Intelligent Document Processing for Insurance: Key Use Cases and Benefits

Updated 04 Jul 2025

16 Min

150 Views

Intelligent Document Processing (IDP) is changing how insurers handle the massive flow of paperwork that powers daily operations. By combining AI, machine learning, and natural language processing, IDP systems can classify, extract, validate, and deliver structured data from complex and unstructured insurance documents like claims forms, medical reports, and onboarding paperwork.

We at Cleveroad have been developing software solutions for the insurance industry for over 10 years. Starting with early machine learning models, we’ve evolved our expertise to deliver modern IDP solutions powered by advanced AI to automate underwriting, claims, and document workflows. We've interviewed Cleveroad's Insurance domain experts and IDP integrators to prepare this comprehensive guide, where you'll learn:

- What IDP in Insurance is and how it differs from legacy automation tools

- Why insurance companies need IDP now, and what operational problems it helps solve

- Key 4 intelligent document processing use cases for the insurance processes automation, including claims, underwriting, and compliance

- A step-by-step IDP implementation roadmap, from insurance process scoping and feasibility analysis to solution rollout

- Common challenges of IDP in insurance you may face, and our experts’ tips to overcome them

What Is Intelligent Document Processing in Insurance?

Intelligent Document Processing (IDP) is an AI-based technology that automates the entire document lifecycle, replacing time-consuming manual processing with faster, more accurate machine-led workflows. Unlike traditional Optical Character Recognition (OCR), which simply converts printed or handwritten text into digital text, IDP understands document context. Intelligent Document Processing combines Machine Learning (ML), Natural Language Processing (NLP), and computer vision to:

- Classify the type of document (e.g., claim forms, medical notes)

- Extract structured and unstructured data

- Interpret entities like names, dates, ICD codes, and medications

- Enrich this data with insights (e.g., identify PHI, redact sensitive fields)

