Generative AI for Insurance in 2026: Use Cases, Benefits, and Implementation Guide

Updated 30 Nov 2025

17 Min

134 Views

Generative Artificial Intelligence (AI) in the insurance industry is becoming a strategic priority. Gen AI helps insurers automate routine decisions and generate business-critical content at scale. It can draft policy documents, summarize claims, write personalized emails to clients, and create training materials for internal teams. On the decision side, it supports tasks like pre-approving simple claims or flagging high-risk applications, doing it all with greater speed and accuracy. For insurers, this means faster workflows, lower manual effort, and a stronger digital experience for customers.

At Cleveroad, we bring hands-on experience in AI-powered digital transformation for FinTech and Insurance sector clients. Our developers design and implement custom Gen AI solutions that support regulatory compliance, boost process efficiency, and unlock new value streams. Whether it’s intelligent automation or personalized risk modeling, we help insurers turn AI strategy into practical results.

We’ve prepared an in-depth guide on gen AI in insurance, where you will learn about:

- Why generative AI matters in the insurance sector and what is its practical role

- Top 6 generative AI use cases across various insurance subsectors

- The steps to integrate generative artificial intelligence into your insurance workflows

- Potential challenges of integrating Gen AI in insurance and ways to overcome them

The Role of Generative AI in the Insurance Sector

Generative AI in insurance is a subset of artificial intelligence that creates original content like text and images by learning from large volumes of existing insurance data, such as claims reports, underwriting documents, customer interactions, and policy templates, adapting the content to the context. According to McKinsey&Co, 65% of insurance organizations already use generative AI in at least one core business function, highlighting how quickly the technology is becoming standard.

Generative AI helps insurers automate communication with customers and deliver personalized experiences at scale. It can automatically create policy documents, fill out regulatory forms, summarize claims, and support agents with instant, AI-generated responses. Artificial intelligence reduces manual work, speeds up processes, and helps insurers offer better digital services with fewer resources.

Cameron Talischi

McKinsey Partner

“We’ve seen significant interest and activity within the insurance sector around generative AI, which is unsurprising given that insurance is a knowledge-based industry involving extensive processing of unstructured data. This is precisely where generative AI models excel.”

Let’s look at what makes Gen AI for insurance especially useful.

Improved productivity

Gen AI automates content creation at scale, such as policy summaries, claim descriptions, email newsletters, FAQs, and internal training materials for agents or support teams, based on previous customer queries and product documentation. It enables teams to produce consistent, compliant content faster, freeing up time for higher-value tasks and increasing overall productivity. McKinsey&Co reported that generative AI has led to productivity increases of 10–20% in core insurance functions such as underwriting and similar.

Faster customer response

Whether answering policy questions or sending updates, Gen AI in insurance can instantly generate personalized and clear customer responses. This allows insurers to replace or support human chat operators, offering accurate answers 24/7, reducing response times, and improving overall customer satisfaction while lowering support costs. According to IBM, insurers using GenAI in customer-facing systems reported a 14% higher customer retention rate and a 48% higher Net Promoter Score (NPS) compared to those not using gen AI.

Consistent documentation

Insurance firms manage thousands of documents, from contracts to claims reports. Generative AI creates these documents automatically while maintaining a consistent tone, structure, and compliance format. This speeds up claims workflows and reduces the risk of errors caused by manual handling. Automating document generation not only improves turnaround time but also ensures higher accuracy across customer-facing and regulatory materials. For example, Artivatic reported that Allianz got a 50% reduction in claims processing time thanks to the simpler structuring of information by implementing GenAI solutions.

Content localization and personalization

Insurers often serve customers across languages and regions. Generative AI for insurance industry supports multi-language content generation and can adapt messaging to different audiences. As a result, clients receive a personalized approach instantly, without waiting for a personal manager to respond. They stay consistently satisfied with service quality, regardless of time zones or language barriers. Infosys says that 44% of insurance companies believe GenAI will have a significant positive impact on user experience and personalization across various regions.

