How to Create a Mobile Banking App in 2026: Steps, Features, Cost

Updated 18 Dec 2025

27 Min

2618 Views

If you're here, you’ve probably already considered banking app development. And also, you’re definitely familiar with modern banking issues too. For several decades, habitual banking often meant waiting in long lines and searching for ATMs or service terminals. But that's no longer the case. Mobile banking has reshaped how we access financial services, making transactions easier, faster, and more convenient than ever.

Cleveroad is a banking app development company with 15+ years of experience in IT. To help you successfully implement one within your practice, we’ve compiled a comprehensive guide on banking app development, revealing insights and valuable information about the overall banking app development process, functionality considerations, price tags, app types, and more.

Here’s a short list of mobile banking app development steps. We’ll also overview each of these steps in more detail throughout the article:

- Step 1. Find a development team

- Step 2. Conduct target audience analysis

- Step 3. Build and test the banking app prototype

- Step 4. Take care of banking app security

- Step 5. Integrate your app with 3rd party services

- Step 6. Banking app development

- Step 7. Release an app and gather feedback

- Step 8. Support and maintain your banking app

Why Mobile Banking is Beneficial: Key Industry Indicators

Banking mobile app development is the process of creating software applications that allow customers to manage their finances and perform various banking transactions using a smartphone or tablet. This involves building a secure and user-friendly platform that serves as a digital extension of a traditional banking system.

Mobile banking app development definitely brings an expanded range of capabilities. A simple and swift solution adoption may significantly reflect on your business scalability and your clients' digital finance experience.

Mobile banking app market overview

Currently, mobile application development for banking is a very promising direction for business owners and entrepreneurs all over the world. Due to the flash-like recognition of modern technologies, digital payments, and the surge for trustworthy, convenient, and secure financial management options, the whole mobile banking industry has faced enormous growth in popularity and adoption. No doubt, mobile banking market statistics is impressive:

- According to Bankrate, 77% of consumers prefer managing their bank accounts via mobile or computer, highlighting widespread trust and comfort with digital banking.

- Coinlaw states that 66% of the global population has access to mobile banking as of 2025, with rapid growth in countries like India, Nigeria, and Bangladesh.

- Dimension Market Research states that the U.S. had the largest market share in the Global Mobile Banking Market with a share of 56.7% in 2024

- Following the MX data, nearly 73% of U.S. users have connected various financial apps to their primary bank accounts to manage finances more seamlessly

Here’s what Daria Yukhymenko, Cleveroad’s delivery manager, says about value of banking app development:

Darya Yukhymenko

Delivery Manager

“I see immense value in developing a banking app tailored for business owners. Mobile banking apps not only streamline financial management but also provide essential tools like real-time cash flow monitoring and expense tracking. This level of control and insight helps entrepreneurs make informed financial decisions, ultimately supporting business growth.”

Benefits for your business

Let’s see what exactly you can get by creating a custom mobile banking solution:

- Lower operational costs. Banks reduce expenses on branch operations and call centers. A well-built app cuts workload and frees resources for higher-value services.

- Higher customer retention. Mobile banking app development lets you offer financial products that are adaptive and customizable to each client’s specific needs.

- New revenue streams. You can integrate microloans, investment products, or insurance directly into apps, turning them into cross-selling platforms.

- Data-driven decisions. Every transaction becomes a source of insight. Digital analytics helps you predict customer behavior and identify upsell opportunities.

- Scalability and growth. Launching services across regions no longer requires building new branches. A secure mobile app lets banks scale faster and reach global audiences.

- Compliance advantage. Mobile platforms are already designed with PSD2, PCI DSS, and GDPR in mind, which strengthen trust and reputation.

Benefits for your clients

Banking app development is also a smart move to provide your clients with an efficient and convenient digital finance solution. Here’s how they can benefit too:

- 24/7 access to finances. Customers can check balances, transfer money, or pay bills anytime, removing the limits of branch working hours.

- Faster transactions. Peer-to-peer transfers, contactless QR payments, and instant bill settlements make daily banking frictionless.

- Convenience. Routine operations that once required paperwork or in-person visits are now completed in a few taps.

- Transparency & control. Real-time push notifications and detailed transaction history give users full visibility over their money.

- Security. Features like fingerprint or face ID login, two-factor authentication, and fraud alerts increase confidence in mobile banking.

- Personalization. Spending trackers, savings goals, and tailored offers help customers manage their finances more effectively.

At Cleveroad, we provide top-notch banking software development services you can utilize to create a secure, reliable, and tech-savvy banking solution that’ll help you expand your service range

Types of Mobile Banking Apps

Bank app development may also serve different purposes and consumers’ needs. Let’s unpack 4 key mobile banking app types and extract their main distinct features and values:

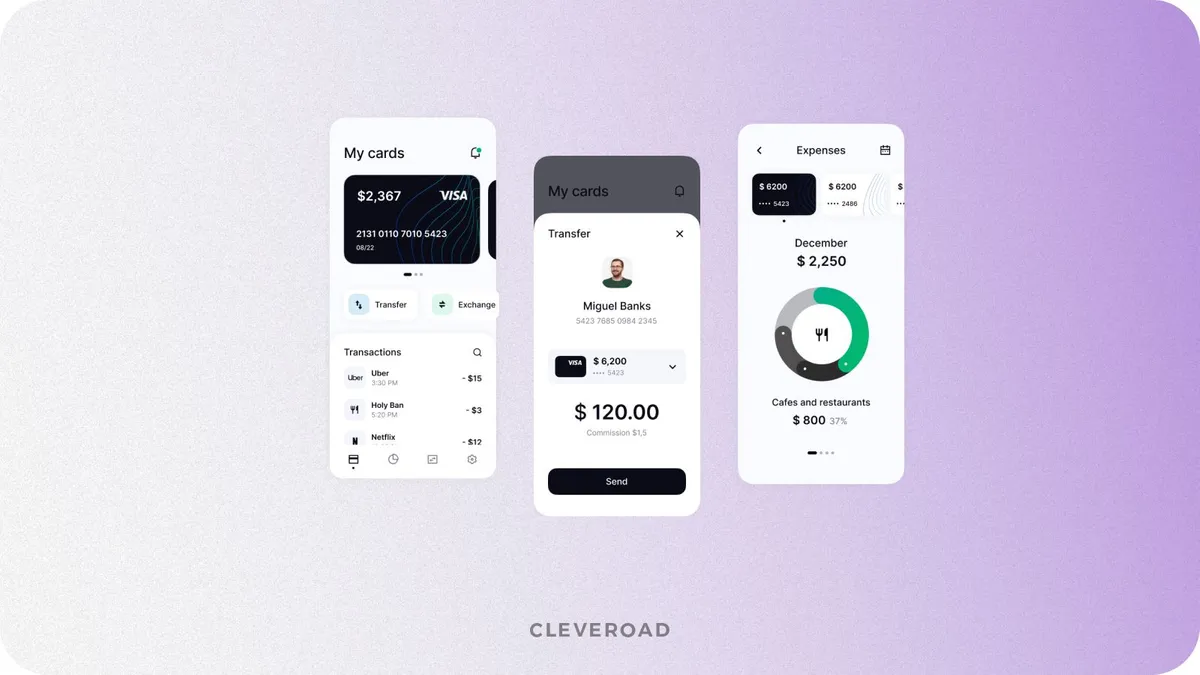

Retail banking apps

Retail mobile banking apps, the most common ones, are usually developed to cover all essential banking users’ needs and include app features like fund transfers, account management, balance checks, mobile banking services, internet banking, and bill payments.