- Route it for human validation only when needed

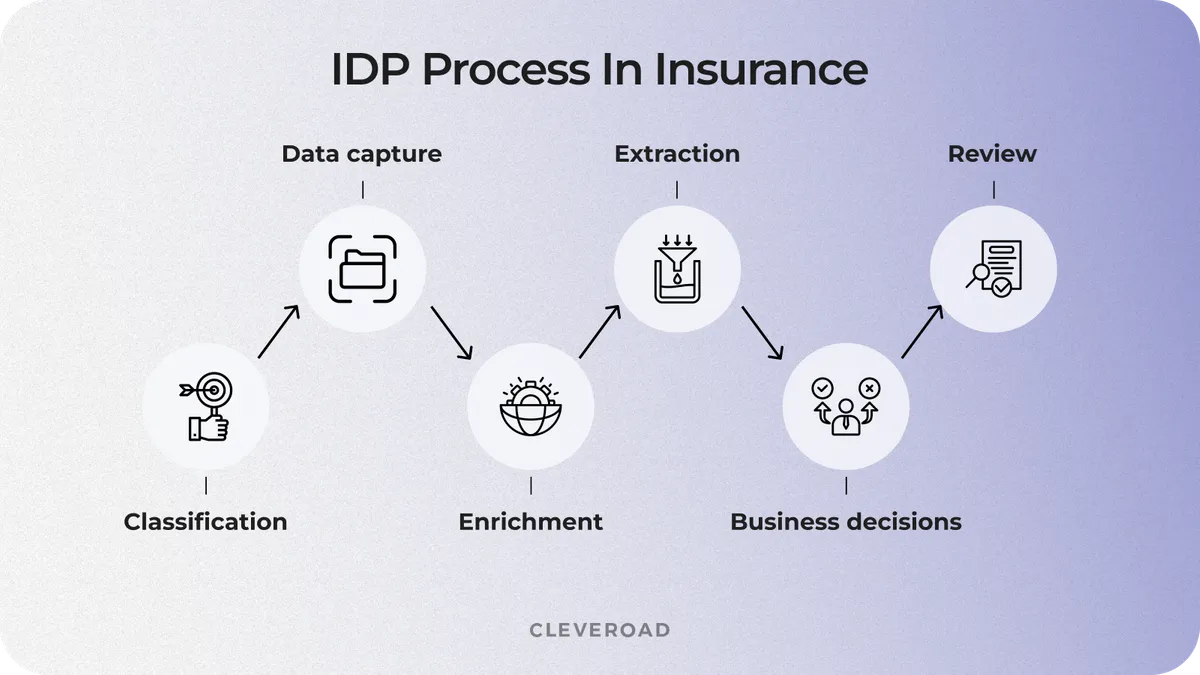

How the IDP works in insurance

Intelligent document processing for insurance automates the way insurance companies handle unstructured documents by extracting key data, classifying content, and validating inputs in real time. Instead of relying on manual review, insurers can instantly route structured information into claims, underwriting, or policy systems, accelerating decisions and reducing human workload.

These capabilities are part of a broader shift toward data-driven automation, which we cover in more detail in our overview of machine learning in insurance.

Below is a step-by-step breakdown of how IDP operates within an insurance workflow, especially during underwriting and claims processing:

- Data capture. All documents, such as scanned PDFs, faxes, and emails, are routed into a centralized intake system to unify processing of structured and unstructured inputs.

- Classification. The system automatically detects document types. For example, claims forms go into structured extraction, while handwritten doctors' notes enter a separate NLP pipeline.

- Extraction. AI models extract key document fields (e.g., policy number, diagnosis, treatment) and label entities to streamline processing and integration.

- Enrichment. NLP models powering IDP detect entities like diagnosis codes or accident details, flag risks, and redact sensitive data by access level.

- Review and validation. If the system’s confidence score for a field (e.g., 82% for poor handwriting) drops below the threshold, it flags the entry for human validation, optimizing effort where needed.

- Ready for business decisions. Clean, structured data flows directly into the claims database, enabling real-time analytics and faster decision-making.

IDP process in insurance

IDP vs. OCR and RPA: What’s the difference?

Unlike OCR and RPA, intelligent document processing insurance platforms adapt to variations in form structure, language, and content. It makes them ideal for use cases like an insurance document processing system, where documents differ from claim to claim, and interpretation is critical. In the table below, we’ve prepared the core differences between intelligent document processing in insurance and other related technologies:

| Technology | What technology does | Technology limitations |

OCR | Converts the image text into machine-readable form | No context understanding; can’t handle handwriting or complex layouts |

RPA | Mimics rule-based user actions (e.g., copying fields between systems) | Breaks with document variability; lacks learning capabilities |

IDP | Understands document content, learns from data, and automates workflows | Designed for complex, unstructured insurance docs |

Why Insurance Companies Need Intelligent Document Processing

Insurance companies face mounting challenges in operating efficiently, from the large amount of data volume to regulatory burdens. Manual workflows no longer scale. That’s why intelligent document processing insurance solutions are quickly becoming essential. Below are the key operational pressures insurers face and how IDP for insurance directly addresses them.

Growing document volume

Insurers process thousands of documents daily, such as claims, policy applications, doctor notes, and more. As digital channels grow, the volume and variety of unstructured content grow too.

IDP solution:

Intelligent document processing for insurance enables faster document intake and triage. AI models automatically sort, classify, and extract data, scaling operations without increasing staff. According to the International Journal of Science’s study, IDP implementation can cut document processing time by up to 80% and reduce error rates by around 90%, compared to manual methods.

High manual labor cost

Data entry experts and claims adjusters spend countless hours reviewing PDFs, emails, and attachments, often duplicating work across systems. Labor-intensive processing slows operations and increases overall costs.

IDP solution:

Automated document processing insurance systems remove the need for manual document extraction. It improves accuracy, lowers staffing costs, and allows skilled employees to focus on high-value tasks, and, thanks to this, boosts both efficiency and morale. Statistics prove it: McKinsey reported that companies that adopt IDP solutions reduce processing costs by 30-50%.

Need for extra speed and accuracy

Underwriting and claims decisions are time-sensitive. Delays lead to poor customer experience and lost revenue. Also, errors in document interpretation can result in compliance risks or wrongful payouts.