Looking to benefit from gen AI? Our cutting-edge generative AI development services are here to help you access innovative scalability and automation

Generative AI Use Cases in Insurance Across Subsectors

Generative AI in insurance industry is beginning to reshape workflows with sector-specific solutions that go beyond generalized automation, providing enhanced customer service and boosting employee performance, increasing overall efficiency.

Here’s how leading insurers are leveraging GenAI through major insurance subsectors.

Property and Casualty (P&C)

P&C insurers handle high claim volumes and complex risk data, often struggling with unstructured documents. Manual claim reviews and policy assessments slow down operational efficiency due to their time-consuming processing. Here are the gen AI in P&C use cases that help solve these subsector problems:

- Automated risk submission parsing

GenAI models extract and standardize risk-related data from various document types, such as PDFs, emails, and spreadsheets. Generative AI reviews incoming submissions and automatically creates structured risk reports.

Trained on past submissions and underwriting decisions, the model understands which data is relevant and how to organize it for faster review. Underwriters no longer need to manually extract data, compare details, and draft reports. GenAI handles it end-to-end, from parsing and analysis to clean, decision-ready outputs.

- Real-time document summarization for faster claims resolution

Generative AI reviews claim-related documents, such as loss reports, adjuster notes, repair invoices, and medical records, and generates concise summaries tailored to the insurer’s decision-making process. Trained on historical claims data and resolution patterns, the model understands which details matter most for case assessment.

Instead of reading through dozens of pages, adjusters receive ready-to-use summaries that highlight causes, timelines, damages, and potential red flags. As a result, claims are processed more efficiently, errors are reduced, and customers receive quicker responses, even during peak workloads.

Let’s examine the case of a company that implemented GenAI in P&C insurance and obtained benefits.

Cytora, a risk digitization platform for commercial insurance, partnered with Google Cloud to digitize and automate commercial risk workflows. They implemented a GenAI platform using Vertex AI and PaLM 2 that parses risk submissions from multiple formats, structures data, and automates policy evaluation with chain-of-thought prompting (a technique used in generative AI to help the model think through problems step by step).

As a result, underwriters receive structured, decision-ready submissions more quickly, which improves portfolio alignment and significantly reduces response times.

Life and Annuity (L&A)

L&A insurers face challenges in tailoring policies to diverse life stages and managing lengthy onboarding and underwriting processes. Here are generative AI use cases that help solve these subsector problems:

- Personalized product configuration and policy drafts

Generative AI in FinTech and insurance creates personalized policies based on customer answers or preferences. It shortens the time advisors spend drafting quotes. Moreover, such an approach helps offer plans that match each client’s needs more accurately. As a result, customers get faster and more relevant proposals with pricing, terms, and coverage options that are faster and more relevant.

- Underwriting support through document understanding

Generative AI in insurance automates the analysis of applications and disclosures. It cross-checks input data against underwriting rules, summarizes applicant profiles, and produces rationale for approval or denial. By understanding and extracting insights from long-form documents like financial statements, GenAI enables underwriters to evaluate risks more efficiently and maintain consistent decision-making logic across cases. As a result, insurers speed up underwriting cycles and deliver faster quotes with greater transparency.

Let’s look at the case when a company implemented GenAI in L&A insurance and received advantages.

Zurich Insurance, a global leading multi-line insurer, implemented a generative AI-powered virtual assistant to automate and enhance claims understanding and documentation. The system, part of the CATIA tool, combines traditional and Gen AI to validate complex claims and summarize case details across multiple languages.

As a result, Zurich improved operational efficiency, reduced manual effort, and uncovered $1.4 million in recoveries during the pilot phase.

Group insurance

Group insurers must support large-scale onboarding and plan management, often for organizations with varying employee needs. Manual benefit customization, lagging communication with clients, and slow underwriting decisions will damage the insurer's reputation. Here are GenAI in group insurance use cases that help solve this subsector’s problems:

- Group plan generation with GenAI

Gen AI in insurance enables insurers to create customized group insurance plans tailored to company size and team structure. It drafts policy documents with flexible benefits and adjusts wording to match legal rules. Thanks to this, generative AI solutions in insurance save time and ensure coverage that fits each group’s requirements.

