How to Get Funding for App Development: Practical Tips for 2026

Updated 04 Dec 2025

18 Min

1961 Views

How to get funding for an app idea if you don’t even clearly know where to start from? Securing funding for an app concept may feel overwhelming, especially if you’re just getting started. However, raising money becomes much more achievable when you understand the key funding options, know how to effectively pitch your idea, and approach the process with essential confidence.

Here are the key takeaways of what you’ll learn from this guide:

- Most startups begin small, often through bootstrapping or crowdfunding, before transitioning to larger funding options, such as angel investors or accelerators.

- It’s way more easy to get venture capital for more considerable investments and faster growth when there’s solid traction

- A strong pitch and a working Minimal Viable Product (MVP) make it way easier to attract investors at any stage.

- Angel investors and VCs can offer you more than cash, as you also get mentorship, business advice, and valuable industry connections.

We at Cleveroad have helped startups bring their ideas to life as real-world products since 2011. We support entrepreneurs from the initial idea stage, helping them create prototypes and MVP versions of their solutions to attract investors. We've interviewed our clients about their startup investing experiences and complemented their responses with expert tips from our Business Analysts to create this comprehensive guide on how to secure funding for an app idea. Let’s get started.

How Can You Generally Get Funding as a Startup?

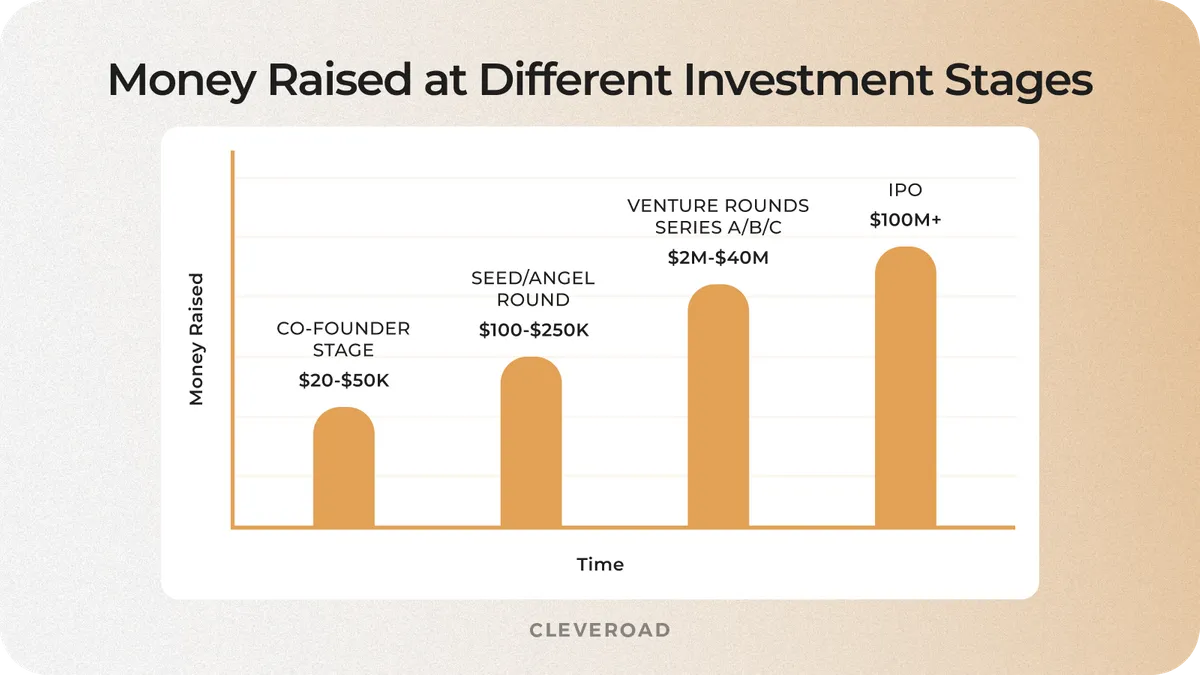

First and foremost, you should understand that app startup funding isn’t just coming and getting money. You need to go through several phases called rounds to prove that your idea deserves investment. Each funding round is made to accumulate enough capital to grow the startup and can take from 3 months to a year.

Let’s discuss the core stages of startup fundraising.

