Generative AI in Banking: TOP-5 Use Cases, Advantages, and Tech Future

Updated 03 Jun 2025

16 Min

117 Views

Generative Artificial Intelligence (Gen AI) in banking isn’t just hype, but a real strategic move. In 2025, banks aren’t just playing around with AI for customer support. They’re rolling out domain-specific Large Language Models (LLMs) to totally change how things run behind the scenes, cut down on manual work, and scale up personalized financial services like never before. Big domain players like JPMorgan, HSBC, and Capital One are not just experimenting, but using Gen AI.

This kind of shift didn’t just happen overnight. The skilled FinTech development teams are behind every solid Gen AI rollout. At Cleveroad, we’ve been building banking software for over 13 years. Over the last couple of years, we’ve been leveraging generative AI to help banks work smarter, enhance customer service, and streamline workflows.

Based on our experience, we prepared this comprehensive article to help you understand how to use generative AI in banking: from the TOP-5 use cases and real-world examples of success from large banks to 4 possible risks to avoid and tech trends in AI for banking sector. Read on to learn how you can benefit from generative AI in the banking sector.

Why You Should Consider Going with Gen AI for Banking

Generative AI in banking operates through the process of studying enormous amounts of human-generated content, identifying patterns and relationships, and applying the same in creating novel outputs. In the banking industry, it translates to creating customized responses for customers, constructing financial reports, forecasting trends, or simulating advisor conversations.

Generative AI models incorporate deep learning, Natural Language Processing (NLP), and Large Language Models (LLMs) that help them interpret, understand, and respond intelligently to customer needs and financial information.

What really sets Gen AI apart in banking is how well it gets the financial context, whether that’s diving deeper into transaction history, spotting fraud patterns, or tailoring investment advice to each client’s financial goals and modern market trends. Such actions are all possible because of smarter AI infrastructure and model designs that let banking systems work with real precision and stay relevant, even when the financial world moves fast.

Some of the most standout features of generative AI tools in banking include:

- Real-time data crunching and smarter decisions

- Natural language conversations and support for multiple languages

- Constantly learning AI models trained with the help of fresh data

- Compliance-friendly AI technologies with transparency and audit-ready tools

As AI technologies continue to grow, the future of generative AI in banking and finance isn’t just about getting things done faster. It’s also about creating totally new ways to make money and completely rethinking how banks deliver their services.

