How to Build a Car Insurance App: Benefits, Features to Include, and Development Costs

Updated 30 Nov 2025

20 Min

465 Views

Car insurance app development is redefining how insurers connect with their customers in a mobile-first world. The leading companies in the vehicle insurance domain like State Farm, Progressive, or AllState strive to stand out from the crowd and seek strategies for attracting and retaining clients. That's why many car insurance businesses have begun providing their services through mobile applications as a convenient incentive for clients to remain engaged.

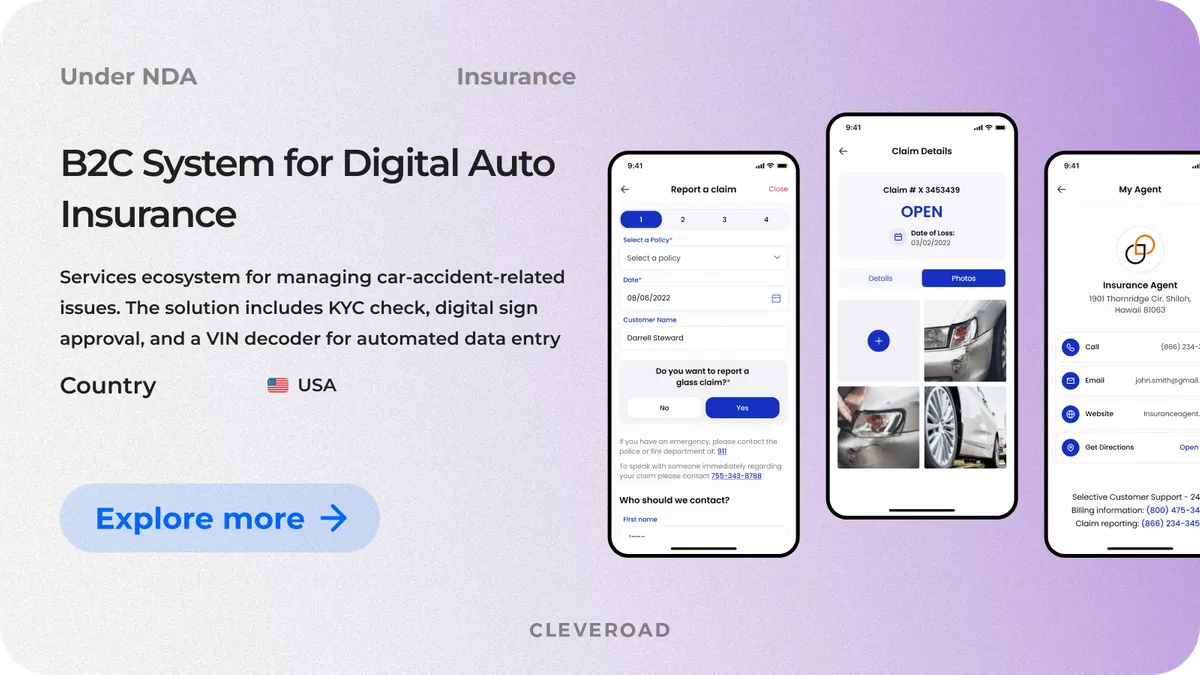

Cleveroad has 13+ years of practical experience in insurance software creation. For example, for one of our clients, a US-based car insurance company, we’ve developed an Online Services Ecosystem for Managing Auto Insurance.

Based on our experience creating insurance software, we’ve prepared a comprehensive guide on what you should know while planning your car insurance app development. You will consider the core feature set for a car insurance app, examples to inspire, cost challenges, use cases, and steps to build a vehicle insurance software.

Major Benefits of Car Insurance Mobile App Development

A car insurance app is a solution created for car insurance agencies, companies, or affiliates to help them prevent fraud activity and streamline quotes, as well as claims management.

Such solutions are helpful for insurance providers, as they bring the following benefits:

- Increased data security. Car insurance apps secure sensitive customer information with integrated privacy controls, protecting business transactions and identifiable information from misuse.

- Intelligent team collaboration. Centralized digital solutions enable agents and insurers to collaborate more effectively, manage multiple policies, and respond promptly to client requirements.

- Enhanced operational efficiency. Integrated claim management functionalities automate claim processing, minimize manual mistakes, and greatly lower claim handling time.