IDP solution:

Intelligent document processing claims processing pipelines reduce turnaround time while enhancing accuracy. NLP-powered extraction and auto-validation minimize errors and deliver ready-to-use data in minutes, not days. According to Arxiv, medical insurance assessment automation reduces processing time from 55 to 35 minutes (–36%), and saves 30% HR costs.

Regulatory pressure

Insurance operations must comply with regulations like HIPAA, GDPR, DORA, and regional data retention rules. Manual document processing makes it hard to provide consistent redaction, auditability, and privacy.

IDP solution:

Intelligent document processing in insurance provides automatic redaction of sensitive data, such as PHI, while securing such data with digital audit trails. It reduces legal exposure and streamlines compliance audits. International Journal of Science’s study reported a dramatic 85% reduction in compliance review time, from 2–4 months down to just ~2 weeks, thanks to system‑enforced handling, audit log generation, and redaction tools that IDP brings.

Opt for our insurance software development services to automate document processing. We can help your insurance business become more efficient by implementing an IDP

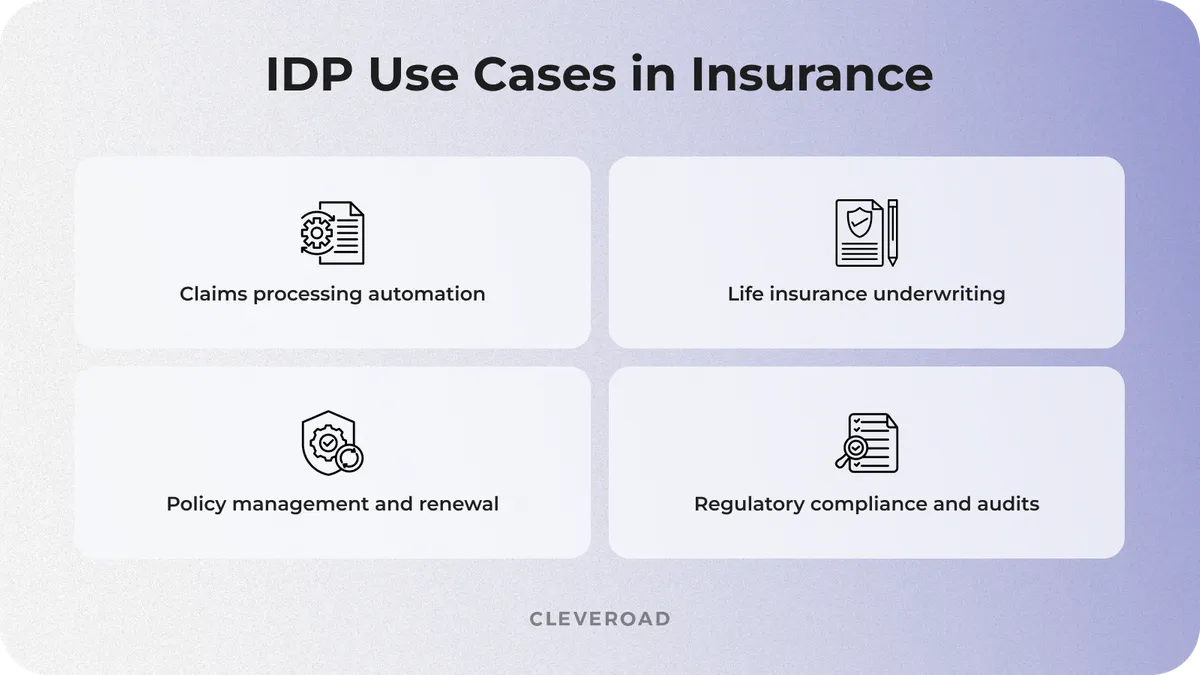

Key Use Cases of IDP in Insurance Workflows

The value of intelligent document processing in insurance goes far beyond simple data extraction. IDP transforms how insurers handle core business operations by turning unstructured inputs into structured, actionable data.

