The Fullest Estimation of E Wallet App Development Cost: All Factors and Hidden Costs Disclosed

Updated 26 May 2025

19 Min

129 Views

How much does ewallet app development cost for your fintech business? The answer might surprise you! While the cost is important, the potential benefits of a custom e-wallet app can be even greater. Improved customer experience, increased brand loyalty, and valuable data insights are just some of the advantages to consider.

This article explores the evident and hidden factors of eWallet app development cost. Moreover, we’ll discuss with you how you can reduce the price for e-wallet app creation, as well as its overall price, and many other essentials.

What Is an E-Wallet App and Why Is It Popular?

E-wallet app is a mobile-based digital payment system that securely stores payment data and manages transactions, as well as performs operations on the basis of a single FinTech platform. In essence, it acts like a digital version of your physical wallet, allowing you to carry your credit, debit or loyalty cards all in one convenient place.

Users can link their payment cards and bank accounts to the e-wallet app. This allows them to make payments for services such as online shopping, utility bills, and peer-to-peer transfers without needing to physically carry their cards or enter their financial information every time.

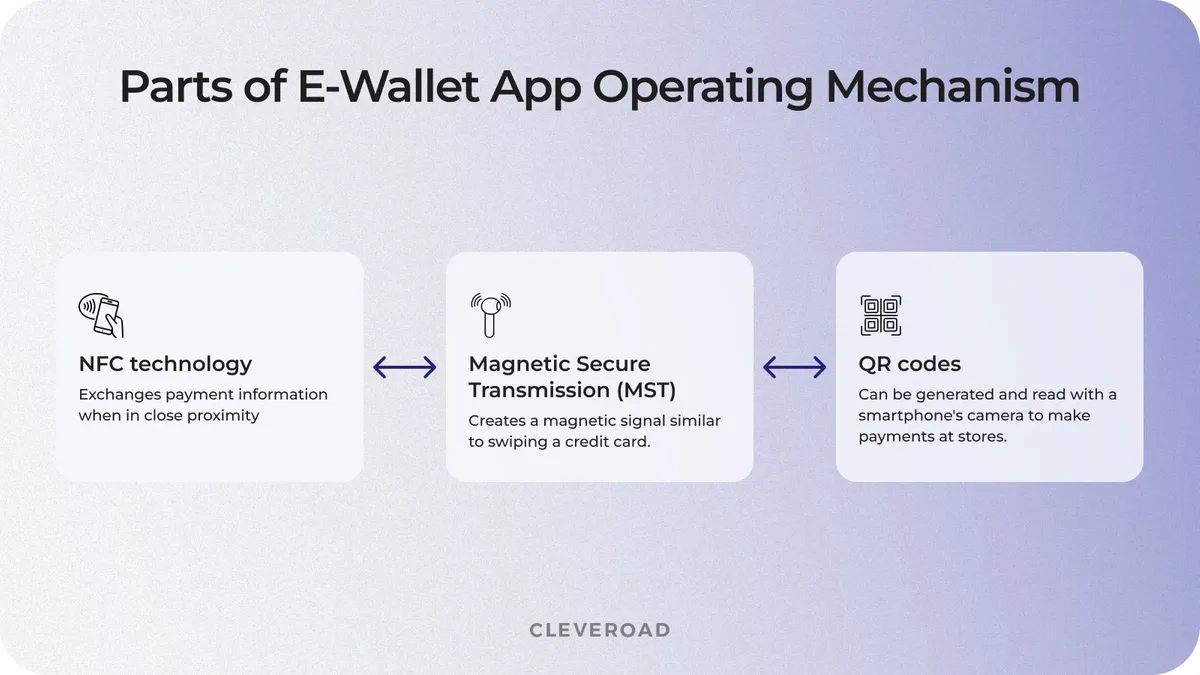

The listed operations are possible through the following constituents of the mobile wallet:

- NFC technology enables two devices to exchange information when in close proximity, and is utilized by both Apple Pay and Google Pay. The merchant must have compatible card readers at checkout to use one of these digital wallets.

- MST was previously used in Samsung Pay to emulate swipes from magnetic stripe cards. However, its use is now deprecated in new models, as NFC has become the new standard. Most banks and terminals are increasingly adopting NFC due to its enhanced security and wider acceptance.