- Higher customer satisfaction. Personalized engagement tools and sales automation, like follow-up notifications, help insurers deliver faster, more relevant service based on individual client profiles.

- Fraud prevention and secure data storage. AI-based fraud detection mechanisms proactively analyze stored data, while centralized storage ensures fast access to essential documents and reduces the risk of data loss or misuse.

Looking at the numerous benefits of vehicle insurance solutions, companies strive to build car insurance app for their business. Thus, as Report.us data mentions, the share of the vehicle insurance market is forecasted to increase from $1.454.1 million in 2024 to $5.934.0 million in 2034.

Considering the stats and the benefits of such a solution for the vehicle insurance industry, you can see that the potential of the car insurance app creation is quite wide. So, that’s the time to think about its development for your company.

Learn more about insurance app development on the whole from our very particular guide!

Key Features For Car Insurance Mobile App Development

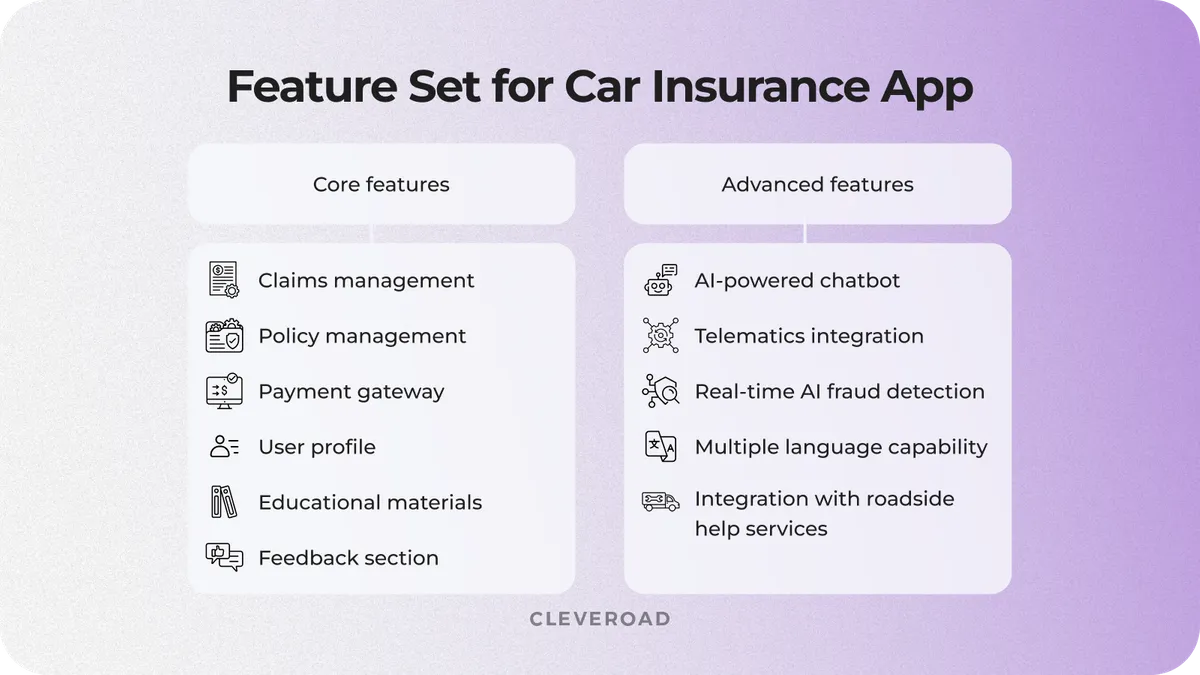

Selecting the right set of features is crucial to develop a successful car insurance application. A well-balanced feature set enhances customer satisfaction, simplifies claim processes, and significantly improves the overall efficiency of insurance services. Below we describe the most important features your app should include.

Car insurance app building feature set for your app

Claims management

Through this feature, you can manage claim submission and tracking through an easy-to-use claims handling module. Your customers will be able to make claims through their smartphones, add supporting documents, and receive instant claim status updates.

Policy management

Developing a car insurance app, you can provide complete policy management functionality to help customers easily view, modify, or renew their policy hassle-free. Moreover, thanks to the policy management functionality, your vehicle insurance app will be able to show key policy information, including coverages, premium values, and renewal dates.