We've asked Cleveroad's Business Analyst, experienced in the Insurance domain, to identify the most impactful use cases of intelligent document processing in insurance. Here's our list of IDP use cases for different insurance processes:

IDP use cases in Insurance

Claims processing automation

Claims processing is one of the most document-intensive functions in insurance. Speed, accuracy, and consistency are essential, and IDP supports all three by converting raw paperwork into structured information. Let’s see how intelligent document processing insurance automates claims processing:

Extract info from CMS-1500/UB-04 forms, receipts, statements. IDP captures and interprets both structured and semi-structured medical billing forms, handwritten notes, and scanned receipts. It extracts key values like treatment codes or billed amounts.

Classify and process documents, mapping them to workflows. Incoming documents are automatically classified, for example, distinguishing between a provider invoice and an Explanation of Benefits (EoB). Based on the type, IDP assigns the document to the correct claims processing path.

Trigger rules for payout approval. With structured data in place, IDP rules engines can assess whether a claim meets conditions for auto-approval, requires further review, or flags for potential fraud, accelerating the claims lifecycle.

Let’s examine the case of a company that implemented IDP for claims processing automation in insurance and obtained benefits:

Pinnacol Assurance, Colorado’s largest workers’ compensation carrier, uses IDP to speed up repetitive tasks like generating client interview questions and analyzing insurance claims. This automation has led to significant efficiency gains, with 96% of employees surveyed reporting notable time savings in their claims processing workflows.

Life insurance underwriting

Life underwriting requires careful evaluation of applicant risk based on documents like lab results and physician statements. IDP simplifies this evaluation and improves turnaround time. This is how intelligent document processing in insurance improves life insurance underwriting:

Analyze medical records, lab results, and ID forms. IDP systems extract critical health indicators and identity verification data from complex, multi-page files. This includes cholesterol levels, medical history, medication lists, and age verification.

Pre-screen applications faster. Underwriting engines utilize pre-screened data to assess initial eligibility, identify potential red flags, and assign risk levels, eliminating the need for a human to review every file.

Generate underwriting summaries. Once documents are processed, IDP outputs a structured summary of risk-relevant data, saving underwriters hours of manual analysis and boosting consistency.

Let’s take a look at the case when a company implemented IDP for life insurance underwriting in insurance and received advantages:

HDFC ERGO, one of India's leading insurance providers, has developed two insurance "superapps" specifically tailored for the Indian market. On its 1Up app, the company uses IDP to deliver context-aware prompts, or "nudges," that guide insurance agents through various document and other scenarios to enhance the customer onboarding process and insurance underwriting.

Policy management and renewal

Ongoing policy servicing requires frequent updates, often based on customer-submitted documents. IDP helps insurers reduce delays and errors in this routine but critical process. The ways in which automated document processing insurance enhances policy management:

Automate form intake. IDP captures data, such as converting address requests or beneficiary updates, from both structured and unstructured forms and prepares it for entry into policy systems.

Sync structured data with CRM or policy database. Once verified, extracted data syncs directly into customer records, keeping policies accurate and reducing time spent on duplicate data entry.

Reduce processing time for updates and renewals. By removing manual steps, IDP accelerates processing timelines, improving customer satisfaction and freeing teams to handle exceptions or escalations.

Here are the cases when a company implemented IDP for policy management and renewal in insurance and benefited:

Länsförsäkringar AB, a Swedish banking and insurance group, implemented IDP to streamline financial planning for policy management and renewals. The AI-powered tools gave managers better cost visibility and control, increasing planning cycles from two to ten per year. This led to faster, more accurate forecasts, cost containment, and improved efficiency in managing policies and renewals.

Regulatory compliance and audits

Insurers must prove adherence to regulations like HIPAA, GDPR, and regional insurance mandates. IDP makes audit readiness a built-in feature of daily operations. This is how intelligent document processing for insurance streamlines regulatory compliance:

Structured audit logs. IDP solutions log every document interaction, when it was received, processed, flagged, or modified, making compliance reviews transparent and traceable.

Fast retrieval of required documents/data. Instead of sifting through archives manually, teams can search and retrieve documents based on any extracted field, such as client name, date, document type, or keyword.