- QR codes, which are the scannable barcodes, can be read with a smartphone's camera. Some apps (e.g., PayPal) allow customers to generate a QR code to be used to make payments at stores.

To facilitate secure payments, current e-wallets implement end-to-end encryption, tokenization, and multi-factor authentication. Fingerprint or face recognition and the use of PIN or passcodes introduce a further level of security. These steps significantly minimize the chances of fraud and unauthorized access and render e-wallet apps secure and trustworthy both for consumers and merchants alike.

Parts of e-wallet app operating mechanism

Why are mobile wallets popular?

The e-wallet market is quite dynamic and popular: according to Market Research Future, the domain revenue was estimated at $124.6 billion in 2024 and projected to grow to $590.2 billion by the end of 2032. Why is it so?

Statista states that the number of smartphone users worldwide increases from year to year. Thus, in the period from 2024 to 2029 it’ll boost to 1.5 billion customers in total, driving the demand for contactless payment solutions like e-wallets to simplify and secure mobile transactions. Paypal estimated in their report that the number of contactless transactions was equal to 1,347.7 billion in 2023 and forecasted to grow to 2,121.6 billion in 2026.

Among the reasons why companies turn to cashless payments and start thinking about e wallet app development, Paypal mentions the following ones:

- Enhanced client experience

- Better fraud prevention and improved security

- Valuable data analytics

- Seamless payments around the world

This rising demand for e-wallet apps stimulates the entrepreneurs ready to develop e-wallet app, to know more about the e wallet app development cost. We’ll explore e-wallet app development cost factors in detail, empowering you to make informed decisions as you embark on their e-wallet development journey.

Factors Affecting eWallet App Development Cost

We’ll explore the most essential cost-forming factors for your future e-wallet solution creation, empowering you to make informed decisions and optimize your e-wallet app development budget.

E-wallet app complexity

The solution complexity significantly influences the e wallet cost due to the range of features required. Here's a breakdown of the e-wallet app variations based on complexity:

| E-wallet app complexity | Description |

Simple e-wallet app | Offers core functionalities like:

|

Medium e-wallet app | Includes features of simple wallets with additional functionalities like:

|

Advanced e-wallet app | Offers a comprehensive suite of features like:

|

The price range according to mobile wallet type can vary depending on different aspects (e.g., specific features chosen, development methodologies employed, overall project scope, etc.) but it usually ranges between each other. Consulting with a qualified fintech app development partner can provide a more accurate eWallet app development cost estimate based on your specific requirements.

Platform selection

The choice of platform is another factor you should pay attention to while estimating the cost of mobile wallet app development. Each platform has its own design guidelines, security protocols, and user experience standards, necessitating additional development and testing efforts.

You can use the following major platform-related options when developing the mobile wallet app for your business:

- Native development (iOS & Android). This option provides the richest user experience and full access to device features, but requires separate codebases for each platform. Approximate cost range of the native e-wallet development equals to $100,000+ per platform.

- Web platform development offers a versatile and accessible option for creating an e-wallet application. It also allows for quicker updates and easier maintenance. The development cost for a web-based e-wallet typically ranges from $30,000 to $70,000+ making it an attractive option for businesses looking to balance cost and functionality.

- Cross-platform development utilizes frameworks like React Native or uses Flutter app development services creating a single codebase that functions on both iOS and Android. The cross-platform e-wallet solution building costs about $50,000 - $100,000+.

! Kindly note that cross-platform e-wallet development is beneficial due to its cost-saving perspective, as it allows you to develop a single codebase that works across both iOS and Android platforms. It significantly reduces development and maintenance costs while ensuring a consistent user experience.

Types of e-wallets

One of the most significant drivers of your cost of mobile wallet app development is the type of e-wallet you decide to implement. Each wallet form provides various levels of functionality, levels of integration, and compliance requirements. Whether you're creating a simple in-app payment utility or a comprehensive financial center, the decision you make will influence both the cost to build and the project's overall technical complexity.

Here is a list of the most prevalent types of eWallet applications, their characteristic features, and the impact these features have on the development cost of an ewallet app:

| Type of e-wallet | Cost-forming peculiarities | Estimated development cost |

Closed wallets |

| $15,000–$25,000+ |

Semi-closed wallets |

| $25,000–$45,000+ |

Open wallets |

| $60,000–$100,000+ |

Crypto wallets |

| $50,000–$90,000+ |

Super apps |

| $100,000–$200,000+ |

Security protocols and features

Security is among the most significant determinants of the eWallet cost. For financial services or bank app integrations, security certifications such as PCI DSS are frequently required and take extra development time and skills.