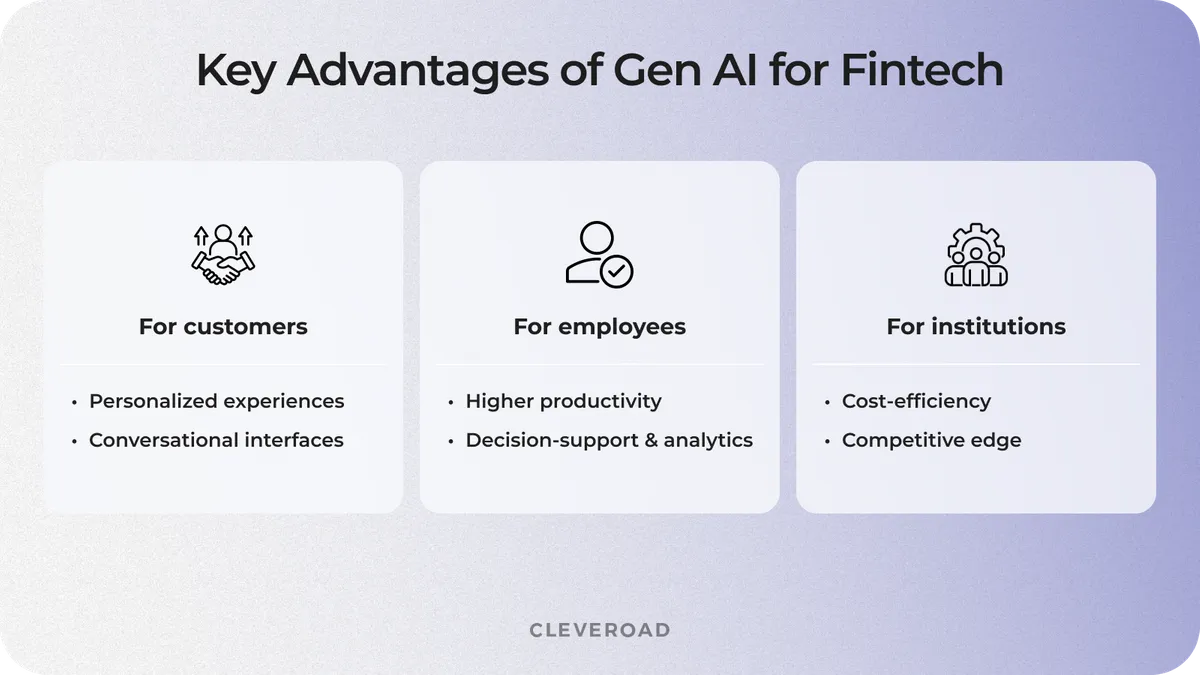

Key advantages of gen AI in banking

When you bring generative AI into FinTech, you open the door to truly personalized experiences, whether for a customer using your banking app, a financial advisor dealing with portfolios, or a team player streamlining how things run behind the scenes.

Key advantages of generative AI in financial services

- The key benefits of gen AI in banking for your customers:

Personalized experiences. Generative AI analyzes huge amounts of customer behavior data and can pick up on patterns in how people spend, save, and make financial choices. That means banks can get a much better read on what their clients need, and do it with more accuracy and real-world context, offering super-tailored financial advice that lines up with customers’ goals, spending habits, etc.

Conversational digital interactions. These conversations are powered by generative AI that understands context, tone, and user intent far beyond scripted chatbots. It delivers human-like, relevant responses in real time, making banking app communication feel natural and efficient. Such AI assistants also operate 24/7, ensuring consistent, smart support without human involvement.

- Gen AI benefits for your bank employees:

Improved productivity. Thanks to banking generative AI, a lot of repetitive tasks (e.g., data entry, compliance reporting, document verification) in banking operations get automated with AI as a digital clerk. That means your employees can focus less on routine tasks and more on strategic work. McKinsey states that banking generative AI would lead to 0.5%-3.4% annual growth in the productivity for each employee.

Decision support and advanced analytics. Instead of getting buried in endless reports and numbers, bank employees can get clean, easy-to-read visuals, like dashboards and quick summaries, that point out what actually matters. That means it’s way faster and simpler to catch risks, keep tabs on performance, and make smart calls. Whether it’s signing off on a loan or managing cash flow, Gen AI turns all that complex data into clear, confident decisions.

- The major advantages of using generative banking AI include:

Cost efficiency. Generative AI minimizes the operational expenses by automating tasks such as report-writing, internal documentation, and client communication. Automation of manual work results in decreased operational expenses. Moreover, according to a McKinsey report, AI-driven automation also raises revenues by 62% overall.

Competitive edge. Gen AI is speeding up responses and answers considering request context, making customer experiences more personal. Moreover, as we mentioned earlier, AI systems also impact employee productivity and overall banking flow efficiency. The ability to react fast and serve smarter is helping early adopters stay ahead of the traditional banks in the competition. Tandfonline proved that you can use generative artificial intelligence to react quickly, keep up with tech-savvy customers, and stay ahead of the competition.

Gen AI market statistics for banking sector

Based on the most significant benefits of generative AI for banking, it's critical to consider the present environment of its uptake in the banking sector. Below are some stats that give an overview of how the financial sector is being transformed by generative AI:

- According to a SAS report for 2024, 60% of bank leaders currently have operational use of generative AI, with 17% of them fully embracing it as a part of their daily routines. Further, 38% of them intend to adopt it in the next couple of years.

- The financial services global market for generative AI was $2.7 billion in 2024 and is expected to grow by reaching $18.9 billion by 2030, with a CAGR of 38.7%, as GlobeNewsWire data.

- The SAS report also says that almost 90% of bank leaders described enhanced risk management and compliance following the implementation of generative AI solutions.

These stats underscore the following: generative AI is already revolutionizing the banking sector. Let's dive deeper and see how you are actually implementing practical applications of generative AI and reshaping your business processes as well as customer experiences.

Take your advantage from generative AI development services rendered by experienced AI development specialists from Cleveroad!

Use Cases of Generative AI in Banking

Gen AI use cases in banking show how you can lean into advanced tech to boost repetitive tasks and improve client service. Here are some key spots where Gen AI banking solutions are really making a huge difference:

Individual financial recommendations

Generative AI pushes personalization in banking a step further by examining financial behavior, creating personalized messaging, product recommendations, and monetary advice. Banks can now provide one-to-one recommendations at scale, shortening the time for customers to achieve their financing goals and enhancing satisfaction, loyalty, and cross-sell opportunities.