Payment gateway

When creating an insurance app and implementing a payment gateway into your vehicle insurance software, you ensure easy and safe transactions. Use multiple payment options, such as credit/debit card, net banking, and bank transfers, to make it easy for customers and establish their trust.

User profile

Due to this feature, your customers can create their own profiles in the car insurance application. They can store their personal information, vehicle details, insurance details, and payment details, which is easier for the user and enables offers to be customized.

Education materials

Education materials functionality will provide simple and understandable educational matters (e.g., articles, guidebooks, videos, etc.) on car insurance policies, their benefits, and coverage terms. This feature makes customers well-informed about their insurance and enhance decision-making.

Feedback review

You can make it easy for customers to give feedback, rate their experience, report problems, or leave ideas on how it can be even better. This feature will also allow you to enhance your services using customers' feedback, which goes to promote satisfaction and retention.

After you’ve proved the viability of your car insurance app concept, you can implement the following advanced functionality when build a car insurance app:

- AI-powered chatbot for instant support

- Telematics integration for personalized premiums

- Real-time fraud detection through AI

- Multiple language capability to facilitate international accessibility

- Integration with roadside help services

This is the list of the core and advanced features you can apply to during the car insurance app development process and use as a vehicle insurance app customer or insurer. Please note that it’s not an ultimate feature list and can be changed according to your current business situation and company requirements. Feel free to book a 30-minute call with our Solution Architect and define the entire functionality of your car insurance app, fully applying your business needs!

Car Insurance App Development Process Step-By-Step

Developing a car insurance app for your business could lower claim processing costs and improve customer convenience. Let’s learn how to create a customer-centric product for your car insurance business and succeed.

Do homework on your side

Before you create a car insurance app, first make some preparations. For starters, think out your future solution’s target market, its business aims, and how they are connected to your company. Decide on who will use your product: a client or an insurer. It’s essential as the user role will determine the peculiarities of the feature set you may prepare.

Find a tech partner to cooperate with

To make your car insurance app development easier, you should look for an experienced IT provider who offers insurance software development. Experienced software development specialists will guide you to create secure and compliant vehicle insurance software step by step.

Make sure the provider has tech experience in mobile app development, essential for insurance projects and has a portfolio of successful case studies. Ensure that the tech partner maintains strict security procedures and is capable of satisfying regional and international compliance standards. Also, give preference to the providers who have flexible partnership models to fit the changing requirements and size of your project.

For instance, Cleveroad offers the following collaboration options:

The cooperation with a reliable tech partner will allow you to pass further steps of car insurance software development faster and easier. The IT specialists will care about all the tech processes, leaving you more time for your key business workflows.

Let’s look through how to build a car insurance app step-by-step on Cleveroad’s Software Development Lifecycle (SDLC) example.

Solution design stage

Our Solution team, including Solution architect, business analysts, and UI/UX designers, meets with you to define the project scope and create a list of features for your future car insurance app. The specialists will do it based on your business goals and constraints, like project timelines, budget, and collaboration preferences.

As a result, you will be provided with a rough cost estimate for car insurance mobile app development, suggested team composition for the next car insurance mobile app development stages, an approximate timeline, and a proposal.

At Cleveroad, we offer our clients a free Solution Design Workshop. Contact us to discuss car insurance automation goals with you aligning these goals with tech implementation!

Discovery stage

Cleveroad's Discovery Phase Services will help you convert car insurance project requirements into a clearly defined plan. Our team will outline the business procedures and the previously gathered needs, including the platforms to be covered (e.g., web, iOS, Android), the feature list, the third-party services (e.g., Google Maps), technologies best applicable for your car insurance app, etc.

The specialists document the technical and business demands for your car insurance app development in the Software Architecture Document. Based on the deliverables from the Discovery phase, our professionals develop a detailed project cost estimate.

Additionally, we assemble a team of IT specialists to build a car insurance app based on your specific requirements. At the same time, the UI/UX designers start working on the future interface of your car insurance product.

Product development and Quality Assurance

To develop your insurance solution and succeed, we use the Agile software development methodology. Our team works on your project iteratively, from sprint to sprint — two-week intervals when the specialists must do a certain amount of work under the supervision of our Project Manager. The following two weeks' work scope is decided upon by you and the development team.

The development team builds the pre-defined functionality during the car insurance mobile app development process. QA engineers work on your car insurance system project until it is released, testing the functionality built throughout each sprint. Particularly, they test the front-end and back-end simultaneously and provide results that software developers may use to address bugs.