Besides providing seamless online banking services, commonly implemented app design choices, such as security features like two-factor authentication and biometric logins, enable banking users to handle personal finances confidently. Notifications for transactions and spending insights add to the convenience, making retail mobile banking apps almost indispensable for personal finance management across Android and iOS platforms.

Chase Mobile is one of the leading retail banking apps in the U.S., providing a full range of personal banking services. This mobile bank is designed for everyday banking with robust security features like biometric login, making it a popular choice among users.

Digital wallets

Digital wallet apps like Apple Pay and Google Pay allow users to make payments, store multiple payment methods, and facilitate peer-to-peer transfers. While thinking on how to make a peer to peer payment app, keep in mind that these apps offer contactless payment options, loyalty card storage, and sometimes even virtual cards, making transactions considerably more accessible.

Digital wallets prioritize security using tokenization, biometric verification, and encryption, ensuring safe transactions. The rise of contactless payments via NFC, that will result in over 60% of the global population (nearly 5.2 billion) users by 2026, digital wallets have become essential for users seeking a quick, secure, and cashless payment solution for everyday use.

Learn about wallet app development cost and valuable tips that’ll help you cut your solution development pricing

Neobanks

Neobank operates exclusively online without any physical branches, catering primarily to younger users who value a mobile-first banking experience. Such apps are often targeted at younger audiences, providing services such as checking accounts, card management, instant transfers, and now you pretty often can spot cryptocurrency support.

If you decide to build a banking app like neobank, you can get an opportunity to stand out by offering lower fees, quick sign-up processes, and innovative features that appeal to freelancers, gig workers, and individuals who prioritize digital convenience.

Chime, one of the most well-known neobanks in the U.S. with over 22 million users, operates entirely online, with no physical branches. Chime offers features like fee-free checking accounts, early direct deposit, automatic savings, and credit-building accounts, all accessible through a mobile-friendly interface. With features geared towards financial wellness, Chime attracts tech-savvy users looking for a seamless, mobile-first banking experience.

Investment banking apps

Investment banking apps are tailored for users who want to manage investments directly from their mobile devices. These apps offer stock trading capabilities, real-time price tracking, and tools for monitoring portfolios.

Many include advanced features such as robo-advisors, which provide automated investment recommendations based on user profiles. By offering users the ability to make well-informed investment decisions on the go, investment banking apps appeal to a growing demographic of self-directed investors.

Robinhood, enables users to trade stocks, ETFs, options, and cryptocurrencies directly from their mobile devices. It offers commission-free trades, real-time market data, and valuable educational resources, along with an intuitive and appealing interface for managing investments. Known for its user-friendly design and commission-free trading, Robinhood has made investing more accessible, especially for newer investors exploring the stock market.

Steps for Banking App Development

Now that you know what features should be added to the banking app, it's time to take a look at how to build it. We’ll walk you through the scenario of developing a banking app by these steps:

Step 1. Find the team

Building a mobile banking app is quite a laborious and time-consuming task. What’s more, it requires a lot of experience from the team working on it.

The best option is to turn to software development companies. Vendors with experience in the FinTech industry will be able to bring your ideas to life. Almost all software development agencies sign an NDA to protect your intellectual property.

Software development vendors can be found on specialized platforms that collect information and feedback about IT companies worldwide. The most famous aggregators are:

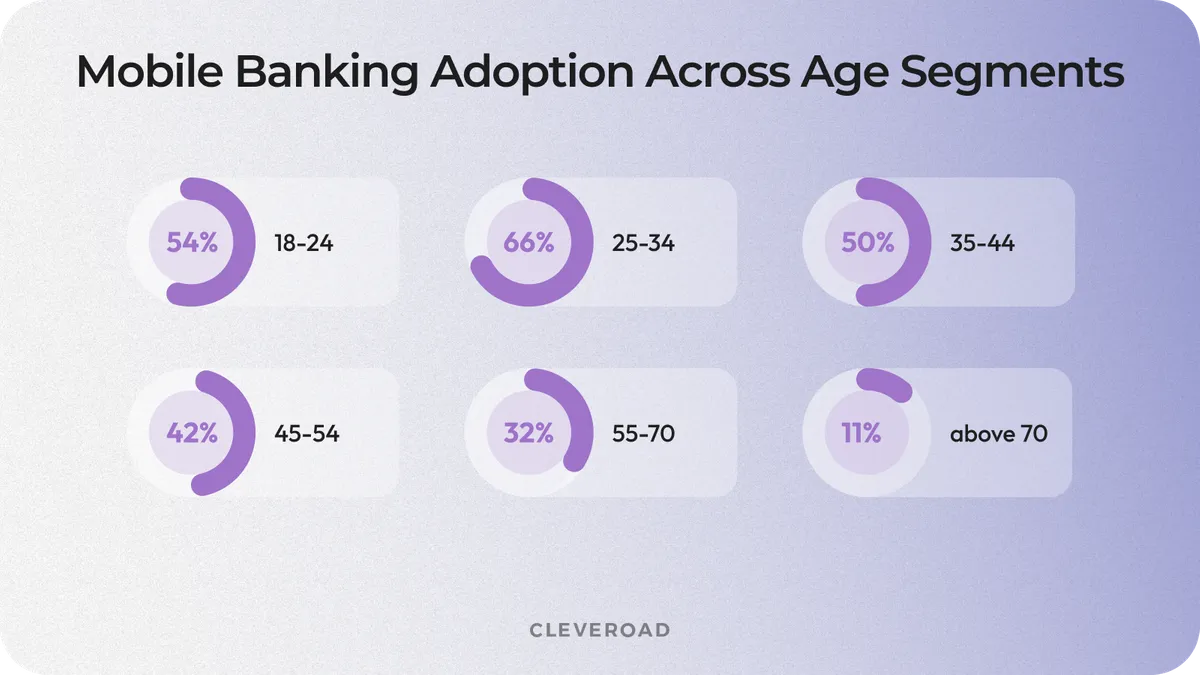

Step 2. Conduct target audience analysis

The better you know your target audience, the easier it’ll be to set requirements for the banking app. The audience of mobile banking is very broad in terms of age and covers people aged 18 to 70 years old and above. However, their user behavior differs. The audience from 18 to 24 mostly uses mobile banking for transfers of small amounts, purchases, school or university fees, and so on. Meanwhile, a mature audience from 25 to 70 uses mobile banking for utility bills, transactions of medium and large amounts of money, cash flow control, and so on.

Mobile banking app age segments

Step 3. Create and test your banking app prototype

You may be asking: "Why do you need a prototype if you can go straight to development?” A banking app is a complex mechanism with many features that make it challenging to develop from scratch.

A prototype is an early working model of your app created to test and validate ideas before full-scale development. Its main purpose is to ensure the final product will meet user needs, which saves significant time and money by preventing costly changes later in the development process.

Creating and testing a prototype is also a vital part of the UI/UX design services. UI (User Interface) design focuses on the visual elements of the app that the user sees, like buttons, colors, and typography. UX (User Experience) design is concerned with how the user interacts with the app, ensuring the flow and navigation are intuitive and efficient. By creating a prototype, designers can test both the UI and UX with real users, making adjustments before any code is written.