Pre-seed stage

At the pre-seed stage, founders try to give their idea a push and begin to develop the startups relying on their own money. Here are the proven ways on how to get funding at the idea stage:

- Look for a reliable co-founder to launch a startup

- Start a crowdfunding campaign

- Raise funds on your own website

- Take part in funding contests

- Focus on angel investing at the early stages

Seed stage

Seed funding implies attracting so-called angel investors to mobile app startup funding. The sum needed is relatively modest to cover the critical business needs such as creating a business plan, recruiting a small team, renting office space, and launching initial product development. This is usually the first answer when founders wonder how to get funding for an app idea, as angel investors often back early-stage projects based on potential rather than existing revenue.

Need to impress investors fast? Our software services for startups are a great way for you to build prototypes and MVPs that show traction, validate ideas, and push your startup toward its next funding round

Series A

Series A aims to attract third-party investors for further growth beyond product validation. At this point, startups typically have a tested business model, some traction with users, and a steady client base that generates revenue. This stage is crucial for those asking how to fund an app after the initial launch, as it focuses on product improvement, marketing, and team scaling. Venture capital firms usually lead this round, expecting startups to present clear growth metrics from previous rounds.

Series B

Series B focuses on scaling up a validated tech business and expanding it to a larger market. By now, your startup has likely reached product-market fit and is showing consistent user growth and revenue. Startups that wonder how to raise money for an app at this level aim to secure funds for team expansion, technology upgrades, and market penetration. Series B funding helps transform promising startups into established market players.

Series C

Series C targets startups with proven success that are looking to dominate their market or expand into new verticals and geographies. Investors at this stage seek stable, high-performing businesses ready for significant growth. Companies seeking funding for app development here are typically scaling rapidly, acquiring competitors, or launching international operations. The valuation often exceeds $100 million, and funding rounds are significantly larger.

IPO

An Initial Public Offering (IPO) marks a company’s transition from a private startup to a publicly traded enterprise. By this stage, companies have established profitability, strong brand recognition, and large-scale operations. Going public answers the long-term question of how to fund an app sustainably, offering massive funding opportunities while increasing the company’s transparency and access to capital markets.

How money raised at different investment stages

Funding Options to Look Out For

As a tech startup founder, you should be aware of the primary financial sources before raising money. So let’s take a look at the main ones below:

Crowdfunding

Crowdfunding enables you to raise small amounts of money from numerous individuals, typically through popular platforms like Kickstarter, Indiegogo, or GoFundMe. You present your app idea with a clear pitch, visuals, and sometimes a prototype, offering rewards or early access in exchange for financial support.

This method works well for early-stage app ideas, especially those with a unique concept or mass-market appeal. It’s a good first step when figuring out how to get funding for app development, as you can test demand before committing significant resources.

Pros of crowdfunding:

- No equity loss, as you retain full ownership of your app

- Provides early market validation and user feedback

- Builds a community of engaged supporters before launch

- Serves as a marketing tool to generate buzz

Cons of crowdfunding:

- Requires a well-planned marketing campaign to gain traction

- Funding is often limited to initial development stages

- High competition makes it challenging to stand out

- “All-or-nothing” rules on some platforms risk receiving no funds if targets aren’t met

Bootstrapping

Bootstrapping involves financing your app using your own money or revenue generated from early operations. For instance, according to ZipDo, the bootstrapping success rate is around 80%, which proves a strong viability compared to externally funded ventures. Apart from this, many founders prefer this approach in the initial stages to maintain full control and avoid dilution.

It’s common for bootstrapped founders to validate their idea step by step without heavy upfront investment. This often begins with a Proof of Concept (PoC), a small experiment to confirm that the core idea or technology is technically feasible. Next, a Prototype may be used to showcase the app’s look and feel and collect early design feedback. Finally, an MVP (Minimal Viable Product) delivers only the essential features to test real user demand and gather feedback with minimal cost.

This process doesn’t always follow a fixed order. Some startups move from PoC directly to MVP, others start with a Prototype, and many build an MVP right away, depending on their product, market, and available resources.