Release, maintenance, and support

The team is prepared to launch your car insurance software. Initially, the QA team conducts smoke tests to determine the stability of the product. When significant issues are found, developers are required to make hotfixes. Afterward, we assist with the insurance solution’s release and deployment of your system in your business environment.

If necessary, we can continue to refine the insurance software based on user feedback and ensure the ongoing maintenance of your solution, including enhancements and the addition of new features.

Benefit from our insurance software development services to create a compliant and scalable car insurance software!

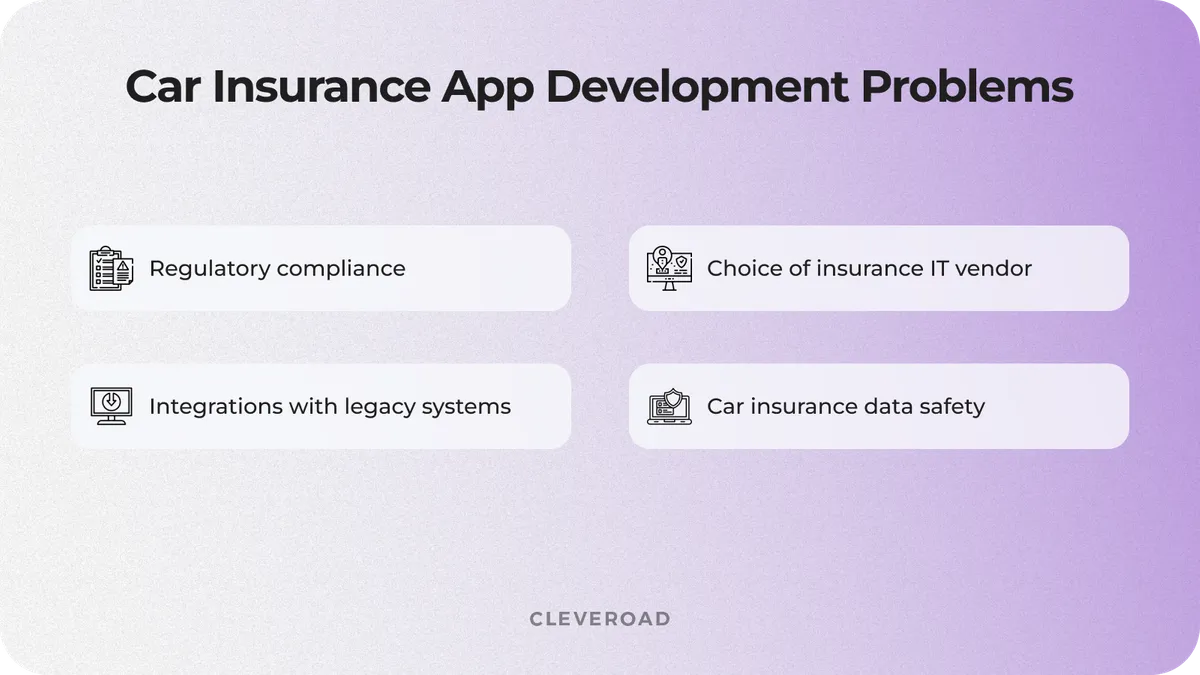

Common Challenges of Developing a Car Insurance App

Here are common problems customers always face in planning a car insurance application building and potential solutions for each issue. As a skilled car insurance app creation vendor, we’ll also provide you with possible solutions for these challenges.

Compliance with regulatory requirements

The insurance industry is heavily regulated, and non-compliance can result in legal penalties, loss of customer trust, and damage to a company's reputation. We’ve prepared a list of standard regulations to consider while developing a vehicle insurance solution.

| Regulation | Why and where essential |

Customer Protection Act | Controls the US business practices |

Payment Card Industry Data Security Standard (PCI-DSS) | Required for vehicle insurance vendors allowing payments through credit cards |

Prudential Regulatory Authority | Regulates and protects car insurance in the UK |

GDPR | Controls the car insurance data handling in EU |

Financial Services Regulatory Authority | Oversees Canadian insurance startup operations and promotes fair premiums |

This is not the ultimate list of regulations your vehicle insurance solution should comply with: the proper regulation choice depends on your target market country. A skilled tech partner knows them and can give you a hint as to the regulatory compliance needed in your particular business case.