Here are the key banking app prototypes we provide at Cleveroad:

- Low-fidelity wireframes: These are simple, skeletal outlines of the app's layout, used to quickly define content structure and user flow. They are typically grayscale and lack visual detail, focusing purely on functionality.

- High-fidelity mockups: These are highly detailed static images that look almost exactly like the final app. They include all visual elements, colors, fonts, and icons, and are used to present the app's aesthetic design.

- Clickable demo prototypes: These are interactive versions of the app's mockups. They mimic user flows and navigation without a live backend, allowing users to click through screens to test the app's usability and overall user experience.

PoC vs prototype vs MVP. Check out our guide to learn key differences between these approaches, and what you should go with during your banking app development

Step 4. Take care of the banking app’s security

When you build a banking app, security is what really matters. So, developers must think of it from the early development stages. Here are some basic tech methods that Cleveroad engineers use to build a banking app and make it secure:

- Data encryption algorithms (SSL and 256-bit encryption). These algorithms encrypt the app’s data, which can only be decrypted by the user with the correct encryption key.

- Source code obfuscation. It stands for bringing the source code to a form that preserves its functionality but makes it difficult to analyze and modify.

- Repackaging protection. App repackaging means that a hacker obtains a copy of the app, unpacks it, adds malicious functionality, and then repacks it.

At a more superficial level, protect user data. The main methods of protection we use are:

- Verification of transactions through generated codes

- Two-factor authentication

- Reminders for users to change their passwords regularly

- Fingerprints and FaceID authentication

Step 5. Integrate your banking app with 3rd party services

Developers integrate third-party services to enhance your banking app functionality without building features from scratch. This is a strategic decision that enables you to use external solutions during the planning phase, as it significantly reduces development time and costs. By leveraging external APIs, you can efficiently add features that would otherwise require extensive custom coding. For a banking application, you might consider integrating the following services:

- Payment gateways (e.g., Stripe, PayPal): For secure and seamless transactions.

- Location-based services (e.g., Google Maps API, Mapbox): For ATM locators or fraud detection based on user location.

- Push notification services (e.g., Firebase Cloud Messaging): To send real-time alerts for transactions or security updates.

- Analytics and reporting services (e.g., Mixpanel, Firebase Analytics): To track user behavior and app performance.

While integrating with these services can be complex due to API compatibility and security requirements, experienced developers will evaluate and select the best options for the app's needs. Proper implementation ensures data security while providing a rich feature set for users.

Step 6. Banking app development

One of the most important steps of banking mobile app development is creating the frontend and backend of the application, which are responsible for bringing the functionality and final design to life. To achieve this, developers must integrate external tools such as APIs, payment gateways, and third-party services that allow the application to function seamlessly and reliably. Increasingly, banks also explore generative AI in banking to enhance customer interactions, automate processes, and provide personalized financial insights within the app.

To ensure that the application functions as expected, developers often build a Minimal Viable Product (MVP). This approach enables you to test the banking app's core concept with real users and in real-world conditions, saving both time and a significant amount of money that would be spent on building an extensive list of features. An MVP contains only the essential functionalities needed to satisfy early adopters and provide value.

Once the MVP is launched, it can be tested with the target audience to gather valuable feedback. Based on this feedback, you can decide whether expand the app's functionality with features that users actually want, refine the product in a new direction, or continue with the MVP as the final product. This lean, iterative process ensures that all subsequent development is data-driven and focused on delivering a fully functional application with features proven to be in demand.

Finally, once the application is developed, it must undergo thorough testing to ensure it is reliable, efficient, and secure. QA engineers test the application's functionality and performance, integrations, and system components to identify any bugs or issues that must be addressed before release.

At Cleveroad, we’ve already assisted a lot of businesses in reaching success and particular recognition by helping them create robust FinTech solutions. For example, here’s our latest cooperation experience with Mangopay company. During the project, our core task was to deliver a solution that could seamlessly integrate into complex fintech systems while adhering to strict financial regulatory requirements. Our team created a sophisticated multi-currency e-wallet solution and ensured strict compliance with KYC (Know-Your-Customer) and AML (Anti-Money Laundering) rules.

As a result, our customer received a state-of-the-art payment infrastructure that provided enhanced functionality and streamlined regulatory processes for Mangopay's clients. The successful project ensured the secure and seamless handling of transactions, while also establishing a strong, lasting partnership with Cleveroad.

Kirk Donohoe, CPO at Mangopay, provides feedback about cooperation with Cleveroad

Step 7. Release the app and gather feedback

The release of a banking app in the App Store and Google Play Market is quite a tricky process. Both stores have rules and regulations that must be followed. For example, in the App Store, there are App Store Review Guidelines. Otherwise, the app will be rejected until requirements are met.

After the release, you’ll get your first feedback from users with comments about bugs and suggestions for improvement. That’s valuable information that can help you in product development.

Step 8. Support and maintain your banking app

Support and maintenance are crucial for the long-term success of the banking app development. The app must be updated regularly to address bugs and security issues and to keep up with the latest technologies and user needs.

The app must also be maintained to ensure its functionality, reliability, and security. Maintenance includes regular backups, updating APIs and third-party services, and monitoring the app's performance to ensure it runs smoothly. In addition, developers must also consider user feedback and work on implementing improvements and new features. User engagement is vital for the success of a banking app, and developers must constantly evaluate user needs and preferences to provide the best user experience.

Features to Include in Your Mobile Banking App

These are the must-have features to create a banking app. We’ll cover each feature in detail so you’ll have a full picture for future research.

Account management

This feature is the basics of all banking apps and includes the following operations:

- Balance check. The information about balance should be the same on all devices and should be instantly updated in the app and on the website.

- Cards and bank accounts management. This category includes ordering cards, closing an account, attaching new cards to an account, and so on.

- Recent transactions. One of the most important features that let users track their expenses.

- Deposit check. Opening a deposit, displaying its conditions and interest on the deposit.