Pros of bootstrapping:

- Full ownership and complete decision-making power

- No time-consuming investor pitches or negotiations

- Encourages lean, cost-efficient business operations

Cons of bootstraping:

- Limited capital slows product development and marketing

- Increased personal financial risk

- Scaling beyond MVP becomes difficult without external funding

- Can lead to founder burnout due to financial pressure

PoC vs. prototype vs. MVP. What is the core difference, and why can these approaches help you attract investors faster? Check our guide to learn more

Incubators and accelerators

Incubators and accelerators offer startups structured programs that combine seed funding, mentorship, networking, and resources in exchange for a small equity stake. Well-known programs include Y Combinator, Techstars, and Seedcamp.

These programs are especially helpful when you’re learning how to raise funds for your app while also gaining guidance from industry experts.

Pros of incubators and accelerators:

- Access to expert mentorship and industry connections

- Small investment to cover early development and operational costs

- Increased credibility with future investors

- Structured support for rapid business development

Cons of incubators and accelerators:

- Equity trade-off for relatively small funding amounts

- Highly competitive selection process

- Fixed program timelines can feel intense and fast-paced

- Limited funding may only support short-term milestones

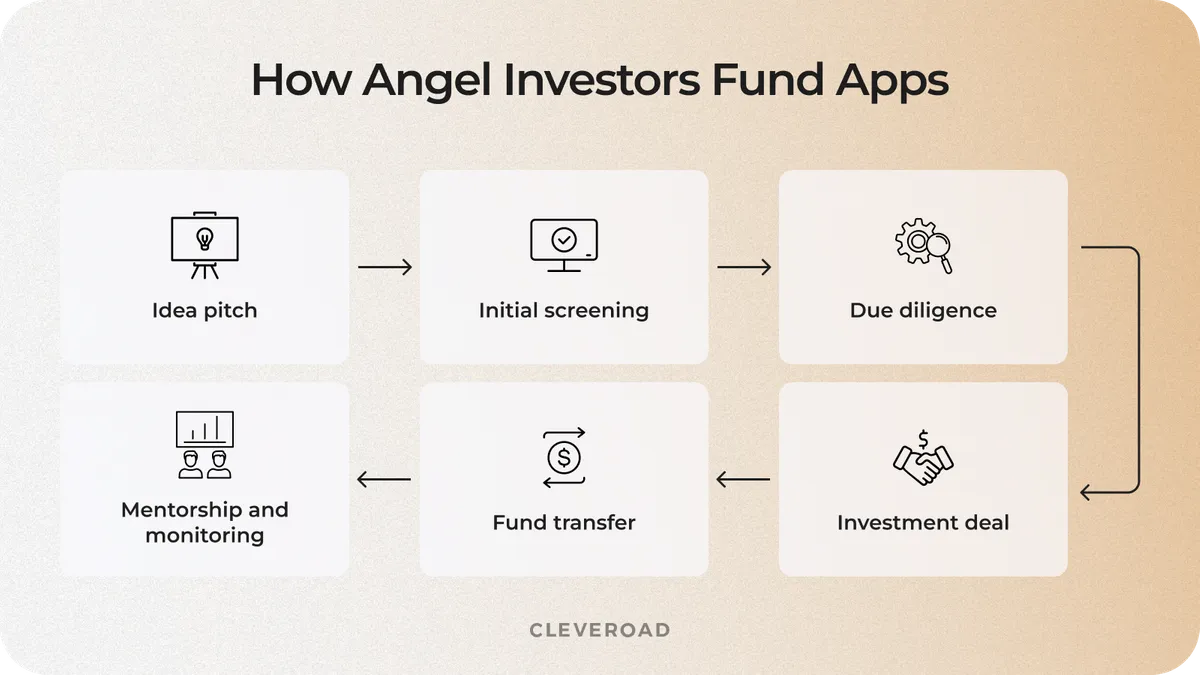

Angel investors

Angel investors are affluent individuals who provide early-stage capital in exchange for equity. They are ideal for app startup funding at the seed stage when the product is in development or just entering the market. In addition to capital, they often bring mentorship and business connections.

Pros of angel investors:

- Quick access to early funding for product development and launch

- Flexible investment terms compared to venture capital

- Mentorship from experienced entrepreneurs and industry insiders

- Can fund ideas with high potential but limited traction

Cons of angel investors:

- Equity dilution even at an early stage

- May involve active oversight or influence from investors

- Individual funding amounts are smaller than VC rounds

- Success depends on networking and personal introductions

Venture capital

Venture capital for app development is suitable for startups with validated products, high growth potential, and scalability. VC firms invest large sums, often at Series A, B, or later, in exchange for significant equity.