At Cleveroad, we ensure strict regulatory compliance through proactive audits and tailored consultations with our Insurance software development experts. In order to seamlessly comply in insurance software development, we develop solutions in keeping with prominent industry frameworks and regulations including ACORD (data exchange), ACA (requirements of the Affordable Care Act), GDPR and PIPEDA (data privacy in the EU and Canada), and HIPAA (processing of highly sensitive healthcare-related information).

Making the right choice for auto insurance IT vendor

Selecting the right IT vendor is crucial for successfully developing a car insurance application. The wrong choice can lead to various problems, including cost overruns, project delays, etc. To mitigate such consequences, you should focus on the following points:

- Seek IT vendors with a proven proficiency in car insurance app development, showcasing expertise in the intricacies of vehicle insurance, like underwriting, claims processing, and policy management.

- Look through vendor references (professional platforms like Clutch are perfect for it) and check the previous clients feedback to gain insights into their experiences, work quality, and whether their expectations were met.

- Confirm the vendor's adaptability to your needs, recognizing the uniqueness of your insurance company's requirements and operational processes.

Since 2011, the Cleveroad team have been helping insurance organizations and coverage providers develop solutions for automating insurance policy management and claims processing, as well as reducing routine tasks. We offer custom mobile app development services tailored to your business goals. Depending on your needs, we can quickly assemble a team of skilled professionals with the right mobile expertise. As your product grows, this team can be easily scaled or adjusted to match changing resource demands.

Our experts can work with you in two flexible formats:

- As a dedicated team, independently managing the entire development process,

- Through IT staff augmentation, where you retain full control and integrate our specialists into your in-house workflows.

Recently, we collaborated with Mangopay, an Irish FinTech company. As the operator of more than 2,500 European platforms like Vinted, Rakuten, and Wallapop among them, Mangopay is focused on creating adaptable, resilient payment infrastructures for C2C, B2C, B2B, and marketplace scenarios.

Our specialists seamlessly integrated into the development process and helped Mangopay's team to upgrade our customer's existing payment platform. Cleveroad's developers were also engaged in building and releasing a new FinTech solution with the highest security and compliance levels, such as KYC and AML. We created an end-to-end solution for frictionless international money movement with multi-currency pricing, multi-currency e-wallets, treasury features, and global payouts.

Here is what Kirk Donohoe, CPO at Mangopay, had to say regarding collaboration with Cleveroad on this project:

Kirk Donohoe, CPO at Mangopay. Feedback about Cleveroad's FinTech Softaware Development Services

Data safety of your car insurance app

The problem lies in the potential risks associated with data breaches, unauthorized access, and privacy violations. Failing to address these issues can result in substantial financial and reputational damage, legal ramifications, and loss of customer trust.

When you build a car insurance app, implement robust data encryption protocols to protect data at rest and in transit. Use industry-standard encryption algorithms to ensure that even if data is accessed, it remains unintelligible to unauthorized parties. You can also provide an access control implementing Role-Based Access (RBAC) permissions to limit exposure to data on a need-to-know basis. Cleveroad adopts best practices for security across the entire development cycle, including coding standards for security, frequent vulnerability scanning, and providing security through integrations with third-party systems (e.g., Actico, Ondato, SAS, SEON, etc).

Car insurance solution’s integration with legacy systems

Legacy systems, often built on outdated technologies, house critical data and processes that must be seamlessly connected to your new application. Failure to address this challenge effectively can result in operational inefficiencies, data inconsistencies, and service disruptions.

You can start solving this issue by formulating a comprehensive integration strategy that outlines the goals, methods, and timeline for connecting the new application with legacy systems. Moreover, you can consider the legacy software modernization services from Cleveroad to update your existing software with new features and the latest technologies, making it more streamlined and robust.

Common challenges of car insurance app development

Car Insurance Use Cases and Success Stories

Developing a car insurance app enables the insurer to digitize their operations, build tighter client relationships, and remain competitive in the rapidly changing marketplace. From startups to legacy providers, adding mobile solutions to your workstream unlocks new ways to reduce costs, enhance service velocity, and increase client loyalty.

Let’s find out examples of how the famous car insurance software is implemented increasing the business profitability.