Let’s find out the most widespread security expenditures for your eWallet app development:

- Tokenization mechanisms — $4,000-$8,000+

- PCI-DSS certification preparing — $25,000+

- End-to-end encryption – $5,000-$10,000+

- Biometric authentication – $6,000-$12,000+

Spending money on good security measures in the early stages decreases the risk later and creates a strong foundation to foster user growth over the long term. The expense to develop secure systems will look costly at first glance but is well worth the investment in terms of user engagement and reputation.

Feature set and integrations

Let’s find out more about the feature set and integrations you may need for eWallet app development, cost on average and other essentials. Our FinTech Solution Architects have prepared a comprehensive table mapping out the features of e-wallet apps by category, as well as their approximate costs.

| E-wallet feature сategory | Focus | Estimated cost range |

Core features | Essential payments: KYC, login, balance, transfers, transaction history | $10,000–$25,000+ |

User experience | Smart tools: budgeting, bill reminders, multi-currency, loyalty sync | $20,000–$45,000+ |

AI & security | Fraud prevention, biometrics, spend analysis, predictive suggestions | $30,000–$70,000+ |

Integrations | APIs for banks, crypto wallets, BNPL, third-party services | $10,000–$80,000+ |

Advanced add-ons | Super app features: investing, insurance, voice AI, marketplaces | $50,000–$120,000+ |

This table provides a helpful starting point to plan your feature set for a business mobile wallet. But in order to tailor the features and integrations to your specific needs and achieve optimal cost-effectiveness, you should contact the skilled fintech software development vendor.

- If you want to know more about advanced e-wallet app features you can implement with Gen AI in FinTech, read our recent article.

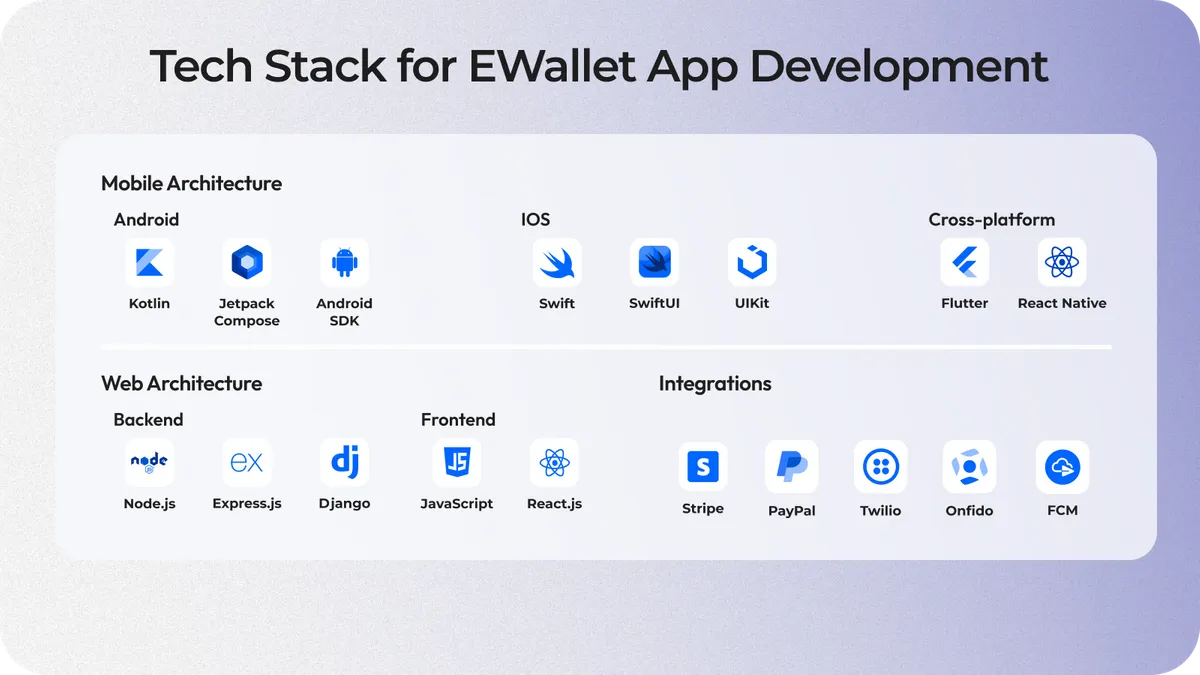

Technology stack

Tech stack choice for mobile wallet creation can yield significant cost optimization. To give you a hint, we’ve prepared the example of the technology stack IT experts at Cleveroad typically use when developing FinTech apps like mobile wallets:

Cleveroad tech stack for ewallet creation

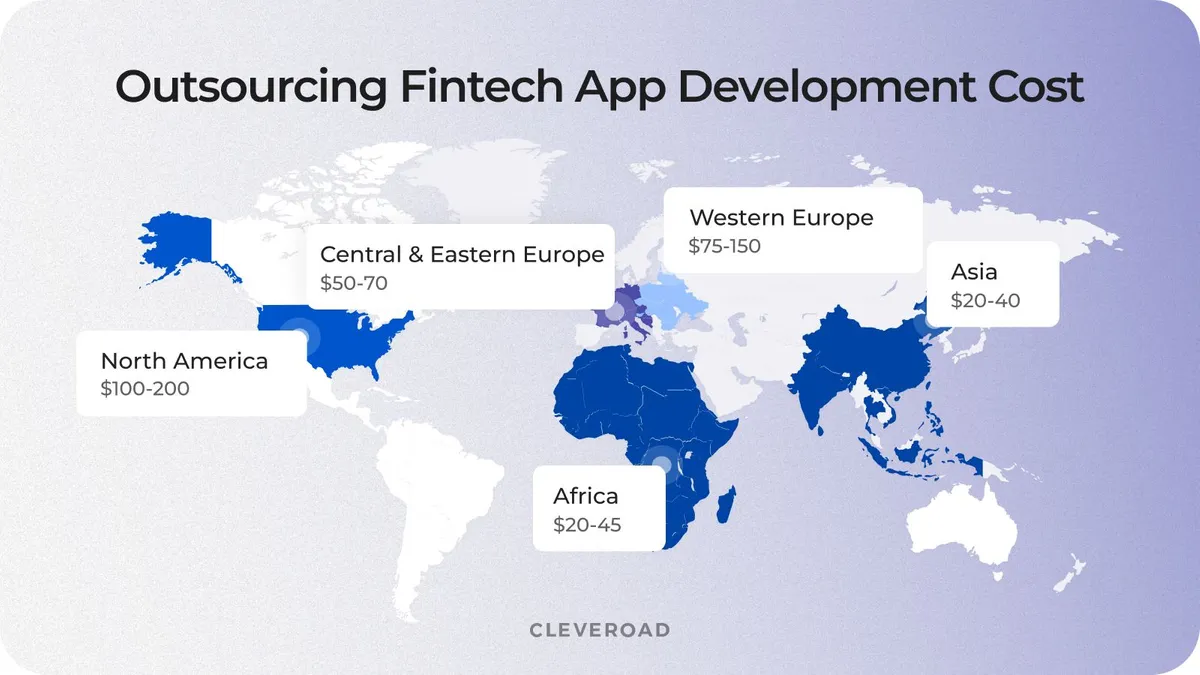

IT vendor’s location

Fintech software development vendors in different regions offer varying costs for their services due to differences in the cost of living, labor market conditions, and economic factors. Here's a breakdown of estimated nearshore and offshore e wallet app development cost:

- Nearshore development. Typically located in neighboring countries or regions with similar time zones. Hourly rates for nearshore software development can range from $50 to $100+ per hour, offering a good balance between cost and communication ease.

- Offshore development. Located in countries farther away with significant cost of living differences. Rates can range from $20 to $150+ per hour, but factors like time zone differences and potential language barriers require careful consideration.

For instance, if you're based in New York, nearshore e-wallet development partners could be found in countries like Canada or Mexico, offering similar time zones and strong technical talent at a more competitive rate. On the other hand, offshore software development teams in Central and Eastern Europe like Estonia or Poland can provide highly skilled developers at even more cost-effective rates.