This option is optimal for companies aiming to scale quickly, expand into new markets, or outgrow their competition.

Pros of venture capital:

- Access to large amounts of capital for rapid scaling

- Strategic guidance from experienced investors

- Strong network connections to partners, clients, and talent

- Enhanced brand reputation and market visibility

Cons of venture capital:

- Significant equity loss and reduced founder control

- High expectations for fast growth and market capture

- Intense scrutiny during due diligence

- Complex deal structures and longer closing periods

Venture Capital vs. Angel Investors: Why These Are the Main Sources of Funding for App Startup

When it comes to raising funding for app development, venture capital and angel investors are two of the most common and effective funding options. Yet, they serve different stages and come with different terms. Let’s break down how they compare.

Venture capital

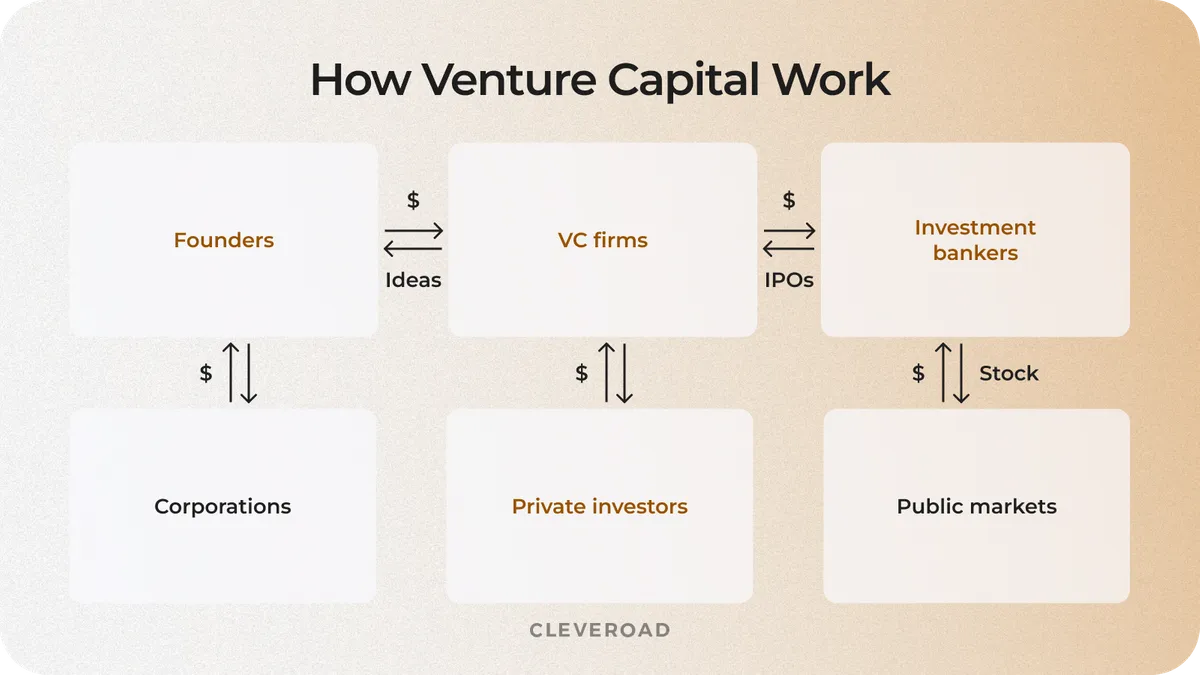

Venture capitalists deal with startups that have the potential to reshape the markets and grow very fast. The money deployed by a VC firm usually comes from institutional investors, corporations, insurance companies, or wealthy individuals willing to make serious investments. So, a VC firm is a partnership: there is a group of people who decide whether or not a company is going to be financed.

The idea is that the VC firm invests in the startup, waits for the company’s growth, and sells its equity stake for a profit. In essence, the venture capitalist purchases a stake in a business idea, helps you scale the existing offering for a short period, and then gets off with the help of an investment banker. The downside for business owners is that this type of app startup funding implies participation in decision-making in addition to a portion of the equity.

How venture capital work

Now, let’s consider how startups can benefit from venture capital financing.