PNC mobile app account management screen

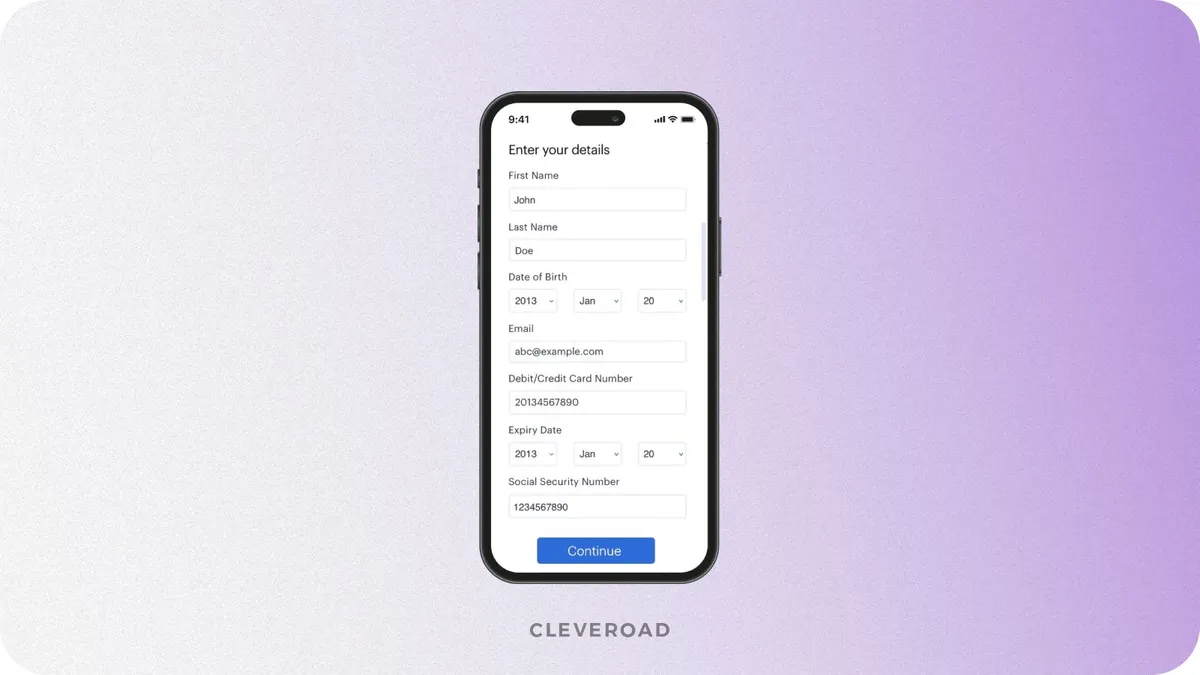

KYC process

KYC (Know Your Customer) is a crucial feature of a mobile banking app development that helps verify customers' identity and ensure the security of their financial transactions. Some benefits of a KYC process are as follows:

- Enhanced security: KYC helps prevent fraudulent activities such as identity theft and money laundering.

- Faster account setup: With KYC, customers can quickly set up their accounts by providing personal identification documents and completing the verification process.

- Compliance with regulations: KYC is often a legal requirement in the banking industry, and implementing it in a mobile app ensures that it complies with relevant legislation.

KYC process

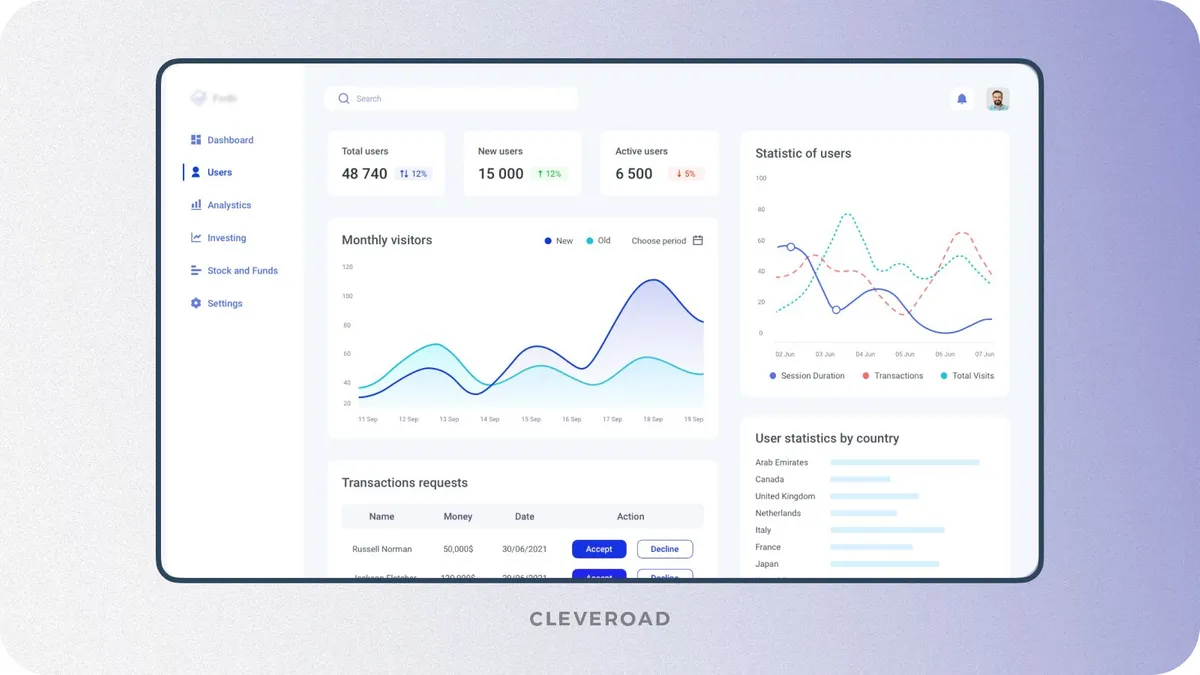

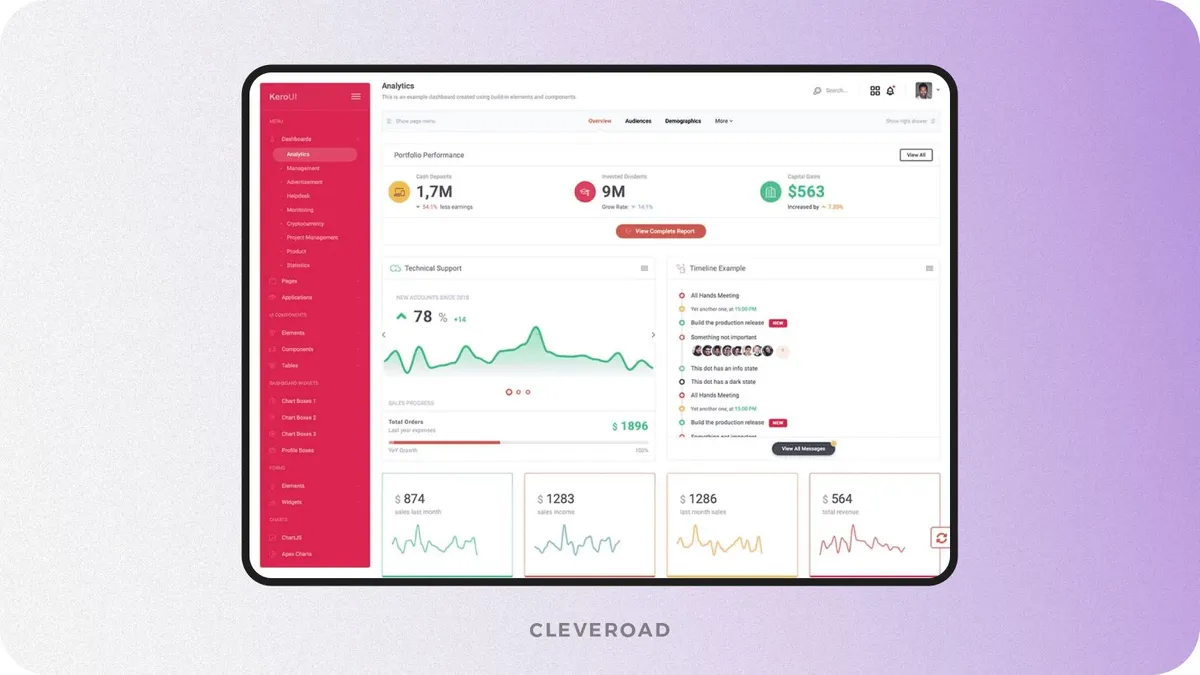

Admin panel

An admin panel is crucial for efficient banking app management, allowing authorized personnel to oversee user accounts, approve registrations, set permissions, and monitor transactions in real time for security. It simplifies content updates – such as adjusting interest rates, product details, or promotions – ensuring users always access the latest information.

Additionally, the admin panel streamlines customer service with access to inquiries, chat logs, and feedback. Compliance management tools within the panel support KYC and AML protocols, while integrated analytics and reporting provide valuable insights into user behavior, transaction patterns, and app performance to guide improvements.