- Onboarding and document support for HR teams

Generative AI helps HR teams onboard new members by summarizing coverage documents and explaining benefits like deductibles, co-pays, and network providers in simple terms. It answers common questions from HR staff and new members about coverage options, eligibility, or reimbursement processes in real time. GenAI streamlines onboarding, reduces confusion, and improves employee engagement with their group insurance plans.

Let’s look at the case when a company implemented GenAI in group insurance and benefited.

AXA XL, a global risk management provider, implemented AI solutions to automate the reading and analysis of large-scale engineering site survey documents used in risk consulting. The company partnered to integrate Cogito, a cognitive computing platform that utilizes natural generative AI to extract insights from documents exceeding 100 pages within minutes.

As a result, AXA XL obtained the ability to review a higher volume of accounts, speed up underwriting quotes, and deliver better service to clients and brokers, especially valuable when tailoring group insurance packages to complex property risks.

How to Implement Generative AI for Insurance

To break down the generative AI for insurance implementation process clearly, we consulted Cleveroad’s Lead AI Engineer. He helped us outline each step, explain the technical nuances, and explained how to align generative AI features with processes of the insurance business.

Let’s look at the step-by-step integration of Gen AI for insurance guide.

Step 1. Define clear business outcomes

Before diving into tech, insurance providers must define what success looks like. Before implementing generative artificial intelligence, you need to decide what tasks it will perform for your insurance business, such as improving policy turnaround or boosting personalization, and aligning them with measurable KPIs across teams. Without this clarity, even advanced gen AI models can fall short.

At Cleveroad, we run a structured AI Strategy Workshop to help you assess the business value of AI integration and prepare a comprehensive roadmap covering all steps to successful automation with insurance gen AI. Our team ensures that all stakeholders agree on outcomes from day one, which reduces scope drift and sets a solid foundation for implementation.

Step 2. Align business and tech teams from the start

GenAI in insurance success requires more than engineering. Legal, product, customer support, and compliance teams must align on system goals, behavior, and boundaries to ensure effective and successful collaboration. The vendor plays a key role in translating generative AI logic into clear business implications for all stakeholders.

Cleveroad facilitates business and tech teams' alignment from day one through shared planning workshops, risk mapping sessions, and tailored documentation. Our teams bridge gaps between business vision and model design, helping every stakeholder stay informed and prepared throughout the GenAI implementation lifecycle.

Step 3. Audit your data and infrastructure

Generative AI models are only as reliable as the data and systems supporting them. At this stage, your generative AI development partner evaluates data quality and ensures the infrastructure is ready for model deployment. The main goal is to minimize compliance risks and model data discrepancies before developers write the code.

Cleveroad's AI engineers handle data and infrastructure audits using automated tooling to assess data pipelines, check compliance (e.g., with GDPR or HIPAA requirements), and prepare infrastructure that can scale with AI workloads, especially important in regulated insurance environments.

Step 4. Build a proof-of-concept (PoC)

It is better to start integrating generative AI in insurance with Proof of Concept - a lightweight version of the AI solution. PoC helps validate the tech feasibility and business value of the chosen AI use case before full-scale development. A qualified AI development vendor helps you at this stage, developing and integrating an AI model with limited functionality, assessing both tech compatibility and the solution's efficiency.

Cleveroad’s AI engineers provide robust AI PoC services to simulate real-world insurance scenarios like claims document analysis, underwriting support, or quote generation. We quickly provide stakeholders with working demos and performance benchmarks to secure internal buy-in and mitigate the risks associated with the main build.

Want to test your generative AI idea? Opt for our AI PoC services to validate the potential of the GenAI solution for your insurance business before you invest in full-scale implementation

Step 5. Develop and integrate the full-scale generative AI

Once the PoC proves value, you can expand your generative artificial intelligence solutions to cover more operations. Your AI vendor will develop a fully functional insurance gen AI model and integrate it into your existing workflows without interrupting any processes. AI engineers expand the model’s capabilities, embed it into workflows, and connect it to enterprise data sources and frontends. Your AI development partner will ensure secure deployment and consistent model output across channels.