- Expertise: VCs bring deep experience in startup growth, business scaling, and financial analysis to guide founders.

- Networking opportunities: VCs spend ~50% of their time networking, offering startups key industry connections.

- Improved public perception: VC backing boosts credibility, making it easier to raise funds from other investors.

- Managing risks: VCs manage risk through syndication, investing alongside trusted funds to minimize exposure.

- Due diligence: VC teams apply market-tested strategies and deep expertise to assess startups before investing.

Angel investors

Angel investors focus on early-stage startups with promising ideas or prototypes but little to no market traction. Unlike venture capital firms, angels are individual investors, often successful entrepreneurs or industry experts, who use their personal funds to invest in startups at the earliest stages of development.

How angel investors fund apps

Angel investments are typically smaller in size compared to venture capital but come with more flexibility and faster decision-making. Angels usually get involved because they see potential in the founder or the product and are willing to take on higher risks in exchange for equity. The key characteristic of angel investment is its accessibility for new founders. Angel investors tend to be more open to backing startups with little business history, focusing instead on the team’s vision and commitment. At the same time, founders should be aware that while angels are helpful, they still take a share of equity and may want some involvement in decision-making.

How startups benefit from angel investment:

- Early-stage capital: Angel investors provide the crucial first funds when other sources may not be available.

- Flexible terms: Angels often offer much quicker deals and considerably more flexible agreements than VCs.

- Mentorship: Many angels have experienced entrepreneurs who guide you through the early growth stages.

- Industry connections: Angels use their network to introduce you to potential partners, clients, or future investors.

- Less pressure to scale fast:** Compared to VCs, angels are usually more patient with growth timelines, focusing on product development first.

Tips for Successfully Getting Funding for Your App

Below, we’ve prepared a short list of best practices to facilitate successful investor search and app startup funding.

Validate your idea

Before reaching out to investors, you must prove there’s a real demand for your app. Start by conducting thorough market research to understand your target audience, analyze existing competitors, and identify gaps in the market. Run customer interviews, surveys, or simple landing page tests to gather feedback early. Validation reduces the risk of building something no one wants and shows investors you’ve done your homework. To help you with this, at Cleveroad, we offer full-fledged product discovery.

Our Discovery Phase is designed to reduce project risks, clarify product goals, and set a clear development roadmap before any coding starts. Here’s how they guide startups through it:

- Business and technical analysis. We analyze your business goals and technical needs to validate your app idea and market fit.

- Interactive workshops. Our product experts run workshops to refine your vision, prioritize features, and align tech solutions with business goals.

- Wireframes and clickable prototypes. Our team creates wireframes and clickable prototypes to visualize user flows and improve UX early on.

- Product specification documentation. You get a detailed spec document covering features, use cases, and technical details to avoid miscommunication.

- Effort and cost estimation. Cleveroad provides accurate time and cost estimates to help you budget smartly and control development costs.

- Roadmap preparation. A clear product roadmap outlines milestones and timelines, giving you full transparency for the development process.

Learn more about what benefits you will get from our Discovery Phase services

Build an MVP

While searching for mobile app startup funding, keep in mind that Investors typically want to see more than just an idea, they want proof of execution. An MVP helps you build a simple version of your app with only the core features that solve the main problem. This allows you to launch faster, collect user feedback, and demonstrate traction. An MVP is also a key milestone that shows investors your ability to execute and adapt. Cleveroad helps startups build efficient MVPs within a few months, allowing founders to enter the market faster and make data-driven improvements before scaling.

At Cleveroad we provide MVP development services for you to safely test the concept without extra investments and delays

Develop a solid business plan

A well-crafted tech startup business plan shows investors you understand how to build a business, not just an app. It should clearly outline your product vision, target users, key features, monetization model, competitive advantages, and go-to-market strategy. Financial projections, including revenue forecasts, customer acquisition costs, and long-term profitability, are crucial to gaining investor confidence. Cleveroad’s product experts can help structure your product roadmap to align with business goals, making your business plan more convincing.