Despite lower e wallet app development cost might come with trade-offs in terms of time zone differences, cultural barriers, and potential communication challenges, the skilled fintech app building providers can overcome these obstacles by employing effective project management techniques, fostering clear and consistent communication, and leveraging their technical expertise to deliver high-quality solutions on time.

For example, Cleveroad FinTech software development experts ensure smooth collaboration and efficient project delivery. Furthermore, we cultivate a culture of open communication, utilizing collaborative tools and fostering regular meetings to bridge any cultural gaps and maintain clear project expectations. Combined with our proven track record in FinTech app development, it allows us to deliver high-quality e-wallet solutions on time and within budget, regardless of location.

Hidden Costs of E-Wallet App Building

Let us find out the hidden e-wallet app development cost aspects that can significantly impact the overall budget.

Regulatory compliance

Each country may have specific requirements for e-wallet app data security, protocols like Anti-Money Laundering (AML) and Know-Your-Customer (KYC), and even user authentication methods, necessitating additional development efforts and potential legal consultations to ensure compliance across your target markets.

Meeting these standards often involves additional legal consultations and certifications. The cost of implementing these measures can escalate with continuous updates to regulations. Moreover, failure to comply can lead to hefty fines and legal battles.

Here's a breakdown of the eWallet app development cost associated with regulatory compliance:

- Legal consultations are equal to $5,000 - $20,000+ depending on the complexity of regulations and number of markets

- Certifications cost about $2,000 - $10,000+ concerning the specific certification required

- Ongoing maintenance measures require $5,000 - $15,000+ per year, including regular audits and updates to security measures

Infrastructure and scalability

The backend infrastructure is the backbone of your e-wallet app, requiring careful consideration to ensure smooth operation and growth. The e wallet cost associated with establishing and maintaining a scalable infrastructure is the following:

| Infrastructure cost component | Description | Approximate cost (per month) |

Cloud services | Cost depends on cloud services usage and data storage requirements | $1,000 - $10,000+ |

Database management | Varies based on eWallet database complexity and chosen solution | $1,000 - $5,000+ |

Server maintenance | Cost depends on the chosen server size and required resources | $500 - $2,000+ |

Load balancing | Distributes incoming traffic for optimal e-wallet performance | $500 - $2,000+ |

Disaster recovery | Ensures your business continuity in case of outages | $1,000 - $5,000+ |

Investing in a scalable infrastructure from the outset is crucial to accommodate future growth and avoid costly upgrades later. By factoring in these infrastructure costs, you can ensure your e-wallet app has a solid foundation to handle increasing user demands and transaction volumes.

At Cleveroad, we as AWS Select Tier Partner can select cloud infrastructure fitting your tech requirements and budget needs.

App publishing

Whether you’re aiming to publish your eWallet app in the Apple App Store or Google Play, you should consider that both marketplaces have their own fees, rules, and regular update requirements. It means you’ll be budgeting for more than just a one-time upload. Think about things like localization, App Store Optimization (ASO), and keeping your app compliant so it stays live and visible to users.

Here’s what usually affects the overall cost of eWallet publishing:

- App developer accounts: $99 per year for App Store and $25 one-time fee for Google Play

- App Store Optimization (ASO): $1,000–$5,000+. The price covers keyword research, optimizing metadata, visuals, etc.

- Localization and translation: $500–$5,000+. The cost increase depends on where you're launching and what languages you need.

- Updates and compliance checks: $1,500–$7,000/year. The said price range includes security patches, policy compliance, added features.

So when you’re planning the cost to build your app, don’t forget these extras. If you're aiming for a cross-platform app, expect to invest a bit more upfront but save on future updates. And if your app handles money, like a payment app, you'll also need to include payment processing fees in your calculations. All this will help you accurately estimate the cost of getting your product live.

Server and hosting

Having a reliable server infrastructure is a big deal when you make your digital wallet apps run smoothly. Whether you're diving into mobile app development or planning to build an ewallet app, your hosting setup will have a major impact on how well everything performs. It affects your app’s speed, security, and ability to grow.

| E-wallet cost factor | Details | Estimated cost |

Cloud hosting | AWS, Azure, Google Cloud (depends on server specs & usage) | $500-$3,000 per month |

Content Delivery Network (CDN) | Ensures global app responsiveness | $200-$1,000 per month |

Backup & disaster recovery | Data backups, recovery planning | $300-$1,500 per month |

Security services | Firewalls, DDoS protection, real-time monitoring | $200-$1,500 per month |

SSL certificates | Annual certificates for secure HTTPS connections | $100-$500 per year |

If you're working with an eWallet app development company, you’ll quickly learn that the digital wallet app development cost can differ a lot. This difference depends on things like your server setup, your user reach, the infrastructure complexity, and the number of users. Our DevOps services are aimed to balance cost and performance of your eWallet solution, selecting the infrastructure properly matching to your app scalability and compliance needs.