We at Cleveroad, as an Amazon Web Services (AWS) Select Tier Partner, provide strong and scalable cloud infrastructure to deploy GenAI across your internal systems like CRM, document management, and claims automation platforms, as well as customer-facing solutions such as self-service portals, chatbots, and personalized policy dashboards. Our team handles data integration, user permissions, and testing, so the solution becomes a seamless part of your operations.

Step 6. Embed governance, monitoring, and explainability

Generative AI in insurance must meet regulatory, ethical, and operational standards. This phase includes configuring monitoring dashboards, implementing explainable AI techniques, and providing ways to cope with model failures. Generative AI vendor bakes these controls into the deployment, not as an afterthought.

Cleveroad builds monitoring dashboards tied to business KPIs and sets up alerting for performance failures. We also consult on internal support and compliance workflows to ensure transparency in every GenAI-driven decision.

Step 7. Scale and improve

Once generative AI proves its value in one area, such as accelerating claims resolution, it opens the door for broader impact. You can extend its application to other processes like risk forecasting, policy generation, or regulatory reporting. At the same time, you can enhance the original solution itself. A tool that once produced only basic summaries can evolve to generate and manage full sets of documentation, automate quality checks, or support multilingual compliance reporting.

We at Cleveroad partner with insurance companies across multiple phases to expand and improve their AI-driven tools. Our teams help upgrade existing functionality, integrate AI into new workflows, and even rework legacy systems to meet evolving business goals. This ongoing collaboration ensures the AI solution keeps pace with market needs and operational complexity.

Recently, we provided IT staff augmentation services to our client, the FinTech company Mangopay, based in Ireland. Mangopay powers modular payment infrastructure for 2,500+ European platforms, including Vinted, Rakuten, and Wallapop. Backed by Advent International, the company offers tailored payment solutions across C2C, B2C, B2B, and marketplace models. Its FX suite enables fast, controlled global money movement.

Mangopay partnered with Cleveroad to enhance their existing platform and launch a new product meeting the highest security and compliance standards (KYC, AML). We engineered a robust solution for global payments, integrating multi-currency pricing, e-wallets, treasury management, and global payouts to support seamless financial services operations across platforms. Beyond technical delivery, our team contributed to product strategy and regulatory alignment.

Our collaboration resulted in the rapid launch of a high-performance FinTech platform and established a lasting partnership built on trust, speed, and consistent results.

Here is what Kirk Donohoe, CPO at Mangopay, says about cooperation with Cleveroad:

Kirk Donohoe, CPO at Mangopay. Feedback about Cleveroad's FinTech Software Development Services

Challenges of Generative AI Solutions in Insurance

While gen AI in insurance opens exciting new opportunities for innovations, it also brings several operational and ethical risks that you can’t ignore. We asked Cleveroad’s FinTech Business Analyst to analyze the common challenges insurers face when adopting generative AI and offer some practical tips to overcome them. So let’s break down the main concerns and how insurers can address them.

Biased outputs and unfair decision-making

Generative AI models reflect the data they’re trained on. If datasets include bias based on gender, ethnicity, geography, or income level, the model can repeat and even amplify these patterns. This can lead to unfair policy pricing, claim denials, or misleading recommendations.

Insurers should audit GenAI models regularly to detect skewed outputs. Using diverse, well-curated training datasets and applying techniques like re-weighting or adversarial training helps reduce bias. It's crucial to involve domain experts during testing to catch edge cases that models may overlook.

Cleveroad's specialists help audit and prepare your data to minimize bias risks from the outset. We ensure training datasets are well-balanced and representative, apply proven techniques like re-weighting or adversarial training, and involve domain experts to test generative AI models thoroughly. This way, we help you deploy fair, compliant, and effective AI systems from day one.

Data privacy and security risks

Generative AI applications in insurance rely on large volumes of sensitive information, including policyholder records, claims documents, health data, and financial histories. If that data is mishandled or exposed during training or inference, it puts both customers and companies at serious risk. Breaches can damage brand reputation and violate compliance obligations.