Admin panel

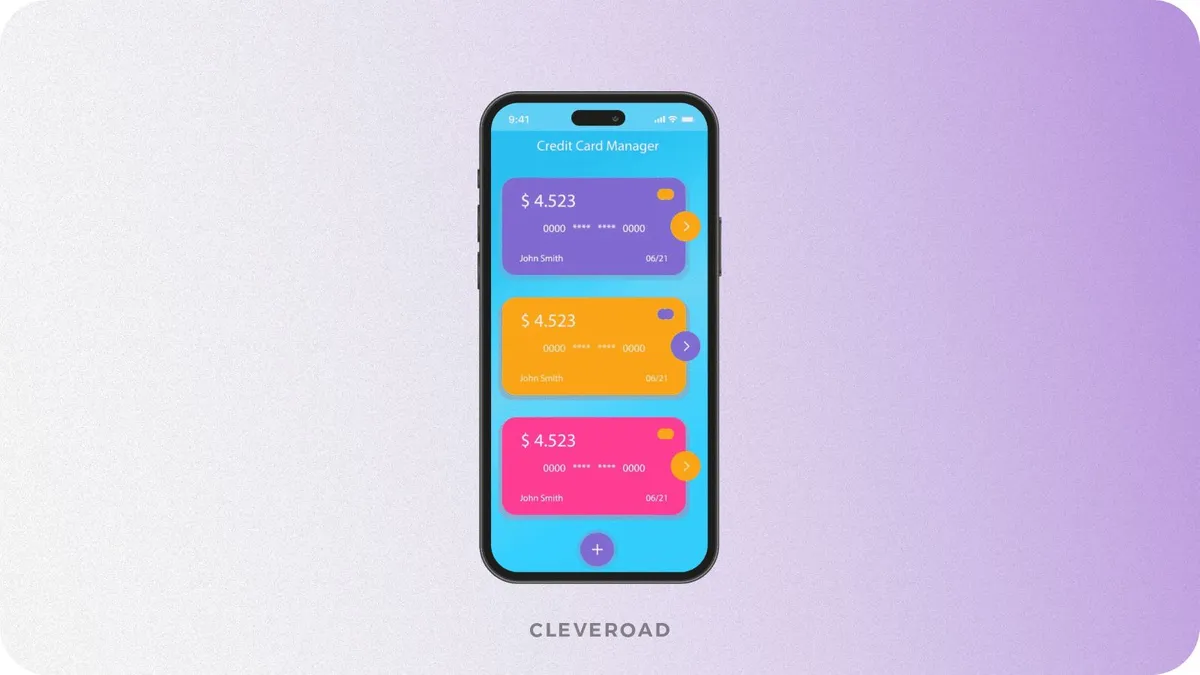

Cards management

All banking applications must have convenient and intuitive management of bank cards. The user should not have questions like “What card do I pay now?”. The interface and the “card switching” procedure should be as painless and easy as possible.

Card management

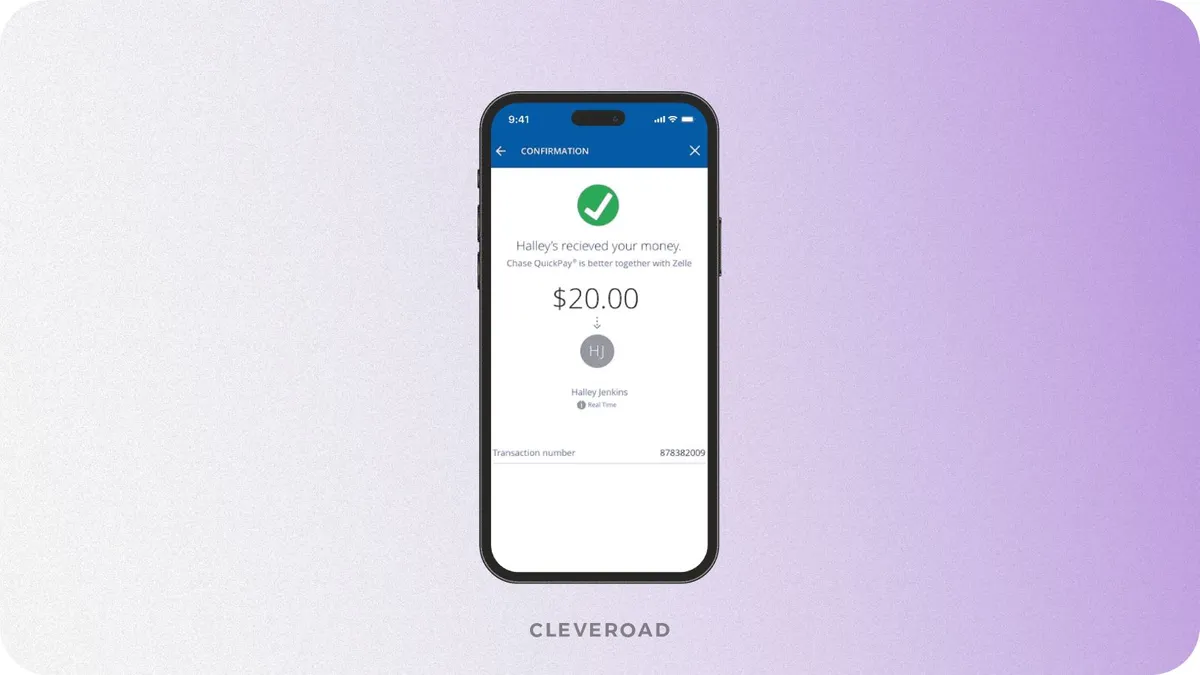

Payments and transaction processing

Users appreciate fast and easy transactions between accounts. No banking app can do without this feature. It’s a system implemented on the server side of the bank where transactions are processed. The app simply displays the result of the transaction.