User support and maintenance

After launch, an e-wallet app requires ongoing support and maintenance to address user issues and ensure smooth operation. This includes bug fixes through Quality Assurance services, features updates, and general troubleshooting. Providing 24/7 customer support can be particularly costly, requiring a dedicated team. Additionally, regular updates are necessary to keep the app compatible with the latest operating systems and devices.

User support and maintenance can range from $1,000 to $10,000+ per month depending on the chosen support plan (basic vs comprehensive) and the size of your dedicated team. These ongoing efforts are crucial for ensuring a positive user experience, but careful planning can help manage these costs effectively.

Optimize your e-wallet building cost with our Fintech software development services!

E Wallet App Development Cost per Development Stages

Now, we’ll talk more about the e-wallet app development in collaboration with an outsourcing vendor, as well as the approximate expenditures for each of the stages.

Cost of Discovery Phase in e-wallet app development

The Discovery phase services involve gathering information, analyzing requirements, and defining the mobile wallet project scope. This phase typically lasts one to three weeks, and to determine its approximate costs, you can multiply the total hours worked by the specialist's hourly rate. The estimated cost can vary from $1,600 to $4,800 or more.

During the Discovery phase, Cleveroad specialists provide rough and detailed project estimates for your future e-wallet app development.

- A rough eWallet app development cost estimate is provided to clients to give an overview of expected expenses and development stages. This process involves two rounds of revisions, with the initial estimate created following a Solution Workshop and a second one after the Discovery Phase.

- A detailed estimate is usually completed by developers based on comprehensive documentation and requirements obtained during the Discovery Phase. The cost assessment considers various factors and specific requirements for each sprint or two developed during the development phase, facilitating detailed planning and effective communication in project management.

Price of UI/UX design in e-wallet app development

UI/UX designers focus on developing user-friendly interfaces for mobile wallets to enhance user interaction. The UI/UX design in digital wallet applications can cost from $5,000 to $50,000 or more, depending on project complexity, scope, and customization requirements.

Cost of e-wallet app development and QA

Mobile wallets are built using a combination of frameworks, libraries, and development tools for both front-end and back-end development. These tools can be either open-source (free) or come with licensing fees. Additionally, an alternative approach for creating e-wallet components is to utilize a third-party provider.

So, how much will the eWallet app development cost? Building a minimum viable product (MVP) for an e-wallet app with basic functionalities can take at least two experienced fintech developers three months. This translates to a starting cost of $30,000+,depending on developer rates (which can vary based on location and experience).

Rigorous QA testing is also essential for a secure and robust e-wallet app. QA services typically range from $5,000 to $20,000+, depending on the complexity of the app and the scope of testing required.

Find out how to build mobile wallet app and make it highly secure from our article!

Maintenance and support cost for e-wallet app

The cost of support and maintenance can range from $1,000 to $10,000+ per month depending on the chosen support plan (basic vs comprehensive) and the size of your dedicated support team. For example, Cleveroad team often offers post-development support for our clients’ software in terms of IT staff augmentation services. It helps them manage these ongoing expenses effectively.

Operations need to follow project requirements, service-level agreements, security regulations, and the standard cloud service infrastructure. Effectively coordinate marketing and sales campaigns alongside the launch of your mobile wallet. Services should be regularly refreshed, upgraded, and optimized. Developers should implement updates with no-downtime deployment to maintain continuous availability and prevent user base fragmentation.

Here is a simplified overview of how your overall e-wallet app development cost could be allocated across major phases of the project life cycle:

| eWallet development stage | Share of total cost |

Planning and research | 5% |

UI/UX design | 10% – 15% |

Front-end development | 15% – 20% |

Backend development | 20% – 25% |

API integration | 10% – 12% |

Testing and Quality Assurance | 5% – 8% |

Deployment and launch | 2% – 3% |

Post-launch maintenance (annual) | 15% – 20% |

Summing up the matter, developing an e-wallet app requires a multi-stage investment, with costs varying based on complexity and chosen functionalities. By planning ahead and carefully considering factors like development stages, team location, and ongoing maintenance needs, you can create a realistic budget for your e-wallet app and ensure its successful launch and growth.

