Banking Software Development Services

- Personalizing customer experience

- Streamlining back-office operations

- Minimizing risks and optimizing operational efficiency

Banking Software Services We Offer

Banking software development services that help businesses streamline internal operations and bring innovations improving the customer experience

Banking Software Development

Development of custom eBanking solutions from scratch with the focus on performance, cost-effectiveness, scalability, and resiliency

Software Modernization

Reengineering the existing eBanking solutions to meet the latest industry standards in terms of security, usability, and interoperability

Third Party Integrations

Aligning custom-built software with internal banking systems, external aggregators, and analytic tools via the proper APIs and EDIs

Digitalization and Automation

Increasing the performance of customer’s banking, accounting, or financial software by automating manual processes.

Banking Software Solutions We Provide

Banking software development from scratch, existing systems’ improvement, and on-demand intelligent solutions to optimize eBanking services and workflows

Core Banking

Data Storage

Data Analysis

Accounts management

Payments processing

Loan management

Insurance management

Reporting tools

ERP Banking Software

SAP integration

NetSuite integration

FIS Global integration

Ellie Mae integration

Oracle integration

Custom development

System Integrations

Integrations with existing internal services

Open banking API

KYC services

Payment systems

Blockchain

Fraud detection platforms

Mobile Banking

Account management

Electronic and physical card management

Payments, Auto-payments

Finance management

Gamified budget management

AI and ML Data Analytics

Advanced analytics

AI cloud services

Image recognition

Natural Language Processing

Online Banking

Digital Account Opening

Online Banking Portal

Robo-advisors

Risk management

Budget tracking

Banking CRM

HubSpot integration

Pipedrive integration

Salesforce integration

Custom development

Currency Exchangers

Real-time currency tracking

FIX API integration

Experience With Banking Regulations and Standards

We are experienced in developing banking solutions in line with industry regulations, standards, and regulatory organizations’ rules to ensure the proper quality of your eBanking system

AML and Consumer Protection

PCI-DSS

Dodd-Frank

PA-DSS

Check 21

PA-QSA

Securities Act of 1933

SOX

USA Frameworks

FTC

OCC

CFPB

FinCen

FDIC

FINRA

CFTC

Switzerland Framework

FMIA overseen by FINMA

Follow requirements for outsourcing according to FINMA Circular 2018/3

Compliance with audit points for client data confidentiality (in particular CID protection and NTK access control)

Secure Payments

PSD2

EMV Chip

Europe

EBA

GDPR

MiFID II, MiFIR

SA and UAE Framework

SAMA & CMA

Our Clients Say About Us

CPO at Mangopay

"Cleveroad promptly and efficiently responds to requests for IT staff expansion, providing us with qualified software engineers."

Banking Solutions We’ve Delivered

We individually approach each solution, find the best ways to implement it, and help the client optimize time, budget, and efforts

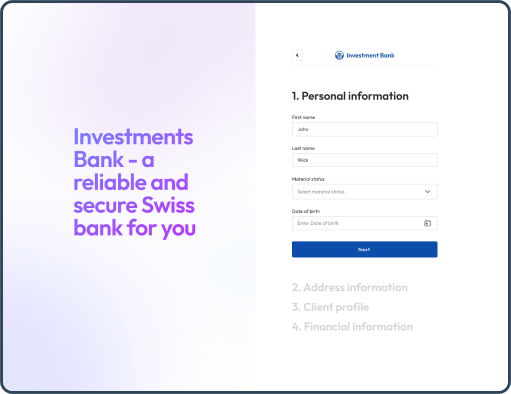

Challenges solved:

- Creation of new software to simplify investment and account opening

- Maintaining and improving of the existing banking system

- Meeting the investment banking regulation (FMIA)

- Improvement of the UX for sign-up and digital account opening

Tech Expertise for Banking Processes

We offer full banking software development coverage and on- demand tech services, guaranteeing quality and meeting deadlines

Engineering services

WEB & Mobile software development

High-performant fault-tolerant systems

API Design & development

Internet of Things

IoT Cloud integration

Card reader integrations

Data collection & analysis

DevOPS

Delivery pipeline and continuous integration (CI/CD)

System automation

Infrastructure maintenance

Software Testing

Analyze complex software for technical debt and potential risks

Manual and automated testing

End-to-end testing

Cloud

Cloud adoption and migration

Native cloud services

Cloud agnostic design

Operations Support

Monitoring, incident management and fixing

Flexible support and maintenance plans

Banking Software Integrations We Implement

Tools and integrations for banking software that we use enrich the solutions’ functionality, optimizing the project’s time and budget and standing in line with security standards

Certifications

We keep deepening our expertise to build business innovative, secure, and compliant software

ISO 27001

Information Security Management System

ISO 9001

Quality Management Systems

AWS

Select Tier Partner

AWS

Solution Architect, Associate

Scrum Alliance

Advanced Certified, Scrum Product Owner

AWS

SysOps Administrator, Associate

Why Hire Cleveroad as Banking Software Development Company

Best practices and compliance with industry security standards

Solutions in line with the latest industry standards regarding security, financial data safety, usability, and interoperability: GDPR, local frameworks, AML and Consumer Protection, secure payments rules, and other FinTech & banking regulations.

Full-cycle development

End-to-end eBanking software development, including Discovery Phase, bespoke UI/UX designs and prototypes, Delivery, and post-production support.

Technology expertise

Cleveroad certified experts help banks and financial businesses choose the best tech stack for solution and advise the architecture, allowing to achieve the project’s business goals.

Continuous innovation

Our team participates in domain conferences and meetings devoted to the latest updates in FinTech and banking standards. The Cleveroad experts apply new approaches and technologies to make innovations serve our customers’ business goals and needs.

Industry Contribution Awards

Leading rating & review platforms rank Cleveroad among top banking software development companies due to our tech assistance in clients' digital transformation

70 Reviews on Clutch

4.9

Award

Clutch 1000 Service Providers, 2024 Global

Award

Clutch Spring Award, 2025 Global

Ranking

Top AI Company,

2025 Award

Ranking

Top Software Developers, 2025 Award

Ranking

Top Web Developers, 2025 Award

Ranking

Top Staff Augmentation Company US, 2025 Award

Questions you may have

Singling out common points and possible difficulties which can be encountered in banking software development

- Core banking

- Mobile banking

- AI and ML data analytics

- ERP banking software

- Online banking

- Software system Integrations

- Banking CRMs

- Currency exchangers

- Articulate your digitalization needs and understand the type of product required for your business

- Assess your time frame and vision of the future system: the timing and peculiarities of the development process depend on it

- Do the market research and find a suitable banking software development provider: study ratings, reviews on Clutch or GoodFirms, evaluate already completed projects of candidates

- Discuss the requirements for the system and its core functionality with your vendor and start developing!