Chase quick transactions

Support

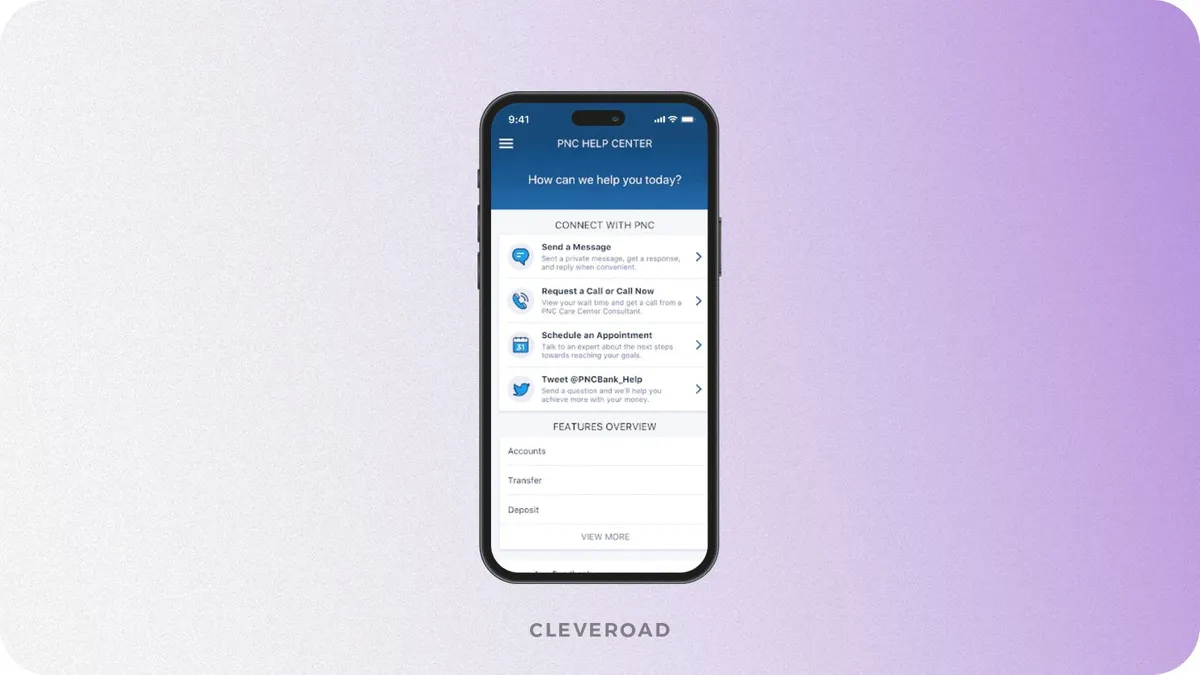

You can’t build a banking app and leave users on their own. They can encounter problems or can have questions while using the banking app. Therefore, it’s necessary to provide users with 24/7 access to support. You can choose between two paths how you can pull this off. The easiest way is to connect the user to the support group via chat inside the app. The hardest one will be to create a chatbot that will take over the responsibilities of support service. However, creating a bot is a rather complicated process from a tech point of view. Besides, you must know what questions users may ask and compose correct answers. However, a chatbot can quickly pay off, as it can save you money on customer support.

PNC mobile app help center

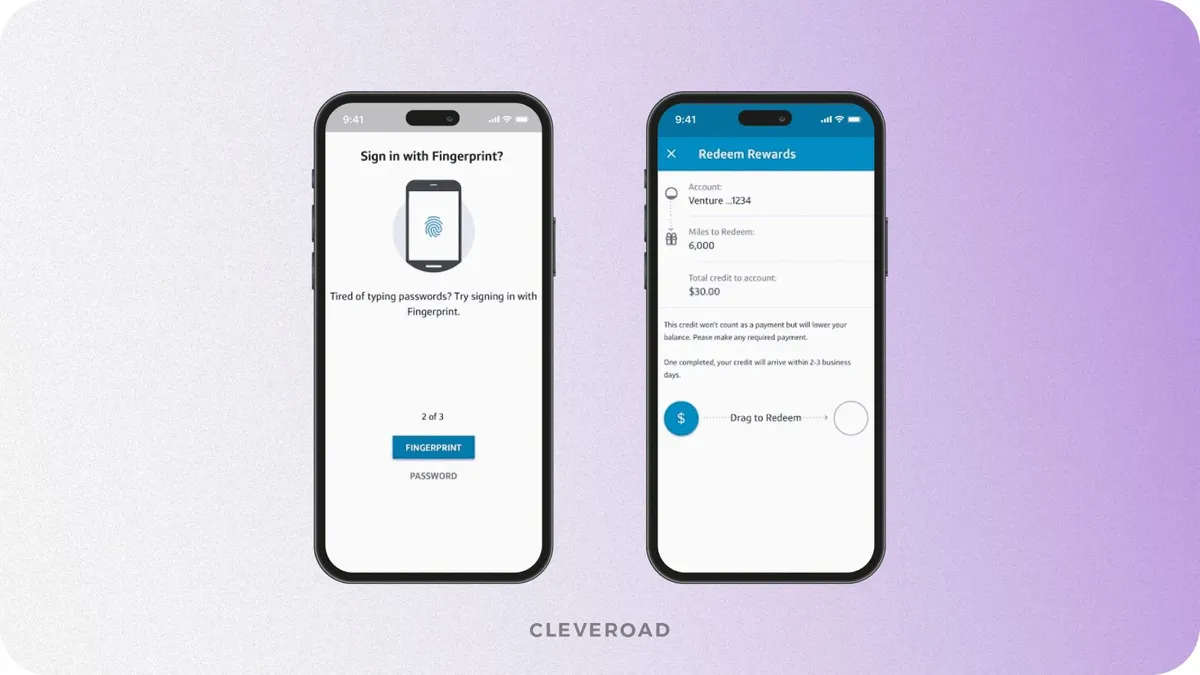

Secure authorization and authentication

Access to the app should be simple yet secure. Let users enter the app in different ways. By far, the most popular ways to sign in are:

- Using a password

- Using a fingerprint

Fingerprint login has already become the standard for banking apps due to its convenience and security. This method can be used to secure every transaction, change of password, and other actions within the app.

Capital One secure authentication interface

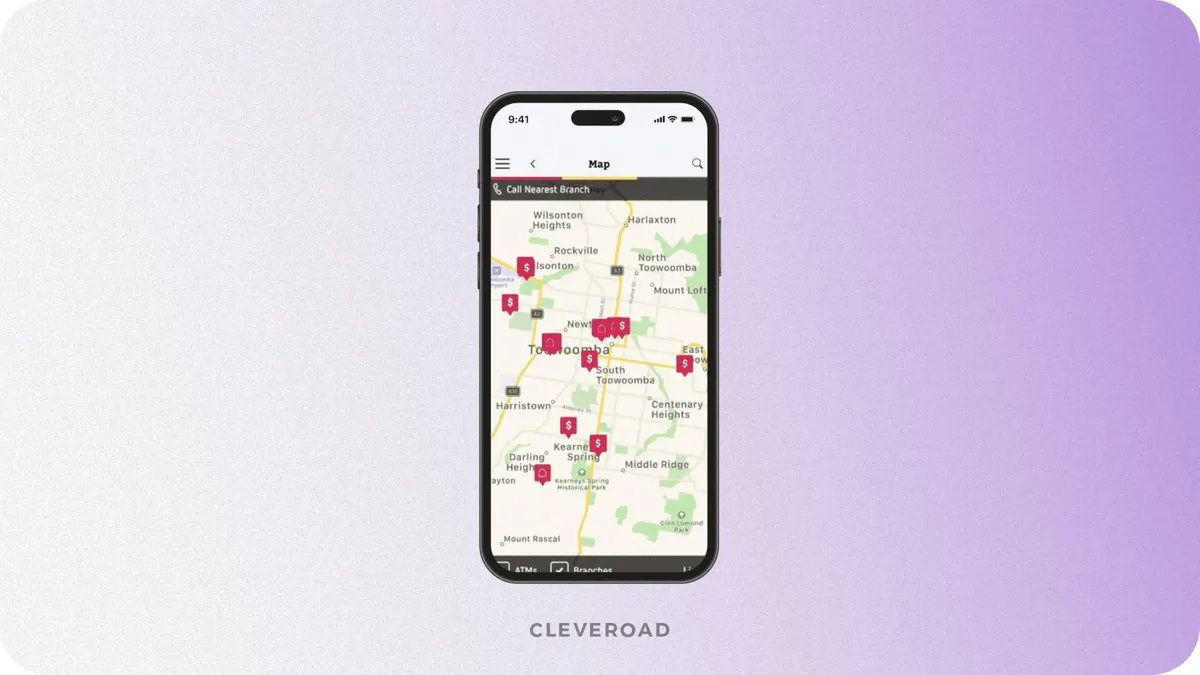

ATMs and bank branches

This feature greatly improves the overall user experience and shows you care about your customers. In addition to a simple location, you can add information about the opening hours of branches and weekends. This feature can work on iOS and Android using Google Maps.