Overall eWallet App Development Cost

Accurately determining your digital wallet app development cost requires careful consideration of several crucial factors. The complexity of features, sophistication of UI/UX design, backend infrastructure requirements, and integration with essential third-party services, such as payment gateways, all significantly influence your final budget.

Additionally, ensuring compliance with local regulations and implementing robust security measures to protect user data are essential aspects that shouldn't be overlooked. Carefully evaluating these elements upfront helps you better predict expenses and sets the stage for your eWallet success.

To tell the long story short, let’s find out the average e wallet app cost based on its complexity:

| E-wallet app complexity | Description | Approximate development cost |

Simple e-wallet application | Offers core functionalities like P2P transfers, bill payments, and top-ups | $25,000 - $50,000 |

Medium e-wallet application | Expands on basic features with in-app purchases, multi-currency support, and budgeting tools | $50,000 - $100,000 |

Complex e-wallet application | Provides a comprehensive suite of features including loyalty programs, investment options, AI-powered financial tools, and robust security measures | $100,000+ |

The above price range for mobile wallet creation is conditional, because the complexity of the app significantly impacts the development cost. To obtain the detailed cost estimate for your e-wallet application, you can directly contact a fintech app development partner. We can help refine this estimate based on the specific features you envision.

Expert Tips to Reduce the eWallet Cost For Your Business

We've compiled a list of our expert tips on how to optimize your expenditures while creating an e-wallet application for your business.

Prioritize features

While a feature-rich app like an electronic wallet might seem ideal, each additional function adds complexity and development time, consequently pushing you towards the higher end of the cost spectrum (Source: Springer). The challenge lies in striking a balance between offering a compelling user experience with core functionalities and managing development costs effectively.

Cleveroad tip: You can conduct thorough market research to identify the core functionalities most essential to your target audience. Start with a streamlined approach focusing on secure payments and transfers. All these activities will be easier in case you pass through the preparation steps to building an e-wallet with a seasoned IT vendor like Cleveroad. We offer you qualitative IT consulting services to help you transform your e-wallet product vision in the best way possible.

Consider cross-platform development

Developing separate apps for Android and iOS can double your development workload and resources. This not only extends the time to market as well as e-wallet app development cost, but also makes ongoing maintenance and updates a complex affair.

Cleveroad tip: Consider cross-platform development frameworks like React Native or Flutter that allow you to create a single codebase deployable on both platforms. This significantly reduces development time and costs if compared to building native apps for each operating system. For example, in our collaboration with Row Nation, we’ve offered to develop a cross-platform solution to cut costs for the app creation.

Georgia Beattie, Director at Australian Rowing Association, on Successful Partnership with Cleveroad

Automate testing and use cloud services

Manually testing your app can seriously drive up the cost of developing an e-wallet, especially for your eWallet scalability. On top of that, using traditional infrastructure usually means big upfront costs, which pushes up the final cost and makes the eWallet app harder to scale.

Cleveroad tip: Our QA engineers conduct automated testing to bug hunt fast and cut down on human mistakes, keeping your mobile banking app based on Android or iOS app running smoothly. Plus, we use cloud platforms like AWS or Azure let you scale your backend smartly while you create an eWallet application for your business.

Outsource e-wallet app development

While in-house development offers complete control over the development process and intellectual property, it might not be the most cost-effective solution for all businesses. This approach can be ideal for large companies with the resources to support a dedicated development team, but for startups or businesses with limited budgets, outsourcing can be a more attractive option.

Cleveroad tip: Strategic outsourcing of specific aspects of development to experienced fintech developers in regions with competitive rates can be a smart approach. Choose a reputable outsourcing partner like Cleveroad with expertise in e-wallet development, strong communication skills, and a proven track record of delivering high-quality work within budget.