At Cleveroad, we integrate strict access controls, anonymize Personally Identifiable Information (PII), and apply encryption both at rest and in transit as part of every GenAI insurance project. We build solutions aligned with ISO 27001 for information security and ISO 9001 for quality management, ensuring robust data protection foundations. Transparency around data usage is embedded by design, making responsible AI practices a core part of the system architecture, not an afterthought.

Technical complexity and integration limits

Generative AI solutions in insurance are resource-intensive and technically complex. Many insurance firms lack the infrastructure or data maturity to support full-scale deployment (Source: SSRN). Existing legacy systems often don’t support the data pipelines or model outputs needed for seamless generative AI integration.

We at Cleveroad implement modular, cloud-native AI architectures that simplify integration with existing systems and reduce technical debt. Our team addresses both legacy modernization and Gen AI deployment within a unified roadmap, ensuring scalability. We also embed data enrichment and governance mechanisms to boost model precision and long-term system performance.

Regulatory and ethical uncertainty

Regulatory bodies are still catching up with the speed of development of Gen AI solution. Many countries have no clear rules for AI-generated content, transparency, or decision accountability, especially in high-stakes fields like insurance underwriting or claims processing.

To ensure compliance and trust, your generative AI solutions must align with existing data governance and insurance regulations from day one. At Cleveroad, we help clients design AI workflows that meet current regional and industry-specific standards. Just as importantly, we continuously monitor legal developments and AI governance updates, enabling quick adaptation when new regulations emerge, so your solution stays compliant as the rules evolve.

Challenges of generative AI solutions in Insurance

How Cleveroad Can Help You with Insurance Generative AI Implementation

Cleveroad is a skilled generative AI development company with over 13 years of experience in creating digital solutions for insurance domain. We are headquartered in Estonia, a country in the Central and Eastern Europe region, and have R&D centers in Estonia, Poland, Ukraine, the US, and Norway. We provide robust generative AI services, including AI strategy workshops, AI consulting, Gen AI PoC creation and testing, generative AI development and integration, and more. Cleveroad offers cost-effective, fast-response, and reliable GenAI solutions tailored to our clients’ unique business needs.

Choosing Cleveroad to integrate generative AI, you’ll get:

- AI Strategy Workshop stage to gain clarity on your GenAI idea, its business value, and how it can be executed, from goals and scope to implementation steps

- AI PoC services to validate and refine the compatibility and performance of a new technology solution with your FinTech business IT ecosystem

- Partnership with an AWS Select Tier Partner that uses robust AWS-native tools to accelerate AI adoption, such as Amazon SageMaker, Bedrock, AWS Glue, and more

- AI engineers who use advanced generative AI technologies such as GANs and VAEs, along with techniques like RLHF and LoRA for efficient fine-tuning, build on top of leading models like GPT-4, DALL-E 3, Claude, and more.

- Partnership with an ISO-certified company implementing ISO 9001 quality management systems and ISO 27001 security standards