Real-life example: JPMorgan Chase runs an AI system that checks out how customers are spending their money, then suggests tailored investment options and ways to save. For instance, they use their CoIn (Contract Initiative) program as one of the instruments to enhance decision-making. This program uses machine learning to scan legal contracts and identify key information points, including contract conditions, provisions, and commitments, to suggest personalized investing recommendations.

Intelligent document processing

One of the most impactful generative AI applications in banking is to handle document recognition and processing. Instead of burning time on repetitive tasks like filling out forms or typing in data by hand, Gen AI for banking can instantly pull and check info from loan apps, ID docs, onboarding forms, or even insurance claims. That means fewer mistakes, quicker responses, and lower costs, plus a smoother, better experience for your customers.

Real-life example: HSBC is using generative Artificial Intelligence to power up their document processing. It’s able to automatically pull and sort info from complex financial forms, cutting processing time by over half. Moreover, HSBC integrates other gen AI use cases, including AI-based fraud detectors, NLP to simplify data presentation for potential investors, and so on.

Automated reporting and regulatory compliance

Keeping up with reporting rules requires a lot of time and money. But with the integration of generative AI, banks can automate those processes and pump out clean, accurate reports super fast. Generative AI also assists in automated compliance checks by continuously scanning transactions, flagging anomalies, and generating automatic warnings, which helps reduce compliance risks and avoid costly penalties.

Real-life example: Bank of America uses generative AI tools to handle quarterly and yearly reports by generating custom reports. This AI-powered approach reduced the time taken in preparing the financial reports from a few weeks to a few hours and enhanced accuracy and compliance significantly.

Virtual banking assistants

Customer support is going next-level with digital banking, especially through conversational AI. With the help of generative AI, virtual banking assistants can now respond to customers with human-like accuracy, pulling data from your own documentation and policies and analyzing customer behavior and previous responses to deliver answers that are personalized, relevant, and fully compliant with each user’s specific needs.

Real-life example: Bank of America’s Gen AI-based assistant, Erica, chats with customers to help them explore financial tools, make payments, and check balances, all with smooth, intuitive conversations. It’s one of the top Artificial Intelligence initiatives shaping the future of AI in banking.

Synthetic data creation for training AI-based models

The development of advanced AI systems, such as fraud detection engines, credit scoring software, or customer service bots, demands huge volumes of quality data. Banks face challenges gaining access to real data in the highly regulated environment of banking due to privacy requirements. Generative AI addresses this by generating sets of synthetic financial data for model training without releasing sensitive customer information. The usage of AI-generated data for model training allows banks to improve AI-driven services and reduce time-to-market while staying fully compliant.

Real-life example: American Express uses synthetic data for training its latest fraud and credit models. It’s helped them speed up feature rollouts and sharpen their predictions, grounding their status as a leader in gen AI banking solutions.

By tapping into these cutting-edge gen AI use cases in banking, financial organizations are setting themselves apart as innovation leaders. They become more efficient, keep customers satisfied, and stay on the right side of the regulators. Whether you’re a growing fintech startup or an established bank, rolling out AI in fintech can be a game-changer. It completely transforms your banking services and redefines your customers’ experiences.

Major Risks to Avoid With Banking Generative AI

The growing adoption of generative AI for banking transforms the financial industry and brings real positive results, but it’s still important to understand possible risks and know how to address them.

AI integration in banking systems

Risk: Another important challenge is the integration of existing banking systems with AI technologies. Many banks make use of legacy systems that may not be compatible with advanced AI frameworks and thus may pose expensive and time-consuming challenges.

Way to avoid: At Cleveroad, we are ready to help you update your current software within our legacy software modernization services to make it AI-ready and incorporate generative intelligence functionality smoothly. We make sure your system is future-proof without interrupting daily operations.

Model bias and fairness concerns

Risk: Bias in AI models is a real issue, especially with advanced AI technologies. If your models are trained on incomplete or biased data, it can mess with everything from loan approvals to how your support team interacts with customers. And yeah, such a bias can seriously damage your brand and customer trust.

Way to avoid: To ensure fairness, banks should regularly validate their AI models using diverse datasets and transparent practices. AI tech experts can simplify this task. For example, we at Cleveroad offer AI model fine-tuning as a part of our AI development services.

Data privacy and regulatory breaches

Risk: When it comes to the banking and financial services industry, data privacy and compliance rules aren’t optional, but the baseline. As more banks start adopting gen AI, handling sensitive customer data with care becomes even more critical. One wrong move could cost you serious legal problems.