Successful car insurance use cases

Major insurance carriers that were already successfully in operation took things a step ahead by rolling out car insurance-specific digital platforms. Those carriers built in-house or partnered solutions to adjust internal processes, upgrade the manner in which agents and customers communicated, and reach more consumers. They not only optimized employee workflows by spending on car insurance applications, but also improved the overall policyholder experience, which led to more retained customers, greater profitability, and more robust loyalty towards brands.

Let’s find out examples of how mature carriers utilized such applications to bridge particular difficulties and unleash new growth potential.

OBI+ (Denmark). In order to streamline their operations with the data, OBI+ chose to develop an insurance application through which customers would get live car data dashboards. The solution improved service delivery and minimized the technology bottlenecks to their non-native-software setup, gathering more than 6 billion euros revenue from 2022, according to Statista.

CARUSO Dataplace (Germany). With the incorporation of connected vehicle information, CARUSO provided emergency responders with live automobile information such as engine temperature and locking device status. This kind of insurance support greatly enhances response times and results for automobile crashes.

Zurich (Germany). Zurich upgraded its claims handling through the integration of real-time car telemetry onto its mobile system. This provided quicker, more transparent claims evaluation and enhanced communication between customers and their insurance agents overall. Such an activity led to $7.8 billion profit in the first quarter of 2025 regarding the InsuranceBusinessMag data.

Vehicle insurance app examples

Prior to car insurance app development, you should get to understand the most prominent solutions available to see what features and insights are valuable. Moreover, you can launch a startup in this industry developing your own insurance app. Below there are examples of the most popular automobile insurance apps that keep influencing user needs and motivating application developers across the globe.

Geico Mobile. The app covers more than 28 million cars and features digital ID cards, policy admin, and roadside assistance. Among its features is its Digital Glovebox, where car and insurance documents are safely stored. It typically leads to $7.8 billion revenue according to S&P report.

Esurance. Targeted to Indian and US users, the Esurance app features instant claim reporting, payments, and discounting through telematics. The company's DriveSense feature analyzes the behavior of drivers to provide dynamic pricing.

State Farm Pocket Agent. Generating revenue of $89.3 billion, the app provides direct agent communication, safe driving incentives, and full-service policy access. Its feature examples include the Steer Clear program to enable young drivers to develop safer habits.

The integration of core features, individualized support, and smart automation is revolutionizing the manner in which automobile insurers interact with customers and conduct business. Selecting the appropriate features and technology needs to happen upfront to ensure risk is minimized and return on investment is optimized when creating an insurance solution.