Based on our expertise, here are the key aspects you should include in your planning:

- Product vision: what your app solves

- Target market: who will use it

- Competitors: market alternatives

- Key features: core functionality

- Monetization: how you make money

- Go-to-market: user acquisition plan

- Marketing: promotion channels

- Finances: revenue and costs

- Growth goals: milestones and scaling

Prepare a compelling pitch

While assessing your concept pitch, focus on the problem you are solving, why it matters, and how your solution is different or better than existing alternatives. Highlight your team’s strengths, your traction (users, downloads, partnerships), and exactly how the investment will be used to accelerate growth.

A live demo or MVP walkthrough can significantly strengthen your pitch. Cleveroad often supports founders with technical insights, product demos, and CTO as a Service, providing strategic technical leadership to shape your product vision, validate architecture decisions, and prepare investor-ready documentation. Having experienced CTO-level guidance helps reduce technical risks, making your startup more attractive to investors by demonstrating a clear, scalable technology strategy.

Get to know more about CTO-as-a-Service we offer at Cleveroad and how we can help you align your business vision with effective tech solutions

How Much Investment Do You Need for Your Startup

Launching a startup app requires varying investment amounts depending on the app’s complexity and market niche. To help you better understand the funding scale, we analyzed the approximate investments needed for several currently popular app examples, which once started as startups:

- Uber secured $200K in seed funding to bring their ideas to life. In the first quarter of 2024, Uber reported revenue of $38.59 billion.

- Instagram, the popular photo-sharing app, received $500K in seed funding to support its early development and made $59 billion in revenue by early 2024.

- Tinder, a leading dating app, raised $485K during its 2012 seed round and generated $1.9 billion in revenue in 2023.

- TikTok obtained $250K in seed funding and earned $18.5 billion in revenue in 2024.

- Airbnb, the major online marketplace, raised $600K in seed funding back in 2009 and reported $2.2 billion in revenue in 2023.

Below is a table with estimated seed funding amounts for common types of startup apps that Cleveroad clients have pursued. This overview gives a practical perspective on what it typically takes to develop and launch apps in different segments.

| App type | Approximate seed investment |

On-demand services | $150,000-$300,000 |

Social networking | $200,000-$500,000 |

Dating apps | $150,000-$400,000 |

Video streaming | $300,000-$600,000 |

Marketplace apps | $250,000-$600,000 |

Fitness and health | $100,000-$250,000 |

Note: Anyway, all these numbers are approximate and may vary heavily depending on your unique app concept case. Feel free to order an estimate to get a more precise price to develop your app.

Why Startups Choose Cleveroad for Building Scalable Apps

Cleveroad is a tech partner with 13+ years of experience, based in the CEE region (Estonia), specializing in helping startups turn ideas into successful digital products. We support founders at any stage, from refining a raw app idea, planning product strategy, building prototypes and MVPs, to scaling full-featured solutions. Whether you need to validate your concept, or prepare for investor pitches, Cleveroad provides end-to-end product development tailored to startup needs.

Here’re what benefits you’ll receive by collaborating with us:

- Startup-focused services. Get discovery phase, PoC, MVP, product design, and CTO as a service to launch faster with less risk.

- Free solution workshop. We help validate your idea and define the most cost-effective way to build your product, increasing investor appeal even at the development stage.

- Flexible cooperation models. Choose dedicated team, staff augmentation, or custom app development tailored to your startup tech needs and budget requirements.

- Investor-ready materials. Receive clickable prototypes, Software Architecture Document (SAD), and Feature Breakdown List (FBL) to strengthen your investor pitch.

- Proven industry experience. Leverage Cleveroad’s expertise across FinTech, Healthcare, Social Media, Streaming, and other industries.

- Strict security standards. ISO/IEC 27001:2013 and ISO 9001:2015-certified processes and NDA signing guarantee full protection of your business information.