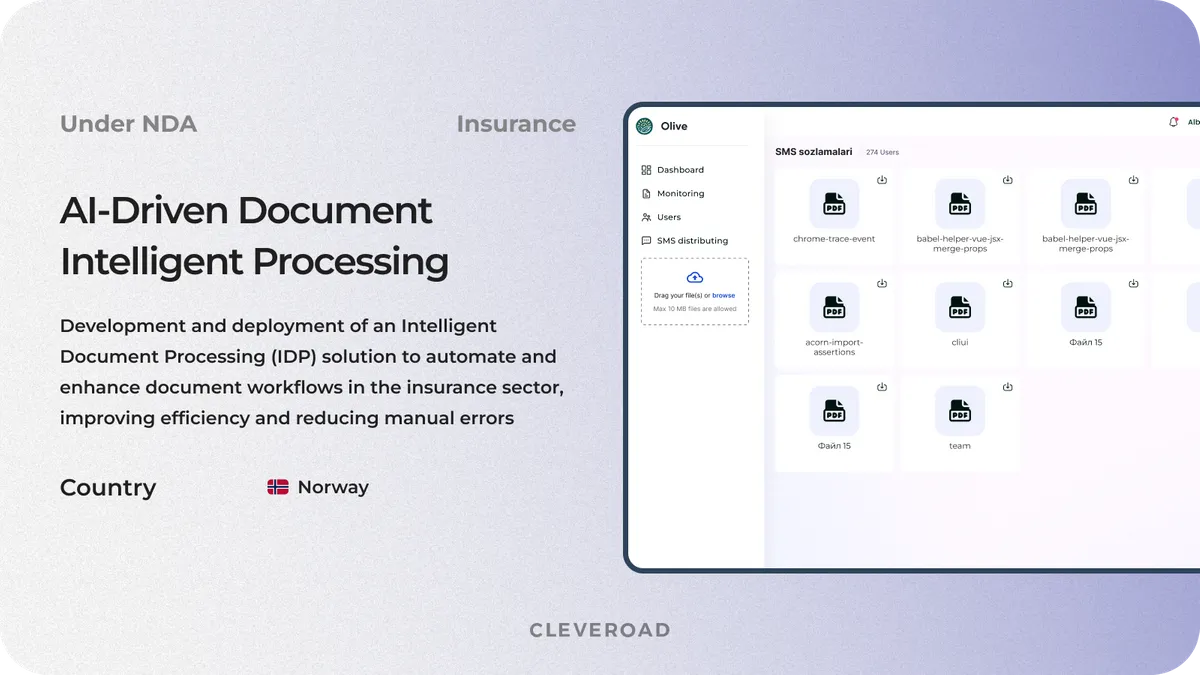

! To demonstrate our experience in creating AI solutions for insurance, we'll show you our recent case

We provided end-to-end development services for our client, an insurance provider based in Norway. The company sought to automate document-heavy processes tied to policy and claim workflows. Their key objective was to minimize manual effort, ensure compliance, and improve the overall speed and accuracy of document handling.

AI-powered intelligent document processing delivered by the Cleveroad team

Cleveroad delivered an AI-powered Intelligent Document Processing (IDP) system tailored to the client’s insurance operations. The solution automates the classification of various document types, enables high-accuracy data extraction, and seamlessly integrates with the client’s internal tools, freeing up staff time and reducing reliance on manual input.

As a result, our customer have received an AI-based IDP system that allowed them to reduce manual processing time by up to 75%, improve compliance readiness, and accelerate claims and policy handling, thereby boosting both operational efficiency and service quality.

Implement GenAI in your insurance business with a reliable vendor

Contact us! Our skilled AI development team is ready to help you improve your insurance business with cutting-edge generative AI solutions

Generative artificial intelligence is a subset of artificial intelligence that focuses on producing original content like text, images, and audio, based on training data. In the global insurance market, gen AI tools lie in automating and personalizing communication-heavy, document-driven processes. Unlike traditional AI, which analyzes data and predicts outcomes, generative AI systems create content with large language models that would normally require significant human effort.

Generative AI's main use cases in insurance across subsectors are:

Property and Casualty (P&C)

- Automated AI risk submission

- Real-time document summarization for faster claims resolution

Life and Annuity (L&A)

- Personalized insurance product configuration and policy drafts

- Underwriting support through document understanding

Group insurance

- Group plan generation with GenAI

- Onboarding and document support for HR teams

Deploying generative AI technologies in your insurance business lets you improve underwriting and pricing, get tailored business insights, and reduce human oversight. Let’s look at the benefits of the potential of generative AI implementation in insurance:

- Improved productivity

- Faster customer response

- Oversight of documentation

- Content localization and personalization

- Support for digital transformation

Generative AI significantly improves your insurance business, providing claims automation, protecting intellectual property, and more. But gen AI can also bring several challenges. The main potential risks of implementing generative AI in insurance organizations are:

- Data privacy and security risks

- Biased outputs and unfair decision-making

- Technical complexity and integration limits

- Regulatory and ethical uncertainty

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article