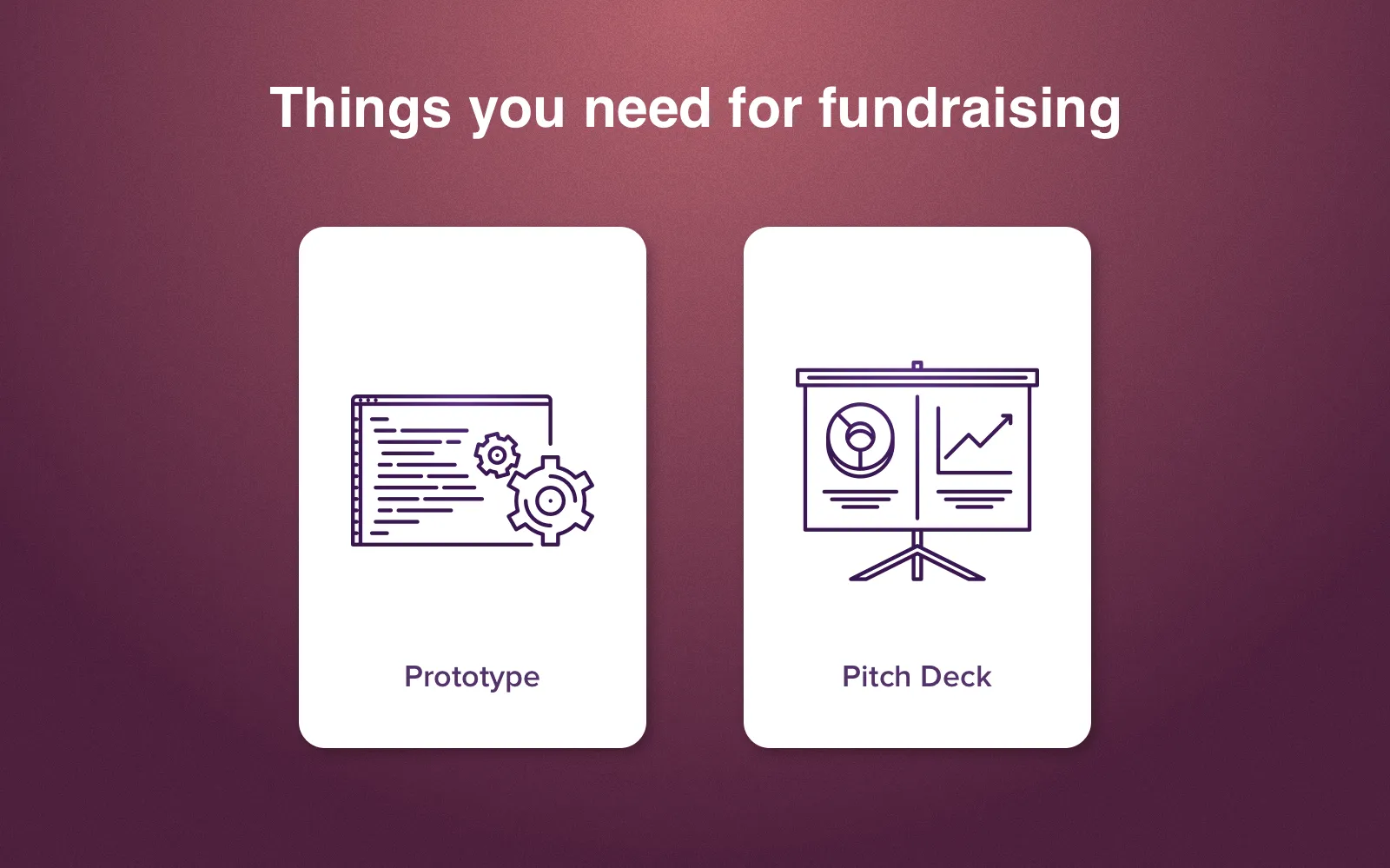

What needs to be done before you meet investors

Only in a case with friends and relatives, you can describe your idea with the help of hands and your fiery speech. With all others, you will have to show your substantive preparations to persuade everyone that you are a serious businessman with a great idea. For the initial stage, you'll need only two things to be ready. It's a prototype and a Pitch Deck.