Ensure data traceability and consistency. IDP maintains data lineage, showing where each data point came from, when it was captured, and whether it’s been validated, reducing compliance risk and human error.

Here is a case when a company implemented IDP for regulatory compliance and audits in insurance and benefits:

Banco Bradesco leverages its robust infrastructure and advanced data management technologies to ensure strict regulatory compliance and data security across millions of transactions. By integrating intelligent document processing solutions, Bradesco automates the structuring, traceability, and audit logging of vast amounts of financial data and documents. It enables faster, more accurate retrieval of information for audits and regulatory reviews and strengthens overall compliance.

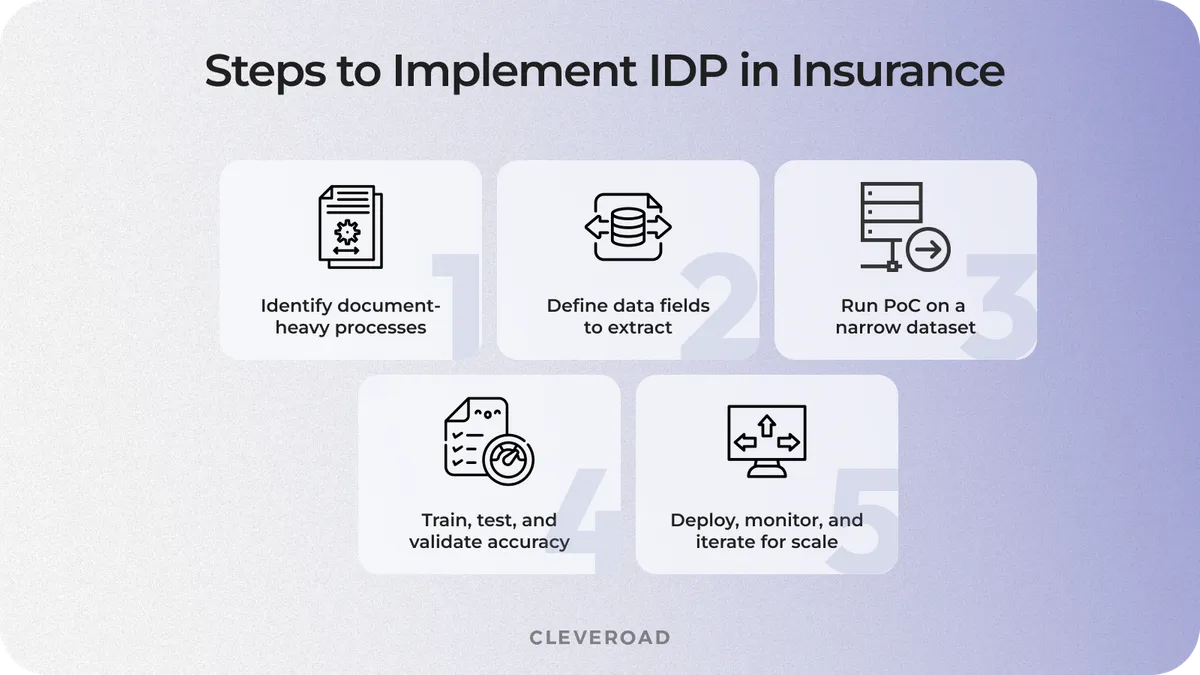

How to Implement Intelligent Document Processing in Insurance Step by Step

Rolling out intelligent document processing insurance solutions needs a structured professional approach. We at Cleveroad follow a clear step-by-step process for integrating IDPs based on our proven expertise in AI/ML, insurance automation, and secure data engineering. Whether you need to build a custom system from scratch or integrate IDP into your legacy platforms, our team will help you minimize risk and maximize impact.

Now, let's see how the Cleveroad team integrates IDP into the insurance workflow.

Steps to implement IDP in insurance

Step 1. Identify document-heavy processes

The first step is to assess your internal workflows. You need to decide where document processing has the biggest difficulties. Claims data handling, customer onboarding, and intelligent document processing life insurance underwriting are typically the most document-intensive areas. You should make this assessment based on pain points such as processing delays, error-prone data entry, or compliance risk.