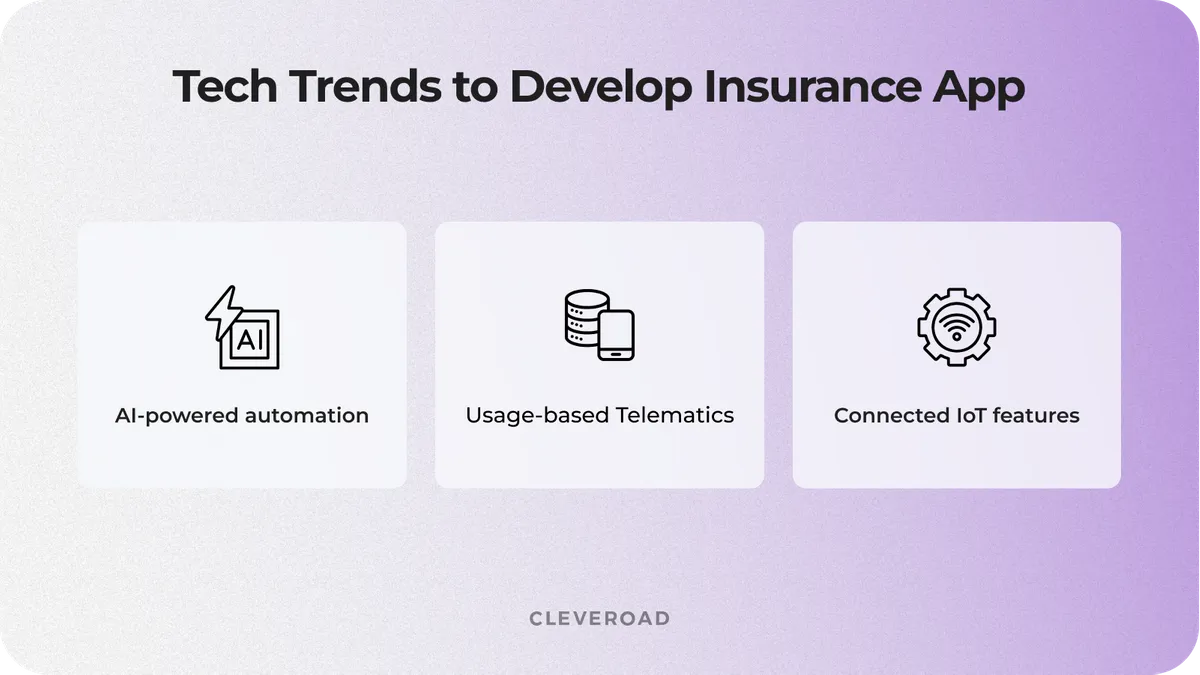

Trends to Utilize During Car Insurance App Development Process

For car insurance business owners looking into how to develop a car insurance app, familiarity with the new technology trends is critical to stay competitive and future-proof. From behavioral analysis to connected ecosystems, today’s technologies hold enormous potential to enhance operational efficiency, personalize the service, and automate claims.

Let’s look at the most prominent technologies transforming car insurance mobile app development and learn how you can incorporate them into your next project.

AI and machine learning

AI and machine learning are driving smart automation in modern car insurance mobile app development. They power tools like fraud detection, custom policy design, and predictive retention strategies by using ML algorithms, behavioral data and continuous learning from human interactions. With AI, your insurance application development team can create dynamic underwriting tools, virtual assistants, and document processing systems to speed up claims.

AI models can be trained to meet industry-specific rules and data to enhance decision-making and meet insurance industry-specific rules. Including artificial intelligence functionalities in your car insurance app enables you to speed up employee workflows, drive overall profitability and productivity, and improve overall customer experience. AI enables your services to become more intelligent and responsive over time, boosting not only the happiness of users, but the performance of your company as a whole.

Take advantage of our AI development services to build a fully automated car insurance solution!

Telematics implementation

Telematics technology is the key to usage-based insurance, allowing the insurer to derive insights on drivers' behavior in real-time and tailor offers accordingly. For example, incorporating telematics transportation system enables companies to move away from static flat-rate pricing to dynamic pricing tied to actual road behavior.

Integrating telematics into an auto insurance app can boost customer satisfaction, and enhance risk management. For anyone planning to build a car insurance app, the features might include GPS, speed tracking, braking patterns, and trip scoring dashboards. Savvy app developers often plug telematics APIs into mobile dashboards to give both users and insurers clear, actionable driving data.

Internet of Things usage

The Internet of Things (IoT) introduces new functionality to digital insurance by connecting cars, gadgets, and networks. In insurance application development, IoT sensors collect data from vehicle systems, smart cameras, and external devices to automate claims, predict service needs, or trigger emergency alerts.

These real-time insights allow insurers to provide preventive care or bundle offerings across coverage types, like property insurance or roadside help. If you're planning to develop an insurance app with IoT integration, make sure it's compatible with automaker APIs and connected infrastructure. IoT also enables seamless updates to your insurance plan based on real-time habits and situations.

Car insurance app development trends

How Much Does It Cost to Create a Car Insurance App for Your Business?

The car insurance software costs from $60,000 to $180,000+. The final price can only be determined by a bunch of factors considered by a tech partner while preparing a detailed estimate:

- Number and complexity of functionality

- Platform choice

- Design

- Security

- Regulatory requirements

- Integrations (e.g., claims management software, CRMs, data analytics tools, etc.)

- Team composition and location

The above range of car insurance software development cost is given only for your awareness. The accurate numbers will be mentioned by the specialists when they study your insurance app concept to build and consider the project requirements.

Moreover, the expenses for the development team are one of the essential cost-forming factors for your ultimate insurance software development. That’s why let’s see what specialists you need in your team to create a solution for rendering vehicle insurance services:

- Project manager

- Business analysts

- Solution architect

- Developers

- DevOps engineers

- QA engineers

- UI/UX designers

For example, you can apply to outsource car insurance app building to the IT company in the CEE region (Estonia in particular). It will help you streamline costs for creating a solution for vehicle insurance, start the project launch quickly and obtain the qualitative software in response.