What to prepare to get an investor for a startup

Prototype

In a case of software development, a clickable prototype is a must. It is difficult to tell and explain how everything will work that is why you should give your stakeholders a chance to test your product by themselves. As an option, you can build an MVP version of your app or website or a software system and run beta testing before a meeting with investors. If you don't have a prototype or MVP yet, you can show them at least design of your future project. Make sure that the design looks great a meeting with potential investors.

Still don't know how to hire mobile app developers for your startup with the perfect skill set? Read our comprehensive guide with tonnes of hints and insights!

Pitch Deck

Pitch deck is a presentation which you create specifically for your potential investors. The simplest version you can create even in Powerpoint or any other similar program. Such a presentation should contain comprehensive information about your startup, with all the numbers and research materials. In order to impress your potential investors, your pitch deck should be laconic and convincing.

Tip. To protect your idea from being copied you need to indicate 'Confidential and Proprietary. Copyright (c) by...' and the name of your company in the square brackets. And a phrase 'All Rights Reserved' on the first page of your presentation.

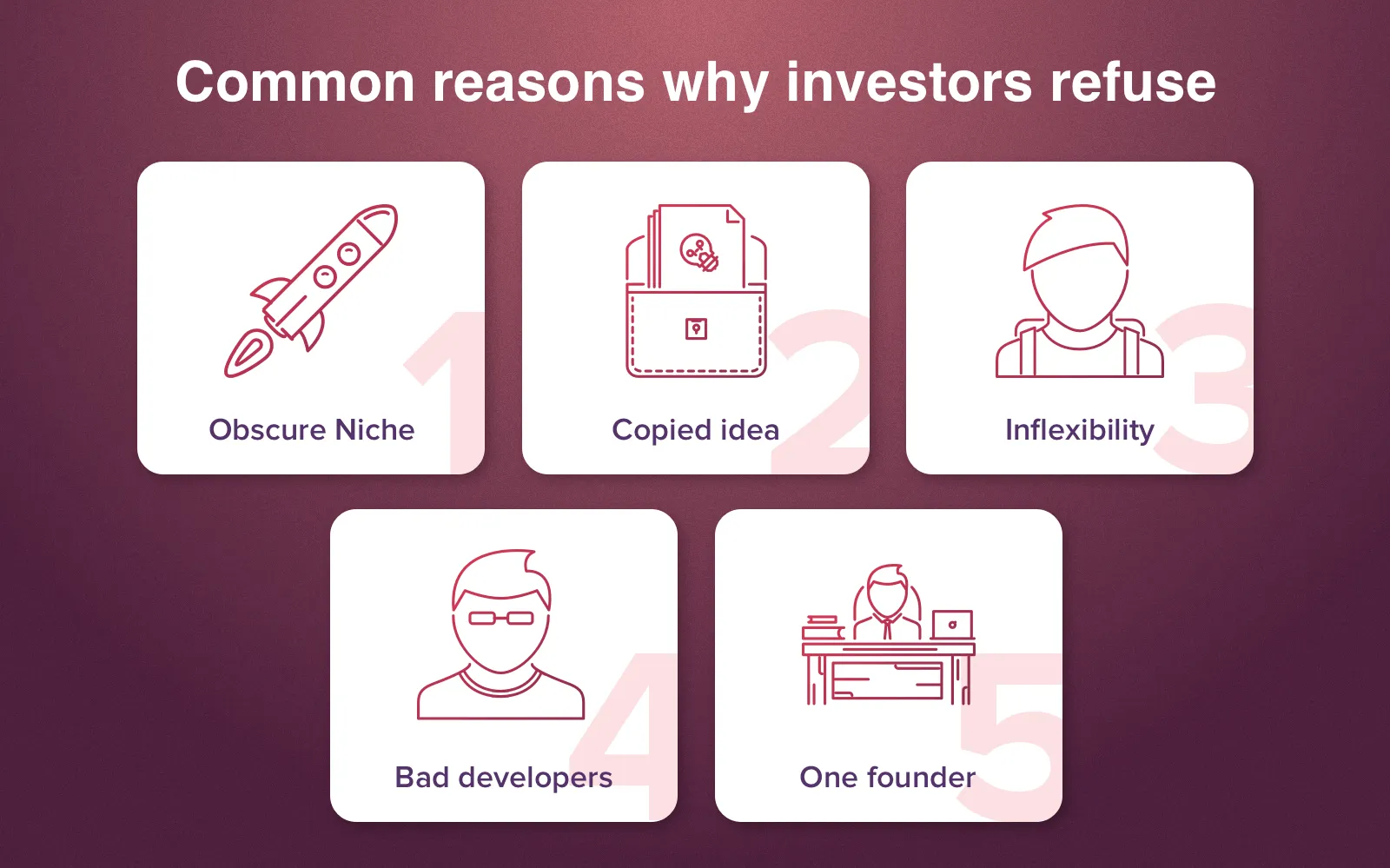

Fundraising mistakes which can kill your startup

Even if you have done everything perfectly, stakeholders can refuse to invest in you. There can be several reasons for that. Explore them in order to avoid these pitfalls.

Startup fundraising common mistakes

Obscure Niche

A new market is great but you should define this market very precisely. If you are afraid of competitors it doesn't mean that you should let them ahead. Don't be scared of your idea especially if it's big and covers large niche.

Copied idea

Don't be surprised if you offer stakeholders to invest in your startup which is an imitation of an existing company and they refuse. Copies don't become great. You need your own, unique product which solves real, existing problems.

Inflexibility

It sounds strange, but the majority of all successful startups were something else then they are now. Thus, you need to be agiler and ready to change the purpose of your startup if something better came to your mind. If you are not sure whether your idea is better than the initial one, you can always talk to your customers and ask their opinion. In a case they are excited about your new concept, you should go for it.

There are so many useful tools for your startup you have no idea about! Check our article about helpful links for a startup to save your time, money and nerves!

Bad developers

Even if the initial idea was extremely great, bad vendors can ruin everything. Remember it when you hire developers for a startup. And even if you want to save some money firing a freelancer instead of an experienced team, you can lose much more eventually. Anyway, try to find as much feedback about a potential vendor as you can. You can visit Clutch, for instance, as it's one of the best platforms where you can read the comments about different development companies