While this step starts internally, a technology partner can assist with evaluating your document flows, identifying automation-ready use cases, and benchmarking against insurance industry standards. Cleveroad experts guide the AI Workshop to help you prioritize the right processes for the highest return on automation.

Step 2. Define data fields to extract

With high-volume processes identified, the next step is to define which specific data points you need to extract and how you’ll use them. In an insurance claims context, it might include policy numbers, dates of loss, and treatment codes. In underwriting, it could involve lab results or flagged risk factors.

The goal here is to align IDP outputs with your business rules, so the extracted data supports automated decision-making. Cleveroad helps map this logic, ensuring that intelligent document processing for insurance feeds structured, accurate information into your operational systems.

Step 3. Run PoC on a narrow dataset/process

Before scaling IDP across departments, it’s critical to validate the concept with a focused Proof of Concept (PoC). It involves selecting a single document type or sub-process, such as accident-related claims or physician statements, and testing IDP performance on real data.

The proof of concept helps verify if your IDP idea brings a real business impact. Cleveroad rapidly develops PoC using either custom-trained AI models or fine-tuned prebuilt engines tailored for intelligent document processing claims processing.

Our AI proof of concept services will help you validate if IDP will bring real value to your insurance processes before investing in full-scale implementation

Step 4. Train, test, and validate model accuracy

After the proof of concept is successful, the system undergoes a training and validation phase. Here, the AI integrators expose the models to a wider range of documents and edge cases. The IDP models learn to recognize different layouts and handwriting variations common in insurance paperwork.

We at Cleveroad validate performance against accuracy thresholds, adjust model weights, and apply business-specific rules to reduce false positives. This step ensures your IDP insurance solution is reliable enough to support production-grade insurance document processing at scale.

Step 5. Deploy, monitor, and iterate for scale

The final step is deployment and continuous improvement. Once the solution meets performance and security standards, Cleveroad integrates it with your policy or claims systems using secure, API-based connections. From there, we set up performance monitoring, feedback loops from your target user of the IDP (such as employees or clients), and automated retraining protocols.

Such an approach ensures your IDP engine evolves alongside your data and business needs, whether you're implementing in new product lines or adapting to market changes. In doing so, your automated document processing insurance capability becomes a long-term asset for digital transformation.

To implement IDP successfully, you need more than just technical execution, you need an experienced partner with deep expertise in both AI/ML development and building software for strictly regulated industries like Insurance, Healthcare, and FinTech

We at Cleveroad have in-depth experience in developing solutions throughout the FinTech domain. To prove our skills, we’ll demonstrate one of our recent case studies.

Recently, we’ve delivered IT staff augmentation services to our client in the FinTech industry, Penneo, based in Denmark. They have over 3,000 clients across various industries, including Finance and Banking, Real Estate, and Audit and Accounting.

Throughout our collaboration, Cleveroad supported Penneo in scaling and optimizing its cloud infrastructure to meet the growing demands of its KYC and digital signature platforms. We helped establish a secure, scalable, and automated DevOps environment tailored to the company’s multi-account SaaS architecture. Using Infrastructure as Code principles and tools like Terraform, our team built the foundation for stable cloud operations and seamless CI/CD workflows.

As a result, our client received a highly scalable and resilient infrastructure managed through the best DevOps practices. Their platform team operates seamlessly across a complex and multi-account architecture with confidence in security, automation, and compliance.

See what Hans Jørgen Skovgaard, CTO at Penneo, says about cooperation with Cleveroad:

Hans Jørgen Skovgaard, CTO at Penneo: Feedback on Cleveroad's Cloud Infrastructure Services

Challenges to Expect with IDP Implementation and How to Overcome Them

While intelligent document processing in insurance offers significant advantages, its implementation comes with specific challenges. Insurance carriers often deal with legacy systems, inconsistent document formats, and poor handwritten inputs, all of which can slow down IDP adoption if not addressed properly.

Below are common hurdles insurers face when implementing IDP.