Heritage Bank ATM map

QR code payments

This feature is another step to a multifunctional banking app. Let users pay for purchases, buy tickets, and pay anywhere using QR codes.

Advanced features to implement in banking apps

Banking application development is not only limited to the features described previously. Here’s a brief list of more advanced functionality you can implement into your own banking application:

- AI-powered chatbot and virtual assistants

- Personalized financial insights

- Biometric authentication

- P2P payments

- Multi-currency and cross-border transfers

- Investment and wealth management

- Cardless ATM access

- Digital wallet integration

- AR branch and ATM locator

- Smart notifications and real-time alerts

- Gamified savings and goals

- Voice commands for banking operations

Learn about what AI use cases you can implement within your banking app to expand your banking app functionality by using our AI strategy advisor

Mobile Banking App Development Challenges

During mobile banking app development, product owners and developers run into challenges typical for the FinTech industry. Let’s identify them by categories:

Tech challenges

The development of banking apps is full of technical nuances that your software engineers must take into account.

Date encryption and storage

The most critical technical challenge is securing sensitive user data. This includes personal information, account numbers, and transaction history. Data must be protected not only when it is being transmitted between the user's device and the bank's servers but also when it is stored on the device itself. A failure in either of these areas can lead to a devastating data breach.

- Solution: Cleveroad developers implement robust encryption standards like end-to-end encryption for all data in transit. For data stored locally on the device, developers use secure storage mechanisms provided by the mobile operating system, such as iOS Keychain or Android Keystore. This ensures that even if the device is lost or compromised, the data remains unreadable.

Real-time transaction processing

Users expect transactions to be processed instantly. Delays in real-time activities like a balance update or a fund transfer can erode trust and cause user frustration. The challenge lies in building a system that can handle a massive volume of transactions simultaneously with minimal latency, all while maintaining absolute data integrity.

- Solution: Real-time transaction processing requires a powerful and highly optimized backend infrastructure. The use of a microservices architecture allows different transaction-related functions to operate independently, preventing bottlenecks. Asynchronous processing and message queues are also used to ensure that a high volume of requests is handled efficiently without overwhelming the system.

API integration with legacy systems

Many traditional banks operate on legacy systems that were not designed to support modern, real-time mobile applications. These older systems are often slow, rigid, and lack modern APIs. The technical challenge is creating a seamless bridge between a new, flexible app and an outdated, monolithic backend without disrupting existing operations.

- Solution: The most effective approach is to build a middleware layer or an API gateway. This acts as a translator, allowing the new app to communicate with the legacy system in a modern, secure way. By insulating the mobile banking app from the complexities and limitations of the older system you can ensure data consistency and functionality.

Regulatory compliance

FinTech companies and banking apps are subject to regulatory requirements like any other technology solution. The main regulations for banking apps are:

GDPR сompliance This regulation concerns any personal data and is applied to all organizations that provide goods or services for EU citizens.

PCI DSS сompliance You should know how to become PCI DSS compliant since this regulation applies to any merchant or service provider that handles, processes, stores, or transmits credit card data.

SEPA compliance It covers any organization of the European Union and other European countries using the euro for transactions.

PSD2 compliance It applies to any payment that happens in the European Economic Area.

- Solution: At Cleveroad, we have rich experience of providing FinTech software development services to customers worldwide and we have deep knowledge of the essential laws and regulations. In this way, you’ll have a higher chance of staying updated on current regulatory requirements, implementing compliant data storage, and robust logging practices to safeguard user data. Software experts can also conduct regular audits and assessments, ensuring your app remains compliant as regulations evolve.

For example, recently, the European Union has adopted implementing DORA as a mandatory procedure for all financial institutions operating in the EU. Additionally, experts can set up frameworks that adapt to various regions’ compliance rules, helping you scale your app globally while meeting diverse regulatory standards.

KYC compliance

Banking app developers face unique challenges when working on KYC compliance in the banking sector. For a financial institution looking to develop a mobile banking application, KYC involves not only verifying a customer’s identity but also assessing the risk of them engaging in activities like money laundering or terrorist financing.

While traditional banking often relies on in-person verification, types of mobile banking apps have to adapt these processes for a digital environment, making use mobile banking apps more secure while also accessible. To effectively create a seamless KYC process, developers need to integrate key banking app features that prioritize security, such as advanced fraud detection and behavioral monitoring. The complexities involved in mobile banking development demand a careful balance between strict regulatory adherence and an intuitive interface, as even minor inconveniences in the KYC process can lead to customer frustration or even abandonment of the app.

- Solution: An experienced tech partner can implement KYC features, including document scanning, facial recognition, and liveness detection, to verify identity securely and efficiently. Advanced KYC compliance often involves AI-powered document analysis and machine learning models that verify identity with minimal manual intervention, balancing security and user experience. A proficient vendor can also integrate with third-party KYC service providers, ensuring that these processes are optimized and fully compliant.

To demonstrate Cleveroad’ experience with financial regulations, we’d like to share with you our recent FinTech case – Micro-investment platform for the Middle East market.

Our engineers built a secure micro-investing app accessible to everyone. The biggest challenge was meeting strict KYC and namely SAMA. To ensure compliance, we designed the app with powerful security features. This included a verification process with liveness detection to confirm user identity, protecting both the client and its users.

As a result, the client received a fully compliant platform, successfully verified and launched. Our client now has a secure, modern app that makes investing easy for a new audience.

Cost to Build a Mobile Banking App

Now that you have an idea of the stages of development, it’s good to be aware of the approximate price of making such a solution. An approximate cost range for a full-featured banking app is between $50,000 and $400,000+. The reason why banking app development costs varies so significantly is based on the wide variety of factors influencing final numbers like functionality set, complexity, design, and the development team's location and expertise.

Here’s a brief breakdown of mobile banking app development cost by the solution’s complexity:

- Basic app ($40,000 - $90,000): This is a simple application, often an MVP, that includes core features that usually include user registration, secure login, viewing account balances, transaction history, and basic fund transfers.

- Medium-complexity app ($90,000 - $210,000): This solution includes everything from a basic app, plus more advanced functionalities like personal finance management, detailed spending analytics, bill payments, and push notifications.

- High-complexity app ($210,000 - $400,000+): High-end apps include all the functionalities of a medium-complexity app, with the addition of sophisticated features such as AI-driven chatbots, advanced security with biometric authentication, etc.

Below you can examine basic features for banking app development and the time it takes to create a functional solution:

| Features/types of work | Approx time (h) |

Registration and authentication | 80 hours |

KYC | 85 hours |

User profile | 80 hours |

Accout activity | 60 hours |

Transfers | 142 hours |

Bill payments | 100 hours |

Cards management | 75 hours |

Security | 48 hours |

ATM&Bank locator | 90 hours |

Settings | 63 hours |

Support | 120 hours |

Admin panel | 321 hours |

Total time | 1264 hours |

Keep in mind that software developers aren't the only specialists you need on a team to build such a complex product. Here's the full team composition you'll need to develop a banking app:

- Front-end developer

- Back-end developer

- UI/UX designer

- Business Analyst

- Project Manager

- QA engineer

- DevOps engineer

- Team lead

However, suppose you already have a particular selection of trusted banking app development specialists and only need specific tech expertise for project-based or temporary cooperation. In that case, you can utilize IT staff augmentation services. In this way, you’ll be capable of fulfilling your tech needs with no need for long-term commitments and extra investments.