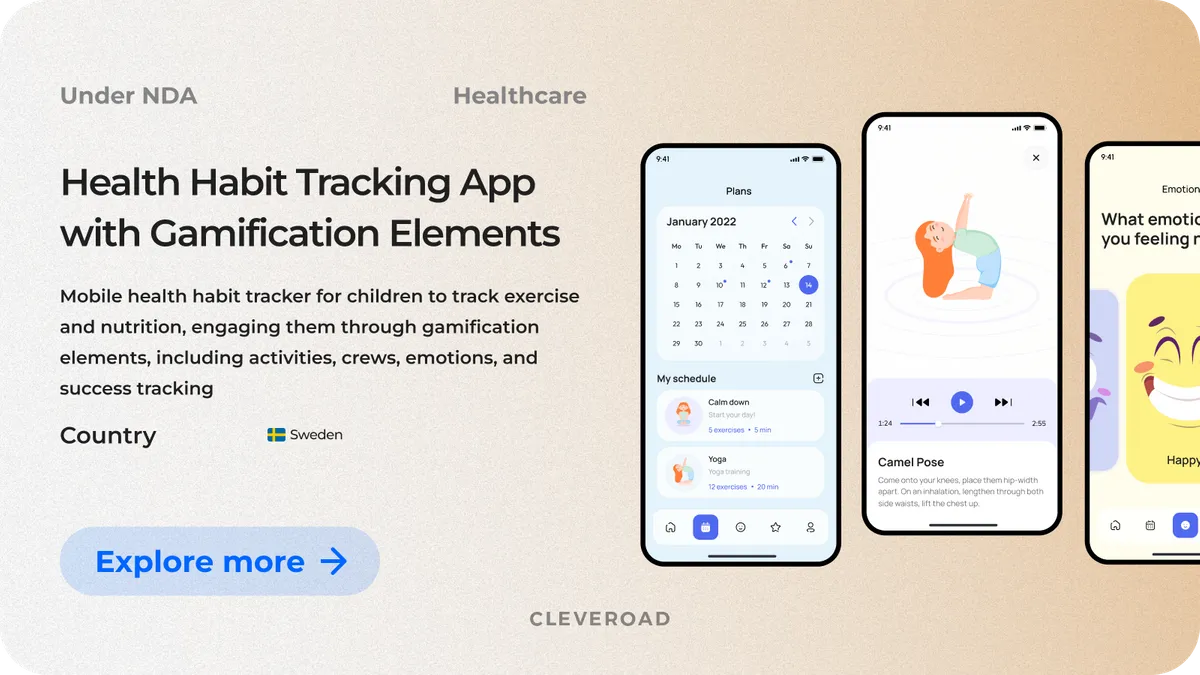

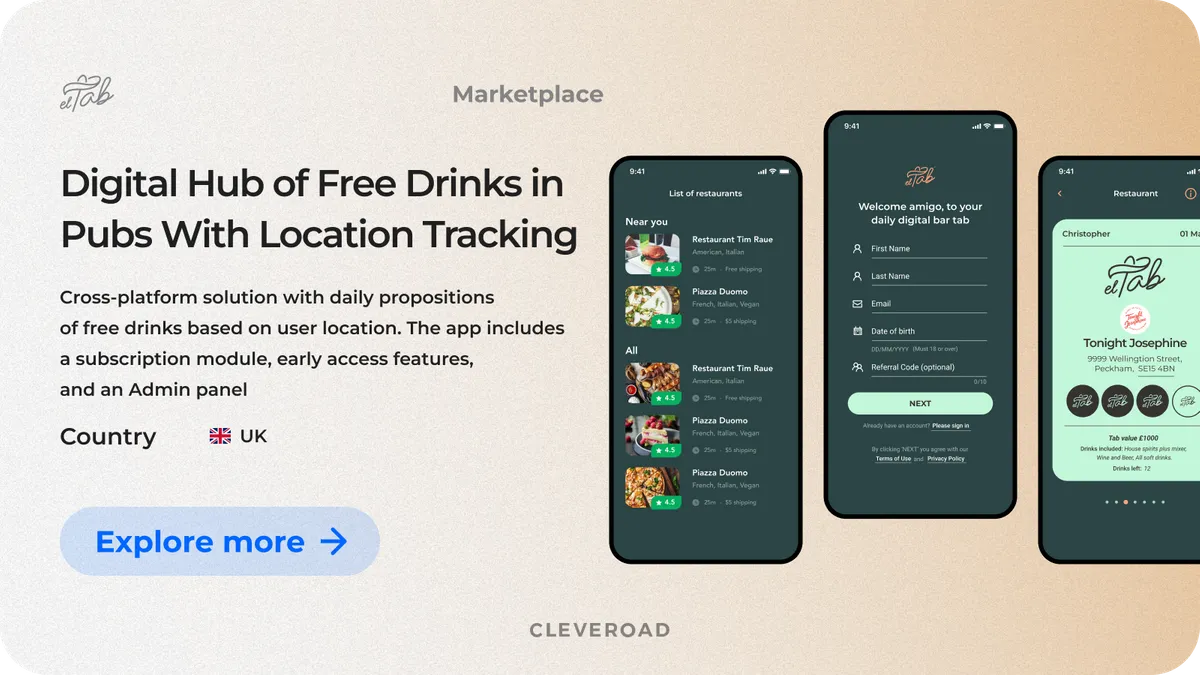

To represent our expertise, we’d like to show you our recent collaborations with startups – Health Habit Tracking App with Gamification Elements and Location-Based Marketplace for Bars and Pubs.