Variability of document formats

Insurance workflows encompass a diverse range of documents, including structured claim forms, unstructured doctor's notes, scanned PDFs, and third-party reports. Its inconsistency makes it difficult for generic systems to extract information accurately (Source: IJSRA).

Cleveroad solves the problem of document format variability by utilizing a modular architecture that adapts to each document type. FoFor instance, for our US-based Healthcare client, we developed a web-based Quality Management System (QMS) with separate modules for Documents, HR, and Training Records, each tailored to meet FDA and ISO compliance. In similar setups, each module can be paired with a domain-specific IDP model to extract, classify, and validate unstructured inputs like audit reports or personnel records. Such a modular design ensures that you get structured outputs from intelligent document processing in insurance, enabling scalable automation across complex, regulated environments.

Low-quality scans or handwritten content

Many critical documents, especially in intelligent document processing insurance, and life insurance underwriting, arrive in poor quality, such as faxed PDFs, low-resolution images, or handwritten annotations. These present major obstacles for off-the-shelf OCR engines.

To overcome this problem, Cleveroad builds and trains custom Optical Character Recognition (OCR) models fine-tuned for insurance-specific data. We use AI/ML to enhance scan clarity, detect handwriting with computer vision, and extract content even from noisy inputs. Our AI pipeline ensures high accuracy even in low-quality data environments.

Integration complexity with old systems

Many insurance companies still rely on legacy core systems for claims, policy, and document management. These systems often lack modern APIs or use outdated data formats, creating friction when trying to adopt automated document processing insurance (Source: IJSRA).

Cleveroad helps insurance companies adopt IDP solutions by modernizing outdated systems that hinder integration. Through our legacy software modernization services, we upgrade core insurance platforms to support automation, scalability, and compliance. It includes a full software revamp, cloud migration, UI/UX redesign, and API integrations. Our goal is to align legacy systems with modern standards so insurers can seamlessly implement IDP and other advanced technologies into claims, underwriting, and policy management workflows.

Cleveroad’s Expertise in Intelligent Automation for Insurance

Cleveroad is a skilled insurance software development company with 13+ years of domain experience. We provide robust insurance software development services, including custom insurance software development and legacy systems modernization, AI-based insurance platforms building, solutions powered by AI/ML, OCR, and NLP, UI/UX design and prototyping, third-party integrations, and more.

Our development processes meet ISO 27001 (security) and ISO 9001 (quality) standards, ensuring secure handling of sensitive insurance data like PII and PHI. We also offer seamless integration with existing claims, underwriting, and CRM platforms through API-driven middleware, enabling automation without disrupting legacy systems.

Choosing Cleveroad to implement IDP in insurance, you’ll get:

- AI Workshop stage to gain clarity on your IDP idea, considering its use cases, business value, and how it can be executed, from goals and scope to implementation steps

- Experience in integrating insurance systems with third-party solutions, including CRM, DMS, KYC/AML tools, and other platforms critical to automation and compliance

- AI PoC services to validate and refine the compatibility and performance of an IDP solution with your FinTech business IT ecosystem

- Partnership with an AWS Select Tier Partner who uses robust AWS-native tools to accelerate AI adoption, such as Amazon SageMaker, Bedrock, AWS Glue, and more

- Experience in creating solutions in compliance with the latest insurance standards regarding security, data safety, usability, and interoperability: HIPAA, PIPEDA, ACORD, ACA, and other