- Note: Given that team composition and the amount of work in our rough estimation above, it’ll cost you approximately $160,000-$180,000 to create a banking app. However, as the final price may range based on your unique requirements feel free to contact our experts to get an estimation tailored specifically to your fintech project.

Cleveroad – Your Reliable Partner in Mobile Banking App Development

Cleveroad is a FinTech software development services provider with over 13 years of experience in the field. We assist businesses of various scales in creating digital products that satisfy their user base need for reliable, highly secure, and modern financial solutions. As a result, this enables business owners to obtain tangible revenue growth opportunities and market recognition.

Banking apps are complex systems that are pretty hard to build. It’s vital to comply with high-security standards and regulations and operate with an advanced tech stack to create a banking app for business.

At Cleveroad, we’re paying attention to the overall project requirements and operating only up-to-date technologies in developing personalized software for business. We’re creating cutting-edge FinTech solutions using Kotlin and Swift, bounding these programming languages with powerful server sides built with Node.js and .NET, and adding reliable third-party solutions like Amazon S3, Amazon EC2, and socket.io.

By cooperating with us, you can count on:

- Quality-first approach. Cleveroad holds certifications for ISO/IEC 27001:2013 and ISO 9001:2015, demonstrating our commitment to delivering secure, high-quality solutions.

- Banking regulations knowledge. We provide expert guidance on standards like GDPR, KYC, ePrivacy, PCI-DSS, ensuring your FinTech software is legally sound and secure.

- Wide range of FinTech services. We create different FinTech solutions including SAP integration, AI cloud services, Banking CRM, Mobile banking, ERP banking software and more.

- Ideas safety. We guarantee the protection of your intellectual property and confidential information by signing a Non-Disclosure Agreement (NDA) from the start.

- Expert AI development. Our team specializes in AI development services for data analysis, enhanced security, and personalized financial services.

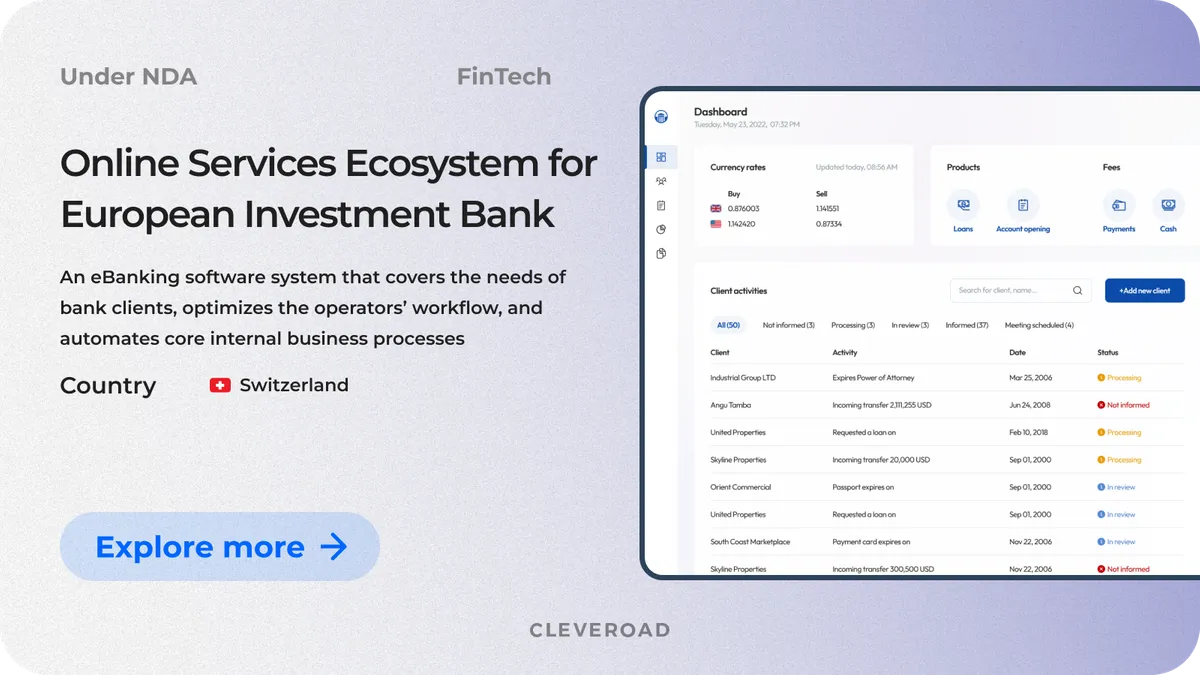

To prove our expertise in FinTech app development, we’d like to present our case of creating an eBanking system.

We helped our customer, an investment bank located in Switzerland, to deliver a new flexible system to provide quality client-oriented services in the investment and meet high-security standards. Its current solution in use was inflexible and didn't allow business scaling. The bank needed a technical partner to:

- Replace the outdated solution with a newly built holistic system that allows simple investment and opening a digital account

- Improve the user experience (UX) so end-users can quickly complete the registration procedure and trading in the investment bank

- Receive new software complying with the Swiss banking regulator's requirements, namely FMIA, so the bank can freely work under its license

The Cleveroad team has built and designed a custom eBanking ecosystem with all the functionality required to cover the needs of B2B and B2C clients, including a user-friendly sign-up, digital account opening system including KYC pass, and an online banking portal. Thanks to the work of our programmers, our clients received an increase in user retention by 20-30%.

Create a tailored banking app with our engineers

Contact us. Our software experts will carefully assess your business needs and solution requirements to deliver a high-quality, secure and scalable mobile banking app

Banking mobile app development is the process of creating software applications that allow customers to manage their finances and perform various banking transactions using a smartphone or tablet. This involves building a secure and user-friendly platform that serves as a digital extension of a traditional banking system.

Here's the key steps to successfully accomplish mobile banking software development:

- Step 1. Find a development team

- Step 2. Conduct target audience analysis

- Step 3. Build and test the banking app prototype

- Step 4. Take care of banking app security

- Step 5. Integrate your app with 3rd party services

- Step 6. Banking app development

- Step 7. Release an app and gather feedback

- Step 8. Support and maintain your banking app

Here’s a brief breakdown of mobile banking app development cost by the solution’s complexity

- Basic app ($40,000 - $90,000): This is a simple application, often an MVP, that includes core banking features that usually include user registration, secure login, viewing account balances, transaction history, and basic fund transfers.

- Medium-complexity app ($90,000 - $210,000): This solution includes everything from a basic app, plus more advanced functionalities like personal finance management, detailed spending analytics, bill payments, and push notifications.

- High-complexity app ($210,000 - $400,000+): High-end apps include all the functionalities of a medium-complexity app, with the addition of sophisticated features such as AI-driven chatbots, advanced security with biometric authentication, etc.

Developing a mobile banking app would take approximately 1264 hours. The most time-consuming part of the project is building the admin panel, which alone requires 321 hours. Other major features that demand a significant amount of development time include transfers at 142 hours, and support at 120 hours. Core functionalities like bill payments and setting up the ATM and bank locator also take a considerable amount of time, estimated at 100 hours and 90 hours, respectively. Meanwhile, essential features like registration and authentication, the user profile, and KYC each take around 80 hours to implement.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsThis is eye opening thank you so much for this Article