Health habit tracking system

Cleveroad partnered with a European early-stage healthtech startup focused on promoting healthier lifestyles through personalized fitness and nutrition programs to create a Health Habit Tracking App with Gamification Elements. The founders initially needed a product prototype to visualize the concept, test market demand, and secure seed funding. Our team developed a clickable prototype highlighting key features like gamified workout routines, reward badges, and habit-forming mechanics, which helped the startup successfully raise its first round of investment.

With this funding, we moved to MVP development, launching fully functional iOS and Android apps that allowed early user acquisition and product validation in the real market. We also built a robust admin panel for managing exercises, nutrition content, and user engagement.

As a result, the client rapidly entered the market with a competitive product, attracted new users, and strengthened their position for future fundraising rounds. The product’s early traction and polished investor presentations, including live demos, directly contributed to further investor interest and growth funding.After strong user feedback, the startup secured additional funding. We continue collaboration to further enhance an app and add more features

Location-based marketplace for bars and pubs

Cleveroad worked with a London-based startup targeting the hospitality industry with a unique subscription model for drinks in local pubs to build a Location-Based Marketplace for Bars and Pubs. As a bootstrapped venture, the startup’s goal was to quickly deliver a polished MVP within a limited budget and tight deadlines to gain initial traction and attract partner pubs and investors.

Cleveroad developed a cross-platform Flutter app featuring multi-payment support (Apple Pay, Google Pay), push notifications, and simple user onboarding, helping the startup launch rapidly on both App Store and Google Play. This early MVP allowed the founders to sign their first partner pubs before launch and run initial user acquisition campaigns

As a result, our client quickly validated their business model, attracted initial partners, and engaged with investors to support future growth. We delivered an admin panel, that enabled efficient partner and user management.. The professional product delivery helped the startup pitch to angel investors with a working demo, leading to early-stage investment discussions and securing commitments for further scaling.

Here’s what Oliver Carew, founder of El Tab says about cooperation with Cleveroad:

Oliver Carew, founder of El Tab provides feedback about cooperation with Cleveroad

Get robust assistance in your startup launch

Start with your app MVP with the support of Cleveroad’s specialists with strong domain and technical knowledge, to ensure your product's viability and attractiveness for investors

To get funding for an app, you typically go through several rounds of funding stages. These include pre-seed funding, seed stage, Series A, B, C, and eventually an IPO. Each stage is designed to help you turn your mobile app idea or web or mobile app concept into a real product. The earlier rounds are ideal for testing your innovative idea and building a user base, while later rounds help scale your app development project.

There are 5 proven ways to raise seed funds for your app development:

- Find a co-founder aligned with your app needs and idea for an app.

- Launch a crowdfunding campaign targeting mobile app investors.

- Raise capital on your own website by pitching your successful mobile app concept.

- Take part in app funding contests or app contests to receive funding.

- Connect with angel investors or VC funding options to fund your app in exchange for equity.

The most popular various funding options include crowdfunding, business incubators, government grants, bank loans, venture capital (VC funding), and angel investors. Tech startups working on mobile app development or building an app often target app investors like VCs or angels who are more likely to invest in a development team with a pitch deck and clear app idea into a reality roadmap.

An angel investor is an individual who gets investors interested in your app development project by providing early capital, usually during pre-seed funding or seed rounds. These mobile app investors typically invest smaller amounts but are crucial in helping to fund your app when your app developers are just starting out.

Venture capital involves professional app investors who raise VC money on behalf of a fund. They typically fund web or mobile app startups with a development team, solid business traction, and a scalable mobile app idea. In exchange for funding, VCs often take equity and are most attracted to teams with experience and a clear path to growth.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsVery informative and instructive. Just what I was looking for.