One founder

It was noticed that the startups with only one founder rarely get successful. It can be explained by a nature of a person who doesn't want to share his idea with others, even with the closest people. Such people are very suspicious and never trusts their partners and employees. With such a personality it's hard to be flexible and adjust to externalities. When a person is open and involves his friends and family he is ready to share not only success but difficulties too. Investors know about it and respond accordingly.

The fundraising process is long and tiring. Don't expect it to be easy. The biggest part of this road you'll have to walk alone. Still, you can always rely on us. Write us if you want to impress your investors with a really high-class prototype or if you are ready to entrust us the whole project.

If you like this article, then don't forget to subscribe to our blog to get only new and fresh articles from Cleveroad!

There are several ways to find investors:

- Angel Investor is one person who is willing to invest in your enterprise. These people usually don't give much money and they can make high-risk investments with fewer profit guarantees.

- Venture Capital is a form of financing which companies or large funds provide startups with. An investment fund is an establishment which performs collective investment on behalf of a group of people or companies who entrusted their money to this fund.

- Business Incubators are the establishments which help young startups and companies to launch and get funded.

- Crowdfunding is a form of money raising with the help of various platforms which offers different conditions. There are some platforms where your startup can get donations from people free of charge, without any reward.

- Initial Coin Offering is a new hype in the investment world. ICO is used instead of the usual percentage in the company which you offer in order to get funding. You sell this cryptocurrency to your investors.

The answer depends on the complexity of your project. It’s possible to have only one investor or several people to invest in your startup.

There are several ways for you to get funded.

- Angel investor

- Venture capital

- Business incubator

- Crowdfunding

- ICO

The first thing you need to remember is that the usual scheme of money raising consists of different phases, which are called rounds. Here are the common steps of a startup fundraising:

- Seed capital is the sum which you have before addressing investors.

- Series A implies you meet first investors and get some money from them.

- Series B supposes you to have some significant results of your startup as a proof of your business viability.

- Series C requires even more significant results from you.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article