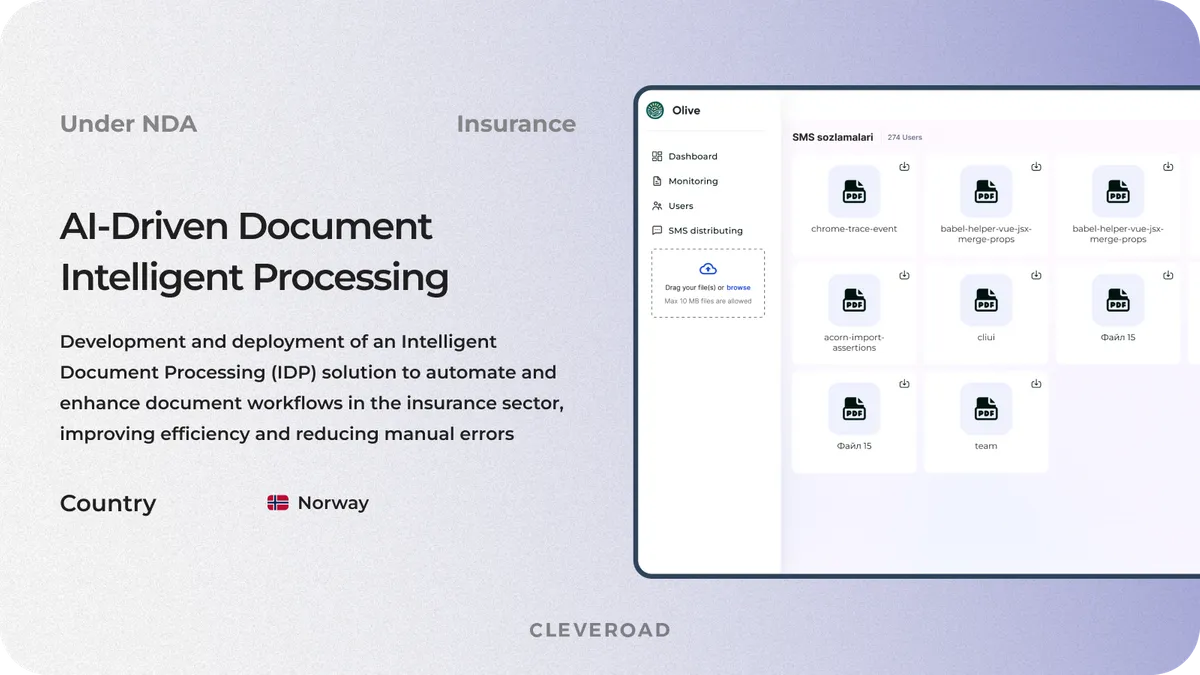

To demonstrate our experience in creating solutions with intelligent document processing for insurance, we’ll show our recent case — AI-Driven Document Intelligent Processing.

We provided full-cycle development services for a Norway-based insurance company aiming to automate document-intensive tasks across policy and claims workflows. The client’s goal was to reduce manual effort, improve accuracy, and meet compliance standards more efficiently.

Intelligent document processing system for insurance developed by the Cleveroad team

Cleveroad developed a custom AI-powered Intelligent Document Processing (IDP) system specifically for insurance use. The solution smoothly integrates with the company’s internal platforms, also providing automatic document classification and high-precision data extraction, which significantly reduces the need for manual data entry.

As a result, the client achieved up to 75% reduction in document processing time, strengthened compliance readiness, and accelerated both claims and policy operations, leading to higher overall efficiency and improved service delivery.

Ready to integrate IDP in your insurance business?

Contact us! With 13+ years of experience in Insurance, we are ready to help you implement an IDP solution in your insurance business to streamline workflows and boost operational efficiency

Intelligent Document Processing (IDP) is an AI-based approaches that enable insurance companies to manage the entire document lifecycle, replacing time-consuming manual processing with faster, more accurate machine-led workflows. Unlike traditional OCR, which simply converts printed or handwritten text into digital text, IDP understands document context.

Insurance operations with intelligent document processing automation are applied across multiple workflows where high document volume and unstructured data create inefficiencies. Key applications include:

- Claims document processing

- Life insurance underwriting

- Policy issuance and management

- Renewals and endorsements

- Regulatory compliance and audits

Let's see how a typical IDP implementation unfolds:

- Step 1. Identify document-heavy processes

- Step 2. Define data fields to extract and workflows to automate

- Step 3. Run PoC on a narrow dataset/process

- Step 4. Train, test, and validate model accuracy

- Step 5. Deploy, monitor, and iterate for scale

Implementing intelligent document processing to automate insurance brings measurable improvements across operations, accuracy, and compliance. Key benefits of intelligent document processing include:

- Faster processing times

- Improved accuracy

- Operational cost savings

- Enhanced customer experience

- Better regulatory compliance

- Scalability across workflows

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article