Estonian skilled software developers’ services are available for $50-70 for an hour of work, one of the lowest wages for IT services throughout the outsourcing regions. Estonian IT specialists also work with the latest technologies (e.g., AI, Machine Learning, IoT integration) to make your vehicle insurance solution a cutting-edge one.

Let’s sum up the reason: why is car insurance software development necessary for your vehicle insurance business?

- Vehicle insurance is a promising industry to enter: PR Newswire forecasts that the industry market share will grow to $1,620.2 billion by 2028.

- The car insurance app creation is perfect to ensure your business data security, as it is developed regarding the appropriate regulatory requirements of your destination country

- Creating car insurance mobile app is essential to streamline complex processes like policy issuance, premium billing, etc.

Car Insurance App Development Company: Cleveroad Expertise

Cleveroad is an insurance software development company from the CEE region, particularly Estonia. We have been on the market for 13+ years now, offering app engineering and IT consulting services for insurance agencies and policy providers. Our solutions help insurance companies stay resilient and scalable and boost their operational performance.

Moreover, the benefit of working with us will give you:

- Receiving a robust and secure car insurance app fully satisfying your business needs and developed in terms of your time and budget

- Cooperation with a tech vendor having ISO/IEC 27001:2013 and ISO 9001:2015 certifications to ensure that we stick to world standards in data security and quality management

- Insurance legacy systems modernization services to meet the latest standards of interoperability, usability, and security of the systems interconnected with new insurance app

- Detecting and preventing claims fraud with the help of our specialists caring about the proper security measures

- Expert-led executive car insurance software development Solution Design Workshop to empower your leadership to decide with confidence on AI possibilities, reduce uncertainty, and develop a high-impact adoption plan aligned with your business strategy.

- On-demand IT services: mobile app creation from scratch, UI/UX car insurance app design services, IT consulting services, and so on.

We would like to share with you one of successful car insurance app development projects we've delivered - Online Services Ecosystem for Managing Auto Insurance. Our customer is the vehicle insurance company from the USA that had an inefficient company app that doesn't allowed their business to scale. We've replaced the obsolete car insurance web app to a completely new system offering qualitative and convenient services from insurers and their employees. Moreover, our team has developed a mobile app for the better insurance experience of our customer's clients

As a result, the customer has obtained the brand-new platform matching their business needs and letting them receive a revenue by offering their services online. Moreover, they have received a robust web app and a user-friendly mobile app to facilitate online connections and attract new clients to their insurance business.

We are ready to help you create reliable and robust vehicle insurance software that will help you effectively automate your day-to-day insurance operations and render your services more effectively. Let’s start our cooperation to provide maximum value to your business and secure your insurance data!

Digitize your car insurance with us

Our team with 13+ years of experience is ready to assist you in creating vehicle insurance app to start profit from insurance services now

Yes, insurance driving apps are indeed a worthwhile idea for businesses interested in selling personalized insurance according to actual driving behavior. Businesses who build an insurance app specific to this type of insurance can enhance user engagement, cut down on fraudulent behavior, and provide dynamic pricing. With the assistance of appropriate app development service, the solution of your company can become the talk of the App Store, leading to the success of your insurance business through enhanced mobile app development for the insurance sector.

To develop an automobile insurance app, begin with an explicitly defined insurance process, audience, and regulatory requirements. Partner with a mobile application development service provider who has expertise in the field of insurance technology to develop and deploy a native app according to your requirements. Whether you are mobile-izing travel insurance or growing an online insurance business, look at the cost of application development, integrations, and compliance requirements, all factors influencing the success and expense of insurance in the mobile-first era.

The app development cost for custom insurance mobile application ranges from $60,000 for a minimum viable product to more than $180,000 for an extensive, feature-rich solution. The ultimate cost varies depending on the features of an insurance tech product, technology platform selection, and security level needed for a digital insurance business.

Business collaboration with the provider of mobile app development services for insurance guarantees smooth budgeting, industry-specific knowledge, and mobile app development scalability to develop profitable insurance and insurance technology products and reduce the cost of insurance software.

To guarantee data security while developing an insurance app, begin with encryption measures, secure APIs, and strong authentication for backend and frontend development. An insurance-compliant mobile app development strategy ensures sensitive data is safe throughout various insurance products, whether you are designing property insurance apps or claim processing apps.

When your app allows safe interactions and implements standards, it enables the development of apps for insurance agents and makes it easier to develop and launch a successful insurance solution.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article