Way to avoid: When you implement generative AI in banking and finance industry, you should put strong privacy frameworks in place. Moreover, keep your compliance playbook updated with the latest regulations like:

- AML and Consumer protection: PCI-DSS, PA-DSS, Dodd-Frank

- Secure Payments: PSD2, EMV Chip

- USA Frameworks: FTC, CFTC, FINRA

- Europian regulations: EBA, GDPR, MiFID II, MiFIR

- SA and UAE Framework: SAMA & CMA

- Switzerland Framework, like FMIA overseen by FINMA, and so on.

These steps not only help you stay out of trouble, but also build trust with customers and ensure compliance with regulations, eliminating the risk of penalties during audits.

Cleveroad offers end-to-end banking software development services to help you smoothly integrate generative AI in bank workflows

Need for explainability in decision-making

Risk: Clients and regulators typically want to understand how decisions are made, especially in areas like banking and payments. One of the big red flags with AI and generative AI in particular, is how hard it can be to explain the intricacies behind AI-driven decisions. Whether it's loan approvals, fraud checks, or investment advice, the participants of the process expect transparency.

Way to avoid: Use interpretable AI models. Techniques like explainable AI (xAI), specifically such tools as LIME and SHAP, can break down the decision-making process of complex models into something regular folks can actually understand.

This kind of transparency doesn’t just help build trust and satisfy regulators; it also makes it easier for teams to get on board with AI and keep using it long-term. At Cleveroad, we build these explainability layers right into our AI-powered fintech solutions, so every automated decision (e.g., fraud detection or credit scores) can be explained in plain terms and backed up when needed.

Find out how to implement Generative AI in Fintech in our guide explaining the whole process from initial consultation to PoC testing and full-scale release!

The Latest Updates For Generative AI in Banking

Let’s break down the hottest trends showing the growing impact of AI in banking and how smart financial institutions benefit from them.

GenAI governance

As more fintech facilities start using generative AI in banking, solid governance has become a top priority. It's all about managing AI the right way: ethically and transparently. A strong governance setup helps banks steer clear of common gen AI risks, like privacy slip-ups or biased decisions, so they can roll out AI with confidence.

JPMorgan Chase applies Gen AI governance through dedicated AI governance teams. These pros are focused on shaping clear ethical guidelines and best practices to lead the adoption of AI in banking.

Proprietary GenAI copilots

Banks deploy custom AI assistants, another called proprietary GenAI copilots. These tools are designed just for banking pros, giving them instant insights, smart analysis, and tailor-made suggestions. In other words, they’re seriously leveling up digital banking experiences.

Morgan Stanley have launched their own AI-powered copilot that helps advisors manage portfolios and craft personalized recommendations. It crunches complex data in real time, helping teams make faster, smarter decisions. These copilots are a clear win for the deployment of generative AI in banking.

The GenAI talent race

As banks boost their AI adoption, the hunt for skilled talent in generative AI technologies is growing quickly. Financial institutions are actively looking for the best minds who can bring generative AI and banking together in smart, strategic ways. And it’s not just about coding: banks need people who get a deeper understanding of financial services empowered by AI and its business impact.

Citibank and HSBC are actively hiring AI experts, data scientists, and generative AI strategists. They’re also investing resources into training and recruiting to stay ahead. Meanwhile, for SMBs and startups, teaming up with experienced software outsourcing companies is a smart move. It’s a fast track to expert support and a smoother entry into the AI world.

The latest trends for gen AI in banking

As the banking industry rapidly evolves, staying aligned with digital transformation trends is no longer optional, but essential. Generative AI is at the forefront of this shift, enabling financial institutions to modernize customer experience, boost operational efficiency, and remain competitive.

To fully leverage these innovations, it’s critical to partner with a tech vendor that not only understands artificial intelligence, but also has proven experience in the banking domain. Contact us to explore how we can help you implement tailored AI-powered tools into your Banking solutions.

Why Choose Cleveroad For Implementing Gen AI in Banking Sector

Cleveroad is a FinTech development company with more than 13 years of experience in delivering scalable and secure Banking software solutions. We help financial institutions, banks, neobanks, and other fintech companies design and develop tailored Gen AI and GenAI technologies and integrate them into core banking systems while ensuring compliance, performance, and user trust.