To further emphasize the eWallet cost benefits of outsourcing, we can transition to discuss the topic of outsourcing hourly wages for e-wallet app development:

Outsourcing e-wallet app development cost for different regions

Because outsourcing allows you to tap into a global talent pool, you can often find experienced fintech developers with competitive hourly rates (e.g., like ones in the Central and Eastern Europe (CEE) region, Estonia, compared to costs for fintech IT specialists services in North America or Western Europe). This can significantly reduce your final development costs in comparison to building an in-house team.

Cleveroad Expertise in E-Wallet App Development

Cleveroad is a FinTech software development company with 13+ years of hands-on experience in the domain headquartered in Estonia. Our team assists financial institutions and establishments in automating workflows, enhancing financial operations and transaction security through developing robust FinTech software solutions, including e-wallet applications, on the basis of modern integrations and tools (e.g., Salesforce, Blockchain, Abra, Paypal, Mastercard, NFC, GPS, etc.).

Working with us, you can receive the following bunch of benefits:

- Partnering with a trusted fintech IT company, certified with ISO 9001 and ISO 27001 for quality systems and security management

- Free Solution Workshop stage to clarify your FinTech business issues and offer a proper technical solution for your e-wallet application

- Signing the NDA to protect the uniqueness of your mobile wallet concept per your request

- On-demand fintech software development services: creating mobile wallets from scratch, software modernization, UI/UX design services, IT consulting, and so on.

- Project Management Office making sure that work on your e-wallet creation meets all your goals, on time and on budget

- Qualitative QA services to check your e-wallet app on each step of its development and ensure its smooth performance

In order to demonstrate our experience in Fintech software development, we’d like to share with you some of our clients’ success cases from portfolio:

- Micro-investment platform for the Middle East market. Cross-platform application intended to act as a mediator between investors and traders. It’s aimed to attract a more micro-investment oriented audience and offer them convenient service automating their routine financial operations.

- Online Services Ecosystem for European Investment Bank. Robust and scalable system offering online investment services, loan lendings, etc. for customers from B2B and B2C sectors.

Our clients from FinTech domain receive positive outcomes from our collaboration and are satisfied by it. For example, we’ve cooperated with an Irish financial company, Mangopay, through IT staff augmentation services. Mangopay builds flexible payment systems that power over 2,500 European platforms, including big names like Vinted, Rakuten, and Wallapop. With backing from Advent International, they offer tailored payment solutions for C2C, B2C, B2B, and marketplace models.

Mangopay joined forces with us to level up their payment platform and roll out a new Fintech product that hits top-tier security and compliance standards, including KYC and AML. We built an all-in-one solution for moving money globally: complete with multi-currency pricing, multi-currency e-wallets, treasury tools, and worldwide payouts. It’s designed to keep financial transactions smooth across all kinds of platforms and marketplaces.

This is what Kirk Donohoe, CPO at MangoPay, tells about cooperation with our Cleveroad team on their Fintech project:

Kirk Donohoe, CPO at Mangopay gives feedback about cooperation with Cleveroad

The cost to build an eWallet usually kicks off at around $30,000 for a basic MVP, but if you're going for more advanced, feature-packed eWallet solutions, it can go beyond $150,000. The cost of building depends on how complex the app is, what tech stack you choose, the level of security you need, and what gets added in during the app development process. Teaming up with a trusted mobile app development company can make a big difference: it helps keep your budget in check and smooths out the entire journey of developing a digital wallet that fits your business just right.

The cost of a digital wallet, also known as an ewallet application, depends heavily on the features and complexity of the app development. Simpler apps with basic functionalities like money transfers will cost less than those with features like investment options or loyalty programs. Expect the following ranges:

- Basic e-wallet app development: $30,000-$50,000+

- Medium e-wallet app development: $50,000-$100,000+

- Complex e-wallet app development: $100,000-$250,000+

The UI/UX design in digital wallet applications can cost from $5,000 to $50,000 or more, depending on project complexity, scope, and customization requirements. This represents just a part of the total ewallet app development cost, which can vary significantly based on the app features you choose to include. Ultimately, the cost to build will depend on the specific functionalities you prioritize for customers that use your application.

You should work on your features prioritization choosing the core ones first. Then, you can consider cross-platform e-wallet development as a cost-effective alternative for creating a fintech app both for Android and iOS. Finally, the fintech software development outsourcing is a strategic decision that can unlock a global talent pool with competitive rates, potentially saving you significant development costs.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article