Collaborating with us, you’ll receive the following key benefits while implementing generative AI for banking sector:

- End-to-end Gen AI integration services covering every aspect of AI adoption, from initial AI consulting and use cases validation, to PoC development, testing, and full-scale deployment

- Collaboration with a vendor holding ISO/IEC 27001:2013 and ISO 9001:2015 certifications, and ensuring we adhere to world standards in information security and quality management

- We create AI-powered banking solutions that adhere fully to domain regulations like PCI DSS, GDPR, PSD2, Open Banking, AML/CFT

- Cleveroad is AWS Select Tier Partner, and our AI engineers are experts in using AWS technologies. So, we can build a software for you using their tools: for instance, we use Amazon Bedrock for developing our cloud-based systems.

- At the same time, we create Gen AI-empowered solutions that are based on top-tier language models like GPT-4, Claude, and PaLM 2

- Expert-guided executive AI Workshop for empowering your leadership team to confidently determine AI possibilities, minimize uncertainty, and create a high-impact adoption plan in sync with your business objectives

We’ve got many satisfied clients in the FinTech industry. For example, we’ve delivered a modular payment software for marketplaces to our client from Mangopay company. This solution allowed the client to integrate into a complex fintech system, comply with financial regulatory requirements and ensure seamless functionality. This is what Kirk Donohoe, CPO at Mangopay, says about collaboration with Cleveroad on banking solutions development:

Kirk Donohoe, CPO at Mangopay. Feedback about Cleveroad's FinTech Softaware Development Services

To demonstrate our expertise in Fintech software development services, we would like to represent one of our most recent case studies in the Banking industry — Online Services Ecosystem for European Investment Bank.

Our customer, a Swiss bank, collaborates with B2B and B2C clients on trading services, online investments, and loan lending. They needed a trustworthy tech partner to develop a new and scalable banking software system (instead of their rigid and outdated solution) capable of helping them expand their services and attract more clients.

To meet our clients’ needs, our team has created a completely custom eBanking application that maintains and enhances existing bank features. We've designed an e-banking web portal that offers an easy sign-up process, an online account opening platform that complies with KYC norms, and an online trading and investing portal. Our solution also integrates seamlessly into the bank's internal DAO and Customer tool, which we've upgraded to increase performance, reliability, stability, and compatibility with the new platform.

In order to enhance user experience and operational efficiency, we also integrated an AI assistant into banking app that offers clients real-time support, custom financial insights, and instantaneous answers throughout the digital banking platform.

As a result, the client has received an eBanking platform with improved UX, which boosted customer attraction and retention 20-30%. The solution attained complete compliance with the Financial Market Infrastructure Act (FMIA) to support secure operation using the client’s current license.

Optimize your banking workflows with our AI experts

Partner with Cleveroad’s Banking software development team with deep knowledge of AI automation and simplify your institution’s workflows with a modern banking system empowered by Gen AI

Generative AI in banking is used to leverage sophisticated models that produce content, insights, or decisions from large datasets, introducing intelligent automation into financial processes. Such gen ai solutions advance corporate and SMB banking by streamlining decision-making, risk analysis, and customer segmentation.

With AI increasingly on the agenda, AI in banks and financial institutions is revolutionizing banks using quantifiable banking benefits such as decreased operational expenses and quicker service provision.

Generative AI is revolutionizing banking operations, interactions, and decision-making. With the ability to learn from enormous amounts of finance data, the power of generative AI supports quicker, smarter, and more tailored services, enhancing efficiency and customer satisfaction at each touchpoint. The following are some of the most important use cases where gen AI is having an actual impact in banking:

- Personalized financial advice

- Automated document processing and generation

- Real-time customer support through virtual assistants

- Predictive analytics and trend forecasting

- Synthetic data generation

Banks can leverage generative AI by adopting it into customer service, risk analysis, and compliance processes: AI is used to streamline processes and increase decision-making accuracy.

From intelligent chatbots to predictive analytics, AI is capable of helping to personalize services and streamline processes as it goes about transforming the banking sector. With AI also capable of helping to detect fraud and process documents, its footprint is quickly revolutionizing banking industry-wide, globally.

A significant issue in adopting generative AI for use within banks is complying with stringent data privacy and financial regulation, where misuse of sensitive data can result in legal and reputational repercussions. A second issue is the unexplainability of AI decision-making, which can damage customer and regulator trust. A third is that implementing generative AI into current systems in banks typically demands considerable technical know-how and can pose vendor lock-in risks if not well managed.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article